Summary:

- This week, Palantir proved again in Q3 that it’s undeniably one of the stronger AI software stocks in the market outside of the cloud hyperscalers.

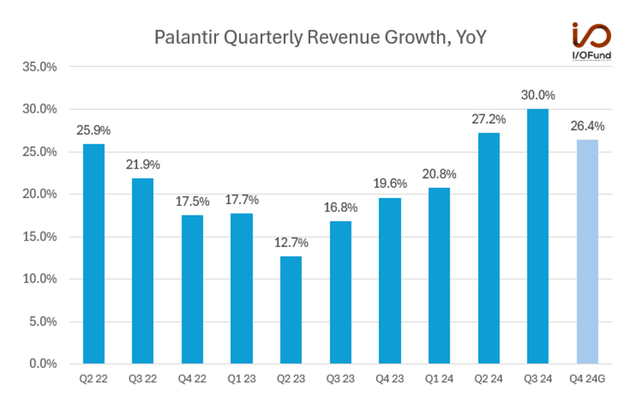

- Revenue growth continued to accelerate, with Palantir reporting revenue growth of 30.0% in Q3, ahead of its guidance for 25.2% growth and up from 27.2% in Q2.

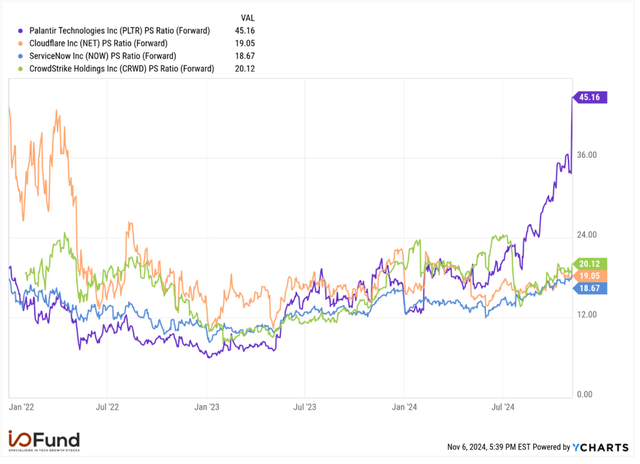

- Palantir is at Mount Everest valuations, trading at topline multiples more than double the next three most expensive enterprise and AI-exposed SaaS stocks in the market: Cloudflare, ServiceNow, and CrowdStrike.

Michael Vi

Two weeks ago, I highlighted that Palantir is “one of the rare few that sees AI drive both real returns for its business and real value for its customers,” while it continues to crush its software peers in AI-related growth. AI offerings have driven a clear acceleration in customers and overall revenue, while many SaaS peers, such as MongoDB and Salesforce, struggle to say the same.

This week, Palantir proved again in Q3 that it’s undeniably one of the stronger AI software stocks in the market outside of the cloud hyperscalers. The company reported visible AI-driven growth and persisting business momentum for AIP, strong revenue acceleration to 30% YoY, combined with strong profitability – a rare combination for growth stocks.

Despite proving again that it’s one of the only software names with real revenue in the market, Q3’s report pushed the valuation even higher. Due to an outlandish valuation, price momentum may soon be approaching a peak.

Blistering AI Momentum Continues

Palantir’s third quarter was characterized once again by strong underlying AI momentum. Palantir beat Q3 revenue expectations by more than $21 million, reporting revenue of $725.5 million in the quarter. The FY24 revenue guide was boosted to just above $2.80 billion, up from $2.75 billion last quarter.

Revenue growth continued to accelerate, with Palantir reporting revenue growth of 30.0% in Q3, ahead of its guidance for 25.2% growth and up from 27.2% in Q2.

Palantir’s Q3 highlights: Strong AI momentum with $725.5 million revenue, exceeding expectations by $21 million. FY24 revenue guidance increased to over $2.80 billion. Q3 revenue growth at 30.0%, surpassing guidance and Q2’s 27.2% growth rate. (Tech Insider Network)

Q3’s results have marked quite the turnaround in just over a year for Palantir, with revenue growth accelerating more than 17 percentage points from Q2 2023 (AIP’s release) to Q3 2024. This was also the highest revenue growth rate recorded since Q1, 2022.

AIP has been the primary driving force of this revenue reacceleration, with strong adoption in the US commercial segment. AIP’s scalability, interoperability and versatility allow it to quickly be integrated by enterprises. Commercial customers can lever Palantir’s AI and machine learning tools to harness the power of the latest large language models (LLMs) within Foundry and Gotham for near-instant analytics & insights, and productivity & efficiency gains.

For a closer look at AIP and how it separates Palantir from the rest of the SaaS universe, read This Stock Is Crushing Salesforce, MongoDB And Snowflake In AI Revenue.

AIP Aids US Commercial Growth

What’s interesting to note in Q3 is that government revenue growth outpaced commercial growth, at 33% YoY versus 27% YoY, a contrast to recent quarters where commercial had been the primary driver. Government’s outperformance was driven by 15% QoQ growth in US government revenue, its fastest growth rate in 15 quarters, while commercial was impacted by a 7% QoQ decline in international commercial revenue due to European headwinds and “a step-down in revenue from a government sponsored enterprise in the Middle East.”

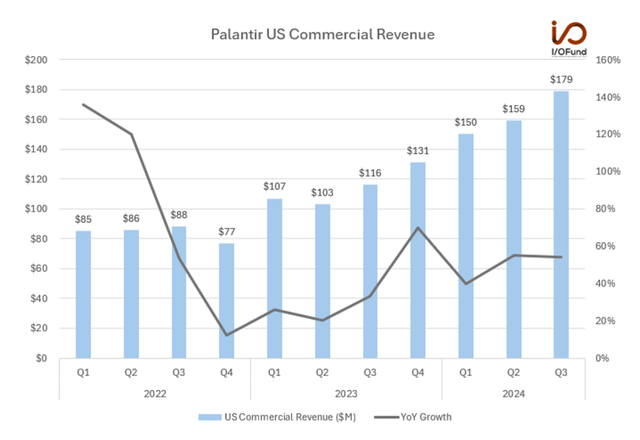

However, US commercial growth remained strong in the quarter, with a growth rate nearly in line with Q2’s. Management said that AIP drove “new customer conversions and existing customer expansions in the US,” as AI models continue to be deployed into production. Here’s what the growth in US commercial revenue looks like:

Palantir’s US commercial revenue rose 54% YoY and 13% QoQ to $179 million, slightly decelerating from 55% YoY growth in Q2. FY24 US commercial revenue is expected to exceed $687 million, indicating at least $199 million in Q4 revenue, with ~52% YoY growth. (Tech Insider Network)

US commercial revenue increased 54% YoY and 13% QoQ to $179 million, slightly decelerating from 55% YoY growth in Q2. Palantir guided for US commercial revenue to exceed $687 million, or 50% YoY growth, for FY24, implying Q4 revenue of at least $199 million, or ~52% YoY growth, representing a 2 point deceleration should it meet that target.

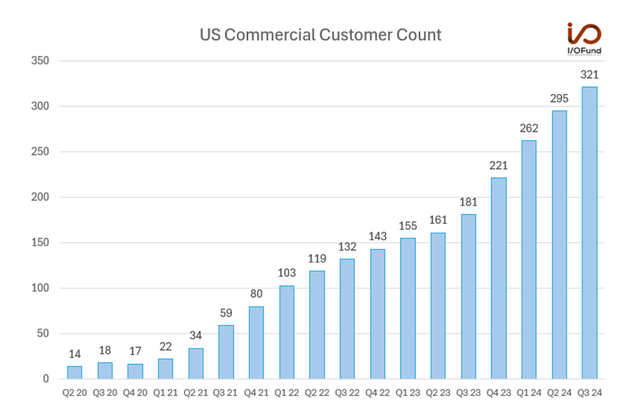

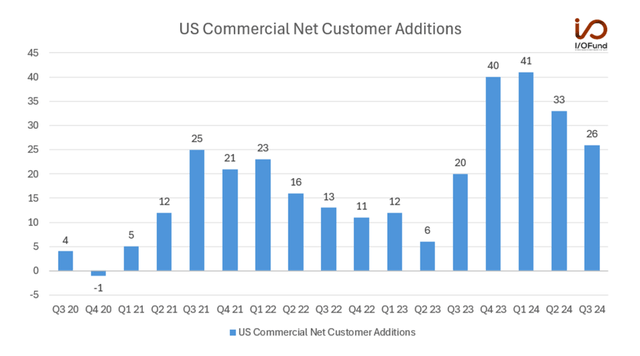

US commercial customer growth remained strong, with customers rising 77% YoY to 321 in Q3. This decelerated from 83% YoY in Q2. Here’s what the US commercial customer growth looks like:

US commercial customer growth remained strong, rising 77% YoY to 321 in Q3, slightly down from 83% YoY growth in Q2. Here’s what the US commercial customer growth looks like (Tech Insider Network)

US commercial customer count has essentially doubled since AIP’s release, but Q3 was the second quarter to show slightly slower customer growth, indicating that Palantir may be relying on existing customers to drive revenue, whereas customer acquisition should be monitored moving forward. Most importantly, NRR has risen to a two-year-high, while RPO is surging, suggesting customer spend could remain elevated for the next few quarters.

Net Retention, RPO Strong, but Watch US Net New Adds

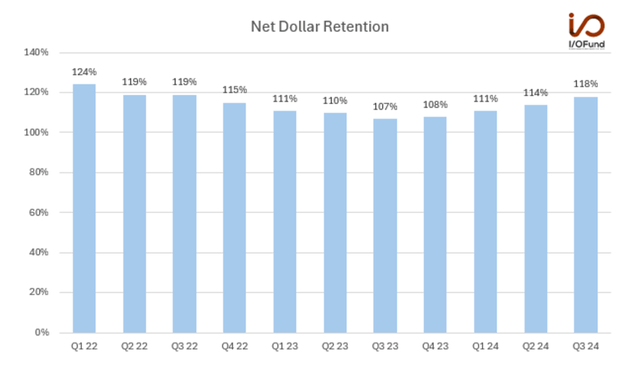

In Q3, net dollar retention expanded to 118%, up from 114% in Q2, 111% in Q1, and 107% a year ago. Management said that this “increase was driven both by expansions at existing customers and new customers acquired in Q3 of last year, as we see the effect of the AI revolution in both industry and government.” Net dollar retention has reached the highest level in two years, but still has room to expand, given that rates were >120% in 2021 and 2022.

In Q3, Palantir’s net dollar retention rate increased to 118%, up from 114% in Q2 and 107% a year ago. This growth was driven by expansions at existing customers and new acquisitions, reflecting the impact of the AI revolution in both industry and government. Net dollar retention reached its highest level in two years, with further growth potential, previously exceeding 120% in 2021 and 2022. (Tech Insider Network)

Palantir has an advantage over other software peers due to its differentiated AI offerings, while adding significant new customers this year and expanding deal sizes with new customers (with FY24’s additions not appearing until FY25) — this provides a path forward for NRR to continue expanding. Initial AIP customers are beginning to appear in NRR, and a few more quarters will provide a clearer picture of how far NRR could expand and at what level it will plateau.

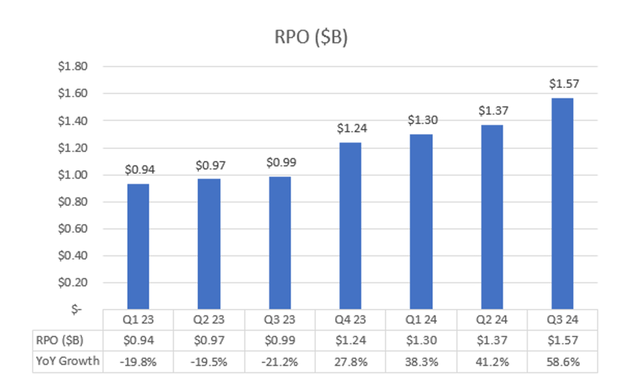

RPO is also sharply rising, implying that customer spend is likely to remain strong over the next few quarters. RPO growth has accelerated over the past four quarters, from 27.8% in Q4, breaking a string of declines in the rest of 2023, to 58.6% YoY by Q3. This is the highest RPO and growth rate since the Tech Insider Network began tracking Palantir in late 2023, and another data point underlying its AI-driven momentum.

Palantir’s RPO (Remaining Performance Obligation) is sharply rising, indicating strong customer spending over the next few quarters. RPO growth accelerated over the past four quarters, from 27.8% in Q4 to 58.6% YoY in Q3. This is the highest RPO and growth rate since the Tech Insider Network began tracking Palantir in late 2023, highlighting its AI-driven momentum. (Tech Insider Network)

However, net additions in the commercial segment are slowing, both in the US and overall. In Q3, Palantir added 31 net new customers in its commercial segment, down from 40 net new customers in Q2 and 52 net new customers in Q1.

This has been predominantly driven by the US, as international commercial has yet to scale. In the US, net new commercial customers have dropped over the past two quarters, falling from 41 net new adds in Q1 to 26 net new adds in Q3. There is a clear deceleration from peak customer acquisition following AIP’s ramp, where net new adds surged from 6 in Q2 2023 to 41 by Q1, before slowing again. Palantir has acknowledged hiccups and issues in its sales cycle, saying in Q1 that they are “at the way early days of figuring out how to actually get customers to buy [AIP]” and “we’re not flawlessly executing on our sales motion.” The friction is appearing within lumpy net new adds.

US commercial has been a driving factor for Palantir, as the primary segment adopting AIP and concentrating AI momentum. Palantir guided for a larger QoQ revenue deceleration for Q4 than in Q3, implying ~26.4% YoY growth, a 3.6-point deceleration from 30% YoY. Last quarter, Palantir’s guidance implied a 2-point deceleration from 27.2% YoY in Q2 to 25.2% in Q3, but a significant beat pushed growth to 30%. (Tech Insider Network)

US commercial has been a driving factor for Palantir as the primary segment adopting AIP and where this AI momentum is concentrated. Palantir guided for a larger QoQ revenue deceleration for Q4 than it had in Q3 – guidance implies revenue growth of ~26.4% YoY, a 3.6-point deceleration from 30% YoY. Last quarter, Palantir’s guide implied only a 2-point deceleration, from 27.2% YoY in Q2 to 25.2% in Q3 – the large beat pushed growth to 30% in the quarter.

Analyst estimates do support this, with Q4 revenue estimated at $777 million, nearly 1% above Palantir’s guide as the market expects a beat once more; yet given the size of the recent beat, estimates may be lagging the underlying business momentum. The estimates correlate to 27.8% YoY growth, a 2.2 point deceleration, while Q1 is expected to decelerate further to 24% YoY before continuing to decelerate in each quarter of FY25.

Cash Flow and Margins are Bonkers

Palantir is in uncharted territory, as it is separating itself as a rare breed in SaaS to see both strong and profitable AI-driven growth. The company’s revenue growth plus GAAP operating and net margins have been in the double-digit range for four consecutive quarters. Additionally, Palantir’s Rule of 40 (revenue growth + adjusted operating margin) reached 68%, up from 46% last year.

To be consistently expanding on the Rule of 40, from the ~40% range at the end of 2022 to nearly 70%, is important as it shows that Palantir is efficiently investing in AI to drive revenue growth higher while increasing its profitability.

Cash flow margins were bonkers in Q3 — operating cash flow was nearly $420 million, or a 58% margin, while adjusted free cash flow was $435 million, a 60% margin. This was a large step up from cash flow margins in the low-20% range in the first half of 2024.

For FY24, Palantir is targeting adjusted free cash flow in excess of $1 billion, implying a margin of ~36%. Fundamentally, to have revenue growth around 30%, free cash flow margin of 30%, and adjusted operating margin nearing 40% is impressive, to say the least.

Valuation is Stretched

Palantir is at Mount Everest valuations, trading at topline multiples more than double the next three most expensive enterprise and AI-exposed SaaS stocks in the market – Cloudflare, ServiceNow, and CrowdStrike. At $55, Palantir is valued at 50x TTM revenue, and 45x forward revenue – its highest ever multiples, exceeding even 2021’s peak – versus 18x to 20x forward revenue for those three peers. Even down the line, Palantir is trading at double its peers, at 146x forward earnings, versus 88x for CrowdStrike and 71x for ServiceNow.

Palantir is trading at Mount Everest valuations, with topline multiples more than double those of Cloudflare, ServiceNow, and CrowdStrike. At $55, Palantir is valued at 50x TTM revenue and 45x forward revenue, the highest ever, surpassing 2021’s peak. In comparison, its peers trade at 18x to 20x forward revenue. Palantir’s forward earnings multiple is also double, at 146x, compared to 88x for CrowdStrike and 71x for ServiceNow. (YCharts)

Growth investors should not forget when we saw this happen before; which was Snowflake, a Wall Street darling trading 2X more than any other cloud stock at 45X Forward PS, with retail investors cheering Warren Buffett’s participation in the IPO. It currently trades at an 11.7 forward PS.

The primary question here is not whether Palantir is a strong AI stock, but will buyers continue to step-in?

Conclusion

Palantir’s Q3 report was met with quite the enthusiasm from the market, but the fundamentals must be immaculate at this valuation. RPO growth has surged over the past four quarters, while Palantir’s Rule of 40 continues to rise as adjusted operating margins expand and revenue growth accelerates. Net retention has risen to two-year highs, reaching 118% in Q3, as deal expansion continues.

However, Q4’s revenue guidance implies a larger sequential deceleration than what was expected for Q3, while US commercial net new adds continue to decline sequentially. This may sound like splitting hairs, but the company is priced far above what any peer is trading, and that typically doesn’t resolve well for tech investors.

Recommended Reading:

- Tesla Stock: Margins Bounce Back For This AI Leader

- Palantir Stock Is Crushing Its Peers In AI Revenue

- Nvidia, Mag 7 Flash Warning Signs For Stocks

- Cybersecurity Stocks Seeing Early AI Gains

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PLTR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our cumulative returns are 131% and a lead over institutional technology portfolios by as much as 157% since inception.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, deep-dives, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.