Summary:

- Palantir’s strong revenue growth, particularly in the US government and commercial segments, supports the scalable AI solution thesis, with 2024 guidance slightly above estimates.

- The company’s AI applications demonstrate real-world utility, reducing manpower and processing times significantly, which enhances decision-making and operational efficiency.

- Despite the impressive performance, Palantir’s valuation is extremely high, posing risks from political budget cuts, competition, and execution challenges across different industries.

Michael Vi

In my last piece on Palantir (NYSE:PLTR), I was on the fence about the company, I had a sizable position but was weighing the IT consulting thesis versus the scalable automation thesis around the company’s business. I believe the dispute got major support favoring the scalable AI solution thesis during 2024 with sizable earnings beats and strong revenue growth.

The question now becomes how good their AI applications are. I believe the third quarter brought major evidence crediting their AI applications, perhaps even making it the first real-world application to be sold at a profit. Let’s take a look.

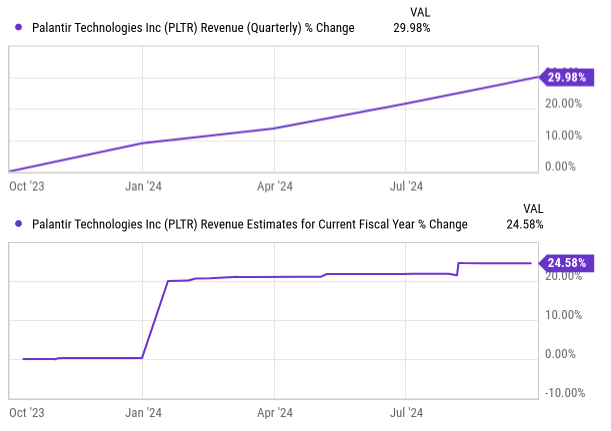

Financial performance

Palantir achieved 30% revenue growth in Q3, year-over-year. Business with the US government grew 40% YoY, while the commercial segment grew at an even more impressive 54%. The thesis here is clear, the company is leveraging AI models that are becoming increasingly more capable, and it is deploying them in their customers for practical operations. Due to these strong results, the company raised its guidance to a midpoint of $2.807 billion for 2024, slightly above estimates. The company also expects to remain GAAP profitable for the current year.

YCharts

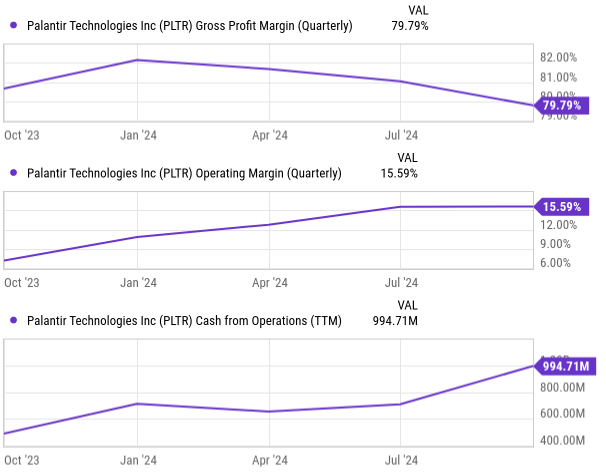

Gross margins remained near the 80% level, while operating margins kept improving and are now at 15.59%. On a trailing twelve-month basis, the company achieved close to $1 billion in operating cash-flow, which is a very symbolic milestone for the company.

YCharts

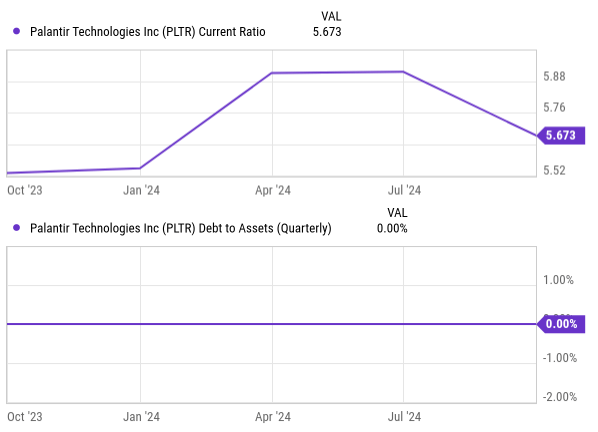

Finally, a quick look into the balance sheet reveals the company has ample liquidity, while it has no debt.

YCharts

Technology Approach

More than developing very powerful AI models, the company is implementing AI in organizations in order to have contextual application that is useful and enhances decision-making. They believe that the companies deploying AI will feel the edge over the companies not doing it.

In the 3Q24 earnings call, the company talked about how Palantir’s Maven Smart System is a good example of the practical usefulness of AI. This system reduces the manpower necessary for complex operations, decreasing the need for operators by two orders of magnitude. An operation that demanded 2,000 people can now be done with 20. The thing about developing models is that they become commoditized. At this stage, the differentiation comes from real-world applications that can have measurable results. Another example is Palantir’s project for one big insurance company that involved creating 78 AI agents to process underwriting. This allowed them to reduce processing time from two weeks to three hours. These types of examples help illustrate the potential of AI applications at scale.

Central to the company’s differentiation is ontology. In this context, ontology refers to organizing and curating data to reflect relationships between data sets of a specific process. That way, an organization can have a map of its knowledge, connecting raw data with real-world concepts. It allows the creation of a semantic layer on top of raw data, describing how data relates to specific processes and enabling easy queries and analysis. The company values ontology far more than AI models because it argues that it is ontology that provides real-world utility to the model. For instance, for these models to be useful for government and private sector applications, they need to adhere to complex requirements. These models must ensure that an AI application follows security protocols and respects data governance.

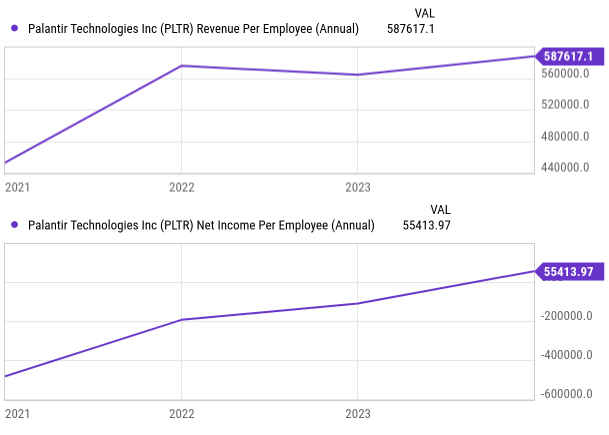

The critical aspect is how to do this at scale, serving more clients without a proportional increase in employee count. The secret is that use cases are being transported across unrelated verticals. A good example is the features developed for government applications that are also relevant to healthcare. This cross-fertilization between different sectors is unlocking scalability and is already visible in the top and bottom lines.

YCharts

Warp speed

Now that we know who won the US elections, we can anticipate that the reindustrialization of the country will be on the agenda. That might come in handy for Palantir. The company has an initiative called Warp Speed whose goal is to address the need to revitalize the American industrial base.

While historically, the US relied on dual-purpose companies serving both civilian and military needs, more recently the defense budget is mostly concentrated on defense contractors. Palantir’s vision is that the US needs to reindustrialize so that it can rapidly adapt for defense, instead of relying solely on a small number of companies, while broadening the economic prosperity. The fact that the Trump administration is also likely to echo these concerns could make Palantir even more relevant. I believe this will be a significant tailwind for the company.

Valuation

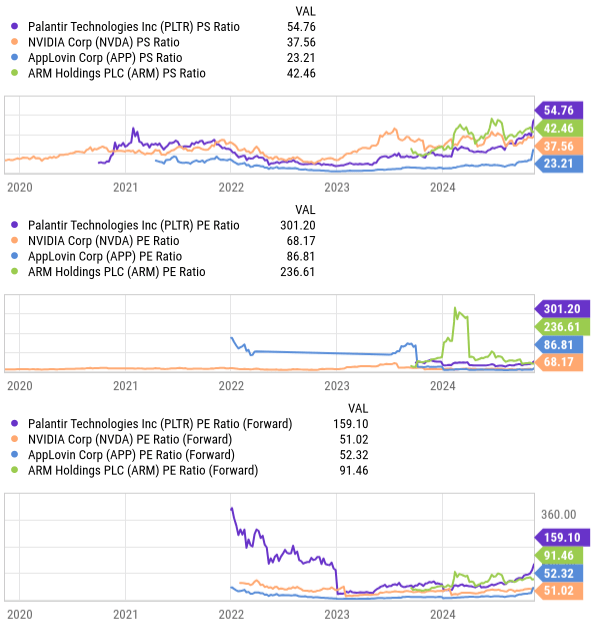

While the Palantir story is a brilliant one, the truth is that the company is valued at stratospheric levels. The company seems valued like a clear winner in the AI space. The best comparable peers in my opinion are Nvidia (NVDA), ARM Holdings (ARM) and AppLovin (APP), and looking at them, Palantir tops all of them in valuation metrics.

YCharts

Risks

After looking at the almost priced to perfection valuation, looking at the risks might be a sobering experience. Even though the company has a high valuation, it is not immune to risks.

For starters, the company has a big dependence on government contracts to derive its revenues. Although this is a source of stable revenue, it also exposes the company to political risks like budget cuts. It goes without saying that any major cutback in defense spending will likely have an impact on the company’s top line.

The company also faces major competitive threats. Enterprise applications are a market where you have both established companies like Microsoft, Amazon or Google, and emerging startups fighting for market share and getting ahead. If the company does not keep pace with the competition, it will likely see reduced demand for its products.

Very importantly, the company has to execute properly. It intends to scale AI solutions across different industries, which might not be straightforward in some cases due to legacy systems or even regulations. If a few of the onboarding projects do not meet the client’s expectations, it might lead to a loss of revenue and negative word-of-mouth.

Finally, there are reputational and ethical risks given the defense agencies’ usage that might spark controversy around issues like data privacy, surveillance, and human rights abuses in military operations. Negative media coverage and backlash from advocacy groups might lead to lost deals and revenue headwinds.

The company has shown in the past a very strong ability to navigate all these risks, but that does not mean it won’t face bumps in the road eventually.

Conclusion

The company has several interesting investment theses going on for it. The most obvious is the strong and accelerating revenue growth. The revenue growth that we have highlighted in the previous paragraphs speaks for itself.

However, that is not the only thesis. The idea that a proprietary AI and ontology framework can create a very significant competitive advantage is even more important, in my opinion. While other companies are too busy in an arms race trying to build huge piles of AI processing capacity, Palantir is focused on deriving utility from the current models. The fact that clients will have a positive ROI from the company’s applications can make all the difference.

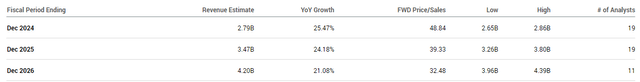

That said, with all the information gathered, we should be able to build a bull-and-bear scenario. We will use the high and low revenue estimates for 2027.

Seeking Alpha

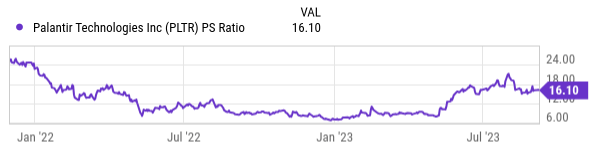

Additionally, we will consider an annual dilution rate of 7.7% (4-year historical average), and adopt sales multiples more in line with the recent past, we will consider 24x for the bull scenario and 6 for the bear scenario.

YCharts

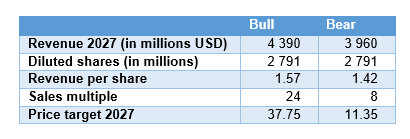

Considering all that, we get the following:

Author’s computations

The biggest implication in this model is that the current stock price is only sustainable if growth keeps accelerating even more, or if there is a huge regime change in the valuation multiple for this company. Given that the growth rate is already stellar and that regime changes of this magnitude are very rare, I am staying on the sidelines on this one because of the valuation. I still have a position in the stock, and I am not thinking about selling, but I will definitely not buy more at these levels. My writing tempo has been awful for this stock, I have held a sizable position for a long time, but I have never written a bull rating on this stock. Sad as it is, now is not the time to change the rating on the stock just because it is highly popular.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.