Summary:

- PLTR has demonstrated the promising monetization of generative AI SaaS layer across the government and commercial segments, thanks to the highly opportunistic AIP boot camp.

- These have led to its higher Net Retention Rates and the growing multi-year Remaining Performance Obligations, sustaining its high-growth investment thesis.

- Even so, with these developments triggering PLTR’s lofty valuations compared to its peers, we believe that there is a minimal margin of safety at current levels.

- Based on its historical trading pattern, the stock is likely to pull back to its uptrend support levels of $24s in the near-term.

- Traders may consider following the massive insider selling and taking part of their gains off the table, before coming back in later.

Just_Super/iStock via Getty Images

We previously covered Palantir Technologies Inc. (NYSE:PLTR) in May 2024, discussing the normalization in market sentiments surrounding generative AI stocks, despite the SaaS company’s robust performance metrics thanks to the successful AIP boot camps.

We had upgraded our rating to a Buy then, preferably after a moderate retracement to its previous support levels of $18s for an improved margin of safety.

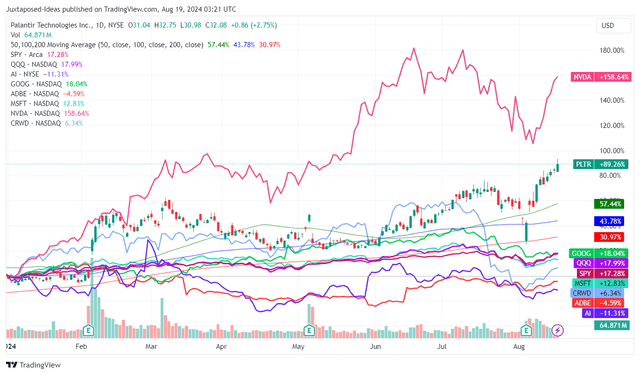

Since then, PLTR has maintained a floor at $20 while rallying by +55.7% to retest its all-time highs of $30s, naturally outperforming the wider market at +6.1%.

This is despite the drastic July 2024 market wide pullback, with the bullish support attributed to the double beat FQ2’24 performance and raised FY2024 guidance, with it underscoring the successful penetration of generative AI monetization through the infrastructure layer to the SaaS layer.

Even so, we are downgrading the stock to a Hold instead, since it is now overly expensive with the baked in growth premium offering interested investors with a minimal upside potential.

PLTR Continues To Outperform Expectations, With Robust Growth Prospects & Performance Metrics

PLTR YTD Stock Price

Since its first GAAP profitability and the seven consecutive positive bottom-line results since Q4’22, it is unsurprising that the PLTR stock has already generated robust gains, significantly aided by the growing demand for its generative AI SaaS offerings.

The latter is already observed in the double beat performance, with its commercial growth accelerating at +32.4% YoY in FQ2’24, compared to +10.4% YoY reported in FQ2’23. Government demand is robust at +23% YoY as well, compared to +14.6% YoY a year ago.

It is apparent from these developments that PLTR’s AI Bootcamp strategy has been highly successful in winning new customers, as observed in the higher overall customer count at 593 (+39 QoQ/ +172 YoY).

This in top of the improved cross-selling to existing customers, given the higher Net Retention Dollar of 114% in FQ2’24 (+3 points QoQ/ +6 from FQ4’23 levels of 108%).

Most importantly, PLTR’s boot camp strategy during the generative AI boom has directly contributed to the SaaS company’s excellent Rule of 40 results at 64% by the latest quarter (+7 points QoQ/ +26 YoY), thanks to the accelerated sales growth at 27% (+6 points QoQ/ +14 YoY) and richer adj operating margin at 37% (+1 points QoQ/ +12 YoY).

Moving forward, we believe that the SaaS company may be able to continue generating robust performance metrics ahead, significantly aided by its highly strategic partnership with Microsoft (MSFT).

It is important for us to highlight that both PLTR and MSFT’s Azure boast “the highest possible DoD Impact Level 6 (IL6) provisional authorization (PA) at the high confidentiality and high integrity (H-H-x) information categorization.”

These developments imply that PLTR will be able to leverage on Azure’s existing Large Language Models and OpenAI’s GPT-4 capabilities, while being integrated into the Federal government’s highly classified cloud data, naturally driving further growth opportunities for the former’s government segment.

With the US government comprising $278M (+8% QoQ/ +24% YoY) or the equivalent 41% (+0.5 points QoQ/ -1.1 YoY) of the SaaS company’s overall FQ2’24 revenues, it is undeniable that the US Federal contracts remain the backbone of its overall prospects.

The next few years are likely to bring forth significant growth opportunities as well, attributed to the higher defense spending as geopolitical hostilities intensify in Gaza and Ukraine.

PLTR’s inflection is further observed in the raised FY2024 guidance, with revenues of $2.746B (+23.6% YoY) and adj income from operations of $970M (+53.2% YoY) at the midpoint.

This is up from the original guidance of $2.66B (+19.8% YoY) and $842M (+33% YoY) offered in the FQ4’23 earnings call, respectively.

The raised guidance is not overly aggressive indeed, based on PLTR’s H1’24 numbers of $1.31B (+24.7% YoY) and $480.02M (+84.6% YoY), with it demonstrating the management’s confidence about generating robust and profitable growth ahead, with another raise and beat performance likely in FQ3’24.

With these numbers well-supported by the growing multi-year Remaining Performance Obligation of $1.37B (+5.3% QoQ/ +41.2% YoY), we believe the stock continues to offer a compelling high-growth investment thesis.

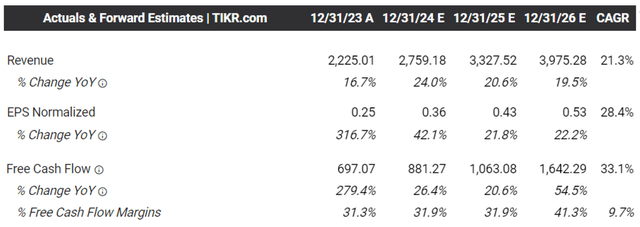

The Consensus Forward Estimates

As a result of the raised FY2024 guidance, it is unsurprising that the consensus have already raised their forward estimates, with PLTR expected to generate an accelerated top/ bottom-line growth at a CAGR of +21.3%/ +28.4% through FY2026.

This is compared to the original estimates of +20.3%/ +23.2% and historical top-line growth of +30.1% between FY2018 and FY2023, respectively.

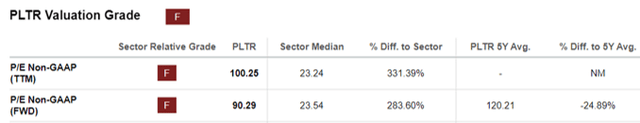

PLTR Valuations

On the other hand, it is undeniable that PLTR may be expensive at FWD P/E valuations of 90.29x, compared to its 1Y mean of 66.90x and 3Y mean of 69.54x.

Even when compared to its AI SaaS peers, it is apparent that PLTR is trading at a premium, including Google (GOOG) at FWD P/E of 21.63x with the projected adj EPS growth of +19.6% through FY2026, Adobe (ADBE) at 30.47x/ +14%, Microsoft at 31.75x/ +15.1%, Nvidia (NVDA) at 45.70x/ +49.3%, and with the rare exception being CrowdStrike (CRWD) at 66.94x/ +24.1%, respectively.

If we are to do the same exercise with its direct competitors, including BigBear.ai (BBAI) at FWD Price/ Sales of 1.83x with the projected revenue growth of +18% through FY2026, C3.ai (AI) at 8.30x/ +20.8%, and SoundHound AI (SOUN) at 21.59x/ +82.1%, we believe that PLTR at 26.04x/ +21.3% appears to be on the expensive side.

Given PLTR’s relatively premium valuation, we believe that there is a minimal margin of safety at current levels indeed.

So, Is PLTR Stock A Buy, Sell, or Hold?

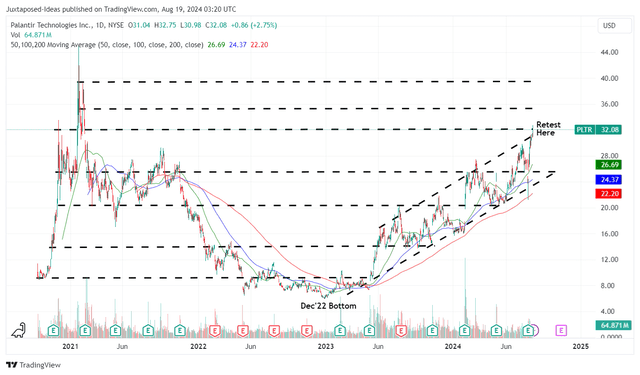

PLTR 4Y Stock Price

For now, PLTR’s uptrend has been impressive since the December 2022 bottom, with it consistently charting higher highs and higher lows despite the recent market rotation from high-growth stocks.

For context, we had offered a long-term price target of $26.70 in our previous article, based on the consensus FY2026 adj EPS estimates of $0.47 and the 2022/ 2023 P/E mean of 57x.

Based on the consensus raised FY2026 adj EPS estimates of $0.53 and the same P/E, we are looking at an updated long-term price target of $30.20, with it implying a minimal margin of safety at current levels.

On the one hand, PLTR’s short interest continues to moderate to 2.85% by the time of writing, down from the previous article levels of 3.52%, with it implying lower volatility from short sellers.

On the other hand, as the stock prices reached new peaks of over $30s, nearing those observed during the February 2021 peaks, it is unsurprising that insiders have been unlocking great gains at current levels with $240M sold in Q2’24 (+30.4% QoQ/ +788% YoY).

While market sentiments surrounding high-growth stocks appear to have normalized after the great correction in July 2024 with the CBOE Volatility Index also moderating, we maintain our belief that there remains a minimal upside potential at current levels.

Based on PLTR’s historical trading pattern, the stock is likely to pull back to its uptrend support levels of $24s in the near-term.

As a result of the potential capital losses, we are downgrading our Buy rating to Hold (Neutral) rating instead. Interested long-term investors may consider waiting for the pullback before adding for an improved dollar cost average.

Likewise, traders may consider following insiders and taking part of their gains off the table, before coming back in later.

For now, do not chase PLTR over the cliff.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.