Summary:

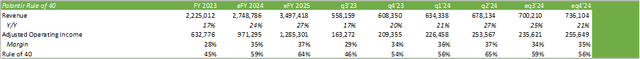

- Palantir is driving top-line growth and margin expansion through its hands-on AIP bootcamps. This drove their “Rule of” to 65% in Q2’24.

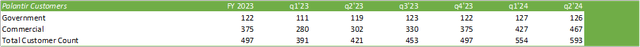

- Palantir grew its customer base by 41% from the previous year to 593 with a total remaining deal value of $4.3b.

- Palantir may be a recession-proof play as users of their AIP have realized significant cost-savings which may lead to further customer adoption and net adds.

J Studios

To no surprise, Palantir (NYSE:PLTR) reported a strong beat and raise in their Q2’24 earnings report as enterprises accelerate their expansion into AI production. This was in part driven by the firm’s aggressive hands-on approach to their sales process with their AIP bootcamps. Given the strength and resiliency of Palantir’s growth strategy paired with their AI-inferencing toolset, I believe Palantir will be one of the few AI-related software firms that will realize growth acceleration, regardless of the macroeconomic environment. For this reason, I will reiterate my STRONG BUY rating with a price target of $32.61/share.

Be sure to review my previous coverage of Palantir here:

Palantir Is Positioned For Continued Growth

Palantir-Oracle Partnership Brings Both Firms Tremendous Upside

Palantir: This Is Just The Beginning

Palantir Operations

I believe the biggest driving factor behind Palantir’s success is their AIP bootcamps. Though the idea of implementing AI and GenAI applications into the workplace has had a little over a year to cycle through the boardroom, real-world, enterprise use cases remain in the area between “does this save or make an enterprise money?” and “is AI exciting because it’s novel?” How Palantir differentiates themselves from competitors like C3.ai (AI) is that the firm provides actual use cases with real data that showcase the capabilities of the platform, allowing for department heads to better understand the “how” and “why” when it comes to bringing the platform into the organization.

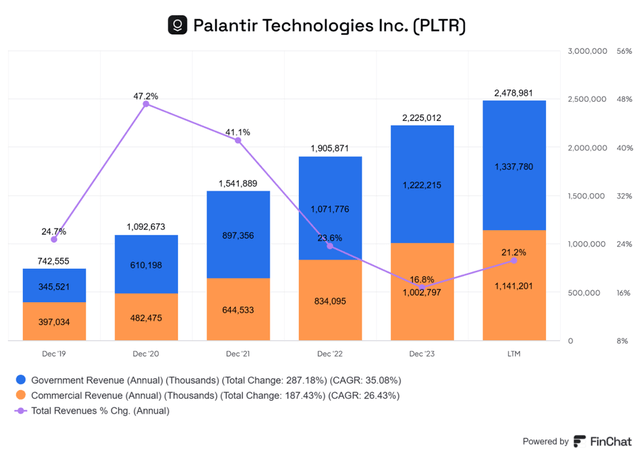

I believe this is one of the factors that Wall Street oftentimes overlooks when valuing Palantir and forecasting the firm’s total market opportunity. Despite Wall Street’s sentiment towards the name, Palantir has proven that AI inferencing is beneficial to its customer base, and the firm has been greatly rewarded for such. Total customer count grew in Q2’24 by 41% to 593, with $4.3b in total remaining deal value. In Q2’24, Palantir closed 96 deals of at least $1mm in value, 33 of which were valued over $5mm and 27 over $10mm.

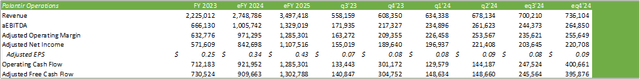

Palantir has proven that scaled operations has been beneficial to margins, as the firm has achieved 7 consecutive quarters of GAAP profitability. Using management’s term for “Rule of 40,” which is defined as revenue growth plus adjusted operating margin, Palantir achieved a “Rule of” 65 in Q2’24. Forecasting the duration of eFY24, I believe Palantir can achieve a “Rule of” 59 for the fiscal year and grow it to 64 in eFY25.

My rationale behind this growth is that Palantir’s production AI applications have proven to save companies money, optimize operations, and eliminate data silos through enterprise data integrations and utilization. I believe that the AIP bootcamps will continue to drive revenue growth and attachment rates as the field staff showcase AIP capabilities on a one-on-one basis. In terms of adjusted operating margins, I anticipate that as platform sales continue to scale, margins will expand as a result of the modular features. Unlike C3.ai who builds one-off, individualized solutions for clients, Palantir’s platform allows for differentiated data to be aggregated and on customized applications developed by their builder community. One example is Kinder Morgan’s (KMI) deal, which involves Foundry and AIP to optimize gas storage, monitor pipelines, and optimize power utilization. In contrast, C3.ai built a customized application for Baker Hughes (BKR) who was an early investor and adopter of the application effectively with similar features from an oil field services standpoint.

In addition to their platform offerings, management announced their latest offering, Warp Speed, which will be utilized to power the American reindustrialization. Warp Speed is said to integrate multiple platforms across an organization, including enterprise research planning, manufacturing execution systems, product lifecycle management, and programmable logic controller with the goal of integrating an entire manufacturing operation from the floor to financials. From my perspective, this offering will go head-to-head with SAP’s (SAP) enterprise solution. I suspect that Warp Speed may have some integration with Oracle’s (ORCL) ERP solution, given the two firms’ partnership. If this is the case, this may be a major tailwind for both Palantir and Oracle, as the two firms can potentially cross-sell platform solutions with Palantir’s AI solutions embedded.

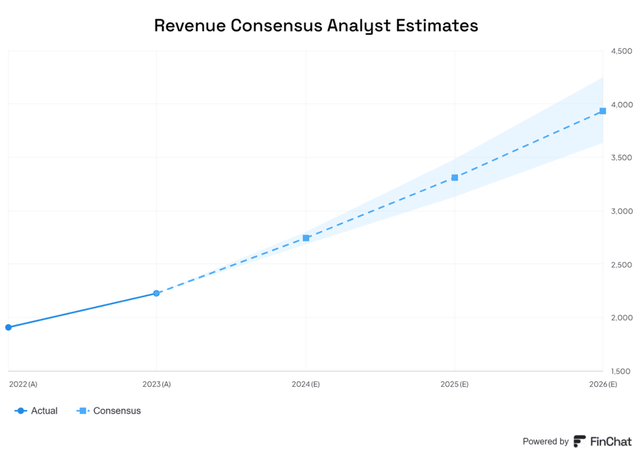

Looking to the financials, I forecast Palantir to reach near the midpoint of management’s forecast for adjusted free cash flow of $909mm in eFY24, growing to $1.3b in eFY25. Cash flow will be driven by operational growth from the top-down to the bottom-line, as I anticipate the firm’s revenue generation to accelerate into the end of eFY24 and even further into eFY25. I believe much of this growth will be driven by the firm’s AIP bootcamp approach to landing and expanding their customer base as well as through scaled margin expansion. Given the state of the global economy and the cost-savings Palantir’s AI platform has to offer, I anticipate further adoption of their platform as a measure for optimizing operations and reducing or eliminating operational expense at the enterprise level. If my presumption of Warp Speed and Oracle’s ERP integration turns out to be true, revenue may accelerate beyond my forecast as Palantir’s potential customer base may broaden if their offerings are included as an add-on. On the government side of the business, I believe the global unrest may draw in additional value for their defense capabilities.

Additional Risks To Consider

Bull Case For Palantir

Palantir is at the center of bringing AI applications from prototyping to production as one of the few firms that has generated positive cash flow with their AI platform. Their product offerings provide operational use cases for optimizing enterprises from the factory floor to the sales staff, all the way up to finance. Their one-on-one classroom-like sales tactics put their product in the hands of organizational heads and present them with real-time working applications, driving the sales cycle.

Bear Case For Palantir

New IT investments may be put on hold if the economy falls into a contraction, resulting in a slower sales cycle and potentially less growth for Palantir. Enterprises may reduce their investments in AI applications in order to manage costs and manage down their technical staff. Competitors like C3.ai, SAP, or Oracle may expand their products to include more robust AI/LLM capabilities and take on Palantir’s market share.

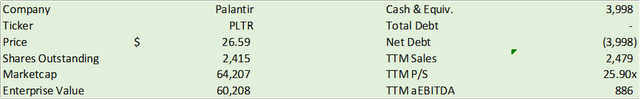

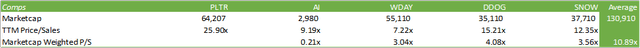

Valuation & Shareholder Value

PLTR shares currently trade at 25.90x price/sales, the upper end of their historical trading range and a significant premium over its peers. I believe PLTR’s valuation is justified given the firm’s long-term growth trajectory and value opportunity across multiple industry verticals.

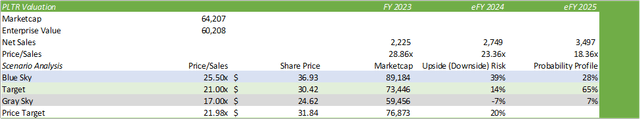

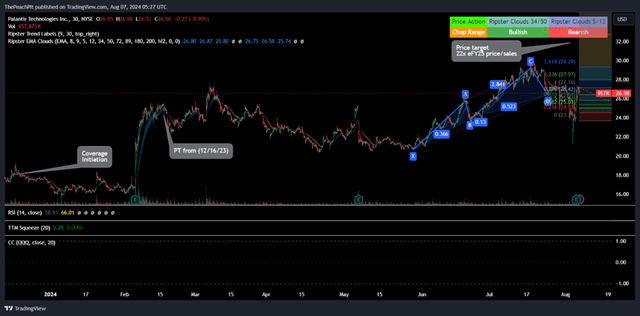

Using an internal valuation method based on the probability of PLTR shares trading at their historical price/sales multiple, I believe PLTR shares hold significant upside potential, assuming my growth forecast for eFY25. I reiterate my STRONG BUY recommendation for PLTR shares, with a price target of $31.84/share at 22x price/sales.

Looking at PLTR shares from a tactical perspective, the stock appears to have undergone its retracement phase and is now positioned for the next wave up. I believe shares should approach my price target of $31.84/share both from a tactical and fundamental perspective, assuming the firm continues to grow and operate as forecasted.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.