Summary:

- Palantir Technologies has been a popular name to own among AI enthusiasts and investors, but its valuation is ahead of projected growth rates.

- I come up with a fair value under $15, which could decline markedly in a recession scenario.

- There is “no room for error” in share pricing, as insiders/management have turned into heavy sellers during 2024, while the technical momentum picture is mixed at best.

gremlin/E+ via Getty Images

Palantir Technologies Inc. (NYSE:PLTR) has been a top choice of artificial intelligence enthusiasts over the past year. However, it’s valuation appears to be well ahead of its projected growth rate. Like I mentioned in a previous note of caution back in November here, when the AI investment excitement dies down or corrects in rapid fashion, Palantir could easily be a $15 or lower stock later in the year from today’s $24 price. Why not wait for a better entry point, if you want exposure to AI-related names?

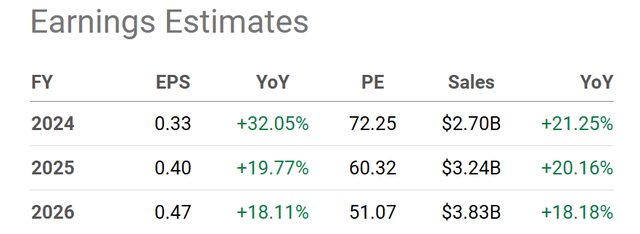

I will say earnings and sales growth rates estimated around 20% per year into 2027 are worth something to owners. But, paying 72x this year’s EPS for 20% annualized growth is incredibly expensive (3.5x forward PEG Ratio, when buy territory is usually defined as 1.0x to 1.5x). In terms of an after-tax earnings yield on investment, Palantir’s 1.5% rate is incredibly unattractive vs. 5%+ for cash savings rates.

Seeking Alpha Table – Palantir, Wall Street Analysts Forecasts for 2024-26, Made June 11th, 2024

My view is nothing can wrong with management’s business execution on sky-high investor expectations for growth. For example, any downshift in expectations from 20% growth rates to 15% would likely be devastating for the stock quote. If we put a PEG Ratio of 2x on the stock from reduced EPS expansion results, using a 30x P/E (2x EPS gains of 15% annually), a bearish price target forecast all the way back down to $10 a share might be possible by the end of 2024. Such would be good for nearly a -60% loss for investors buying around $24 today.

Let me explain some of the data keeping me on the sidelines, waiting for a misstep in the economy (recession pulling down operating results) or a re-evaluation of how investors rate the business (away from current super-bullish AI projections and sentiment).

Palantir – Q1 2024 Earnings Presentation

Stretched Valuation

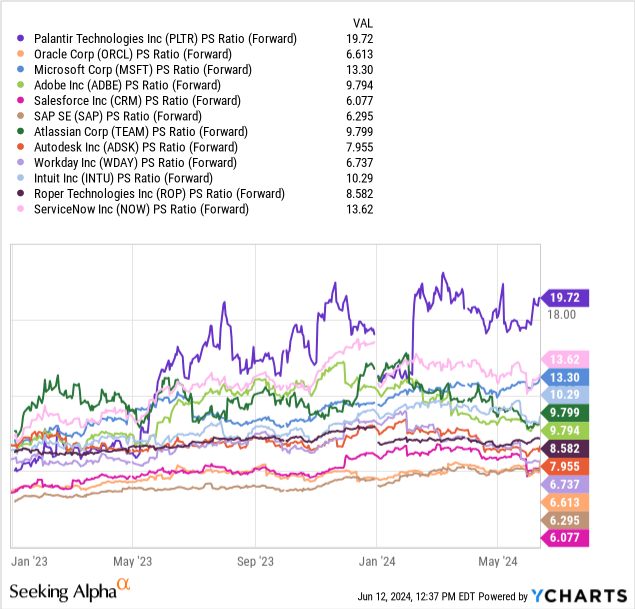

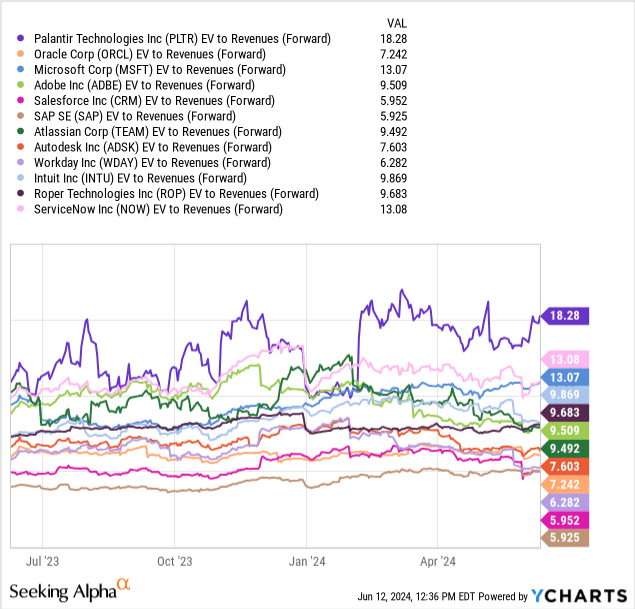

My biggest valuation issue is the price to sales ratio has moved from a middle of the pack, big-data software number several years ago to the highest in the peer group by far. Below is a chart of this idea starting in January 2023. Over the last 18 months, price to forward estimated sales have skyrocketed from 7x to almost 20x, mostly supported by AI hype. The current sales ratio is more than DOUBLE the mean average for the industry. My sort group includes Oracle (ORCL), Microsoft (MSFT), Adobe (ADBE), Salesforce (CRM), SAP SE (SAP), Atlassian (TEAM), Autodesk (ADSK), Workday (WDAY), Intuit (INTU), Roper Tech (ROP), and ServiceNow (NOW).

YCharts – Palantir vs. Major Software Peers, Price to Forward Estimates Sales, 18 Months

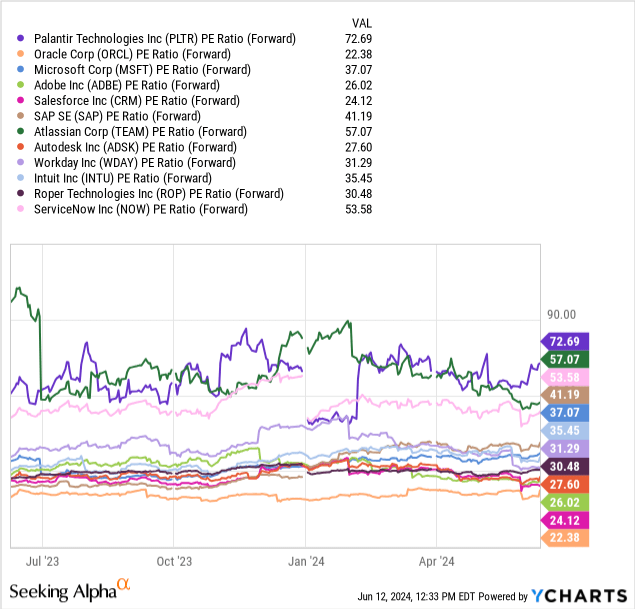

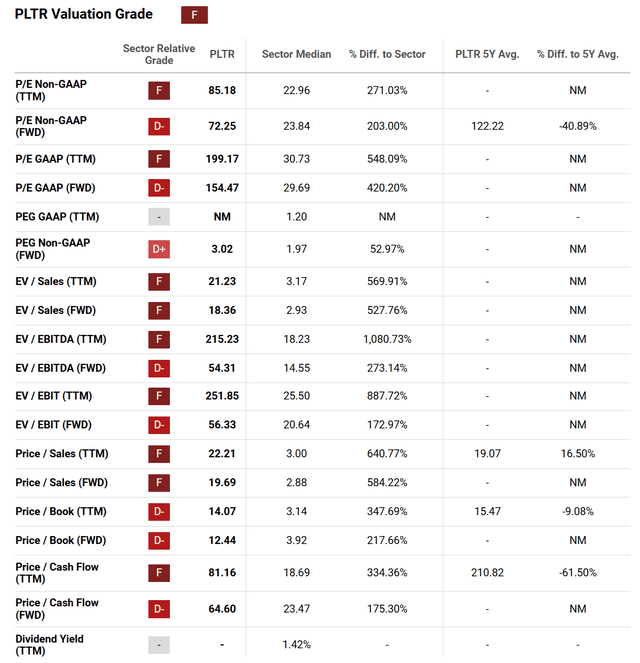

Other valuation calculations on basic underlying fundamentals have also moved to extremes vs. the software industry. The forward P/E ratio of 72x for calendar 2024 is another 100% premium setup vs. the industry.

YCharts – Palantir vs. Major Software Peers, Price to Forward Estimates EPS, 12 Months

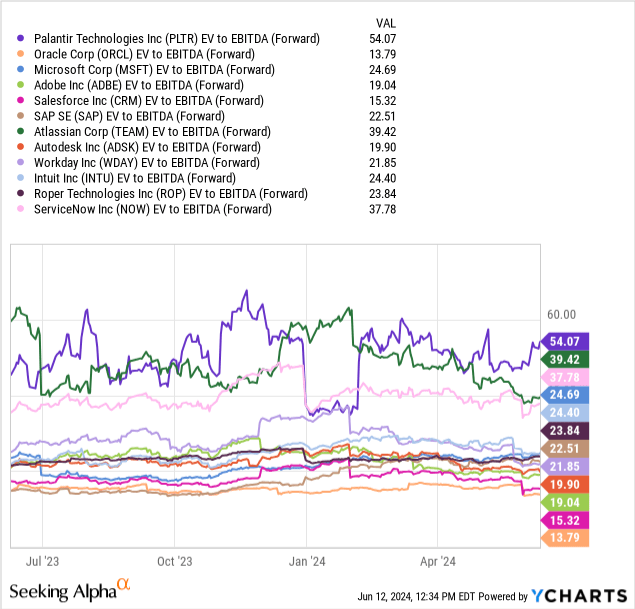

When we take into account debts and cash on hand, the enterprise valuation on cash EBITDA is just as overcooked. The forward estimated number of 54x is an even greater distance than the 22x median average from peers.

YCharts – Palantir vs. Major Software Peers, EV to Forward Estimates EBITDA, 12 Months

In addition, the EV to forward Revenue multiple of 18.3x is another DOUBLE the median sector average just over 9x. So, investors buying at $24 a paying a pretty penny for a position.

YCharts – Palantir vs. Major Software Peers, EV to Forward Estimates Sales, 12 Months

On a larger number of stats, the Seeking Alpha Quant Valuation Grade is clearly an “F” for new buyers. You are sticking your neck out, counting on even better growth rates than now forecast to keep the stock quote from declining. On strict comparisons to peers and competitors, Palantir has a valuation that is getting harder each day to logically justify.

Seeking Alpha Table – Palantir, Quant Valuation Grade, June 11th, 2024

Technical Momentum Picture

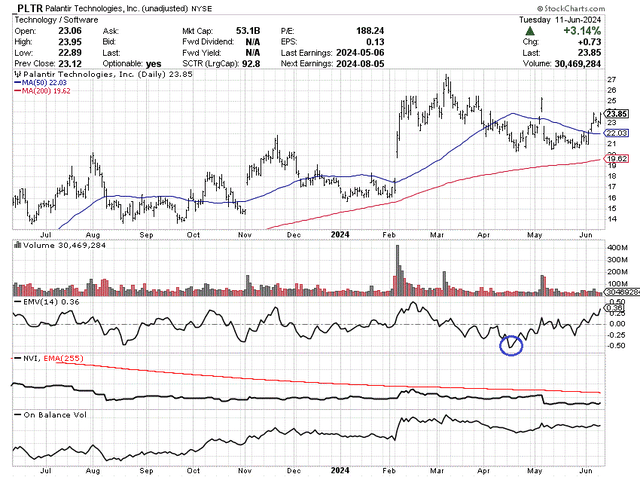

When I review the trading pattern for Palantir, I don’t see much to get excited about either. Most momentum indicators are rather blah for a stock rising +50% in price over the last 12 months. Despite the NASDAQ 100 index outlining new all-time highs in June, PLTR”s $24 price is well below the $27 high in early March.

I have mentioned the Ease of Movement indicator in past Big Tech bear articles since the spring, which also suggests a lack of buying interest has been a problem from time to time in Palantir. The 14-day EMV slide in April is particularly concerning (circled in blue below). It was the worst score since January 2022, and highlighted an absence of buyers to support price for several weeks.

The sliding Negative Volume Index over the past 12 months is also a symptom of overhead supply standing in the way. Luckily, a major bull market in technology names, plus the AI buzz around Palantir have been able to overcome selling volumes.

Lastly, On Balance Volume has only been to generate a minor gain over the past year, with a peak in March. Strong OBV readings would be preferable for a grand multi-year bull market span. All of the above leave me very suspicious of PLTR gains, and whether they can be sustained if any bad news hits shares.

StockCharts.com – Palantir, 12 Months of Price & Volume Changes, Author Reference Point

Final Thoughts

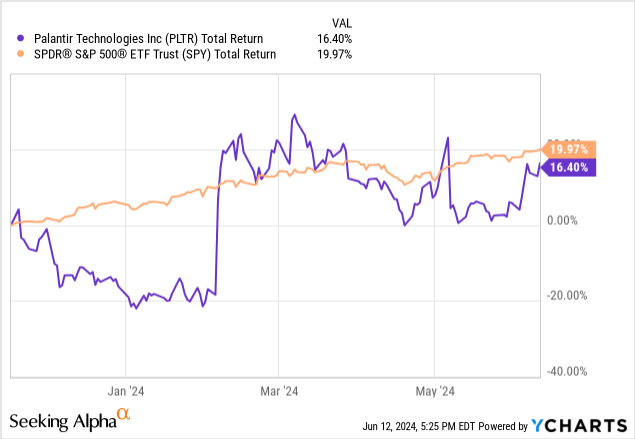

Since my November 20th article, Palantir has risen from $20.65 to $24, a +16% gain approximately matching the S&P 500’s performance over six months, if not starting to lag the market.

YCharts – Palantir vs. S&P 500 ETF, Total Returns, Since November 20th, 2024

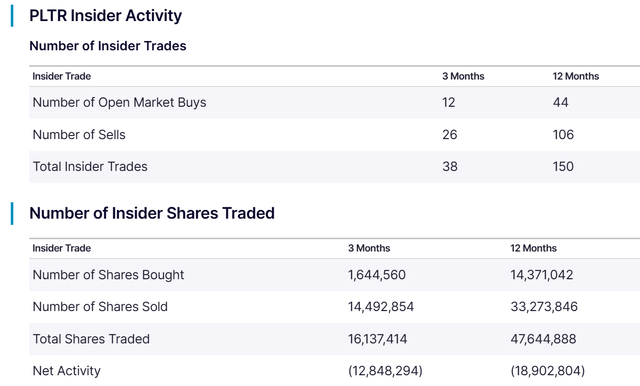

Insiders and management have been HUGE net sellers of the stock, especially during the first half of 2024 (about $250 million in liquidations since March). If the immediate outlook was truly rosy to those running the company, while operations over the latest few months were hitting on all cylinders (yet to be publicly reported), why is my question?

Nasdaq.com – Palantir, 12 Months of Insider Trading Activity Reported to SEC

Honestly, the way Palantir is valued leaves no room for error. It’s sitting at an ultra-expensive boom pricing level. The key will be future operating performance vs. today’s lofty growth expectations, the same as any other streaking share pop based in boom psychology.

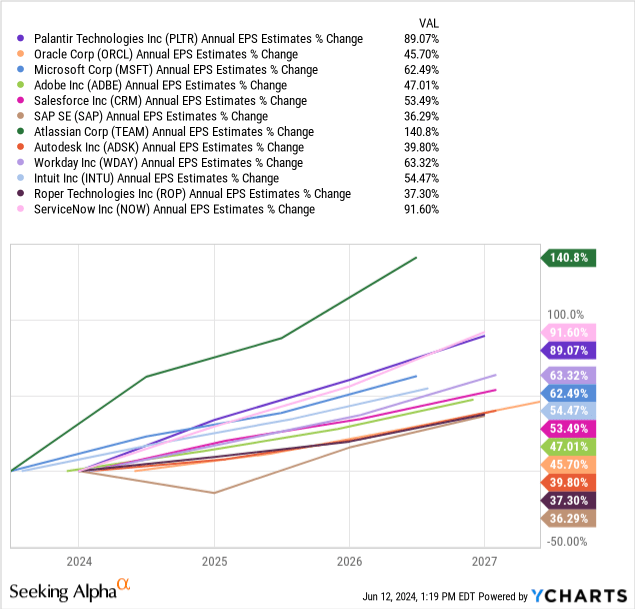

YCharts – Palantir vs. Major Software Peers, Analyst Projected EPS Growth Rates into 2027

Q1 2024 included revenue growth of 21% YoY and a sixth consecutive quarter of GAAP EPS at $0.04 (13% profit margin), with cash earnings per share around $0.08. Company guidance for free cash flow generation during the full year of $800 million to $1 billion is measured against an equity market cap of $54 billion today (1.6% to 1.9% for FCF yield). Nothing spectacular to justify its valuation, but the stock is riding a wave of hope right now, pumped by management press releases and interviews.

If a recession with earnings misses are coming in the second half, look for a big step down in sentiment regarding future AI-related growth expectations at Palantir. I am still in the camp (like Warren Buffett and Jamie Dimon) believing we will have recessions again, perhaps even this year. With interest rates remaining elevated and the Treasury yield curve inverted, we may only need a black swan event to cause consumers to surrender spending for a spell.

Shares could be knocked down to $15 with relative ease, and still represent a premium valuation to software peers. Given a deep and prolonged recession, where corporations cut back on all capital spending (including AI development), Palantir has the potential to trade under $10 again. That’s the risk argument keeping me away from ownership. With only several years of Palantir trading history available to investors (absent a serious recession), I am using Oracle and Cisco (CSCO) stock weakness in general during economic contractions as proxies for what will happen given flatlined operating results.

How could the stock quote remain in an uptrend the rest of 2024? I will say this is one possible outcome. You have to be rooting for a goldilocks economy with lower interest rates, fast to faster rates of AI deployment by the U.S. government (Palantir’s single biggest customer representing around 50% of sales) and large-cap businesses, with an economy growing GDP at real rates above 3%. Nevertheless, I find it hard to model a price above $30 anytime soon, even if optimistic forecasts prove out. It’s the valuation problem in a nutshell, shackling future price advances.

So, we have worst-case scenario downside risk beyond -50% vs. theoretical rewards in the +20% to +25% category, under the best circumstances. The math just doesn’t work for me. I rate shares a Sell, and suggest new capital be deployed elsewhere. If the share price approaches $15 later in the year, I will take another look.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.