Summary:

- Palantir was one of my highest-ranking companies in a SaaS screen I created. The company’s “perfect on paper” with strong metrics, rapid revenue growth, rising margins and huge TAM.

- Qualitatively, Palantir has a huge moat, compelling narrative and clear mission-statement.

- The “black box” nature of the company’s services and its controversial CEO give me pause.

- Valuation measures are off-the-charts overvalued and its entry into the S&P 500 could be viewed as the “Inclusion Curse”.

Thesis

A few months back, I published an SA article entitled Screening for the Best SaaS Companies, in which I screened for the best SaaS companies out of a pool of 84 names. Palantir was the 10th highest-ranked company. The ranking was based on specialized metrics used by venture capitalists. This article’s goal is to concurrently convince you that Palantir is a great company but a terrible stock.

Introduction

Palantir (NYSE:PLTR) is an AI optimized company that helps organizations collect, normalize and utilize all forms of data so that organizations can make decisions. The company operates under two platforms: Gotham (for governments) and Foundry (for businesses) and more recently introduced Apollo which is a system that manages both Gotham and Foundry. Palantir was named after the mystical seeing stones in Lord of the Rings.

Given the controversies over Palantir’s business and its stock’s valuation, I was both intrigued and motivated to look into this. I rarely give “Sell” recommendations except when I see clear-cut accounting or business model issues. Palantir would be the exception!

Does Palantir have the attributes of a premium-valued company?

I’ll cut to the chase and say a “clear YES.” Palantir has several of these highly valued metrics, both qualitative and quantitative. Quantitatively they include:

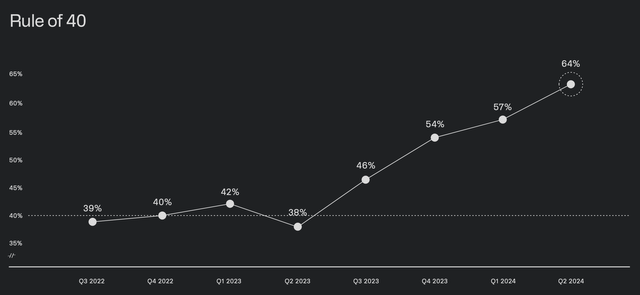

Access to a large and growing TAM (see Business Position section below) Strong Net Retention Rate (114% in 2Q’24, +400bps y/y) High gross margins and strong Unit Economics A history of earnings “beats & raises” High and growing Rule of 40 (Revenue growth + FCF Margin)

Qualitatively premium companies have a:

Compelling Narrative and Mission Statement Strong business position and high entry barriers Unique service and clear value proposition High Net Promotor Scores (NPS) albeit Palantir’s 33 isn’t the highest. Diversifying customer-base Manageable risks Visionary leadership.

Recent financial performance

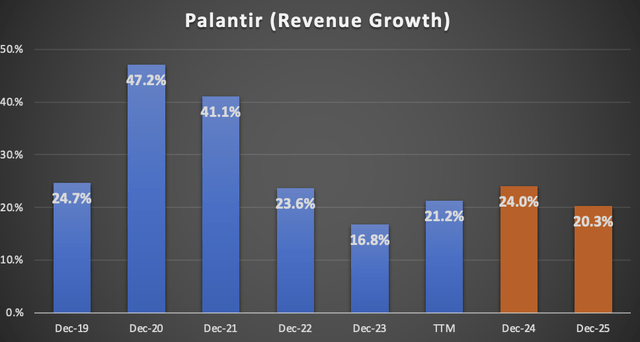

Several SA contributors (such as The Techie) did a superb job at analyzing Palantir’s recent earnings results, so I won’t repeat them here. The TLDR is that 2Q’24’s earnings were great – represented by a bottom & top-line “beat & raise.” In fact, revenue growth is accelerating (see chart below).

Author’s creation, Seeking Alpha data

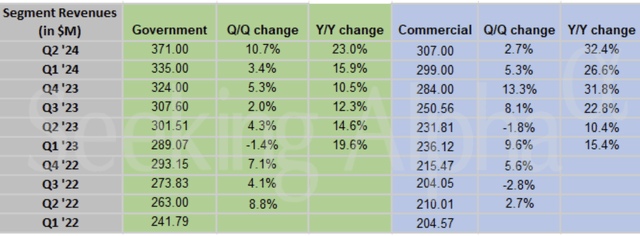

The Commercial business segment, which was introduced subsequent to Palantir’s government business, started gaining momentum in late 2023 and demonstrates continued expansion and diversification (see Table).

Business position and TAM

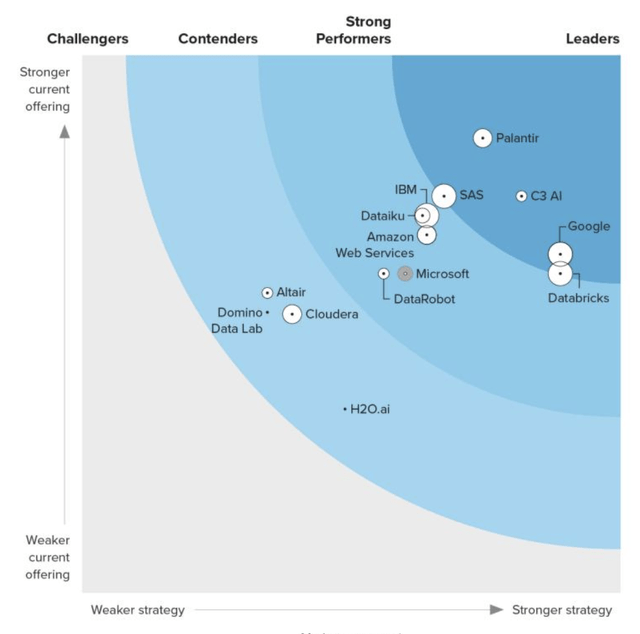

Palantir has a strong business position (up and to the right) as measured by Forrester’s Wave for AI and Machine Learning. Palantir estimated (in its S-1 filing) its TAM to be huge at$120BN. However, that estimate was previous to ChatGPT. Now, analysts such as Wedbush’s Dan Ives think its TAM could hit$1 trillion. This is an even larger opportunity-set (meaning Palantir’s revenue scale vs its TAM) than Nvidia’s (NVDA)!

The many controversies of Karp

When I analyze companies and founders, I always seek out opposing opinions to test my thesis. Palantir is “perfect on paper” however, there is circumstantial and anecdotal information that worries me. Palantir and Karp remind me of Tesla (TSLA) and Musk: two highly controversial figures surrounded by controversies. Without one, there isn’t the other.

Alex Karp has never shied away from controversy. He is extremely pro-American and has picked winners & losers in the geopolitical chess game. These aren’t opinions without consequences – Palantir has provided AI and data analytics services to the U.S. intelligence agencies and military. Palantir has also been criticized for helping ICE (Immigration and Custom Enforcement) deport immigrants. Given the “black box” nature of Palantir’s business, it is not known if privacy and human rights are being violated.

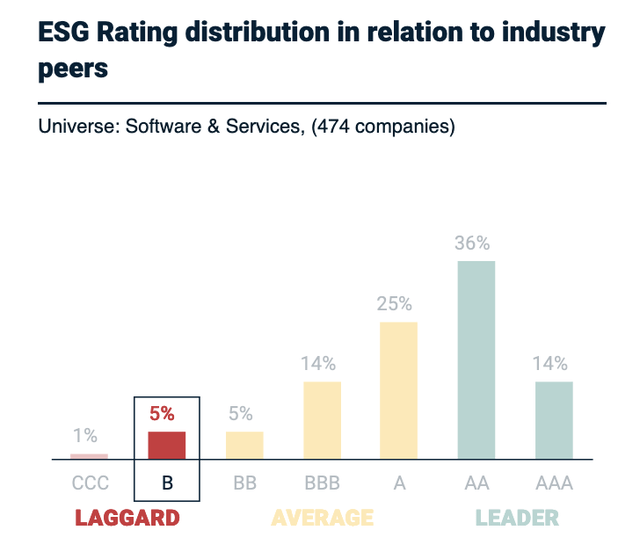

ESG and Glassdoor reviews

Despite the recent blowback in ESG and socially responsible investing, I consider it a key factor in investing as it helps to authentically align my values with investments. I rely on MSCI’s ESG ratings, of which Palantir is rated “B” Laggard within the software industry (see chart). I not only weigh Glassdoor’s ratings to broadly determine the “Social” factor of companies but to determine quality of management and culture. Palantir’s Glassdoor CEO approval rating is amongst the lowest (65%) that I’ve ever seen within the software space (chart below). Even Morningstar, which rarely has an unkind thing to say about management, stated that it “lacks confidence in the executive team” given that Palantir “recklessly” lost $300MM in SPAC investments, whereby those portfolio companies would be expected to purchase Palantir’s services. Speaking of odd holdings, Palantir had invested $51MM in gold bars in 2021 just in case there was a “Black Swan” event.

Other anecdotal evidence of a top in Palantir’s stock price:

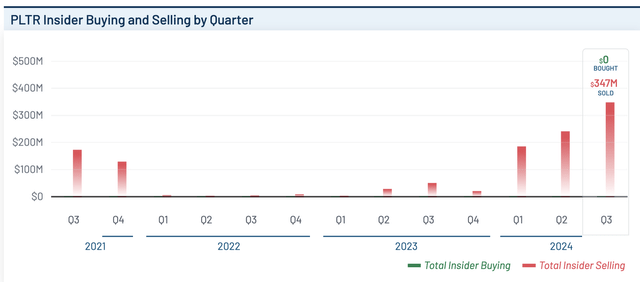

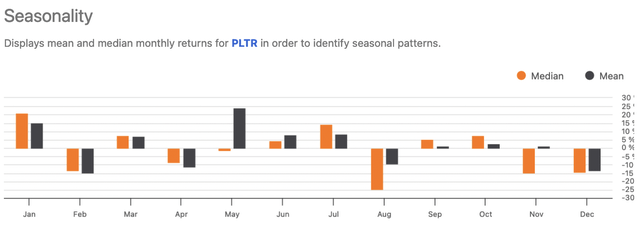

Parabolic moves in the stock price combined with overhead resistance (see chart) Heavy Insider Selling, especially from the CEO and founders (Peter Thiel and Alex Karp) Concerns from several SA contributors A seasonally weak period for Palantir as well as risk-assets in general (chart) The S&P 500 “Inclusion Curse” The CEO’s continued “shelling” of the company wherever he speaks.

Seasonality

Besides trendlines, I’m a believer that sentiment and seasonality are proven contributors to a stock’s performance. Equities continue to remain in a seasonally weak period and Palantir has historically shown weakness during the Autumn period (see chart).

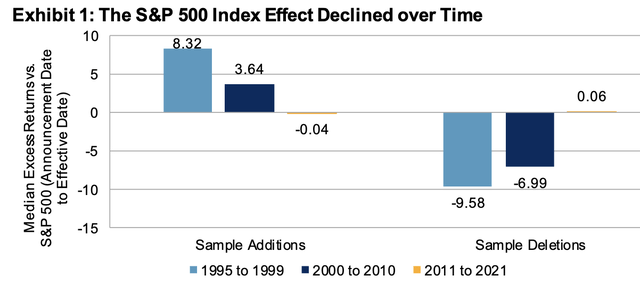

S&P 500 “Inclusion Curse”

On 9/6/2024, S&P Global announced that Palantir would join the S&P 500 on 9/23/2024. Shares rose 7% in after-hours trading on excitement that passive asset managers would be required to purchase its shares. However, studies have shown that any positive stock price gains during said announcements tend to lose their effectiveness over time. A S&P Dow Jones LLC study shows this in the chart below. I would argue that the effect has intensified since the study’s 2021 cut-off date. It also follows that this underperformance is likely to intensify when the inclusion date is around the S&P 500’s all-time-highs (as is the case now). I think most readers recall the excitement about Tesla (TSLA) entering the S&P 500 in Dec’20, to which the shares have underperformed since.

Valuation

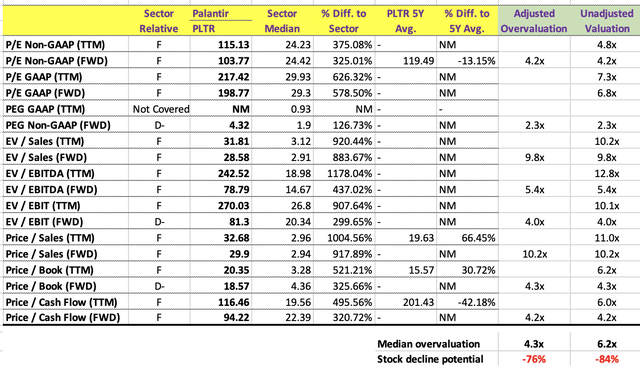

Palantir’s shares are over-valued using a multitude of metrics as presented in the table below. If one were to normalize Palantir’s valuation, shares could decline about 80% – a huge amount ! (Note that I use an “Adjusted Overvaluation” metric to eliminate duplicates and outliers).

Author’s creation, Seeking Alpha data

The best valuation method

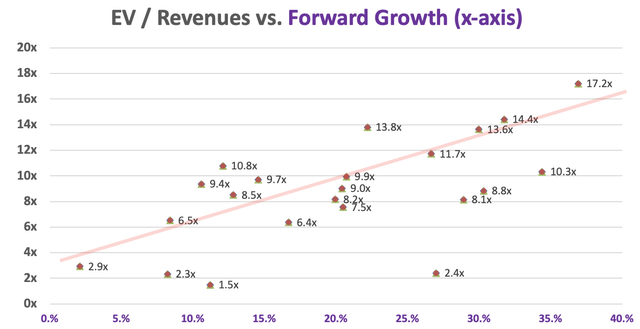

However, I would like to focus on EV/forward Revenues to determine what premium PLTR’s shares should trade at. Palantir’s EV/forward Rev. multiple, at 28.6x is significantly above the 5.5x for the BVP NASDAQ Cloud Index. However, that 5.5x multiple is for the “average” company, not superstar Palantir. We would need to compare PLTR’s multiple with a regression line of forward revenue growth.

Palantir shares trade above the regression line (28.6x versus the regression point of 12x) of revenue growth versus EV/forward Revenue multiples for the largest, best positioned SaaS companies as compiled by Bessemer Venture Partners. It is also above Meritech Capital’s SaaS regression line (regression point: 16x). (Note: it’s worth repeating that I not only compare PLTR to the average SaaS company, but to the largest premium names as well as those companies growing at a similar rate.)

Based on the above analysis, Palantir’s shares could drop to around $20/share or 40-45% from current levels during this Bull market, and far lower if there’s a correction.

Author’s creation, Bessemer Venture data

Conclusion:

I won’t mince words. I have never had a good gut feeling about Palantir. It feels like a stock with a cult-like following. Now that I’ve done a deeper analysis, I stand by those feelings with concrete evidence and anecdotal findings. There are several top-performing SaaS companies to choose from. Palantir is the only company I would avoid, hence my “Strong Sell” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.