Summary:

- Palantir has been one of the top-performing AI software stocks this year with a 156% YTD return, thanks to accelerating revenue growth and strong business momentum from its AIP.

- Fundamentally, what’s most critical for shares is maintaining a revenue growth rate above 20% for the foreseeable future.

- Government revenue growth was 23% YoY, up 7 percentage points from 16% YoY in Q1.

- The one caveat is PLTR’s valuation, at 34x FY24 revenue and 29x FY25 revenue, is increasingly challenging to sustain.

Michael Vi

Palantir Technologies Inc. (NYSE:PLTR) has been one of the top-performing AI software stocks this year with a 156% YTD return, thanks to accelerating revenue growth and strong business momentum from its Artificial Intelligence Platform (AIP) released last year.

AIP sets Palantir apart from the rest of the SaaS universe, driving visible AI-related growth and acceleration in multiple different metrics – at this time, other leading AI favorites such as Snowflake or MongoDB can’t say the same. Outside of the cloud hyperscalers, Palantir is one of the rare few that sees AI drive both real returns for its business and real value for its customers due to AIP.

Below, I break down how Palantir’s AIP is putting it a step above peer Salesforce, MongoDB and Snowflake with visible AI growth, and its undeniable ‘secret sauce’.

Palantir’s AI Growth Is Visible

AIP has driven tremendous growth for Palantir’s business since its release, with primary impacts arising in the commercial segment. A clear inflection point in Palantir’s growth is visible following AIP’s release, while other ‘AI’ cloud peers can’t say the same about AI-driven growth.

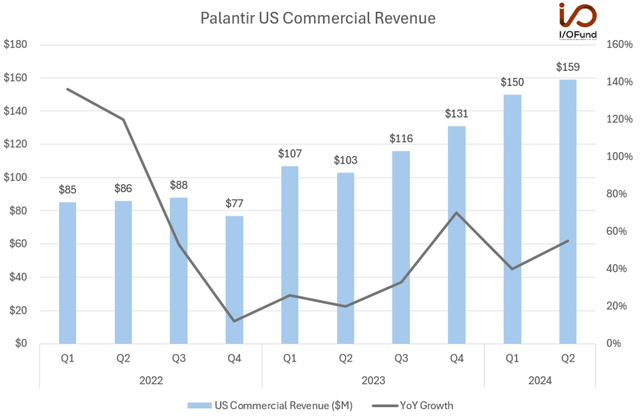

Palantir said that “US commercial continues to accelerate in Q2 2024 alongside [the] AIP revolution” with “unprecedented demand”, and the numbers to back this up:

-

55% YoY revenue growth in US commercial to $159 million, accelerating from 40% YoY in Q1.

US Commercial revenue growth accelerated to 55% YoY in Q2 as revenue rose to $159 million. (Tech Insider Network)

-

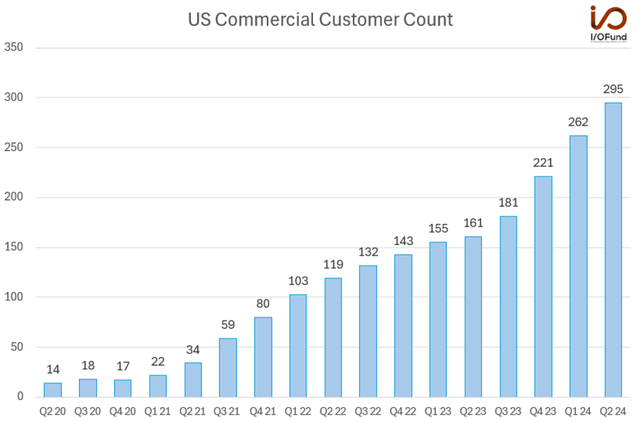

83% YoY growth in US commercial customers to 295 and 98% YoY growth in US commercial deals closed to 123.

-

103% YoY growth in US commercial remaining deal value and 152% YoY growth in US commercial total contract value to $262 million. Chief Revenue Officer Ryan Taylor explained that “one of the most notable indicators of our delivery is the volume of existing customers who are signing expansion deals, many of which are a direct result of AIP.”

Here’s what the growth in US commercial customers looks like:

Palantir’s US Commercial customer growth has reaccelerated over the past few quarters thanks to AIP. (Tech Insider Network)

US commercial customer growth began to stagnate through late 2022 and early 2023, but following AIP’s release in Q2 2023, customer count re-accelerated. There is a clear inflection point from where QoQ customer additions were decelerating – from 12 net adds in Q1 2023 to six net adds in Q2 2023. Following the AIP-driven acceleration, net adds rose to 20 QoQ in Q3 2023, then 40 QoQ in Q4 2023.

This matches a similar acceleration in commercial customer growth as Palantir quickly became a market darling following its IPO, which was seen as a way to drive growth in the commercial sector. From Q4 2020 to Q4 2021, commercial customers grew nearly 5X. Now, as a stock market darling once more with a unique and unbeatable AI offering, Palantir is seeing commercial growth resume.

Palantir Is King Of AI Among Cloud SaaS Stocks

Other leading cloud ‘AI’ stocks are struggling to put up AI-driven growth numbers like Palantir.

Salesforce reported 8% YoY revenue growth in Q2, decelerating from 11% YoY in Q1, as subscription revenue growth decelerated to 9% YoY, down from 12% YoY in Q1. Salesforce sees Q3 revenue growth of 7%, another deceleration. The full-year revenue growth of just 8% to 9% translates to the SaaS giant struggling to realize AI gains. Furthermore, Salesforce’s more AI-aligned offerings, MuleSoft and Tableau, decelerated sharply in Q2, from 27% YoY to 13% YoY for MuleSoft and 21% YoY to 11% YoY for Tableau.

MongoDB witnessed a much steeper deceleration in Q2, as Atlas and new workload wins struggled at the start of the year. In Q1, MongoDB reported 22% YoY growth with Atlas growth of 32% YoY, and this decelerated to 13% YoY revenue growth in Q2 as Atlas declined 5 percentage points QoQ to 27% YoY. For the full year, MongoDB guided to about 14.6% YoY growth in Q2 as it slightly boosted its outlook, a steep deceleration from 31% YoY growth in fiscal 2024.

Snowflake’s product revenue growth decelerated from 34% YoY in Q1 to 30% YoY in Q2, and while this was ahead of its guidance by 3 percentage points, growth is set to decelerate further in Q3. Management guided for 22% YoY growth in product revenue for the third quarter, a steeper QoQ deceleration rate, with the full-year product revenue guide of 26% YoY. Despite management saying that they see “great traction” in early stages of AI products, there’s no visible inflection or acceleration in growth.

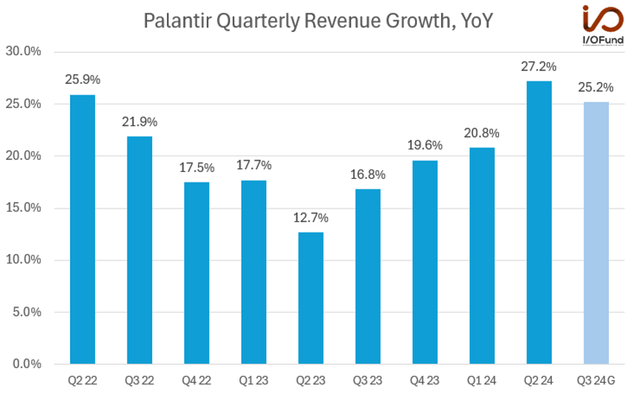

In sharp contrast, AIP has helped Palantir drive a significant topline acceleration over the past four quarters.

AIP’s strong momentum has helped drive quarterly revenue growth to 27.2% YoY in Q2 2024, up from 12.7% in Q2 2023. (Tech Insider Network)

Palantir reported 27.2% YoY revenue growth in Q2, aided by strength in US commercial stemming from AIP as well as government revenue accelerating significantly. Palantir’s YoY revenue growth bottomed in Q2 2023 at 12.7%, the same quarter as AIP’s release, with revenue growth now 15 points higher. Despite guiding for a slight 2 percentage point deceleration in Q3 to 25.2% YoY growth, Palantir would only need to beat its guide by 1.5% to keep this revenue acceleration intact.

Fundamentally, what’s most critical for shares is maintaining a revenue growth rate above 20% for the foreseeable future – analysts currently estimate fiscal Q2 2025 to be the one quarter of the next eight with revenue growth just below that threshold. Given AIP’s strength just one year following its launch, with clear inflections in customer and revenue growth, it will be the telling sign of Palantir’s AI status if it can maintain these revenue growth rates as it scales.

Palantir’s AIP Separates It From The SaaS Universe

Palantir’s standout performance so far in 2024 against SaaS peers can be attributed to the success of AIP, which, at its core, is a comprehensive AI platform that lets enterprises lever Palantir’s AI and machine learning tools and harness the power of the latest large language models (LLMs) within Foundry and Gotham.

Gotham was the company’s first product and is built for government operatives in the defense and intelligence sectors. The platform enables users to identify patterns hidden deep within datasets using semantic, temporal, geospatial and full-text analysis, with mixed reality capabilities to allow operations to be run in a virtual environment as well. Graph allows data objects to be seen as nodes and edges, while Map tracks geolocated objects, runs searches and displays key data.

Foundry was built for the commercial sector, and is centered around the three-layer Ontology Core, integrating semantic, kinetic, and dynamic layers for real-time data analytics and AI-powered decision-making capabilities:

-

The Semantic layer brings volumes of data into one place, and lets users generate detailed object properties

-

The Kinetic layer brings operations and business behaviors into a real-time graph linked back to the Semantic layer, creating the basis for AI-driven analytics, real-time monitoring, identification of inefficiencies, and ability to optimize workflows

-

The Dynamic layer connects models to objects and actions, reasoning across both the Semantic and Kinetic layers for AI-powered automation and AI-driven decision-making, alongside multistep simulations with AI predictive analytics to explore possibilities of changing actions or events

AIP combines with Foundry’s data operations suite and Apollo’s autonomous software deployment capabilities as part of Palantir’s ‘AI Mesh’, providing enterprise and government customers with a full suite of AI products from the web to mobile to the edge. With the Ontology, linking data and logic into an AI-accessible environment, Palantir brings generative AI directly to an enterprise’s operations, delivering real-time AI-driven operational decision-making abilities.

Palantir describes Gotham and Foundry as the “ability to construct a model of the real world from countless data points.” AIP links this all together, and this is what separates Palantir as a standout in the SaaS space – outside of the cloud hyperscalers, Palantir is one of the rare few that sees AI drive both real returns for its business and real value for its customers due to AIP.

What further sets AIP apart is its scalability, interoperability and versatility. With AI Mesh, organizations can integrate AI across different operations and applications, while its design facilitates interoperability with existing enterprise software and systems. AIP is also extremely versatile, having been successfully and seamlessly integrated into enterprises spanning a wide range of industries from tech to healthcare to aerospace, while still driving value to customers.

The uniqueness of Palantir’s AIP and value that it can quickly provide has driven growth for the company. CEO Alex Karp said in Q2 that:

Growth across the commercial and government markets has been driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic.”

Essentially, there is constant strong demand for an applicable, scalable, versatile AI platform that can drive real-time results with an instant value-add for an organization. Chief Revenue Officer Ryan Taylor added that Q2’s:

Exceptional results are a reflection of a market that is quickly awakening to a reality that our customers have already known, we stand alone in our ability to deliver enterprise AI production impact at scale.”

Government Is Palantir’s Secret Sauce

While Palantir is undoubtedly seeing strong business momentum in the commercial sector, the government sector remains Palantir’s bread and butter, being that the government sector has funded the company and allowed it to aggressively invest in AIP while expanding margins, with a recent growth acceleration

In Q2, US government revenue accelerated to 24% YoY growth, up 12 percentage points from 12% YoY growth in Q1. Overall, government revenue growth was 23% YoY, up 7 percentage points from 16% YoY in Q1. Management noted that Palantir was:

Selected for several notable awards in Q2, which led to the strongest US government bookings quarter since 2022, reflecting the growing demand for our government software offerings.”

This included a production contract from the DoD, Chief Digital and Artificial Intelligence Office (CDAO) for an AI-enabled operating system for the DoD, with an initial $153 million order and additional awards for up to $480 million over a 5-year period.

The acceleration in the government segment aided overall revenue growth in the quarter, as the government continues to remain Palantir’s primary revenue source, accounting for nearly 55% of total revenue. This is why the government segment is vital for Palantir, and is its ‘secret sauce’ – these long-term, high-value government contracts provide consistent and recurring revenue and financial stability, allowing the company to venture and invest to scale AIP while expanding margins and increasing its profitability.

Conclusion

Palantir has been on a tear this year, and is outperforming major cloud competitors, thanks to the strength and uniqueness of its AIP offering. Palantir has the best of both worlds in government contracts and AI exposure, as well as accelerating enterprise AI adoption and strong customer and revenue growth.

The one caveat is Palantir’s valuation, at 34x FY24 revenue and 29x FY25 revenue, is increasingly challenging to sustain. In the past, the low 20x revenue multiple range has tended to be the level that even the industry’s leading SaaS names have struggled to break past over the last few years.

Recommended Reading:

Nvidia, Mag 7 Flash Warning Signs For Stocks

Cybersecurity Stocks Seeing Early AI Gains

4 Things Investors Must Know About AI

AI PCs Have Arrived: Shipments Rising, Competition Heating Up

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our cumulative returns are 131% and a lead over institutional technology portfolios by as much as 157% since inception.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, deep-dives, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.