Summary:

- Palantir’s business is accelerating, the ecosystem is expanding, and the deal pipeline is raging.

- In addition, expect 50% free cash flow margins in the back half of the year.

- Despite excellent results, solid fundamentals, and strong outlook, Palantir’s valuation appears stretched.

- The margin of safety is non-existent here, and I think investors should tread carefully.

Luke Sharrett/Getty Images News

Introduction

Palantir (NYSE:PLTR) reported exceptional Q2 results that show accelerations across its operating segments, namely the Commercial and Government segments, reflecting unprecedented demand for Palantir’s enterprise software solutions.

In addition, every single profit metric improved sequentially, demonstrating the company’s ongoing operating leverage and increasing earnings potential.

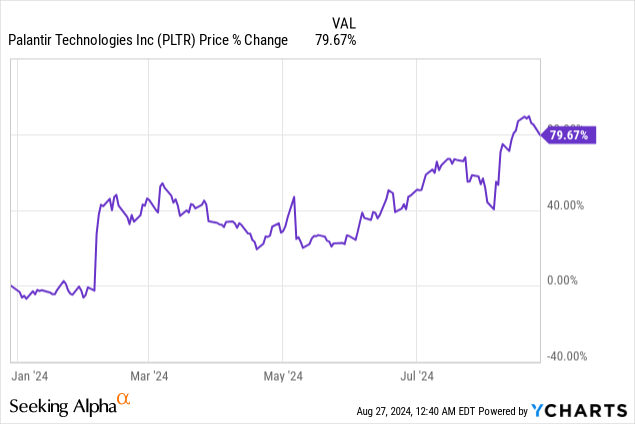

Ever since my previous article on Palantir, the stock has risen by more than 30% in just three short months, and this year alone, the stock is up by more than 80% YTD.

While my bullish calls on Palantir stock have fortunately been right, I understand that Palantir’s current valuation may have grown too far, too fast.

Growth: All Systems Go

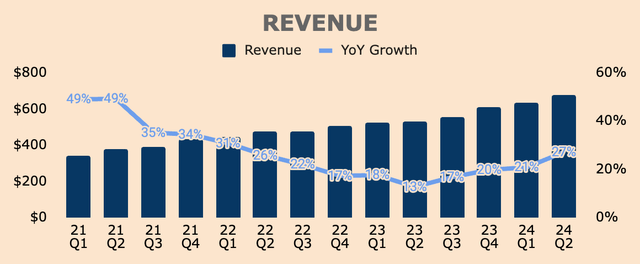

For four consecutive quarters, Revenue growth rates have continued to accelerate, most prominently in Palantir’s most recent quarter. In Q2, Palantir generated $678M of Revenue, growing 27% YoY, which accelerated by 6pp QoQ. This also beat both the high-end of management’s guidance and analyst estimates by $25M — Palantir continues to be underestimated.

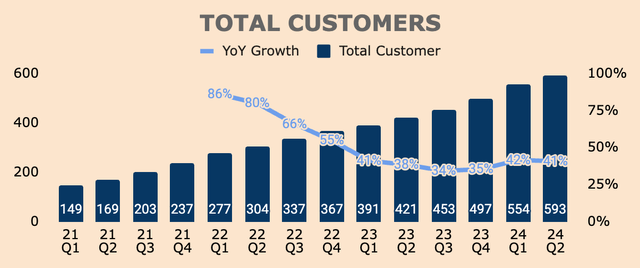

Outperformance was driven by strong momentum in its US Commercial and Government businesses. Most importantly, strong topline growth was supercharged by Total Customer growth, which was 593 as of Q2, up 41% YoY.

Now, Palantir is notorious for being a black box company — complicated, mysterious, secretive — but its rapidly growing client base is sufficient proof that what Palantir offers is real, effective, and impactful. Mind you, these are some of the most important organizations in the world including governments, hospitals, and conglomerates.

Customers are concrete indicators of Palantir’s value offering as well as leading indicators of future Revenue growth — knowing that Palantir continues to lock in customers is enough to understand what Palantir is capable of.

A lot of what we’re doing sounds complex on the outside, but what is not complex is the customers already understand they need it. So it’s like a lot of our actual advantages, the customer is way ahead of investors, way ahead of people investing this, and we also and we’re way ahead of our customers and we have distribution.

(CEO Alex Karp — Palantir FY2024 Q2 Earnings Call)

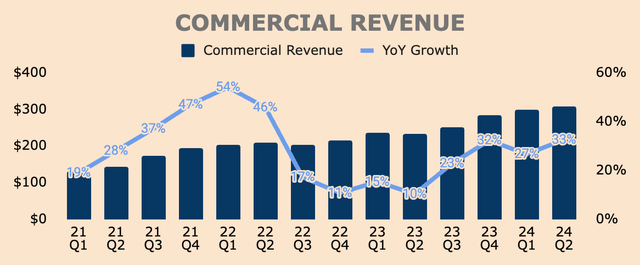

Much of this customer growth was driven by its Commercial segment. In Q2, Commercial Customers grew 55% YoY to 467, which produced $307M of Commercial Revenue, up 33% YoY. The US market continues to be robust while the International market slowed down:

- US Commercial Revenue was $159M, up 55% YoY, driven by an 83% YoY increase in US Commercial Customers, to 295.

- International Commercial Revenue was $148M, up 15% YoY, driven by a 22% increase in International Commercial Customers, to 172.

As you can see, Commercial Revenue growth accelerated again in Q2, even despite a 50%+ decline in Revenue from Strategic Commercial Contracts — without this impact, Commercial Revenue would have grown 40% YoY.

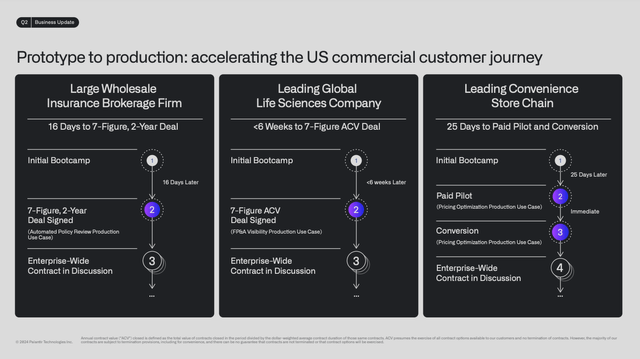

Of course, the momentum in the Commercial segment was driven by AIP, which just turned one year old. In this AI-hyped world, Palantir is uniquely positioned to help enterprises unlock the power of AI… straight into their operations. Management touts this as “prototype to production”.

Since launching AIP in mid-2023, Palantir has completed AIP bootcamps with over 1,025 organizations worldwide — through this prototype phase, Palantir was able to convert a good chunk of these organizations into the production phase, which explains the monumental growth of Palantir’s Commercial unit.

Enterprises want results fast — Palantir can execute within weeks and deliver results well beyond their expectations.

Palantir FY2024 Q2 Investor Presentation

And it seems that growth for the Commercial segment has only just begun. For instance, US Commercial Remaining Deal Value is up 103% YoY and US Commercial Total Contract Value is up 152% YoY, which should translate to strong Commercial Revenue growth for the foreseeable future.

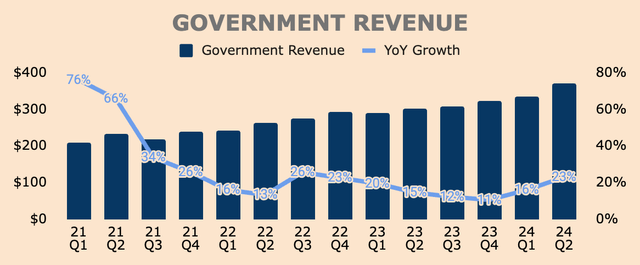

On the Government side, Revenue was $371M, up 23% YoY, driven by “momentum in the Department of Defense and favorable deal timing”. Breaking it down by geography, US Government Revenue was $278M, up 24% YoY, and International Government Revenue was $93M, up 21% YoY.

Notably, Palantir saw “the strongest US Government bookings quarter since 2022”, with big-time deals such as its 5-year $480M contract with the Chief Digital and Artificial Intelligence Office to deploy and scale AI systems across the DoD.

Despite Government Customers growing only 6% YoY and losing one customer QoQ, to 126 as of Q2, Government Revenue growth accelerated by 7pp QoQ, reflecting “the criticality of our software and our nation’s defense capabilities”. It is also worth noting that government budget spending on software technologies is still very low, thus providing a long growth runway for Palantir in the public sector.

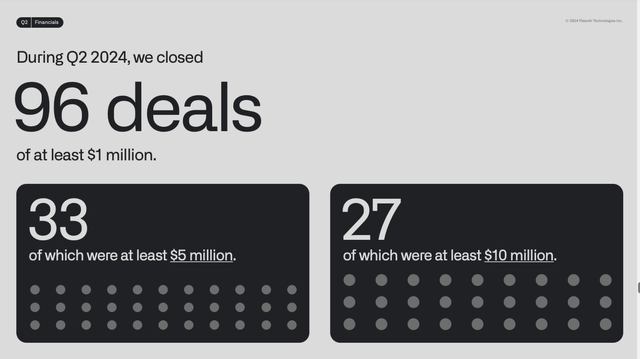

That being said, Palantir’s deal pipeline is more robust than ever, with 27 deals over $10M closed in Q2, which, I believe, is a record high for the company.

Palantir FY2024 Q2 Investor Presentation

Perhaps, that is why management raised their full-year 2024 Revenue guidance to $2.75B at the high end, as compared to $2.69B previously. For Q3, management expects Revenue of $701M at the high end, which implies a 26% YoY growth.

As you can tell, business is accelerating, the ecosystem is expanding, and the deal pipeline is raging — all systems go for Palantir.

And through its best-in-class enterprise software, AI capabilities, and distribution strategy, Palantir is well-positioned to capture the $600B AI infrastructure market.

We have from the beginning set out to build software products that provide our partners with a structural advantage over their adversaries and competitors. We are not and have never been interested in marginal improvements or remedying modest inefficiencies. The right software properly wielded can and should transform an institution. And it is that ambition that has won over not only our existing partners but that of an entirely new cohort.

(CEO Alex Karp — Palantir FY2024 Q2 Letter to Shareholders)

Profitability: Record Profits

Palantir’s profit lines have never looked better as well.

In Q2, Gross Profit hit an all-time high at $550M, growing 29% YoY, with an 81% Gross Margin.

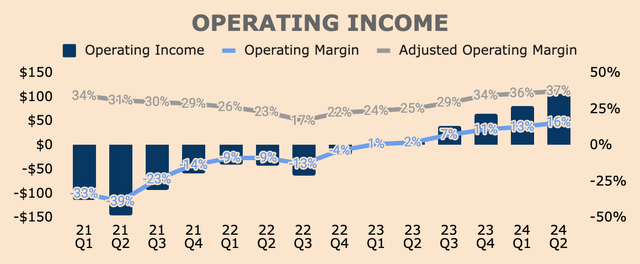

Operating Income also hit record highs at $105M, representing an Operating Margin of 16%, which improved 14pp YoY and 3pp QoQ. Adjusted Operating Income was $254M at a 37% Margin, which improved 12pp YoY and 1pp QoQ, its highest reading ever.

Oddly enough, management expects Adjusted Operating Income to decline sequentially in Q3, to $237M at the high end of their guidance. On the bright side, management raised their full-year 2024 Adjusted Operating Income guidance to $974M at the high end, from $880M previously, reflecting ongoing business momentum and operating leverage.

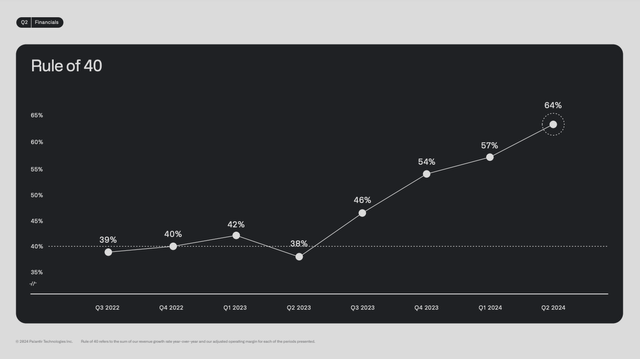

Most impressively, Palantir delivered a Rule of 64 (37% Adjusted Operating Margin + 27% Revenue growth) in Q2, an incredible milestone and well above its Rule of 40 target.

Palantir FY2024 Q2 Investor Presentation

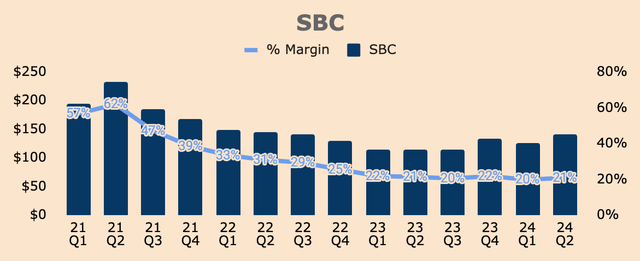

While Stock-based Compensation as a % of Revenue remains elevated at 21%, it becomes less and less of an issue as Palantir becomes more and more profitable with each passing quarter.

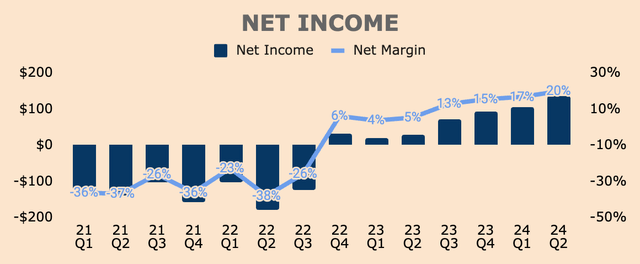

As you can see, Palantir’s bottom line continues to improve. GAAP Net Income was $134M, representing a Net Margin of 20%. GAAP EPS was $0.06. Non-GAAP EPS was $0.09, beating estimates by $0.01.

All things considered, Palantir continues to grow rapidly without sacrificing profitability. In fact, Palantir is producing record profits quarter after quarter, displaying strong demand, execution, and operating leverage across Palantir’s platforms.

Health: Stronger Than Ever

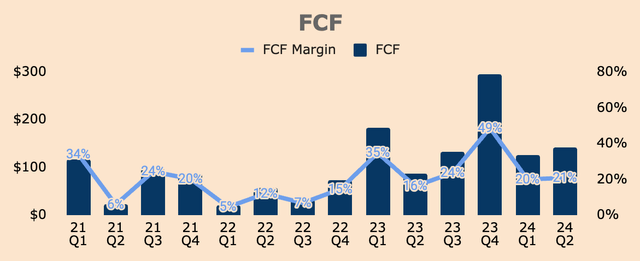

Palantir produced $141M of Free Cash Flow in Q2, representing a robust FCF Margin of 21%. In the TTM, FCF was $696M, representing a FCF Margin of 28%.

Management expects FCF of $0.8B to $1.0B for the full year. Considering that H1 FCF was $268M, we can expect FCF of $700M+ in the back half of the year. This implies an acceleration of FCF generation for the remainder of the year.

We expect cash flow to ramp through the back half of the year, in line with expected timing of government and commercial year-end collections.

(CFO Dave Glazer — Palantir FY2024 Q2 Earnings Call)

Also, management guided for $2.75B of Revenue for the year at the high end, which means Revenue of about $1.44B in H2. So assuming H2 FCF of $700M+ and H2 Revenue of $1.44B, it would translate to an H2 FCF Margin of about 50%!

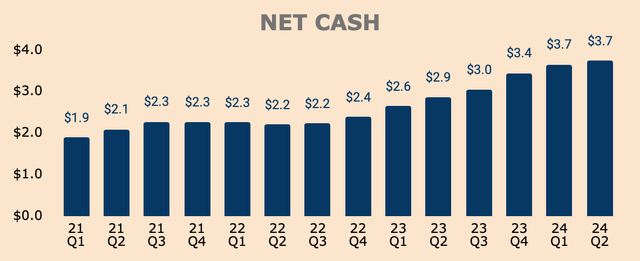

Palantir has $3.7B of Net Cash as of Q2 — given robust FCF ahead, Net Cash is set to expand even further. Palantir’s balance sheet is stronger than ever, but it looks like it’s going to get even stronger moving forward.

Valuation: Priced to Perfection

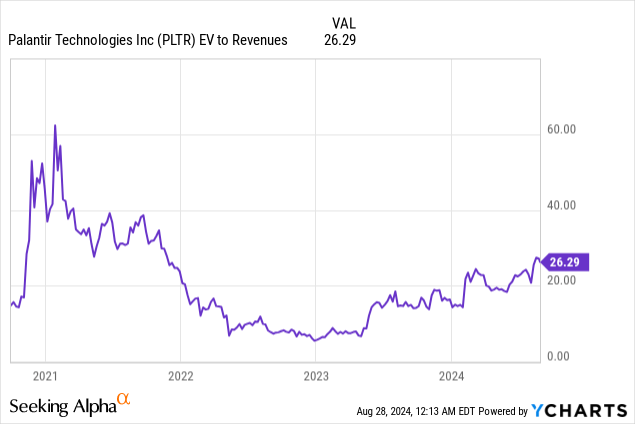

Despite excellent results, solid fundamentals, and strong outlook, Palantir stock looks expensive at current levels. It is not as expensive as it was back in 2021, but an EV to Revenue multiple of 26.3x is asking a lot.

Analysts have an average price target of $25 a share, implying an 18% downside.

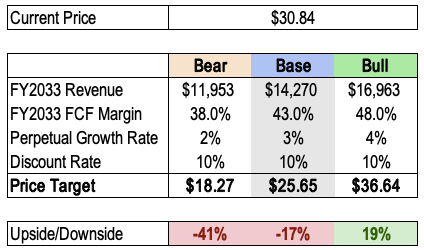

I have a base-case price target of about $25 as well. Here are my key assumptions:

- FY2033 Revenue of $14.3B, which is a 20% CAGR.

- FY2033 FCF Margin of 43%. As explained earlier, Palantir is capable of achieving 50%+ FCF Margins. However, the timing of payments in the back half of the year might have artificially pumped margins in the short term. That said, I want to be extra conservative, which is why I have projected a long-term FCF Margin of 43% instead. Even so, a 43% annual FCF Margin is considerably higher than its TTM FCF Margin of 28%.

- Perpetual Growth Rate of 3%.

- Discount Rate of 10%.

As you can see, my assumptions are quite aggressive. Even then, my base-case price target is only $25 a share, implying a 17% downside from here.

Author’s Analysis

Having said that, I think Palantir stock is currently priced to perfection, which may mean limited upside potential in the next twelve months.

Conversely, if Palantir’s business continues to accelerate, we may see additional upward momentum in the stock. In addition, Palantir has yet to be added to the S&P500, which could serve as a major catalyst for the stock.

Risks

The biggest risk of all, in my opinion, is valuation. As explained earlier, Palantir seemed to be priced to perfection. If Palantir loses momentum or if growth slows down materially — like what we saw in 2022 — the stock may be severely punished. The margin of safety is non-existent here, and I think investors should tread carefully.

Thesis

Palantir’s investment thesis revolves around being the sole operating system for major corporations and government entities around the world, propelled by the rise in AI applications and large language models — enterprises need to make sense of these complex concepts and integrate them into their operations, and Palantir is uniquely positioned to fill the gap in this nascent market.

While Palantir’s growth story is very much intact, its valuation is showing signs of overheating, as the stock has 5x-ed in less than 2 years.

The risk to reward may not look compelling in the short term, but if investors can endure some near-term volatility, they’ll be rewarded in the long run. After all, the best times for Palantir are yet to come.

I would say the single most interesting thing about this quarter, if you had to reduce it to one simple fact, after 20 years, after changing the way people do Intel, after changing the way the battlefield works, after changing the way people procure software, after exporting our platforms to our allies, after punishing our adversaries, after building a commercial business, after DPOing, after seeing it all reaccelerate, the best times for us are yet to come and we are planning to just take our energy and run this business as a business of which we are, which is our owners. We are owners with a very long-term focus for the best interest of our country, our allies and our Palantirians, and our investors.

(CEO Alex Karp — Palantir FY2024 Q2 Earnings Call)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.