Summary:

- Palantir’s stock has surged 98% since my previous bullish call due to strong fundamentals and massive industry tailwinds.

- AI-driven demand is fueling Palantir’s rapid revenue growth, with both business segments showing 25%+ YoY growth and new offerings launches enhancing its value proposition.

- Palantir’s government contracts and innovative AI tools position it as a trusted partner, with industry tailwinds expected to drive a 29% CAGR in AI spending through 2028.

- I think that PLTR is fairly valued at the moment, which is attractive for investors of such a stellar company.

JHVEPhoto

My thesis

Palantir (NASDAQ:PLTR) stock is on fire as it has rallied by 98% since my September 29 bullish article. I think that the rally is only partially explained by the FOMO effect because the company’s fundamentals are strong, and industry tailwinds are massive. There are numerous bullish factors around the stock which are likely to help drive further aggressive business expansion, which sooner or later will result in even more rapid share price appreciation.

The risks of a temporary correction are inherent after big rapid rallies, but as a long-term investor I am not very much concerned about temporary share price pullbacks. In fact, I will actually be very grateful in case the stock dips because it will mean that I have an opportunity to get such a fantastic stock at a discount. The stock is fairly valued at the moment, not overvalued. This means that PLTR remains a Buy.

PLTR stock analysis

The AI tailwinds that are fueling PLTR’s rapid business expansion and share price rally show no signs of abating. All industries across the board scramble to achieve maximum efficiency by integrating AI in their operations. This makes Palantir’s expertise in data analytics and AI-powered decision-making tools have become increasingly invaluable.

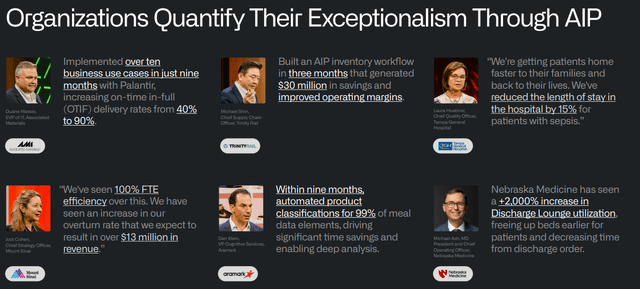

Palantir’s IR

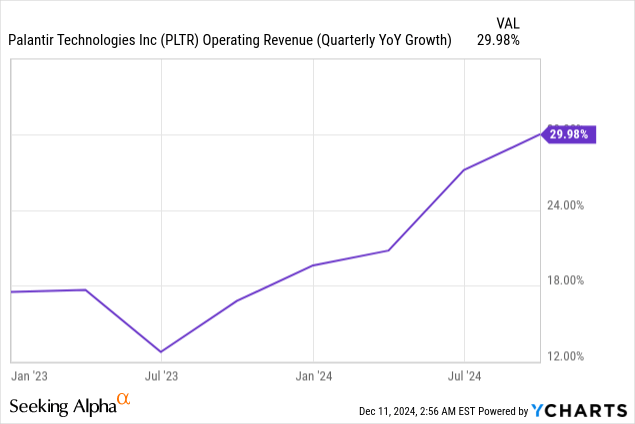

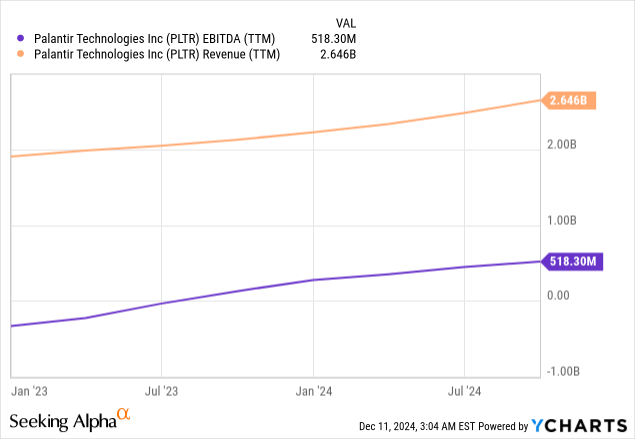

The rising demand for PLTR’s offerings is clearly seen by its rapidly accelerating revenue growth over the last several quarters. As companies become larger, their revenue growth tends to decelerate which is natural due to higher multiples. This makes Palantir’s rapid revenue growth acceleration of the last two years especially valuable for investors.

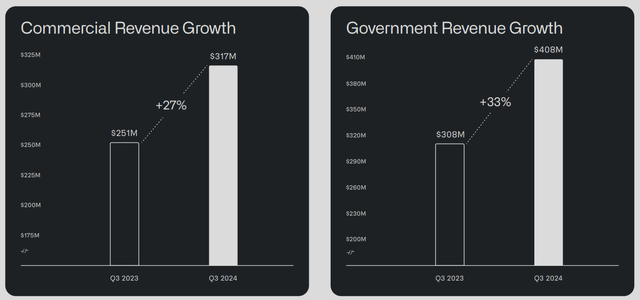

The company demonstrates accelerating growth across both segments, which is another rock-solid source of fundamental strength. Palantir’s both business lines are on fire with a 25%+ YoY revenue growth in Q3.

PLTR’s IR

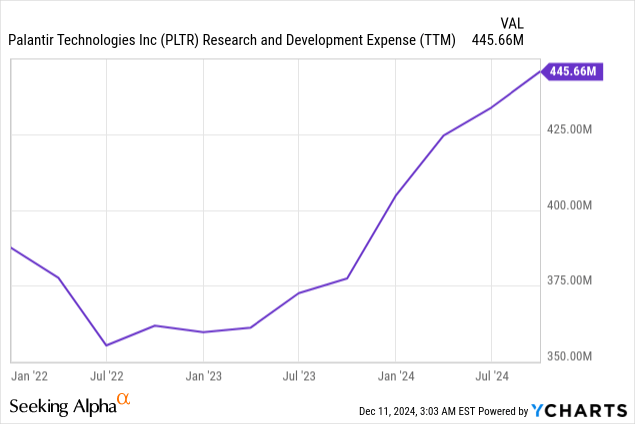

The company’s Artificial Intelligence Platform (AIP), launched in mid-2023, has quickly become a cornerstone of its growth strategy. According to the management, AIP is very strong in enabling organizations to implement AI-driven solutions efficiently and at scale. The management reiterated its plans to invest aggressively in AIP. This will highly likely help in improving the company’s value proposition, and this will be attractive for both current and potential customers. With the R&D spending soaring there is a high probability that PLTR will roll out several new offerings and features in 2025.

New products (or modules) are highly likely to help PLTR maintain robust revenue growth. The company’s business model has already proven to be highly efficient and scalable. Therefore, increased revenue growth will likely translate into greater profits for shareholders, which can either be reinvested in further growth initiatives or returned to shareholders through buybacks. Either scenario appears positive for PLTR bulls.

I have already mentioned that the Government segment is thriving, and it remains a cornerstone of business expansion. The company’s contract with the U.S. Special Operations Command has been recently expanded with the software firm to deliver advanced AI and mission manager capabilities. Another big positive information for this business line is the recent FedRAMP high baseline authorization grant. This step is crucial as it allows Palantir to securely provide its full suite of products to the U.S. government agencies. This strengthens PLTR’s positioning as a trusted partner for critical operations of the world’s number one economy.

The company is not content with its current success as I see that the management is actively pushing boundaries of what is possible with AI. The launch of new AIP for Developers features, including tools like Ontology SDK 2.0 and Workflow Builder, highlights Palantir’s commitment to boost innovation and enable faster, more efficient development for its customers.

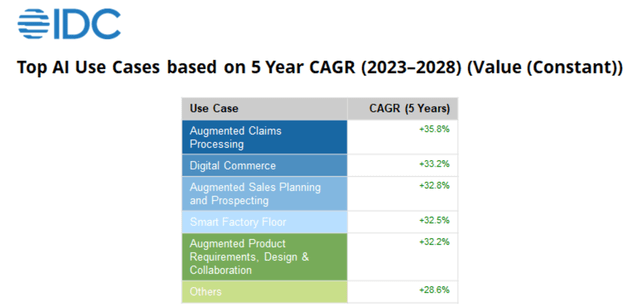

IDC

Industry tailwinds are expected to remain strong over the next several years. According to IDC’s forecast, the worldwide spending on AI will demonstrate a 29% CAGR over the 2024-2028 forecast period. Moreover, this growth will be fueled by strong demand growth across various use cases, which makes the window of opportunities for Palantir quite wide.

Intrinsic value calculation

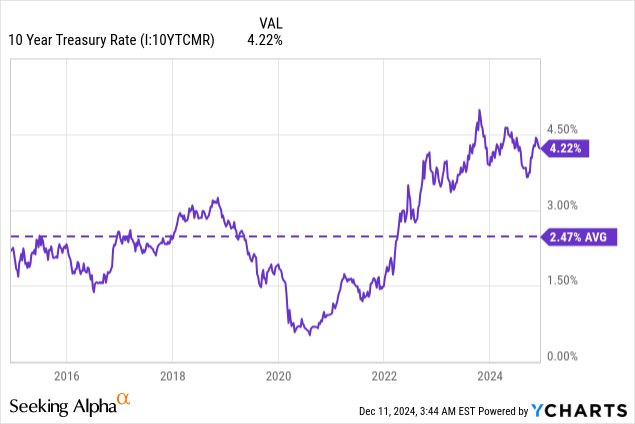

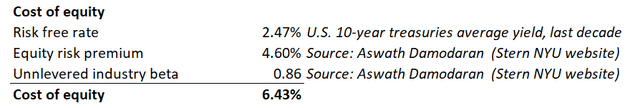

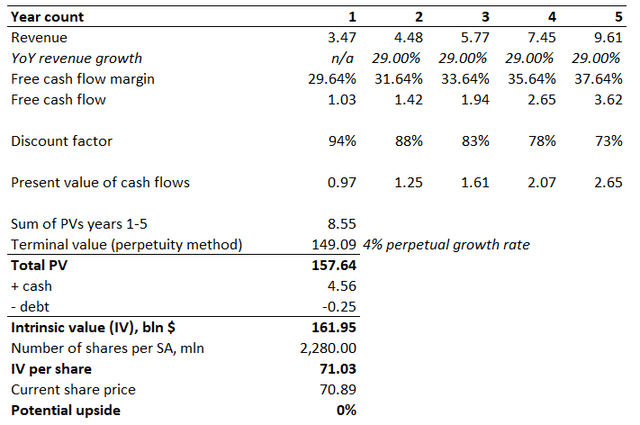

Palantir’s stock analysis reveals that the company is likely to demonstrate strong revenue and profitability growth over the decades. Therefore, my DCF model will consist of quite aggressive assumptions. But before, I have to calculate the discount rate. It will be the cost of equity since Palantir’s reliance on debt is quite low ($0.25 billion total debt for a $170+ billion market cap company).

Palantir’s almost invisible leverage also enables me to use the unlevered beta, which is inherently lower. I rely on recommendations from Aswath Damodaran for unlevered beta corrected for cash for the computer services industry. The last decade’s average 10-year treasury yield is 2.47%, which is the risk-free rate that I use for my CAPM calculations. Putting all required CAPM variables together gives me cost of equity of 6.43%.

DT Invest

The year 1 revenue assumption relies on the average FY2025 forecast from Wall Street analysts. For the period between year 2 to year 5 I incorporate a 29% revenue CAGR. The aggressive revenue CAGR assumption for the next five years is balanced out with a relatively modest (for a company like PLTR) 4% perpetual growth rate. PLTR’s TTM levered FCF margin is 29.64%. Due to the company’s strong correlation between the revenue and EBITDA growth, I expect that PLTR will be able to expand the margin by at least 200-bps per annum.

Below working with my DCF simulation suggests that the stock is almost perfectly fairly priced. With a robust set of catalysts and aggressive investment in innovation, a stock like Palantir easily deserves a premium. Nevertheless, the stock currently trades at fair value. Not overvalued means attractive valuation for a stock like PLTR.

DT Invest

What can go wrong with my thesis?

Investing in Palantir is not only about the positives. There are inherent stock market risks like unfavorable developments around the Fed’s monetary policy, or investor fears that are not related directly to PLTR or AI industry.

Moreover, there are some notable business risks. First, the company’s revenue is concentrated among a limited number of large customers, according to the latest 10-Q form. The loss of one or more of these key customers could significantly impact on revenue and profitability.

Any thriving industry attracts numerous players, meaning elevated competition risks for PLTR. There are Magnificent 7 tech companies that possess vast financial and human resources to expand into Palantir’s addressable market. Competing directly with giants like Google or Amazon will be extremely challenging for a young company like Palantir.

Last but not least, the AI industry is very young and over time I expect it to become more regulated. Therefore, there might be additional regulatory requirements around data privacy or security, which could pose additional risks or compliance costs for Palantir.

Summary

The company is positioned well to demonstrate long-term robust revenue growth and profitability expansion. AI tailwinds are expected to remain extremely strong as businesses see benefits from leveraging cutting-edge tools to streamline processes. Moreover, I think that a fair valuation for a growth superstar like Palantir is very attractive since the stock is not overvalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.