Summary:

- Palantir’s bootcamp sales methods have proven effective, driving strong U.S. commercial growth, but recent government sales surged unexpectedly, boosting overall revenue.

- U.S. commercial revenue grew 70% year-over-year, while non-U.S. commercial lagged due to geopolitical factors and less bootcamp utilization.

- Concerns include limited analyst participation on earnings calls, insider selling, and S&P 500 inclusion having boosted the stock price.

- Taken everything into account from strong U.S. commercial growth guidance, geopolitical tensions and the stock runup, I’m downgrading Palantir stock to a hold.

hapabapa

Over the last 12 months, I wrote several articles about Palantir (NYSE:PLTR) with the premise that its Bootcamps sales methods could be a game-changer. The first one dates back to November 23′. This idea is definitely not disproven in the latest quarter as sales continued to be strong. Unless there’s a meaningful change in the earnings/sales trajectory of the business, I don’t plan to revisit the bootcamps. I think they’ve more or less proven to be very effective. In the medium term, sales growth rate is going to be the key driver of Palantir’s stock price.

The problem with this last quarter is that one sales trend changed. Ever since bootcamps were introduced, U.S. commercial, as a segment, was growing at a much higher pace compared to Government.

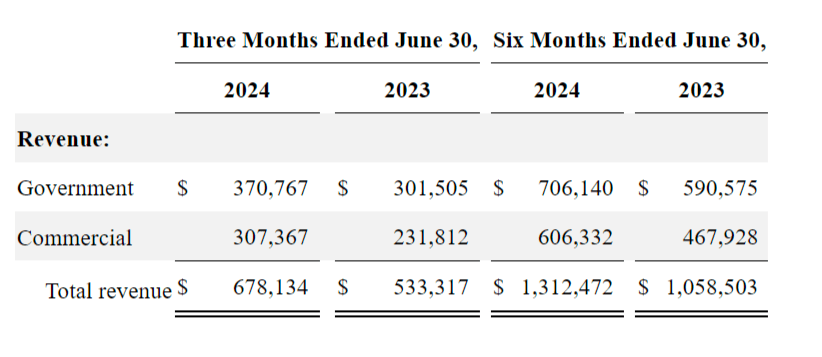

This last quarter, Government was suddenly very strong:

Palantir revenue by segment (Palantir 10-Q)

In a vacuum, that’s great because government is still the largest slice of the pie. Ergo, if it shows the highest growth rate, this means Palantir’s overall revenue growth rate is the highest.

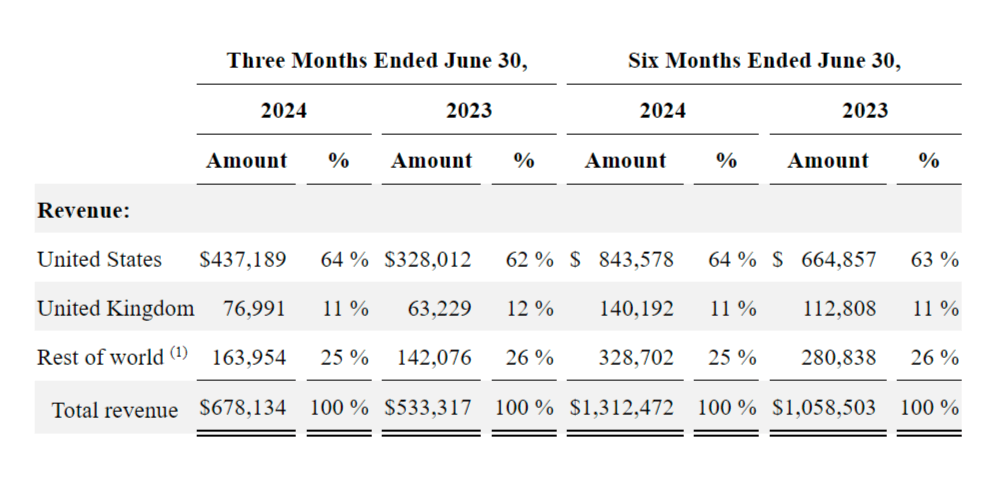

Palantir Revenue by Geography (Palantir 10-Q)

However, in my last article I wrote:

The key factor to watch will be the sustainability of U.S. commercial sales growth. This segment’s ability to maintain its current momentum is crucial to maintain and increase Palantir’s valuation. I don’t see other segments catching up to this type of growth rates any time soon.

It’s a good thing that per the earnings call, U.S. commercial was very strong. Non-U.S. commercial wasn’t (which isn’t a huge problem for now) while government was strong all around:

…Our US commercial revenue, excluding strategic commercial contracts, climbed 70% year-over-year. Our US commercial ACV closed was up 44% year-over-year and up 19% sequentially, while our deal count in US commercial was nearly twice what it was just a year ago. We maintain conviction in our ability to land new customers and subsequently expand those engagements as we sharpen our focus to taking our customers across the chasm from prototype to production…

My reading of the segment sales trajectories over the past year is that the bootcamps have been extraordinarily useful to Palantir and its customers. These were first piloted and rolled out in the U.S. Palantir growth outside of the U.S. could be lagging for a number of reasons. Palantir sells mission-critical software, and governments and institutional customers have all been confronted by the awkwardness of global supply chains by Covid and the invasion of Ukraine. As far as I know, bootcamps haven’t been utilized in Europe to the same extent either, and this explains at least part of the difference.

There were some things on the earnings call that aren’t red flags, but that gave me pause. In past calls, there were also complaints about the number of salespeople the company could find. There was more color about the salesforce being ramped up and Karp even floated an idea to fly over salespeople from Europe to the U.S. as the ROI was much higher. That kind of talk has died down.

Another thing I didn’t like is that there were only two bullish analysts on the call, and otherwise management took questions from shareholders. Generally, practices like this are intended to avoid hard questions. I don’t think that fits well with how I understand the Palantir ethos.

Then there’s been insider selling from Karp and Peter Thiel.

Finally, the company has been included in the S&P 500 (SPY) and that’s probably given the stock a short-term boost as well.

In the end, management guided for U.S. commercial growth above 40% going forward. To me, this is the most important number in the short to medium term. Meanwhile, there are large scale global conflicts/wars ongoing. There is a trend of increasing geopolitical tension. Governments seem to experience a greater urgency to update the capabilities of their armed forces, as well as the defensive capabilities of all infrastructure. Nvidia expects billions of sovereign spending for the year (see The Key Takeaways From The NVIDIA Earnings Call). This expansion of government AI capacity is almost certainly a tailwind for Palantir for this year and next. Taking everything, including the extraordinary runup of the stock, together; I’m downgrading Palantir towards a hold, down from a strong buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.