Summary:

- Palantir Technologies’ recent financials show strong growth, with Q2 2024 revenue up 27% YoY and significant gains in both U.S. Commercial and Government segments.

- Despite impressive growth and profitability improvements, Palantir remains overvalued, limiting long-term returns for investors.

- Potential inclusion in the S&P 500 Index could provide a short-term bullish catalyst, but fundamental overvaluation persists.

- Even with optimistic assumptions, discounted cash flow modeling indicates Palantir is highly overvalued, so my “Hold” rating is again reiterated.

hapabapa

Intro & Thesis

I’ve been covering Palantir Technologies Inc. (NYSE:PLTR) here on Seeking Alpha since October 2021, initially rating the stock as a “Sell” due to its overvaluation and seemingly limited growth at the time. My bearish calls were successful for about a year – until market expectations shifted towards rapid growth through AI, which allowed PLTR stock to recover quickly. Due to persistent overvaluation, I couldn’t upgrade PLTR to “Buy,” even though the positive effects from their new-at-the-time AIP bootcamp program seemed quite obvious. Anyway, I upgraded the stock to “Hold” in February 2023 and have written about the company once a quarter since then, coming to mostly neutral conclusions.

After the quarter, I decided to take a fresh look at the company and examine why my previous neutral thesis has aged poorly and how sustainable the YTD rally I see in PLTR is. It will be particularly interesting to analyze how a possible inclusion in the S&P 500 (SP500) could affect the stock price.

As a result of my update today, I come to disappointing findings for Palantir bulls: Even under the most optimistic assumptions, the stock is glowingly overvalued, suggesting limited returns for investors in the years ahead. However, the possible inclusion may indeed give PLTR another bullish catalyst to make it even more overvalued in the short term.

Why Do I Think So?

First off, let’s begin with the basic – recent financials review. Palantir reported its financial results for Q2 FY2024 in early August 2024, reaching ~$678 million in sales and surpassing the high end of its guidance range by about $29 million, as well as the consensus estimate by ~$25 million. That was a 27% YoY increase – a significant acceleration from the 13% growth recorded in Q2 FY2023 because this time the whole growth was driven by both U.S. Commercial and Government segments (last year we saw a deceleration in particular business areas). The U.S. Commercial segment’s revenue soared by 55% YoY, a remarkable jump from the 20% growth in the same quarter last year. The Government segment showed strong performance, too, with revenue growth reaccelerating to 23% YoY.

So overall, the finding I made last quarter remains relevant today: Palantir has discovered a sustainable growth driver in the form of its AIP bootcamps, reviving its previous growth rates. Additionally, the geopolitical situation and the success of PLTR’s systems in the Russian-Ukraine conflict have yielded positive results, allowing the company to secure several new contracts with the U.S. military-industrial complex and government agencies.

What’s more important for Palantir – the profitability side of the question – also kept improving. The firm’s non-GAAP EBIT surged by 88% YoY to ~$254 million, with the non-GAAP operating margin expanding by over 12% up to 37%. This margin expansion occurred thanks to the strong unit economics we saw in Q2: US commercial customer count went up by 86% YoY, while for Q2 alone PLTR closed 96 deals of at least $1 million each – all that looks pretty impressive if you ask me. At the same time, the consolidated OPEX didn’t move that much – Seeking Alpha’s data shows just a marginal rise of 6.7% for the quarter.

So as a result, the operating leverage turned out to stay massive with non-GAAP diluted EPS going up to $0.09 (up from $0.01 in Q2 2023), while GAAP EPS increased to $0.06 from $0.01. The difference between GAAP and non-GAAP results was primarily due to stock-based compensation, which accounted for 22% of revenue in the quarter – still a pain point for some investors.

On the corporate front, Palantir has been actively expanding its strategic partnerships: In May, the company was awarded a production contract by the U.S. Department of Defense “to license its AI-enabled operating system,” with an initial award of $153 million and potential additional awards of up to $480 million over 5 years; In April, the firm announced a strategic partnership with Oracle Corporation (ORCL), moving its Foundry platform workloads to Oracle Cloud Infrastructure. As Argus Research analysts noted in their report (proprietary source, August 2024), this partnership:

“aims to expand Palantir’s addressable market by leveraging Oracle’s global cloud network, enabling customers to maximize data analytics value while addressing data sovereignty requirements.”

Furthermore, in March, Palantir secured a $178.4 million contract from the U.S. Army for the development of prototypes for its Tactical Intelligence Targeting Access Node (TITAN) program, designed to “provide actionable targeting information for enhanced mission command and long-range precision fires.” All these highlights indicate that the business has been actively flourishing indeed recently.

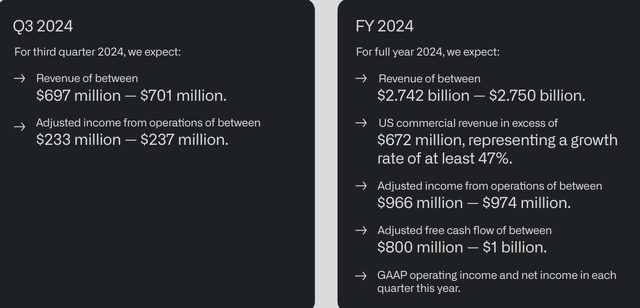

So following all the positives over the past few months of operations, Palantir’s management raised its full-year sales guidance for the 2nd time, now projecting growth of >23% (at the midpoint of the new range). They also increased its FY2024 non-GAAP EBIT margin guidance by about 4% (to >35%).

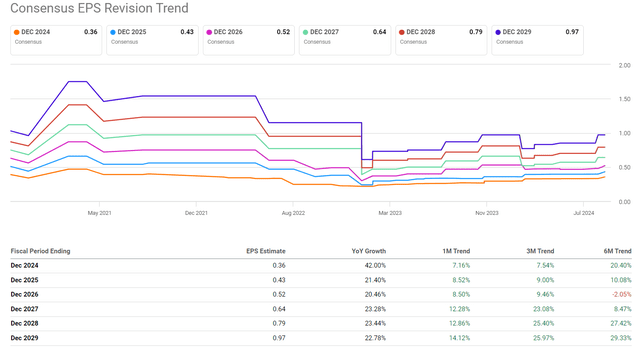

The market seems to have strong confidence in the management and is extrapolating the positives for the years ahead: Over the last 90 days, the consensus estimates for the company’s EPS and sales have been increased 15 times (for each metric), without a single downward adjustment during this period, which is truly impressive:

Looking ahead, I see another bullish catalyst that could stimulate short-term growth in PLTR: the potential inclusion of the firm into the S&P 500 Index (SPY, SP500), which comprises the 500 largest American companies. Why is this important? The reason is that passive investing has become increasingly popular among both U.S. and international households in recent decades. Consequently, there’s a growing influx into ETFs – this trend is driven by the common belief that beating the market is very difficult, which is indeed true. One effective way to keep up with the market is to invest in the entire market. John Bogle discussed this extensively in his seminal works on asset allocation – I highly recommend reading some of his masterpieces.

Anyway, according to The Motley Fool’s data, Palantir meets all the criteria for entry into the S&P 500 Index. The announcement of removed and added companies is set to occur on September 6th. This quarter is likely to mark the 7th consecutive quarter of profitability for Palantir by GAAP standards, and the firm’s market cap now exceeds $68 billion, placing it among the 300 largest companies in America. Thus, the chances of Palantir being included in the index this time are very high. This is especially true after narrowly missing out last time. I believe this time, it should make it.

Unfortunately for bulls, in my view, this will only serve as a short-term bullish factor.

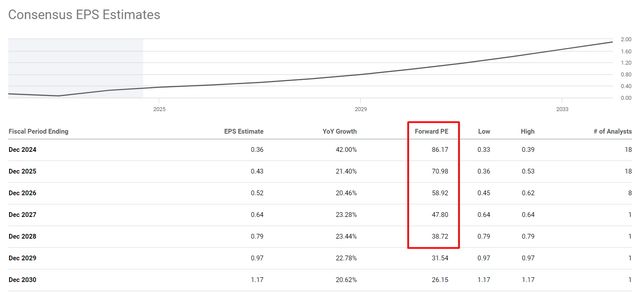

For the company to sustain its growth in the market cap, which aligns with investor expectations, there should be a fundamental justification for this. Palantir has tremendous growth rates, indeed, but everything has its limits. Currently, the consensus is that the company’s EPS will grow at an impressive CAGR rate of about 18% over the next decade. Yet, when examining the valuation P/E multiples, they are projected to decrease from today’s 86.2x to 38.7x in 5 years – in my opinion, the multiple contraction priced-in right now is simply not deep enough to justify the risks PLTR may face while expanding its operations.

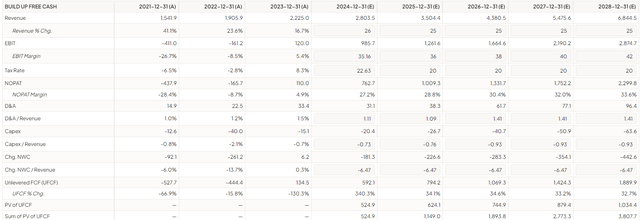

Many people are skeptical about DCF modeling for growth companies, but anyway, let’s proceed with an experiment. I’ll intentionally assume that Palantir’s revenue growth over the next 5 years will exceed today’s already optimistic consensus forecast. Instead of the average 20-21%, I’ll assume a growth rate of 25%. Additionally, I’ll assume that the operating profit margin will expand beyond market predictions – not just to 34-35% by FY2025, but to 36%, and further to 42% by FY2028. This implies that the company will consistently use its operating leverage, achieving rapid, extensive growth in EPS. Assuming a tax rate of only 20% and using historical averages for CAPEX-to-sales and D&A-to-sales ratios, I arrive at the following preliminary results.

FinChat, the author’s notes added

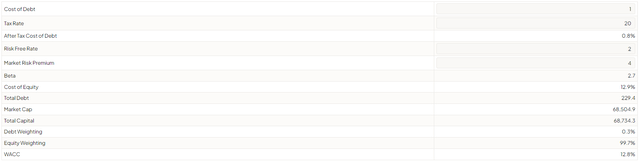

Let’s go further and assume the company’s cost of debt is around 1%, which is a relatively minor factor since the company relies more on issuing shares than on debt. Nonetheless, I’ll also assume the risk-free rate drops to 2% and the market risk premium is only 4%. With these assumptions, I calculate a weighted average cost of capital of ~12.8%.

FinChat, the author’s notes added

Then, if we assume – or rather, if the consensus assumes – that the P/E multiple will systematically decrease by nearly half over the next 5 years, I’ll also take as an assumption that the EV/FCF ratio will decrease by only 16-17% during the same period. This means it would fall from ~73x to just 60x. In this scenario, I would still conclude that PLTR is overvalued anyway, albeit by only 9%:

FinChat, the author’s notes added

The Bottom Line

So, what conclusions can we draw from all of the above?

Firstly, I acknowledge that Palantir is indeed experiencing rapid growth recently. Management is doing everything possible to sustain the reactivation of revenue growth. Furthermore, the operating profit, which emerged several quarters ago, continues to expand due to operating leverage, which is definitely a positive.

Secondly, we should anticipate a significant catalyst in the near future that could drive short-term stock growth – potential S&P 500 index inclusion.

Thirdly, we’re dealing with a highly overvalued company. It’s already trading at a substantial premium to market norms, and any financial modeling, even with very optimistic assumptions, is likely to lead to the conclusion of overvaluation. I understand this is a somewhat controversial argument when considering financial modeling for a growing company; nevertheless, what other method should we rely on?

I’m not satisfied with the consensus. It suggests only a modest reduction in the valuation multiples over the coming years. I believe it’s more reasonable, given such growth, to expect a contraction not to 35x but to 25x. This would better compensate investors for the risk of uncertainty, in my opinion. However, we must work with the situation as it is, which is why I am compelled to reaffirm my “Hold” rating today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!