Summary:

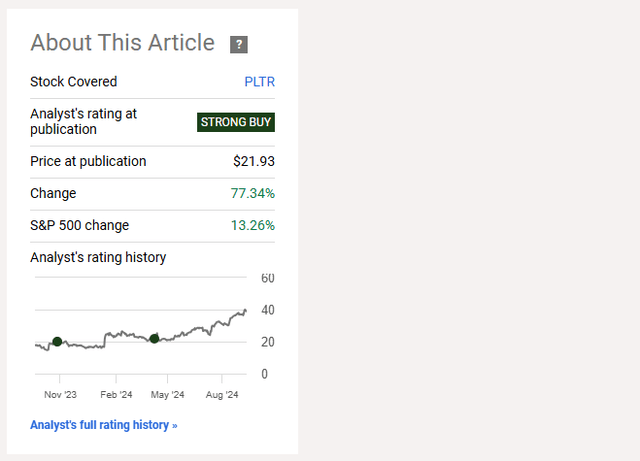

- Palantir’s stock has surged 77% since our ‘Strong Buy’ recommendation, but its current valuation – at 33x sales – looks extended.

- Despite strong financial and operational performance, including ~30% revenue growth and improving margins, the stock’s price is way ahead of underlying financial results.

- As a result, we’re soft-downgrading the stock to a ‘Buy’ from a ‘Strong Buy’ in light of the extended multiple.

- We recommend selling put options on PLTR to balance risk and reward, offering a 12% annualized yield and potential assignment of the stock at a material discount to the market.

Cesare Ferrari/iStock via Getty Images

It’s been almost 5 months to the day since we last wrote about Palantir (NYSE:PLTR), the high-flying B2B Data/AI SaaS company.

In an article titled “Palantir: Still Tons Of Upside“, we argued in May that the stock was ~reasonably~ valued given the company’s AI business drivers, and that investors should stay long given the potential for considerable appreciation from that point onwards.

This view has borne out to be correct, considering that PLTR shares are up about 77% since we made that call (and just shy of 100% from our first ‘Strong Buy’ rating last November), trouncing the S&P 500 return of 13% in that time:

However, while PLTR did grow nicely in the company’s most recent earnings report, much of the appreciation in the stock is down to one thing – multiple expansion.

In other words, investor excitement for the company is maybe a little bit ahead of where the company’s financial results are.

Consequently, we’ve had to think more deeply about PLTR, given that we’re not willing buyers of any company on earth at 33x sales. The potential for downside at a price like that is simply too strong.

After some consideration, our conclusion is that we’re still positive on PLTR’s financials and operations on the whole, but buying the stock at this price is too much of a risk. Thus, a strategy like selling put options on PLTR seems like the best way to balance R/R in the name.

Today, we’ll explore the company’s recent and upcoming earnings reports, examine the valuation in more detail, and explain why we think selling options on PLTR is the best course of action for most investors at this juncture.

Sound good? Let’s dive in.

PLTR’s Financials

In case you’ve been living under a rock, PLTR has had one hell of a year.

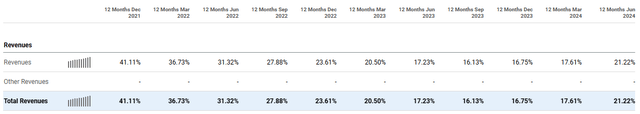

After seeing sales growth slow (on a YoY percentage basis) from the mid-20s to the mid-teens in 2022 through 2023, interest in the company’s products has re-accelerated as of late given the launch of PLTR’s AIP (‘Artificial Intelligence Platform’) product, which has seen considerable demand in the commercial market.

Company AIP boot camps have been well attended, and management had the following to say on the recent Q2 earnings call:

Overall revenue growth, excluding strategic commercial contracts, accelerated to 30% year-over-year and 10% sequential in Q2. Our exceptional results are a reflection of a market that is quickly awakening to a reality that our customers have already known, we stand alone in our ability to deliver enterprise AI production impact at scale.

These words are backed up by the numbers.

Here’s a look at TTM sales growth figures, where you can see the deceleration from 2022 into 2023, followed by a re-acceleration in 2024:

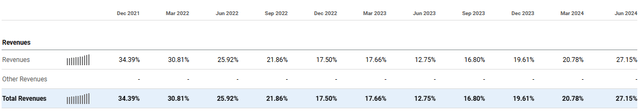

Viewed on a quarterly basis, you can see here just how much sales growth has re-accelerated in Q1 and Q2 of 2024:

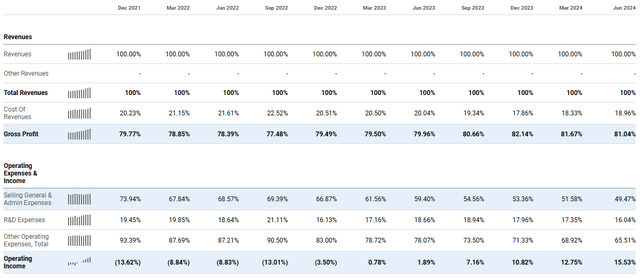

On the gross margins front, PLTR has also been able to sustain and actually improve margins a tad, from the high 70s to low 80s range in recent quarters, which shows how the company’s pricing power has led to better overall profitability:

When combined with PLTR’s largely stable OpEx, the company is producing excellent results on a per-share basis.

We’re encouraged by the company’s focus on scaling high margin, sticky commercial revenue, which is a big factor in why PLTR’s sales are valued at such a premium.

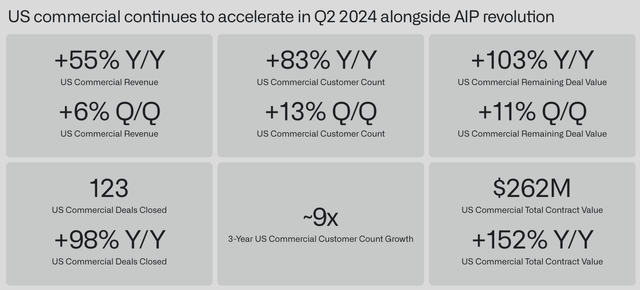

Here’s a snapshot from the recent Q2 report:

As you can see, the company’s growing customer count, total contract value, and overall revenue are moving up and to the right, which shows how strong PLTR’s execution has been.

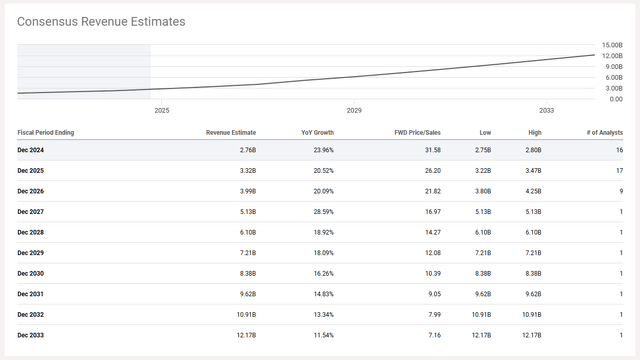

Looking ahead to PLTR’s next scheduled earnings report, which is towards the end of this month, we’re anticipating continued growth on the sales front, mostly in line with analyst expectations:

We’re expecting revenue growth in the 30%+ range, gross margins above 80%, and operating margins nearing 20%. These numbers would represent continued progress from previous quarters and showcase the company’s execution chops when it comes to the AI B2B opportunity.

Overall, we’re very happy with PLTR’s underlying organic operational results and financials. When combined with the developing gross and operating margin profile, we think it’s possible to see a long tail of 20%+ annualized EPS growth for the foreseeable future.

PLTR’s Valuation

Apparently, everyone else thinks so too.

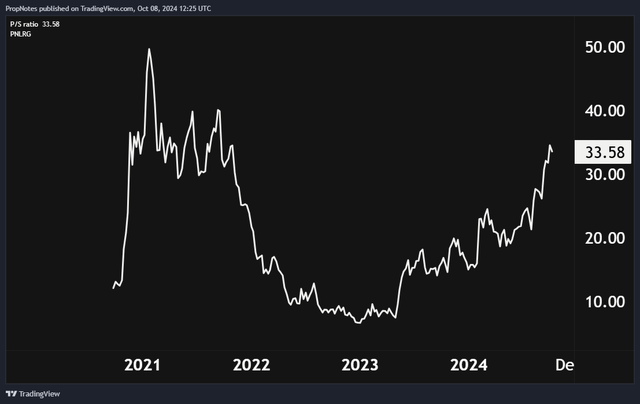

When we wrote our last article, PLTR was trading at roughly 21x TTM sales.

Expensive, but deservedly premium, in our view.

Now, with only one more quarter of results under the company’s belt, shares are trading at 34x sales, which is, in our view, simply absurd:

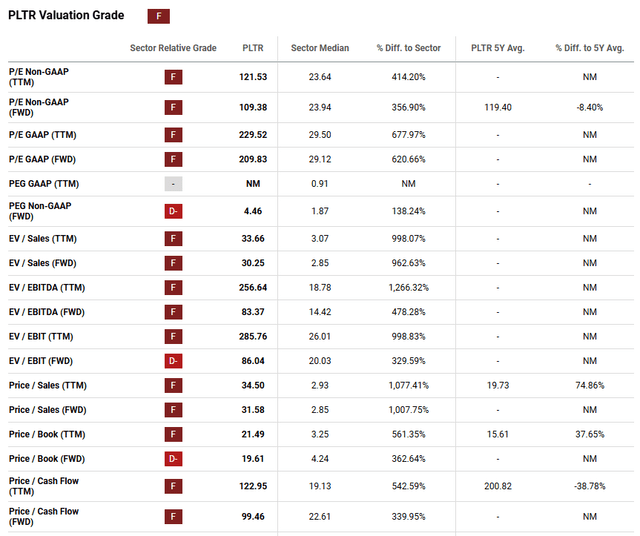

Seeking Alpha’s quant rating system agrees, giving PLTR an ‘F’ on the valuation front.

Sometimes, we don’t think SA’s system takes context into account, but in this scenario, it’s tough to argue the model is wrong. Sure, the company’s ARR is excellent, which amps up the premium. Margins are also improving, which should reduce the P/E at an abnormally fast rate, which makes the stock appear more expensive than it otherwise might.

However, if you zoom out for a second, the stock is now trading at the same ‘heights’ it was during the great tech mega frenzy of 2021, which many agree in hindsight was a poor time to be investing into high-growth companies:

PLTR has come a long way from then, particularly on the net income front, but margins are still under 20%.

Even if margins expand to 35%+, which would be a theoretical limit provided by other scaled, digital only tech companies like MSFT and META, we still don’t think a 33x sales multiple would be deserved.

The really concerning multiple here is the PEG, which is around 4.6x. This is from the P/E of roughly 197 TTM, and the EPS growth rate of around 42% in FY ’24.

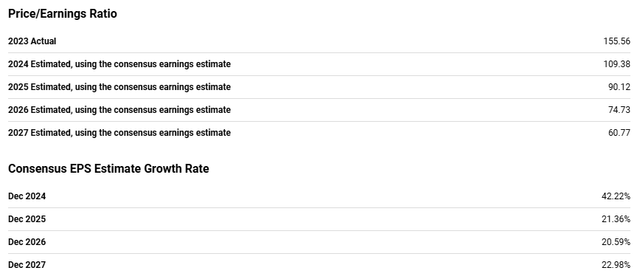

This shows that the P/E is very, very high even when taking into account PLTR’s level of growth. That said, as PLTR’s EPS growth is set to slow somewhat in coming years, it means that the PEG isn’t set to materially decrease, either, as time goes on:

This is a tricky situation, and put simply, we don’t think PLTR is worth what the market is asking.

We’d buy the stock on a dip given the strong organic results, but the stock is priced to perfection and beyond, which makes an entry at this price highly risky.

High-Yield Option Overlay

So – the stock is pricey for the time being, and we’re happy to buy a dip, but remaining unallocated to the market generally is suboptimal.

What to do?

In this scenario, we think selling put options on PLTR is the best course of action.

In case selling put options is a new concept to you, when you sell a put option, you’re agreeing to purchase stock in something at a given price by some future date. That’s it – that’s all.

In return for agreeing to buy shares of, in this case, PLTR, investors can earn a substantial cash payout.

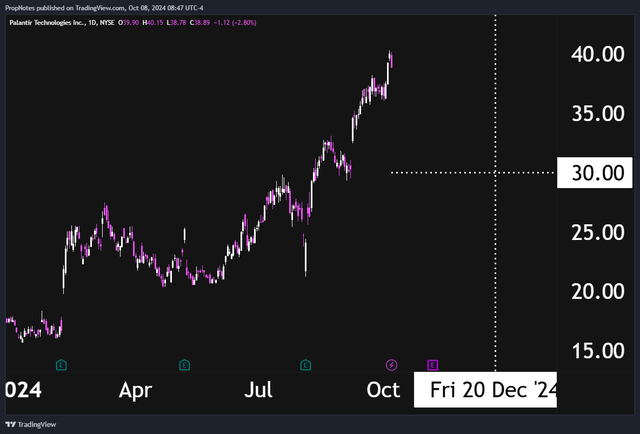

Today, we think selling the December 20th, $30 strike put options appears optimal:

These contracts pay out $71 per contract and require $2,929 in buying power to sell. This works out to a 2.4% yield over the next 73 days, which works out to around a 12% annualized yield.

If PLTR closes on December 20th above $30, then you don’t need to buy it, and you keep the 2.4% payout. If PLTR closes below $30, then you would typically be assigned the stock at $30 and may have an unrealized loss on the stock. However, you’d still get to keep the 2.4% yield.

To us, this strategy produces a solid payout, and would net buyers (if assigned) a 23% discount on the stock, which works out to a ~23x FWD sales multiple. This would still be expensive, but much more tolerable than the current price.

A strategy like this seems like it would mitigate the largest risk with PLTR right now – the valuation – and could provide investors a solid yield

If you’re already in PLTR, then selling call options would be the corresponding move.

Summary

All in all, PLTR’s multiple looks – frankly – a bit hard to invest in at this price; it’s simply too expensive.

Despite this, the company continues to race ahead, sign new clients, and grow market share. We’d love to own the stock, but the price is a serious risk.

While others may be content to wait for a dip, selling put options on PLTR and taking advantage of the stock’s inherent volatility seems like the best course of action.

Yielding a solid 12% annualized, and with the potential to get assigned at a discount to the current market, we think selling options appears to be a solid win-win for investors at this juncture.

Consequently, we’re downgrading PLTR to a ‘Buy’ from ‘Strong Buy’.

Stay safe out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PLTR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.