Summary:

- Palantir Technologies Inc.’s heavy reliance on government contract used to concern me.

- However, government contracts (especially from DoD), once past a pivotal point, provide recurring revenue and growth opportunities.

- Judging by the recent developments, I believe Palantir has already reached this point.

- Additionally, potential S&P 500 Index inclusion could create more demand for the shares and reduce price volatility.

portishead1

PLTR stock taught me a lesson

I last wrote on Palantir Technologies Inc. (NYSE:PLTR) about 3 months ago. Given the rapid development of its business, it would be helpful for me to start with a brief recap of the background. At that time, the company had just reported its 2024 Q1 results. The results were mixed and triggered a sizable price correction of more than 10% after the press release. Under this context, I wrote an article, entitled Give The Knife More Time To Fall, as illustrated by the screenshot below, to argue for a hold thesis. The article argued that:

In the longer term, I expect the company’s defense products to perform well given the differentiating features. However, in the near term, I see more downside pressure than upside potential and I rate the stock as HOLD. To reiterate, the first concern on my mind is its small profit due to cost pressure. Second, I’m not optimistic that the stock can overcome the ~$26 resistance level anytime soon judging by the recent insider activities and technical trading patterns.

As shown in the screenshot above, the stock price, after falling mildly after my last writing, staged a robust rally. All told, the stock price advanced by more than 26% since my last writing and hovers near $26 as of this writing.

Given the large changes in its stock prices and business fundamentals, an updated analysis is in order. In the remainder of this article, I will explain a key lesson I learned from the stock: the role of government contrast. I will detail A) how I misjudged a key factor in my earlier assessment: its heavy reliance on government (especially DoD) contracts, and B) how these contracts can serve as a secular tailwind for the business.

PLTR stock: heavy DoD reliance turned out to be a key advantage

PLTR’s heavy reliance on government contracts weighed heavily in my previous assessment of the stock. I used to consider such reliance as a negative as they are too sensitive to factors outside the business’ control such as government policy changes and government budgeting.

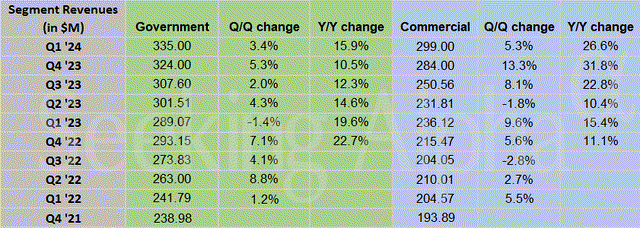

Its recent financials (e.g., see the 2024 Q1 earnings report shown in the chart below) partially relieved my concerns for two reasons. First, its revenues from the commercial side have now grown to be at a comparable magnitude as the government side (although government contracts are still the main contributor). To wit, in Q1, commercial segment revenues reached $299M, compared to about $335M from the government segment. Second, the growth rates on the government side have been consistent over the past few years as seen amid a wide range of macroeconomic conditions, showing the resilience and staying power of its products.

However, what I failed to consider is that government contracts, especially those from DoD, are highly sticky and very recurring once they reach a pivotal point. Judging by the recent developments, I think PLTR has already reached that pivotal point.

Historically, warfare has always been the place where disruptive technologies are first applied, and AI is no exception this time. The pace of AI infusion — and also deployment — in DOD turned out to be so much faster than I expected (see the next chart below for their impact on the battle in Ukraine). Specific to PLTR, a milestone in my view (with hindsight) was the recent award it received for its TITAN system (Tactical Intelligence Targeting Access Node) from the U.S. Army. The dollar amount of the award is certainly not ground-shaking: PLTR was awarded an initial $178M for the first two years. However, I believe this reflects the beginning of tectonic shifting in the world of defense.

This is the first time in my knowledge that a software company has been named the Prime on a production program. Other members of the production team assembled include the usual hardware-oriented names you can expect: Northrop Grumman (NOC), L3 Harris (LHX), etc.

Given the strong symbolic signal from this contract, I anticipate continued penetration opportunities for PLTR for future DOD contracts and government contracts in general.

PLTR stock: potential for SP500 inclusion

Another potential catalyst is the inclusion in the S&P 500 Index (SP500). For readers unfamiliar with the details, to be eligible for the index, a company needs to meet the following criteria:

- The company should be from the U.S.

- Its market cap must be at least $8.2 billion.

- Its shares must be highly liquid.

- At least 50% of its outstanding shares must be available for public trading.

- It must report positive earnings in the most recent quarter.

- The sum of its earnings in the previous four quarters must be positive.

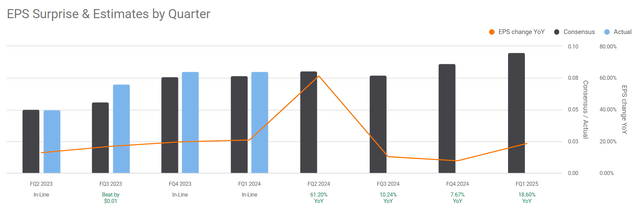

As you can tell, PLTR now meets all these criteria already. Notably, regarding the last requirement, PLTR has been reporting GAAP profit for at least 4 consecutive quarters as seen in the next chart. The next index rebalancing of the index is expected in September, and I think there is a good chance that PLTR would be included at that time. I further anticipate that becoming a member could provide further support for its stock prices.

Besides the enhanced prestige and visibility, inclusion in the index should attract more institutional investors. Many institutional investors are limited to members of the S&P 500. Thus, inclusion in the index makes PLTR eligible for them and thus enjoys a higher demand. Inclusion in the index also creates higher demand for index funds (e.g., ETFs, mutual funds, CEFs, etc.). In today’s investing world, a massive amount of money is invested in funds that are based on the S&P 500. If PLTR gets added to the index, these funds are obligated to buy its shares to match the index composition. This creates an immediate and substantial demand.

Other risks and final thoughts

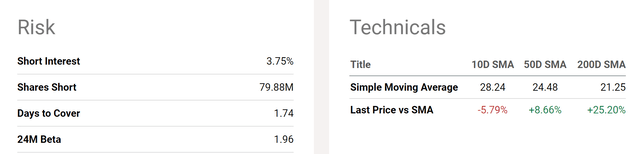

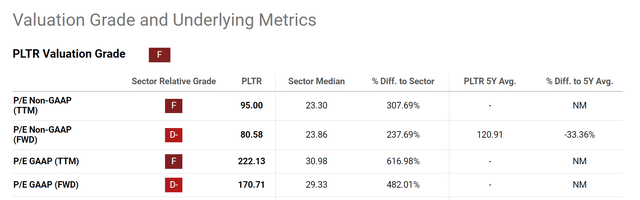

Despite the above positives, the stock is certainly not for everyone. It is a high-risk, high-reward bet and is only suitable for more aggressive investors. As a simple example, its 24-month beta is about 1.96 as seen in the first chart below, meaning the stock is almost twice as volatile as the broader market. If it indeed gets included in the SP500 index as analyzed above, I expect the inclusion to help reduce its beta. I’ve already mentioned both the pros and cons of its reliance on government contracts above already. For its commercial segment, regulation and concerns about data privacy and security could lead to uncertainty or even legal risks. Given its relatively small earnings, PLTR’s valuation ratios are significantly stretched relative to both its sector and close peers. As an example, the chart below summarizes PLTR stock’s valuation grade. Its P/E ratios are vastly above the normal standards across all metrics as seen.

All told, my thesis is that Palantir Technologies Inc.’s defense products have reached a pivotal point, judging by the recent development. I anticipate continued penetration opportunities and recurring revenues from the defense segment. Therefore, I anticipate a bright growth future for PLTR given the milestone it has reached and the differentiating features of its technology. To reiterate, my above anticipation is geared toward the longer term (say the next 3~5 years). In the near term, investors need a strong nerve to stomach setbacks and violent stock price swings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.