Summary:

- Palantir is positioned for significant growth across its government and commercial customers. Customer contracts are both expanding and being extended with AIP.

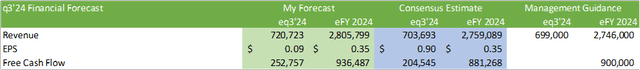

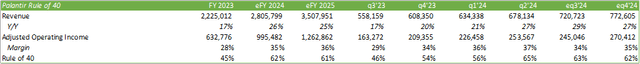

- My forecast for Q3’24 calls for revenue at $720mm, exceeding guidance, with an adjusted operating margin of $245mm and EPS of $0.09/share.

- Despite high valuation, the addition to the S&P 500 and strong momentum suggest Palantir shares can sustain higher valuations.

Hiroshi Watanabe

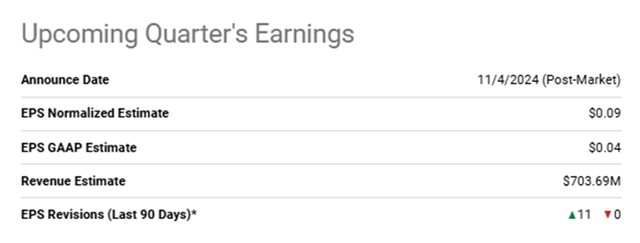

Palantir (NYSE:PLTR) is poised to release earnings on November 4, 2024, the day before the US presidential election. Palantir underwent a few significant events since reporting q2’24, including multiple large deals and partnerships as well as being added to the S&P 500. As events unfold for the AI platform firm, the share price has far outpaced my previous price target of $32.61/share. With earnings right around the corner and the large deals announced throughout q3’24, I am upgrading my price target to $51.68/share at 35.57x price/sales with a STRONG BUY rating.

In the last 90 days, 11x analysts have revised EPS estimates up with zero downward revisions.

Corporate Reports

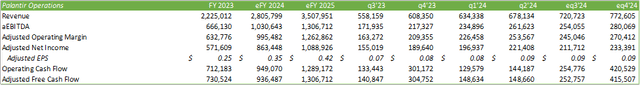

Palantir Operations

On October 23, 2024, Palantir announced its partnership with L3Harris Technologies (LHX) to help accelerate L3Harris’s digital transformation. The partnership includes a strategic collaboration covering US Army programs, including the TITAN program, in modernizing operations and weapons defense systems. Palantir was previously awarded $178.4mm to develop and produce 10 TITAN prototypes. With this contract, Palantir became the first software prime with the role of developing an AI-defined vehicle with deep sensing capabilities for long-range precision for the modern battlespace. The solution Palantir is providing includes sensors, networks, and automation improve time from sensor to shooter. In partnership with L3Harris, the firms will integrate L3Harris’s WESCAM system with Palantir’s Sensor Inference Platform that will provide the AI/ML for improved target detection and delineation during live fly tests.

In addition to this, Palantir was awarded a $99.8mm 5-year contract by DEVCOM Army Research Laboratory to extend Maven Smart System access to the Army, Air Force, Space Force, Navy, and US Marine Corps.

Lastly on the defense side of the business, Palantir announced its partnership with Microsoft (MSFT) on August 8, 2024, to improve cloud security, AI, and enhance analytics capabilities for the US Defense and Intelligence Community. The agreement is designed to allow critical national security missions to operationalize Foundry, Gotham, Apollo, and AIP Platform in Microsoft’s government and classified cloud environments. In turn, Palantir will be an early adopter of Azure’s OpenAI Service within Microsoft’s Secret and Top Secret cloud environments.

On the commercial side, Palantir is further entrenching itself in the medical industry through its multi-year, multi-million dollar contract with Nebraska Medicine. According to the press release, Palantir leveraged its AIP bootcamp to work with Nebraska Medicine to further develop new workflows in less than 6 weeks. Accordingly, Nebraska Medicine has realized a 2000% improvement in Discharge Lounge Utilization, improving hospital bed turnover. The hospital group is also leveraging an AI-powered appeal program to more effectively combat payor behaviors.

Palantir also deepened its partnership with BP (BP) through a 5-year agreement. Palantir has been working with BP since 2014 to support O&G production, energy transition, and its digital transformation, amongst other things. BP will be moving forward with Palantir’s AIP software to improve decision making through automated analyses for actionable items. A major factor involved is grounding the platform’s recommendations in order to prevent potential hallucinations.

In addition to this, Palantir extended its partnership with APA Corporation (APA) in a multi-year, multi-million dollar extension, building upon its original agreement signed in 2021. APA is extending its AI capabilities with the AIP software platform to improve operational planning, supply chain management, maintenance planning, production optimization, and contract management. The platform has enabled APA to improve equipment reliability through real-time monitoring as well as optimize its logistics.

Palantir Financial Position

Corporate Reports

Taking into account the major announcements throughout the quarter, I am updating my forecast for q3’24 as well as eFY24. I’m expecting revenue to come in above the guided range of $697-701mm at $720mm for eq3’24 with an adjusted operating margin of $245mm, above the guided range of $233-237mm. I’m forecasting adjusted diluted EPS to come in at $0.09/share for both eq3’24 & eq4’24 for a total EPS of $0.35/share for all of eFY24.

Corporate Reports

For eq3’24, this will create a “Rule of” 63% based on the firm’s year-over-year revenue growth and adjusted operating margin. For all of eFY24, I’m forecasting Palantir to produce a “Rule of” 62%.

Corporate Reports

Risks Related To Palantir

Bull Case

Palantir’s AI software platform has proven to be a profitable addition to enterprises’ software stack, driving both new customer acquisition and contract extensions with existing customers. I have stated in previous reports that the AIP bootcamp is the best sales tactic on the market by placing proven capabilities of the platform in the hands of potential customers with live data and results. As the platform scales to include more customers, I have reason to believe Palantir’s operations will realize economies of scale with stronger operating margins.

The firm was added to the S&P 500 index on September 23, 2024, adding a new shareholder base that has driven the company’s valuation beyond its historical range.

From a geopolitical perspective, Palantir may realize exceptionally strong growth amongst sovereign governments as tensions rise across geographies.

Bear Case

Palantir’s share price has far exceeded its historical trading range at nearly 40x price/sales. The firm’s q3’24 earnings results will likely drive intense volatility into either direction given the extended premium.

From an operational perspective, growth going out may be limited in the near-term given the cloud data center growth impediment due to power sourcing.

Valuation & Shareholder Value

Corporate Reports

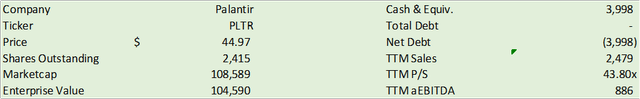

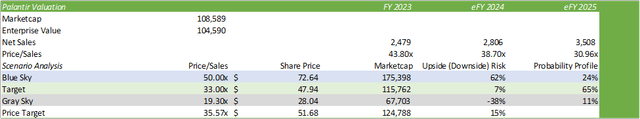

PLTR shares have experienced a strong run-up in price, resulting in nearly a 40x price/sales multiple. Given the strong momentum going into earnings with the addition of the stock being added to the S&P 500, shares may be capable of continuing forward beyond its high valuation watermark of the last 3 years. The highest shares have traded were post-IPO in 2020 at nearly 50x price/sales.

Given the additional shareholder base the S&P 500 added, I have reason to believe that PLTR shares will have the ability to support a higher valuation despite the appearance of being overextended.

My concern is that given the huge run-up in share price, investors may be anticipating a strong earnings beat paired with improved guidance for the duration of the year, potentially well beyond the scale of what the firm is capable of. Management has mentioned on previous earnings calls that they are staffing up to support the heightened demand for its AIP bootcamps.

Using a broader valuation range based on the firm’s historical valuation range, and given the broader shareholder base, I am upgrading my price target to $51.68/share at 35.57x price/sales and will be reiterating my STRONG BUY rating.

Corporate Reports

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, APA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.