Summary:

- Palantir Technologies Inc. reported another stellar earnings report for Q3.

- The demand for the company’s AI software continues to increase and is unlikely to slow down anytime soon.

- Despite this, Palantir’s stock is priced for perfection and the company needs to constantly exceed expectations and raise guidance to retain the momentum.

Kevin Dietsch

Ever since the introduction of its artificial intelligence platform, better known by its acronym AIP, in the spring of 2023, Palantir Technologies Inc.’s (NYSE:PLTR) stock has been mostly appreciating to this day. The company briefly reached a market capitalization of $100 billion last month. The growth has been fueled primarily by the impressive demand for AIP, which helps different companies and state enterprises better optimize their operations by deploying large language models within their organizations that are tailored to their needs.

The Q3 earnings report, which was released recently, showed that the demand for Palantir’s tools and services is not slowing down, and the company is on a path to have another successful year. At the same time, Palantir also has everything going for it to continue to show a stellar performance in the future, and the double-digit growth of its business in the following years is almost a guarantee at this point.

Another Stellar Quarter

Palantir has been one of my best investments in the last year and a half. For a long time, I have been covering its latest developments here on Seeking Alpha, and have been bullish about its stock. While last month I sold half of my position in the company due to valuation concerns, I continue to hold another half in my portfolio. Despite Palantir trading at excessive multiples that are far greater in comparison to its peers, holding a downsized stake in the company still makes a lot of sense, since the business’s growth opportunities are nearly endless at this point. The recent Q3 earnings results support this case.

The latest report shows that from July to September, Palantir was able to generate $725.52 million in revenues, up 30% Y/Y and above expectations by $21.83 million. At the same time, its non-GAAP EPS of $0.10 was also above the expectations by $0.01.

While those results are impressive, it’s safe to assume that Palantir will be able to continue to show such a stellar performance in the upcoming quarters as well. This is because more than a year has passed since AIP was launched, and yet the demand for the company’s software remains high. During the quarter, the company managed to close 104 deals worth over $1 million, while its customer count increased by 39% Y/Y and 6% Q/Q. Thanks to such results, Palantir increased its U.S. commercial revenue for this year to $687 million, which represents a growth rate of at least 50%.

What’s also important to note is that the latest developments within the industries, which in one way or another are related to the ongoing generative AI revolution, are indicating that the demand for AI-related tools, products, and services is also not expected to slow down anytime soon. Last week, I wrote an article on Nvidia (NVDA), where I highlighted that the company’s competitors and suppliers are also experiencing an impressive demand for their products. This is as its clients scale their AI-related expenses to run more advanced large language models, better known as LLMs.

Even hyperscalers like Microsoft (MSFT), Amazon (AMZN), and Google (GOOG, GOOGL) in their respective conference calls from last week stated that they are expected to increase their CapEx spending this year, primarily on AI infrastructure to meet the growing demand.

All of this points to the fact that Palantir’s growth opportunities in the commercial space are nearly endless at this point, thanks to its advanced AI software. As the generative AI market is expected to grow by an aggressive double-digit rate in the coming years and be worth close to $1.5 trillion by the end of the decade, it makes sense to believe that Palantir’s business will also benefit from such a growth.

What’s also true is that Palantir has a chance to continue to benefit from the increased AI-related spending in the government sector in the foreseeable future. In Q3, the U.S. government revenue was $320 million, up 40% Y/Y and 15% Q/Q.

Going forward, the government-related revenues are likely to continue to increase as well in the following quarters. This is because Palantir has been awarded various long-term contracts by the military and different branches of the Department of Defense this year, which should create recurring sources of income. At the same time, Meta Platforms (META) earlier today announced that it partnered with Palantir and other AI-related companies to provide its open-source Llama models to U.S. government agencies, which could be considered a positive development as well.

Considering all of this, it’s safe to say that Palantir’s growth story is far from over. The company recently increased its guidance and now expects to generate between $2.805 billion to $2.809 billion in revenues this year, above the consensus of $2.76 billion. Given the impressive performance in the first three quarters of the current fiscal year, it’s likely that the company will meet or even exceed this guidance.

Priced For Perfection

Despite all the growth opportunities, my biggest issue with Palantir is that valuation risks are rising, and its stock is priced for perfection. By trading at over 100 times its forward earnings and 34 times its forward sales, the company has little room for error and constantly needs to exceed expectations to support the growth of its stock. At the same time, the margin of safety for investors is also thin at the current levels. This is why I sold half of my position in the company recently at a profit.

In my latest article on Palantir from last month, I published my very optimistic valuation model. It showed that even if Palantir grows its revenues at 40% each year for the next five years, its fair value would be around $36 per share. This is still below the current market price. However, it’s also highly unlikely that Palantir will be able to grow at such a rate for a few years in a row, which I’ve also noted in that article.

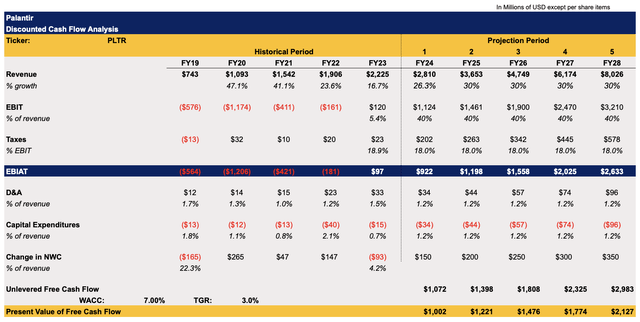

The improved guidance, which was released along with the Q3 earnings report, indicates that in FY24, Palantir’s revenues will increase by ~26.3% Y/Y. This is the higher end of the recent guidance. Below I’m presenting an updated model, which changes the revenue assumptions for FY24 per that guidance. At the same time, the revenue assumptions for FY25 and beyond stand at 30%, which is a possibility given the impressive demand for AI-related software that’s expected to remain for a while. All the other assumptions in the updated model remained the same as before.

Palantir’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

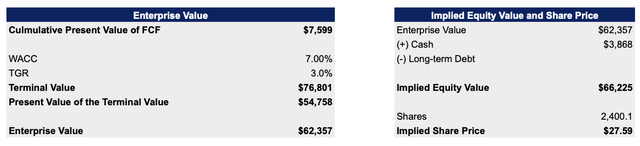

This model shows that even if Palantir meets the high end of its guidance this year and manages to grow its revenues by 30% in the upcoming years, its fair value would be $27.59 per share. This is still significantly below the current market price.

Palantir’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

While the more moderate model shows that Palantir’s fair value is below the current market price, that doesn’t mean that the company’s shares will trade close to that price anytime soon or that they won’t appreciate further in the foreseeable future.

After the release of the Q3 earnings report, which includes improved guidance, Palantir’s shares have appreciated during the after-market hours even though the company could be considered overvalued. This indicates that Palantir is priced for perfection. As long as it manages to exceed expectations and raises its guidance in the coming quarters, then its shares have a chance to continue to grow, just as happened with Google last week. However, one quarter of disappointing guidance could kill the stock’s momentum, as was the case with Microsoft last week.

The Bottom Line

Undoubtedly, Palantir is a great company that has more than enough growth opportunities to continue to deliver impressive results for years to come. The demand for generative AI tools is unlikely to significantly decrease anytime soon. By establishing itself as one of the major B2B providers of generative AI tools, the double-digit growth of Palantir’s business in the coming years is almost a guarantee at this point.

However, the company’s stock is priced for perfection, and at the current price, offers little margin of safety. That is why I recently sold half of my position in the company to make a profit and decrease my risks, while at the same time still holding the other half of the position, as Palantir’s growth story appears to be far from over.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.