Summary:

- Palantir’s robust FQ3’24 performance and raised FY2024 guidance further underscore its growing moat in the US government along with increased mindshare in the commercial sector.

- The stock’s outperformance continues to demonstrate an impressive bullish support from its investors, as it charted new heights beyond historical levels.

- PLTR is no longer trading within reasonable valuations/ fundamentals for investors seeking long-term capital appreciation, worsened by a highly risky momentum investing strategy.

- If anything, the management has already hinted at further shareholder equity erosion in the recent earnings call, with it potentially being a bottom-line headwind.

- While PLTR may continue to offer a compelling SaaS investing story, we are reiterating our Sell rating upon the exhaustion of the stock’s current upward momentum.

Klaus Vedfelt

We previously covered Palantir Technologies Inc. (NYSE:PLTR) in October 2024, discussing the successful monetization of the ongoing generative AI chip and SaaS boom, as observed in the high double digits revenue growth.

Even so, we had believed that its return profile at the inflated valuation levels was likely to be underwhelming, attributed to the overly expensive valuations. This was on top of the growing SBC expenses and insider selling, with it negating the high growth investment thesis and increasingly rich net income margins.

PLTR’s Bull Case

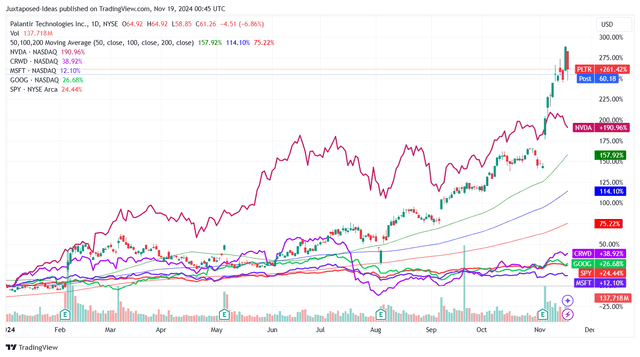

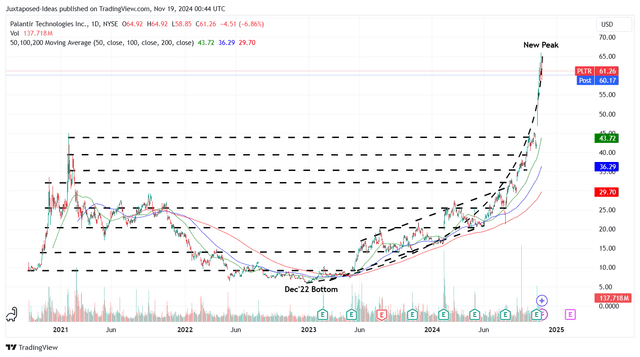

PLTR YTD Stock Price

Since then, PLTR continues to demolish the bears with an outstanding +45.9% stock price outperformance, compared to the wider market at +0.6%.

Author’s Historical Rating

It is apparent by now, that our previous Hold rating in August 2024 and Sell rating in October 2024 have been proven wrong, as the bulls won over the bear at the moment.

Much of PLTR’s outperformance is also attributed to the +58.8% stock price gain after the FQ3’24 double beat performance, with revenues of $725.51M (+6.9% QoQ/ +29.9% YoY), richer adj EBITDA margins of 39% (+0.5 points QoQ/ +9.2 YoY), and positive adj EPS of $0.10 (+11.1% QoQ/ +42.8% YoY).

If anything, readers may want to note that its government prospects are mostly tied to the US government, which currently comprises 78.4% of its government revenues and 44% of its overall revenues in the latest quarter.

With Germany likely to reverse their previous decision and PLTR expanding their reach within the UK, it is undeniable that its long-term growth potential is promising, despite the -7% sequential decline in FQ3’24 international commercial revenue growth, “as a result of continued headwinds in Europe and a step down in revenue from a government sponsored enterprise in the Middle East.”

The same has been exemplified by the overall government segment’s relatively rich contribution profit margin of 59.5% (-2.9 points QoQ/ -0.9 YoY), compared to the commercial segment at 59.9% (+0.7 points QoQ/ +6 points YoY).

This is on top of PLTR’s expanding Net Dollar Retention of 118% (+4 points QoQ/ +11 YoY) and multi-year Remaining Performance Obligations of $1.57B (+14.5% QoQ/ +58.9% YoY), as commercial sales also recovered by leaps and bounds to $317M (+3.2% QoQ/ +26.2% YoY).

If anything, the management has already raised their FY2024 guidance for the third time to +25.8% in YoY revenue growth and +36.7% in YoY Free Cash Flow generation, compared to the original guidance of +19.2% YoY and +23.1% YoY, respectively.

Combined with the growing completed deals and customer counts, it is apparent that the AIP boot camp has been highly monumental to PLTR’s increasingly rich Rule of 40 score at 68% (+4 points QoQ/ +22 YoY) and the stock’s outperformance on a YTD basis.

This is on top of the company’s growing penetration in the US government segment along with increased mindshare amongst the commercial sector, with it signaling an increased barrier to entry as other competitors flounder, including C3.ai (AI), BigBear.ai (BBAI), and Snowflake (SNOW), amongst others.

PLTR’s Bear Case

The Consensus Forward Estimates

Even so, based on the consensus FY2025 adj EPS estimates of $0.47, PLTR’s extremely expensive FWD P/E non-GAAP valuation of 139x is undeniable, compared to its 5Y mean of 119x.

Assuming no changes to the consensus FY2030 adj EPS estimates of $1.27 (based on one estimate) and minimal stock price appreciation, it is apparent that the stock may only grow into its premium valuations over the second half of the decade at FY2030 P/E non-GAAP valuation of 51x, nearing its 2022/ 2023 P/E non-GAAP valuation mean of 57x.

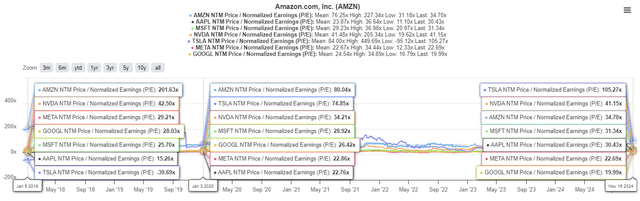

Mag 7 Valuations

These developments naturally mimic the natural maturing of most high growth companies, one that we have observed for some of the Magnificent 7 stocks.

The reason that we have chosen Magnificent 7 stocks to compare against PLTR, is attributed to the latter’s near vertical stock price rally as its offerings are increasingly adopted by the US federal government along with commercial consumers.

If anything, PLTR’s federal cloud service offering has received a DoD Impact Level 6 (IL6) PA from the Defense Information Systems Agency (DISA), a security clearance similarly obtained by some of the top global hyperscalers, including Microsoft Azure (MSFT) and Amazon AWS (AMZN), with Google Cloud (GOOG) only at Level 5.

With PLTR increasingly becoming a cloud/ SaaS powerhouse, a comparison may be apt indeed – particularly with AMZN, whose premium P/E non-GAAP valuations have moderated from the peak of 227x observed in January 2018, down to 34x in October 2024.

Even so, we must highlight that AMZN is the exception to the rule, as observed above, since all other Magnificent 7 stocks consistently remain well within the double-digit P/E non-GAAP valuations pre- and post-COVID-19 pandemic.

Even the godfather of AI, Nvidia (NVDA), is still trading reasonably at FWD P/E non-GAAP valuations of 41x, despite the company’s undisputed market leadership in AI accelerator chip market and the robust data center related capex boom over the foreseeable future.

The same can be said of Tesla (TSLA) at 105x (relatively cheaper than PLTR), attributed to the ongoing electrification trend across EVs and solar energy, along with the potential monetization from the autonomous driving capabilities, robotaxi, and humanoid robots.

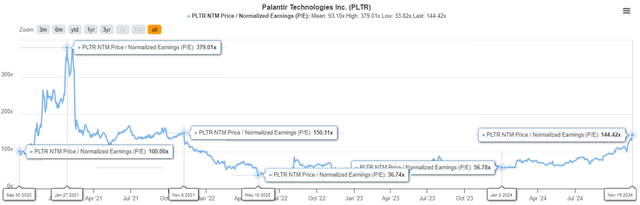

PLTR Valuations

For now, with PLTR already trading at triple digit FWD P/E non-GAAP valuations, albeit still lower than the peak 379x observed in January 2021, we maintain our belief that the stock’s overly expensive valuations remain a major red flag for investors seeking further capital appreciation prospects.

This is worsened the relatively higher beta of 1.94x, compared to the wider market/ SPY at 1x and the US SaaS sector median of 1.14x, on top of the relatively lower institutional ownership at 55.8% compared to NVDA at 71.7% and AMZN at 68.6%, while nearing TSLA at 52% – with it implying more volatility in the meantime.

As a result of the uncertainty of PLTR repeating AMZN’s historical trend, we believe that it remains more prudent to observe the former’s stock price movement for a little longer, despite the high-growth trend and promising long-term prospects.

While the stock may potentially generate new heights ahead, in our opinion, valuations and fundamentals do matter for investors seeking long-term capital appreciation prospects, with the inflated valuations and sky-high stock prices implying a relatively risky form of momentum trading.

This is especially since 20 customers comprise 45.3% of PLTR’s LTM revenues, compared to the overall customer count at 629, exemplifying its increasingly risky customer concentration, as FY2025 also bring forth a tougher YoY comparison attributed to the double-digit growths observed through AIP in FY2024, as many of its AI SaaS competitors play catch up in the near term.

If anything, the management has already hinted at further shareholder equity dilution in the recent earnings call, with it potentially being a bottom-line headwind as discussed in our previous article:

On the back of the company’s strong performance, our inclusion in the S&P 500 and the increase in our stock price, we will continue to monitor if we become required to accelerate stock-based compensation expenses if certain market based vesting criteria are achieved earlier than expected. (Seeking Alpha)

So, Is PLTR Stock A Buy, Sell, or Hold?

PLTR 4Y Stock Price

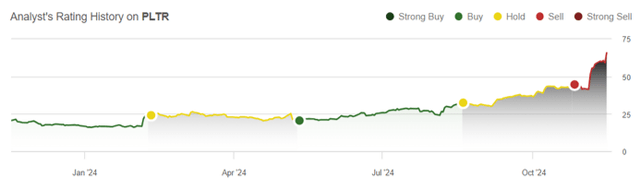

With PLTR now charting new heights and more traders/ investors chase the rally (potentially attributed to Fear Of Missing Out/ FOMO), we believe that the stock is no longer trading based on fundamentals at the moment.

While we may have liquidated all of our holdings too early and thus, missing out on the stock’s recent rally, it goes without saying that it is unlikely that this buying momentum may last forever, with any sign of slowing growth and/ or analysts’ downgrades potentially bringing forth painful corrections.

We continue to stand by our long-term price target of $31.90 as well ($30.20 in our previous article), based on the consensus raised FY2026 adj EPS estimates of $0.56 (previously $0.53) and the 2022/ 2023 P/E non-GAAP mean of 57x.

While PLTR may continue to offer a compelling SaaS investing story and robust bullish support, as most early investors also enjoy rich capital appreciation (depending on their entry points), it is undeniable that there remains a minimal margin of safety at current levels – resulting in our reiterated Sell rating upon the exhaustion of the stock’s current upward momentum.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.