Summary:

- Palantir’s Q4 FY2023 significantly beat consensus estimates for both EPS and revenue, causing PLTR stock to rise sharply on the news. How much is left? Read on.

- The company’s AIP bootcamps have been successful in capitalizing on the growing demand for AI in business. It’s now the “pearl” of the company when it comes to revenue expansion.

- There should be even more growth drivers as soon as the company completes work on the Mission Manager project and begins its mass commercialization.

- I can’t upgrade PLTR stock because it trades today at 46 times FY2027 earnings, which makes the stock too overvalued even assuming stronger EPS growth than Wall Street expects today.

- I am therefore maintaining my “Hold” rating, as I do not know when the stock price will settle at a realistic level.

Alex Wong/Getty Images News

Introduction

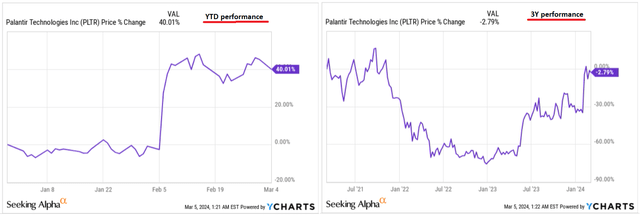

I have been covering Palantir Technologies Inc. (NYSE:PLTR) here on Seeking Alpha since October 2021: I initially rated the stock as a ‘Sell’ due to its overvaluation and seemingly limited growth at the time. My bearish calls were successful for about a year – until market expectations shifted towards rapid growth through AI (and not only), which allowed PLTR stock to recover quickly. I upgraded the stock to “Hold” in February 2023 and have written about the company once a quarter since then, coming to either neutral or pessimistic conclusions (mostly neutral). In my most recent article on PLTR, I concluded that the company’s business is indeed growing very fast and with high quality – so it became tough to remain bearish. At the moment, PLTR’s stock price is approaching the 3-year highs, having risen 43% year-to-date:

Since it’s been a whole quarter since I last analyzed Palantir, I decided to update my coverage today and try again to understand how far the company has come in terms of growing its business and maintaining profitability, and more importantly, whether it makes sense to take risks now when PLTR’s stock price is soaring so high?

Q4 FY2023 Review: Financials And Corporate Developments

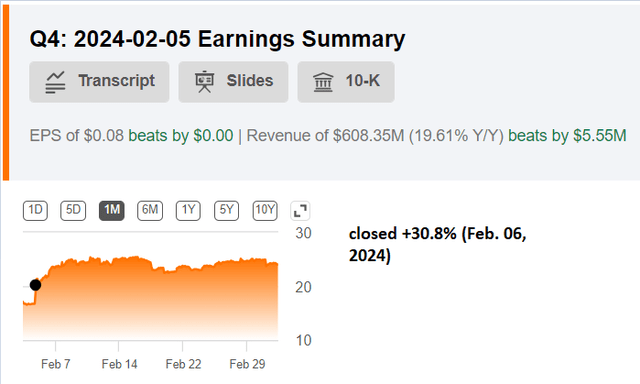

The company published its results for Q4 FY2023 (and for the full year – see PLTR’s 10-K) early last month, significantly beating consensus estimates for EPS and revenue, causing PLTR stock to rise sharply on the news:

Author’s compilation, SA Premium data

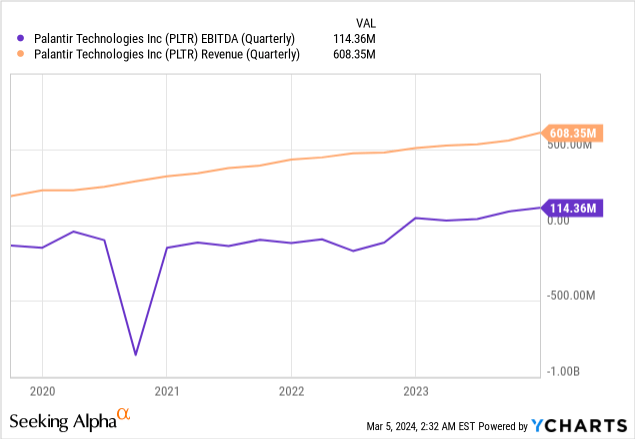

Palantir’s Q4 FY2023 revenue was $608 million, up 20% YoY. As a result, the full-year revenue of ~$2.2 billion showed a YoY growth of 16.74%. This acceleration was driven primarily by the US commercial business, which saw a remarkable 70% year-over-year growth due to momentum in AIP, based on the CFO’s commentary during the latest earnings call.

What I wrote last time about AIP’s prospects continues to be realized. Palantir has managed to find a new growth driver in its commercial market. Its boot camps, I suspect, are particularly popular given the increasing turn to AI by corporate America: no one wants to simply lag behind their industry peers, as is often the case when new breakthrough innovations come to market. History is full of such examples: the emergence of industrial use of plastic in the 20-30s of the last century or the worldwide spread of the Internet in the 80-90s are the first thing that comes to mind. As a rule, the companies that were able to adapt quickly survived, and while the process of adapting new breakthrough technologies gained momentum, those who were “selling shovels” (by analogy with the Klondike) received the greatest profit from this process.

The Palantir AIP bootcamps are the “golden shovel” that few could have thought of in 2021 – here the company showed how important it is not to miss the slightest opportunity to make the most of current trends. For those who don’t know, PLTR defines these bootcamps as follows (from the recent IR presentation):

These immersive, hands-on-keyboard sessions allow new and existing customers to build live alongside Palanr engineers, all working towards the common goal of deploying AI in operations.

Palantir may be treated differently, but the company is actually one of the pioneers in the application of AI in various industries. Years of cooperation with the US government also give PLTR a kind of special status. So as soon as the demand for the use of AI in business skyrocketed, I assume Palantir became one of the most obvious options for entrepreneurs to get help.

The growth of Panatir’s US commercial business segment enabled the company to further expand its margins: In Q4, it achieved an adjusted operating margin of 34% and reported GAAP net income of $100 million, contributing to total net income of $210 million for the full year. The last quarter of FY2023 was the 5th consecutive profitable quarter for PLTR.

My words that companies are taking the implementation of AI seriously are confirmed by the latest survey study by PWC: Some 73% of US companies have already adopted AI in at least some areas of their business. And the growth potential still appears to be huge. The same study says that 44% of business leaders are planning data modernization efforts by 2024 to take better advantage of GenAI. So PLTR’s addressable market is going to keep expanding, in my view.

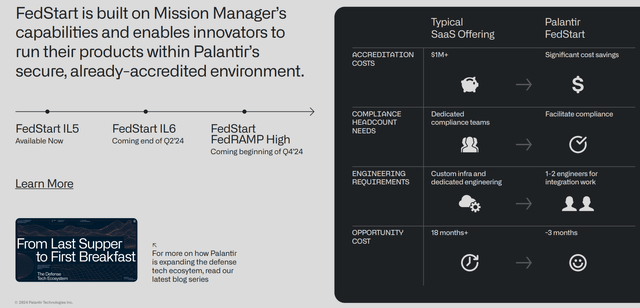

In addition to the AIP bootcamps, the company is also actively developing its product line, which recently included the Mission Manager. According to the description in the IR materials, this is a comprehensive platform tailored to the evolving needs of government agencies, particularly those of defense and intelligence operations. According to management’s plans, the company will work through 2024 to expand the capabilities of this platform and introduce new features that will save potential customers months of work and millions in opportunity costs.

It’s still difficult to call Mission Manager a game changer for PLTR right away, but if the project does take the final shape that management claims, then this will definitely boost confidence that today’s 5 consecutive months of profitable growth is just the beginning.

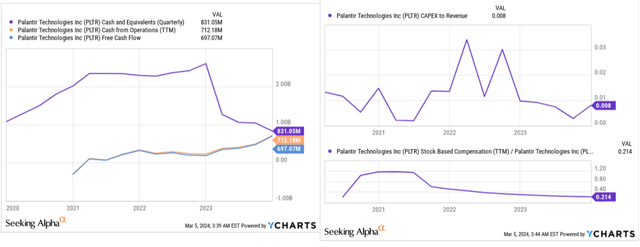

As for the quality of current growth, we still see a very high SBC-to-sales ratio here: although this metric has dropped from over 35% last year, it is still above 20% today, which is quite a lot. But this is a kind of investment in human capital because Palantir pays less than 1% of sales for CAPEX and I assume that the main cost point in the development of new projects and the expansion in the labor cost. As long as sales and EBIT growth and the EPS growth rate exceed these costs, the company should continue to grow. In the long term, however, I think PLTR needs to change its approach to employee compensation.

I don’t like the fact that cash on the balance sheet continues to fall, even though PLTR is doing quite well from a cash flow generation perspective (even adjusted for SBC).

Summarizing all this, I come to the interim conclusion that PLTR’s margins are improving despite certain problems, and sales growth rates are also increasing – all thanks to new trends in the market that the company has adapted qualitatively and created new revenue streams. I think there’s definitely a bigger prospect for business growth continuation. But the attractiveness of a stock depends, as almost always, on its valuation – let’s take a look at that.

Palantir’s Valuation Analysis Update

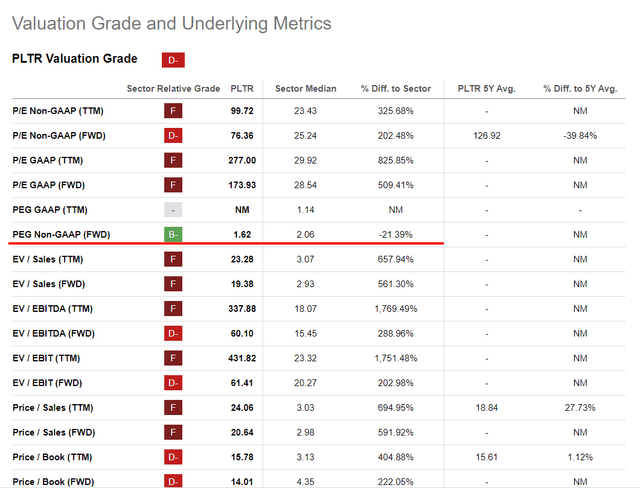

Once again, Palantir Technologies’ stock cannot be described as cheap: According to Seeking Alpha’s Quant System, PLTR’s Valuation grade is rated “D” – that’s better than 3 months ago, but still much higher than the sector’s average. The only metric that stands out from the general backdrop of overvalued multiples is next year’s non-GAAP PEG ratio, which is 21.39% below the sector’s median figure:

Seeking Alpha, PLTR’s Valuation, author’s notes

As for any other growth company, the decisive factor for Palantir is not what multiple the market gives it today, but how quickly its multiple is projected to shrink in the coming years. From financial theory (and generally from my experience), I can assume that the more the market assumes that the multiple will fall, the more upside potential the stock has. This is mainly because some companies usually can maintain (or even increase) their market valuation (P/E, P/S, etc.) thanks to stable margins – contrary to what Wall Street implies.

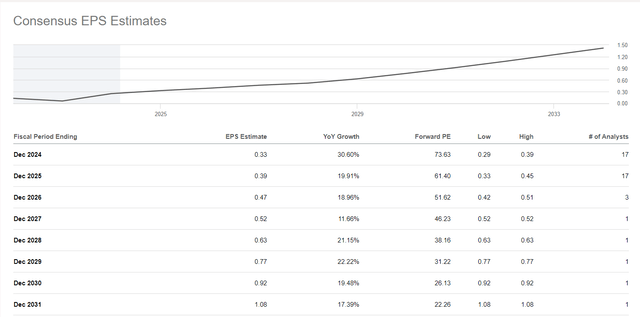

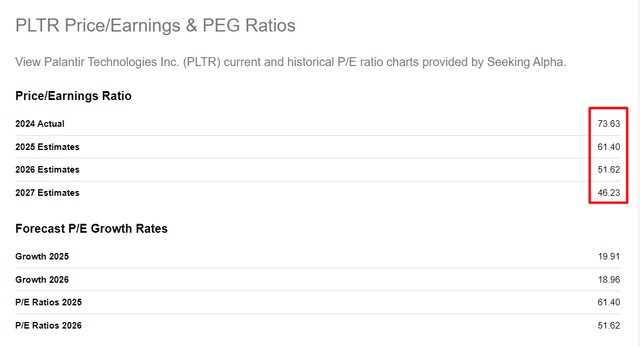

Unfortunately for Palantir shareholders, the market seems to be pricing the stock very, very expensively as far as I see it: according to Seeking Alpha, PLTR’s price-to-earnings ratio will be ~46x in FY2027:

Seeking Alpha Premium, PLTR, author’s notes

In other words, the investor pays 74 times FY2023 earnings today to get a stock with a P/E ratio of 46x in 3-4 years. At the same time, the EPS CAGR for the next 4 years is projected to reach only 12% (from FY2024 to FY2027 inclusive).

Even Nvidia (NVDA), which also sells “shovels” in this “AI Klondike” (just in a different niche) should have a price-to-earnings ratio of 25x in 4 years. At the same time, NVDA’s earnings per share should increase by 13.55% annually over the same period, based on the consensus data.

I think a fair valuation for Palantir is 25x in price-to-earnings ratio in 4 years from here. At current prices, the current premium is about 85%, but with Palantir rapidly beating analysts’ forecasts – as shown by Seeking Alpha’s earnings surprise data – I’m assuming EPS growth of 20% rather than 12% over the next 4 years. This is a relatively realistic assumption, in my opinion, given that Palantir is competing for its fast-growing TAM with a host of new entrants that will most likely increase in number. Palantir should then earn about $0.684 in earnings per share in FY2027, if my math is correct, instead of $0.54 (as currently expected). The implied P/E ratio would then be around 35x – that’s ~40.5% more than PLTR stock has today.

The Verdict

Palantir Technologies definitely has a lot of prospects now, and there should be even more growth drivers in the near future as the company completes work on the Mission Manager project and begins its mass commercialization. The AIP bootcamps should remain the “pearl” of the company when it comes to revenue expansion, and the government contracts will, in my opinion, provide some stability in the company’s business structure, even if they will not have a noticeable impact on growth.

However, I can’t upgrade Palantir stock because it trades today at 46 times FY2027 earnings, which makes the stock too overvalued even assuming stronger EPS growth than Wall Street expects today. PLTR would have to fall several dozen percent or continue to beat consensus estimates by 50-100% each quarter to maintain investor optimism and for the current valuation to at least have a reasonable explanation. I think the chances of such a scenario are pretty slim, as competition in the market is likely to increase sharply as the whole AI trend attracts more and more people who want to ride it.

I am therefore maintaining my “Hold” rating, as I do not know when the stock price will settle at a realistic level.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!