Summary:

- Despite some valuation methods and scenarios indicating overvaluation, Palantir’s strong AI-driven growth and flexible sales strategy justify a Buy rating, with a potential 20% correction risk.

- Palantir’s AI platforms, Gotham and Foundry, cater to both government and commercial sectors, leveraging favorable industry trends and a modular sales approach to drive growth.

- The company’s financial health, with $4 billion in cash and minimal debt, along with strong revenue growth and operating leverage, supports long-term value creation.

- Insider selling and a significant YTD bull run suggest caution, but I am prepared to increase holdings if the stock approaches $30, anticipating substantial future growth.

Michael Vi/iStock Editorial via Getty Images

My thesis

From the standpoint of traditional valuation methods, such as ratios and discounted cash flow analysis, it is clear that Palantir’s stock (NYSE:PLTR) is overvalued. On the other hand, ratios ignore qualitative factors while DCF’s are based on variables that just assumptions.

Palantir is a well-rounded company benefiting from significant industry tailwinds, which justifies a premium over its current share price. However, the extent of this premium is often a subject of debate. It’s not uncommon for high-performing stocks to continue rising despite perceived “overvaluation”. Using a DCF approach, I have estimated that the stock price is unlikely to fall below $30 over the next twelve months. With the current share price around $37, there is a potential risk of a close to 20% correction. I am willing to accept this risk because a standout company like Palantir warrants it. Therefore, I am initiating a position in the stock and will be prepared to increase my holdings significantly if PLTR approaches $30 per share. My rating for PLTR is Buy.

PLTR stock analysis

The software company Palantir Technologies Inc operates data integration and analytics platforms for government agencies and commercial enterprises to help make decisions and improve operations at mass scale. It was founded on software designed for use in the U.S. intelligence services and has since extended its customer base. In 2023, 55% of Palantir’s revenue came from its government segment, 45% from the commercial segment of its customer base, and 38% from outside the U.S..

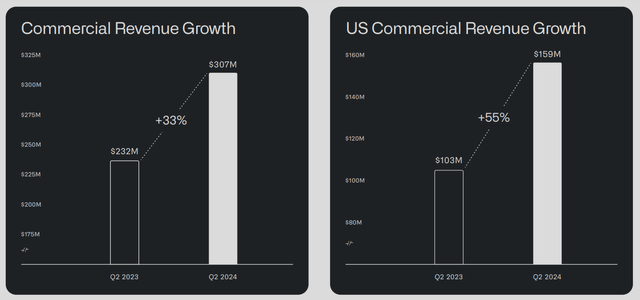

Palantir’s Q2 2024 presentation

The above slide from the latest earnings presentation suggests that both segments demonstrate strong growth momentum, which I think indicates that the company’s value proposition to its clients is compelling. There are a few robust reasons, both broader and company specific.

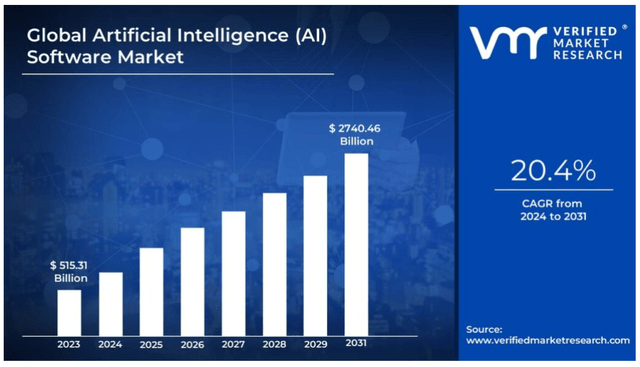

First, Palantir’s offerings leverage artificial intelligence (AI) capabilities, and we all know that the demand for AI features is high. Palantir’s two main platforms, Gotham and Foundry, are designed to help both government and commercial clients harness the power of data using AI and machine learning (ML). According to Verified Market Research, the global AI software market will be worth $2.7 trillion by 2031, observing a 20.4% CAGR. Therefore, industry trends are expected to be extremely favorable for PLTR for the next seven years.

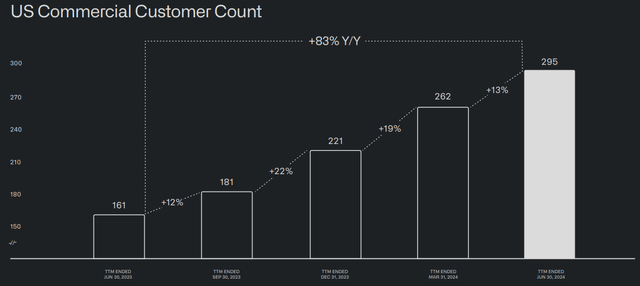

The second strength is company specific, and it is Palantir’s flexible approach to selling its offerings. Palantir is focused on value-add large companies that are looking for unique AI/ML services to meet their business requirements. This has allowed the company to land large government and business clients, spending millions on its systems. Yet, over time, the management realized it needed to expand its customer pool. The company began to implement a modular sales strategy, enabling clients to purchase specific modules of its products instead of buying the entire Palantir platform upfront, and a pricing model that encourages spending based on usage. This strategy not only decreases the barrier of entry for new clients, but also helps them start small and paves a path to increasing their spending over time as they scale up their usage of Palantir’s solutions. As a result, we can see below that the company’s U.S. commercial customer count is soaring.

Palantir’s Q2 2024 presentation

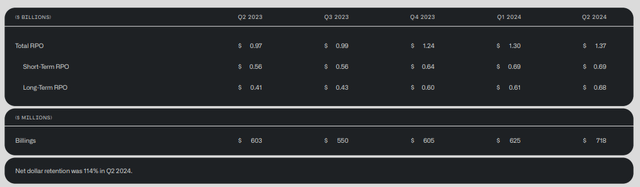

Another reason to believe that Palantir will be able to maintain strong revenue growth for longer is the dynamic of key underlying business metrics. The remaining performance obligation (RPO) is a key metric showing the total value of contracted revenue that has not yet been recognized. In the below chart we see that Palantir’s RPO is consistently growing sequentially every quarter. The net dollar retention rate is also stellar at 114%, meaning that the company does not only retain 100% of its revenue from existing contracts but also upsells and cross sells to these clients.

Palantir’s Q2 2024 presentation

With that being said, we see that there is a strong favorable secular trend and the company’s approach to attract new customers and expanding relationships is excellent. This conclusion is backed by recent developments because over the last couple of weeks Palantir has won several new contracts including the U.S. Army, DEVCOM Research Laboratory, and APA Corporation (APA). Now, let’s look at how the company is able to convert revenue growth into profits and value for shareholders.

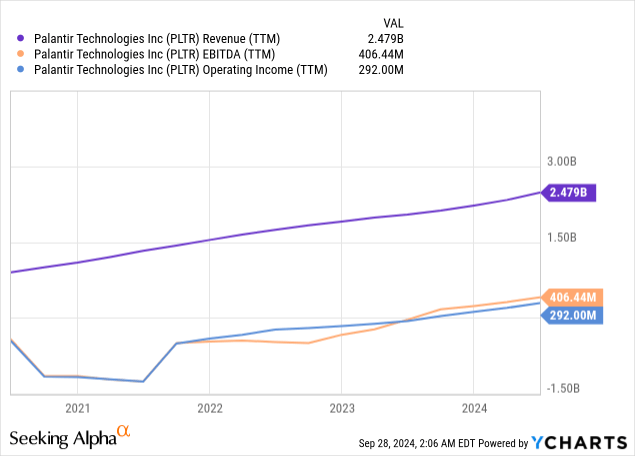

In the below chart we see that Palantir’s operating income and EBITDA firmly correlate with revenue growth, which means that the growth is managed efficiently. I consider such a correlation between revenue and EBITDA to be a strong bullish sign, because more revenue growth will mean more value for shareholders in the future. And in the above two paragraphs I have explained why Palantir’s revenue is highly likely to maintain strong growth trajectory for the next several years.

My analysis of the stock will be incomplete if I am not mentioning the management’s ability to accumulate profits, since Palantir’s financial position is impressive. The company had $4 billion in cash as of June 30, and only $260 million in total debt. Therefore, the company can exercise robust financial flexibility if needed to invest in new ventures or acquisitions.

Recent developments in the monetary environment are also quite favorable for PLTR. The Fed eventually started its interest rate cuts a couple of weeks ago, and is ready to continue moving to the less restrictive monetary policy through 2025. A cheaper cost of capital will highly likely boost business overall activity and customers will be more aggressive in spending on innovation and adoption of Palantir’s offerings.

In summary, Palantir looks like a well-rounded business that successfully rides the AI wave. Since this is a strong secular trend, I think that PLTR exceptional business approach and flexible strategy to sell its offerings will help in capitalizing on favorable trends for longer.

Intrinsic value calculation

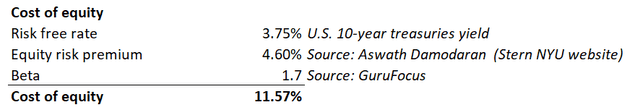

Palantir’s discounted cash flow model will require me to figure out the discount rate first. We have seen above that the company has almost no debt. That makes the cost of equity the most suitable discount rate. Below I share my working where I calculate the discount rate using the CAPM formula. As a result, the cost of equity is 11.57%.

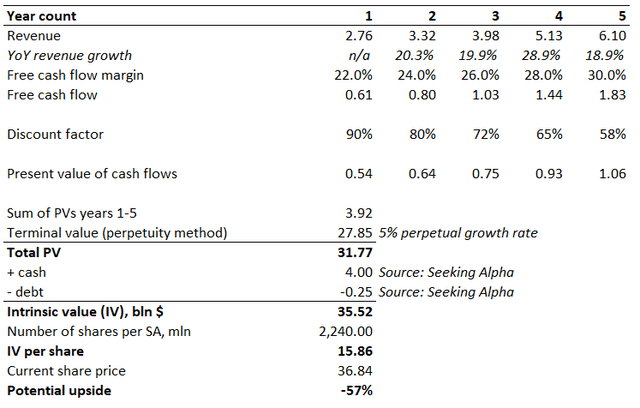

I think that the largest Wall Street analysts do their job well, and it is worth relying on their consensus revenue growth projections. Moreover, revenue growth rates are approximately in line with the projected AI software industry CAGR, which was mentioned in earlier paragraphs. The levered FCF margin is 22%. In the main part of the analysis, we saw that PLTR is strong in demonstrating operating leverage. Therefore, I expect the FCF margin to improve by two percentage points per annum during the next five years. For the first scenario I am using a 5% perpetual growth rate, but I will explain later why this might be too conservative.

As the above scenario suggests, the stock is around 57% overvalued. I think that the market is extremely unlikely to be that wrong since a $15.86 intrinsic value per share is too low. I think that the explanation of such an unfairly low intrinsic value estimate lies in the constant growth rate. While a 5% constant growth rate might seem already aggressive since it is significantly above long-term inflation and GDP growth averages, I want to challenge this assumption.

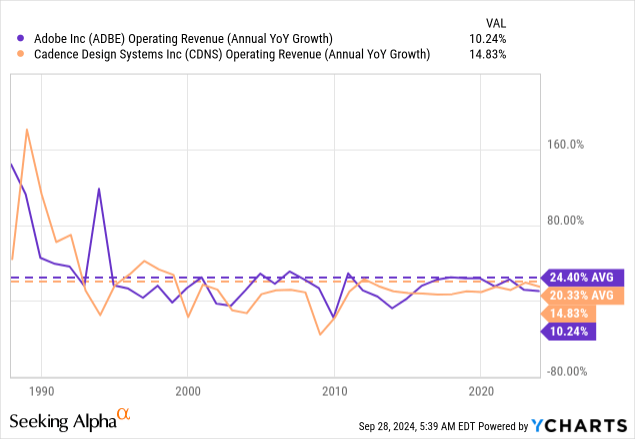

Applying a constant growth rate in line with or slightly above the GDP growth could have been fair in the industrial era. However, the digital revolution which started in 1980s suggests that there are companies that are able to maintain a double digit CAGR over several decades. I am not talking about absolute champions like Microsoft (MSFT) and Apple (AAPL), but there are also a few other less popular (but still iconic) companies that managed to deliver stellar revenue CAGR over several decades.

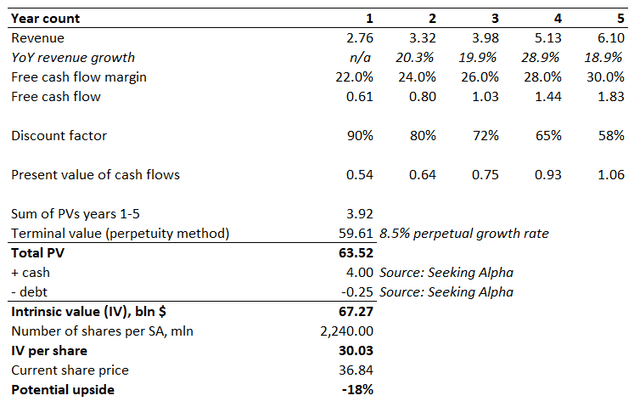

The above examples include software companies like Adobe (ADBE) and Cadence Design Systems (CDNS). Both of them are software companies that were true disruptors several decades ago, like PLTR in the 2020s. Despite operating since 1980s, both these companies still maintain revenue growth that is notably above 5%. As we see, ADBE’s revenue CAGR over the last three decades is 24.4% and CDNS’s CAGR is 20.33%. Wall Street analysts expect ADBE to maintain double-digit revenue CAGR for the next decade. The same situation is with Cadence’s consensus revenue estimates, but the horizon itself is slightly shorter. Therefore, I think that it is conservative enough to incorporate a high single-digit constant growth rate for PLTR. I think that 8.5% is conservative, which I incorporated in the below spreadsheet.

With a more aggressive constant growth rate, the intrinsic value per share is around $30. Let us say that $30 per share will highly likely be a crucial psychological support level for the share price. Therefore, if PLTR drops somewhere near closer to $30-$31, it will be a no-brainer opportunity to bet big.

What I might be missing?

I think that a 15-20% correction from the current share price will be fair for the stock, especially considering a massive 115% YTD bull run. On the other hand, for exceptional businesses like PLTR there is always a big risk of missing out. When Nvidia (NVDA) surpassed a trillion dollar market cap it was almost impossible to believe that it can move closer to two trillions. But we all know that it very easily surpassed the two trillion mark as well. Therefore, PLTR’s share price might never pullback to $30. It will mean that I have lost a compelling investing opportunity because the business indeed has a massive potential.

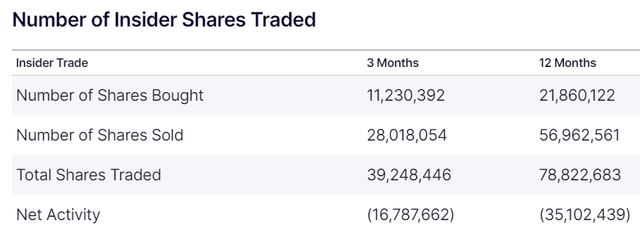

On the other hand, we see that insiders are selling the stock aggressively. In several previous articles from my peer authors, it was emphasized that the CEO, Alex Karp, sold the stock worth hundreds of millions. I would like to add yesterday’s fresh information from SA News, that Peter Thiel, the Chairman, old over $600M worth of the company’s stock this week, bringing his total disposals this year to over $1B. Such a big sell-off from insiders is rarely a good sign, and Nasdaq suggests that there were far more insider selling than buying over the last few months.

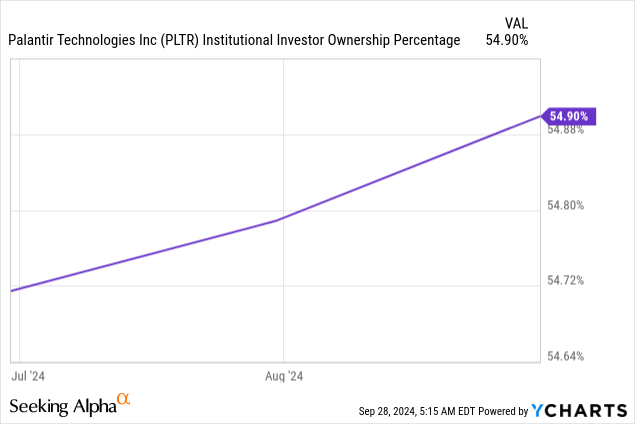

While significant insider selling might be a red flag from the share price perspective, it does not make the business itself worse. Moreover, both Alex Karp and Peter Thiel still hold PLTR stock worth billions of dollars. Last but not least, the percentage of institutional investor ownership has expanded over the last three months and the recent inclusion of PLTR in the S&P 500 index will highly likely help to attract more institutional investors.

My verdict

After weighing all the pros and cons of investing in Palantir, I am starting a position in PLTR. Despite overvaluation, for such a well-rounded business like Palantir that enjoys massive secular tailwinds, there is always a probability that the stock might continue soaring due to substantial revenue or EPS growth revisions. I do not want to miss out on such a compelling opportunity. On the other hand, a massive YTD bull run together with aggressive insider selling might mean that optimism has peaked, and we are close to a roughly 20% correction. Therefore, I am buying (Buy rating) the stock, but will leave some spare capital to be able to double down in case of a correction.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.