Summary:

- Despite a ~4x rise this year, Palantir has further gains to offer investors, and I’m reiterating my buy rating on the stock.

- Palantir’s unpredictable growth trajectory and multiple quarters of accelerating revenue make near-term valuation multiples unreliable (the stock trades at ~49x FY25 revenue).

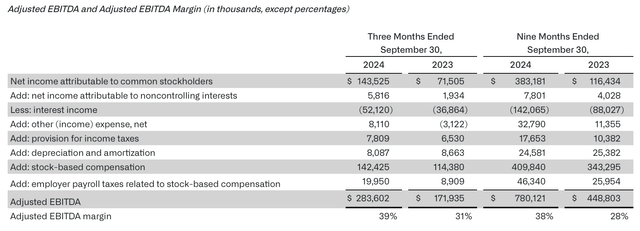

- In Q3, the company drove 30% y/y revenue growth, accelerating three points while also expanding adjusted EBITDA margins by 8 points y/y.

- We note that the company has only ~500 commercial customers, signaling its broad expansion potential in enterprise.

Michael Vi

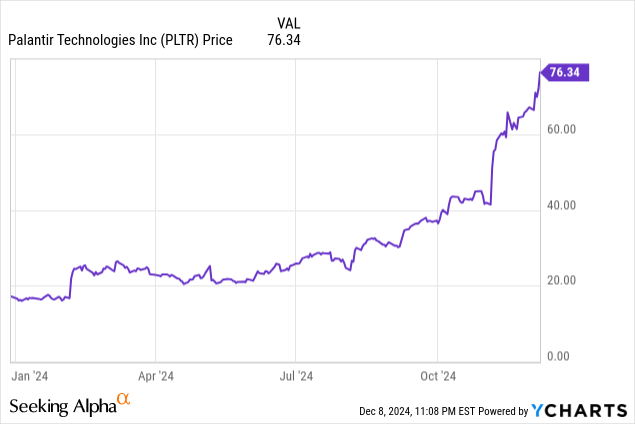

I bought Palantir (NASDAQ:PLTR) on the very first day it went public, with my initial position costing me less than $10 per share. On the very first day it traded, the markets were already jittery about the AI stock’s valuation (before AI became a major driver for valuation explosions) and the stock failed to rally in its earlier days like many IPOs do because of concerns that the lockup expiration would trigger a wave of selling by insiders who had held shares in the unicorn for years.

Today, at least in my view, the mood for Palantir remains no less nervous as sell articles abound, even as the stock has shot up more than 4x YTD: driven by a combination of excitement over Palantir’s tremendous sales execution this year and AI tailwinds, alongside major buying after the company became part of the S&P 500 in September. And yet, despite my usual preference for stocks that exhibit reasonable valuations, I’m still holding on to my position in Palantir, easily the best performer in my entire portfolio all year long.

Palantir’s incredible, unpredictable growth patterns help to invalidate its huge near-term multiples

I’m reiterating my buy rating on Palantir after examining the company’s latest Q3 results. My faith in the company is based on two tenets:

- Revenue growth continues to accelerate, and this is driven by both the company’s government and commercial arms. On the government side, a Republican sweep of the White House and Congress likely ensures priority given to defense spending, bumping the prospects of healthy sales from Palantir’s biggest customer. Palantir has also always espoused a corporate ethos of “America first” and safeguarding American values throughout the world (it is, after all, the software platform credited with helping the U.S. track down Osama bin Laden). This ethos may be rewarded

- On the corporate side, Palantir continues to prove the limitless possibilities driven by AI, and has wide opportunity to expand into SMBs. Palantir’s corporate products started off with tools designed to help banks detect fraud, but has since expanded to limitless automation and detection potential. We note that Palantir doesn’t just sell a specific AI application: instead, it sells the whole platform by which companies can build and deploy AI applications, making its applicability quite broad. Palantir’s penetration in overseas corporates also remains low (the U.S. is just shy of 60% of overall commercial revenue), giving the company a wide TAM overseas. It’s also worth noting that Palantir currently has around 500 enterprise customers, most of which are blue-chips. Over time, it has vast potential to make itself accessible to smaller customers that can expand over time.

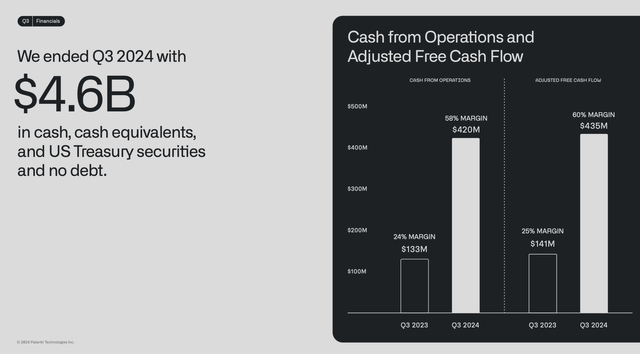

Of course, these strengths come attached with an ultra-high valuation. At current share prices near $76, Palantir trades at a market cap of $173.84 billion, having added more than $100 billion in market cap this year alone (that being said, by comparison, Nvidia (NVDA) has also added more than $1 trillion in market cap this year, so if we’re keeping score, there are other companies that have raced even higher at an even faster pace). After we net off the $4.56 billion of cash on Palantir’s latest balance sheet, its resulting enterprise value is $169.28 billion.

For next year FY25, Wall Street analysts are expecting Palantir to generate $3.47 billion in revenue, up 24% y/y. Taking this estimate at face value, Palantir trades at 49x EV/FY25 revenue – whereas most of the software industry’s bellwethers, such as Salesforce (CRM) and Workday (WDAY), have gone down to a ~6-8x forward revenue multiple.

So, does this mean Palantir is up to ~5x overvalued, after its stock has quadrupled this year? In my view, no. The reason is because Palantir is not on a predictable growth trajectory. We’ll discuss Q3 results next, but very few companies at a ~$3 billion annual revenue scale are also capable of accelerating their pace of growth, and as quickly as Palantir is. This helps to distill the idea that Palantir is unpredictable, and that its revenue base could multiply quickly.

The composition of Palantir’s deals is what helps to support this idea. Again, Palantir generates just under half of its revenue from the U.S. government, which as seasoned software investors are aware can provide some of the most lucrative contracts in the industry (recall the intense competition between Microsoft (MSFT) and Amazon (AMZN) for a $9 billion contract from the Pentagon). Palantir has, in my view, entered into this league of large-cap software vendors and is equally in line to receive a large share of federal IT spend. Add this on top of the myriad use cases that commercial clients can provide, and we have a formula for sustained growth for Palantir.

I’ll re-evaluate holding on to my position in Palantir if either of the following two conditions are triggered:

- If Palantir’s growth decelerates to the low 20s

- If Palantir’s margins stop progressing and profitability is no longer growing

Until then, I don’t think near-term valuation multiples are altogether meaningful for a software company whose growth itself has proven quite unpredictable (and in always surprising to the upside, this is a great thing). Stay long here and enjoy the ride.

Q3 download

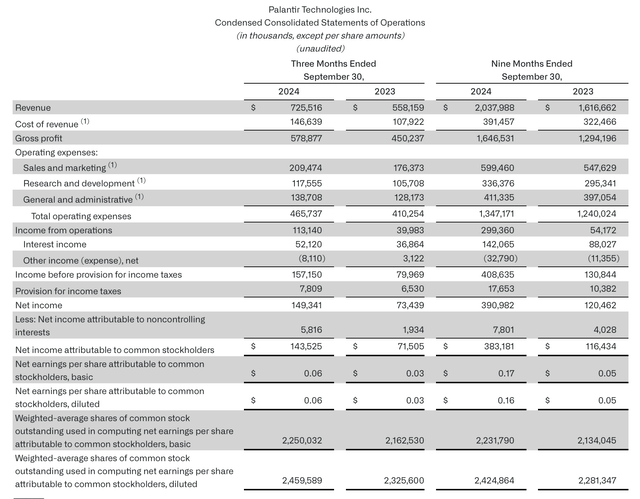

Let’s now go through Palantir’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Palantir Q3 results (Palantir Q3 earnings deck)

Palantir’s revenue grew 30% y/y to $725.5 million, decimating Wall Street’s much more conservative expectations of $703.7 million (+26% y/y). It’s worth noting as well that Palantir’s revenue accelerated 3 points relative to 27% y/y growth in Q2, which in turn accelerated from 21% y/y growth in Q1. To me, it makes more sense to rely on near-term valuation multiples when companies are on a “normal” decelerating growth curve: but this just doesn’t apply to Palantir.

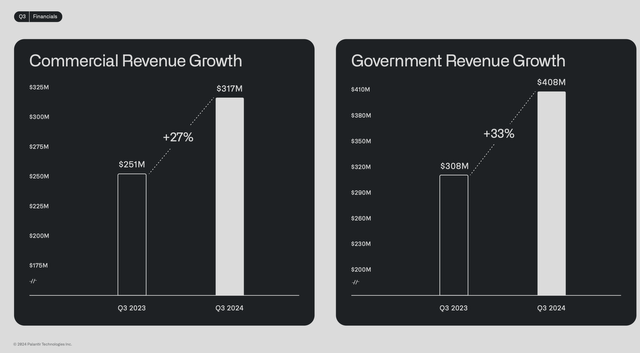

The acceleration in Palantir’s overall revenue was primarily driven by the company’s government segment, which represented 56% of overall revenue in Q3. Government revenue soared 33% y/y to $408 million, ten points stronger than 23% y/y growth in Q2.

Palantir revenue by segment (Palantir Q3 earnings deck)

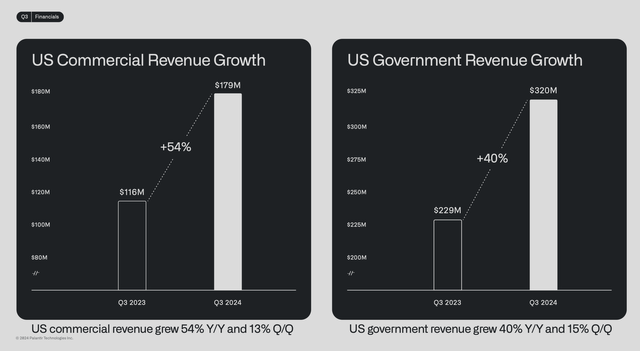

Of course, nowhere does the investor thesis of “American exceptionalism” play out more than in Palantir, for which U.S. growth is far outstripping international growth, particularly in the government segment, where U.S. government revenue grew 40% y/y to $320 million. Again, I firmly believe a Trump presidency will benefit Palantir’s America-first ethos and its longstanding partnership with U.S. defense entities, and its potential to land large government deals with the new administration is broad.

Palantir US trends (Palantir Q3 earnings deck)

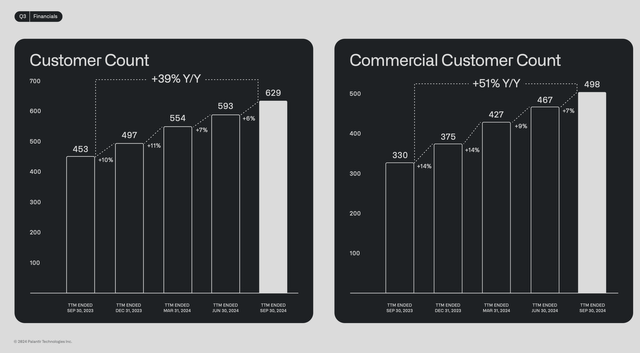

Strong U.S. commercial revenue growth can’t be ignored as well. U.S. commercial accelerated 54% y/y to $179 million (25% of overall revenue), in-line with Q2’s 55% y/y growth pace. And yet, we should recognize that Palantir’s room for expansion in the commercial sphere is still broad.

As of the end of Q3, the company had just 498 commercial customers, of which 321 (64%) are in the U.S.

Palantir customer counts (Palantir Q3 earnings deck)

Let’s compare that, meanwhile, to a few other high-performing mid-cap enterprise software companies that regularly report customer counts (not all do, especially among large-caps).

- Datadog (DDOG): as of Q3 this observability software company has ~28k customers, of which over 3k generate >$100k in ARR

- HubSpot (HUBS): this CRM company has 238k customers, with its focus on SMBs (the average annual revenue generated is roughly ~$11k), and it’s currently generating ~$0.7 billion in quarterly revenue – more than double Palantir’s entire commercial segment this quarter

- Atlassian (TEAM): the enterprise collaboration and work management platform has “over 300k” customers, of which ~47k generate more than $10k in cloud ARR. It’s worth noting that Atlassian deploys a primarily self-service sales model, without a dedicated sales rep push.

The distinction is clear: Palantir is still in the very early innings of capturing its enterprise potential. Of course, not all mom-and-pop businesses might be a fit for Palantir, and that’s okay. But comparing against other successful software companies showcases that the company has quite a bit of room to expand, especially if it added lighter-touch/self-service sales processes to accommodate customers with less complex needs.

And on the profitability front, we note that despite accelerating growth, Palantir also continues to impressively expand its margins. Adjusted EBITDA grew 65% y/y to $263.6 million, with margins expanding 8 points y/y to 39%:

Palantir adjusted EBITDA (Palantir Q3 earnings deck)

Year to date, Palantir’s adjusted FCF of $435 million has also grown more than 3x versus the prior-year period:

Palantir FCF (Palantir Q3 earnings deck)

Risks and key takeaways

Palantir is an exceptional company whose multiple successive quarters of accelerating revenue growth speak to the broad untapped opportunity this company is currently enjoying in deploying its AI solutions for both government and enterprise clients: and in the latter arena, the company has barely ~500 customers and is just getting started.

Valuation is the biggest risk for Palantir, hands down. Yes, the stock trades at an uncommonly bullish valuation premium, but I find near-term multiples here to be an inconclusive guide when its growth trajectory has been so difficult to predict. These are joined by a number of fundamental risks, including the potential of government efficiency measures led by the DOGE (Department of Government Efficiency) which could have the impact of stunting the company’s federal deal momentum. It’s also possible that as more software companies release more specific AI point-solutions that are more “plug and play” relative to Palantir, that the company could face stiffer competition.

That being said, few companies in AI carry the brand cachet that Palantir does. Stay long here and hold out for further gains.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.