Summary:

- Palantir’s shares have dropped after the release of its first quarter report, but the size of these declines seems unwarranted.

- The company reported solid revenues of $634 million, beating analyst expectations, and Palantir has generated net profits during each of the last six quarterly periods.

- Palantir’s guidance figures for the second quarter and full-year periods were slightly disappointing, but its strategic approach is well-defined and recent declines in share values could be a buying opportunity.

hapabapa

Palantir Technologies (NYSE:PLTR) shares have plummeted following the release of the technology defense company’s first quarter earnings report. However, the size of these declines seems to be unwarranted, and we believe that the stock is looking like a good buying opportunity at these lower levels.

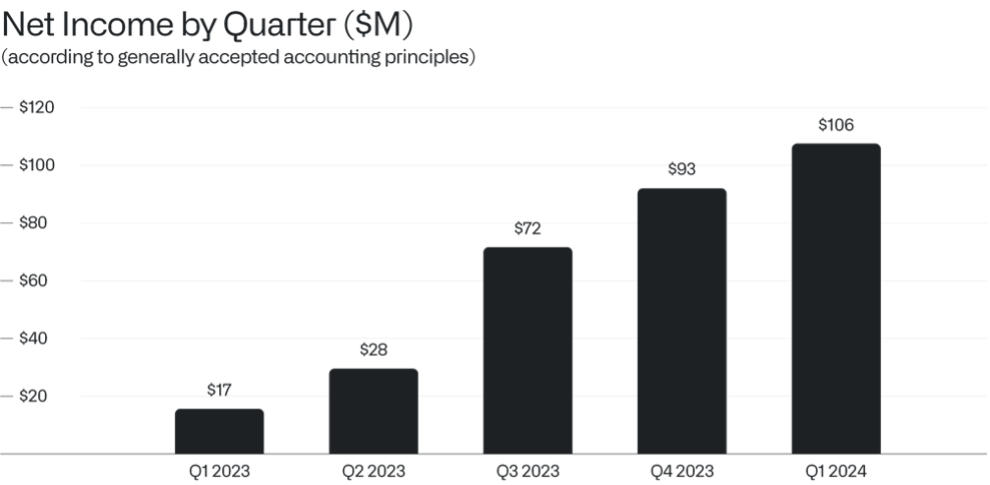

Net-Income By Quarter (Palantir)

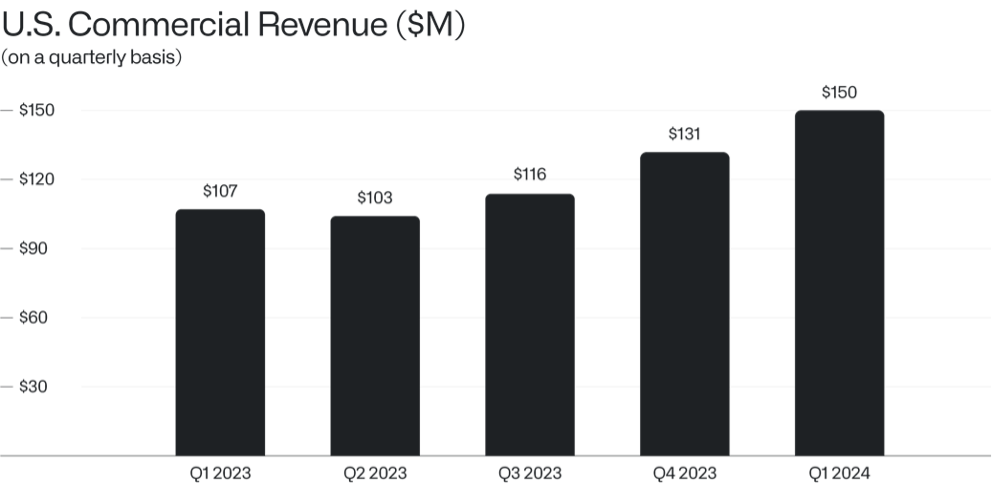

For the period, the global artificial intelligence big-data company reported per-share earnings of $0.08 (matching consensus estimates) alongside revenues of $634 million (indicating annualized growth rates of 21% relative to the $525 million recorded during the same period last year and beating analyst expectations of $625 million). In the U.S. commercial market alone, Palantir generated revenues of $150 million during the quarter (roughly 24% of the firm’s revenue during the period) and Palantir expects this regional market to maintain its positions as one of its strongest drivers of growth near-term.

U.S. Commercial Revenues (Palantir)

On the negative side, Palantir released second-quarter and full-year guidance figures that were slightly disappointing relative to prior expectations. Specifically, Palantir now estimates revenues will fall within a $649 million – $653 million range (against prior expectations of $653 million), while estimates for the full-year period are now calling a $2.68 billion – $2.69 billion range (against prior expectations of $2.71 billion).

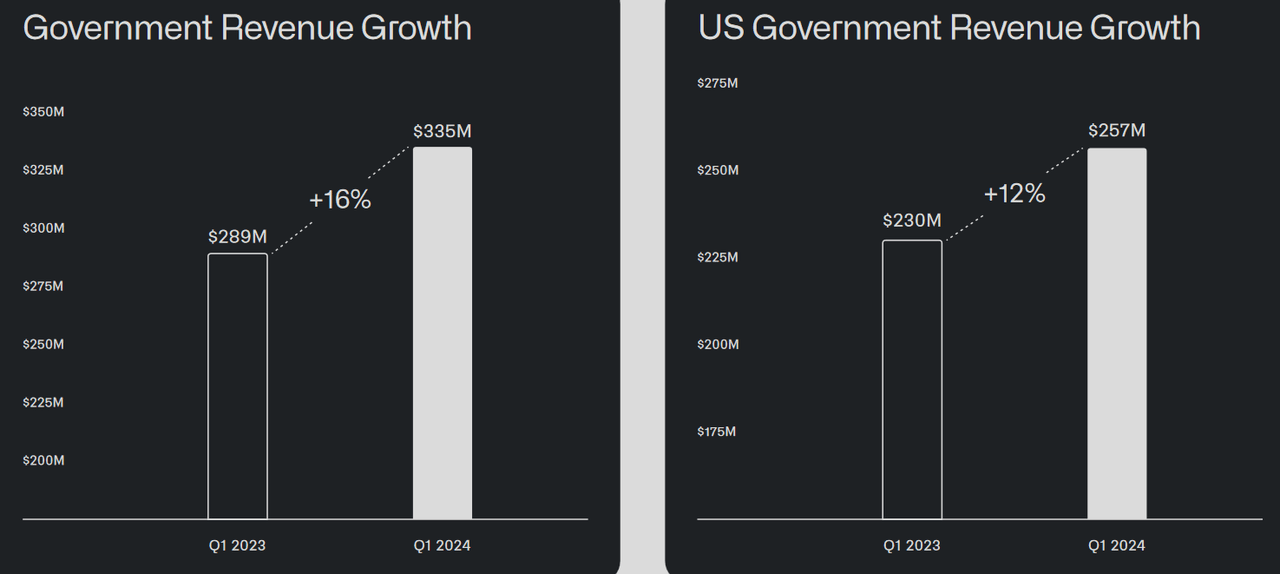

Government Revenue Growth (Palantir)

In an open message for shareholders, CEO Alex Karp explained:

The software platforms we have built make possible quantifiable and transformative results for the enterprise. Our partners need the right software infrastructure—the underlying technical architecture that is a precondition for effectively enabling write-back functions, data lineage tracking, large language models, and more generally the handoff between human and algorithmic agents—in order to make artificial intelligence work…

Warfare in this century will continue to be transformed by software. Many fear the application of artificial intelligence in the military context, including its potential to make possible more autonomous and indeed self-directed weapons systems.

It has been less fashionable, however, to note that software, including the systems that currently enable target selection and mission planning, has become as vital to the elimination of an adversary as it is to protecting the innocent from harm. The platforms in use by our defense and intelligence partners present a very real threat to the survival of our enemies. But those same software systems may also make possible and indeed hasten the beginning of the end of an era of total and indiscriminate war.

Overall clarity in Palantir’s strategic approach appears to be well-defined, and the negative market reaction to the company’s most recent earnings report seems excessive (in our view). Net income for the quarter posted at $0.04 per share (or $105.5 million), which marks a dramatic improvement from the quarterly net income of $0.01 per share (or $16.8 million) that was reported during the same period last year. Most importantly, we can now see that Palantir has generated net profits during the last six quarterly periods – and the company currently generates more in quarterly profit than it did in annual revenues during earlier portions of Palantir’s history.

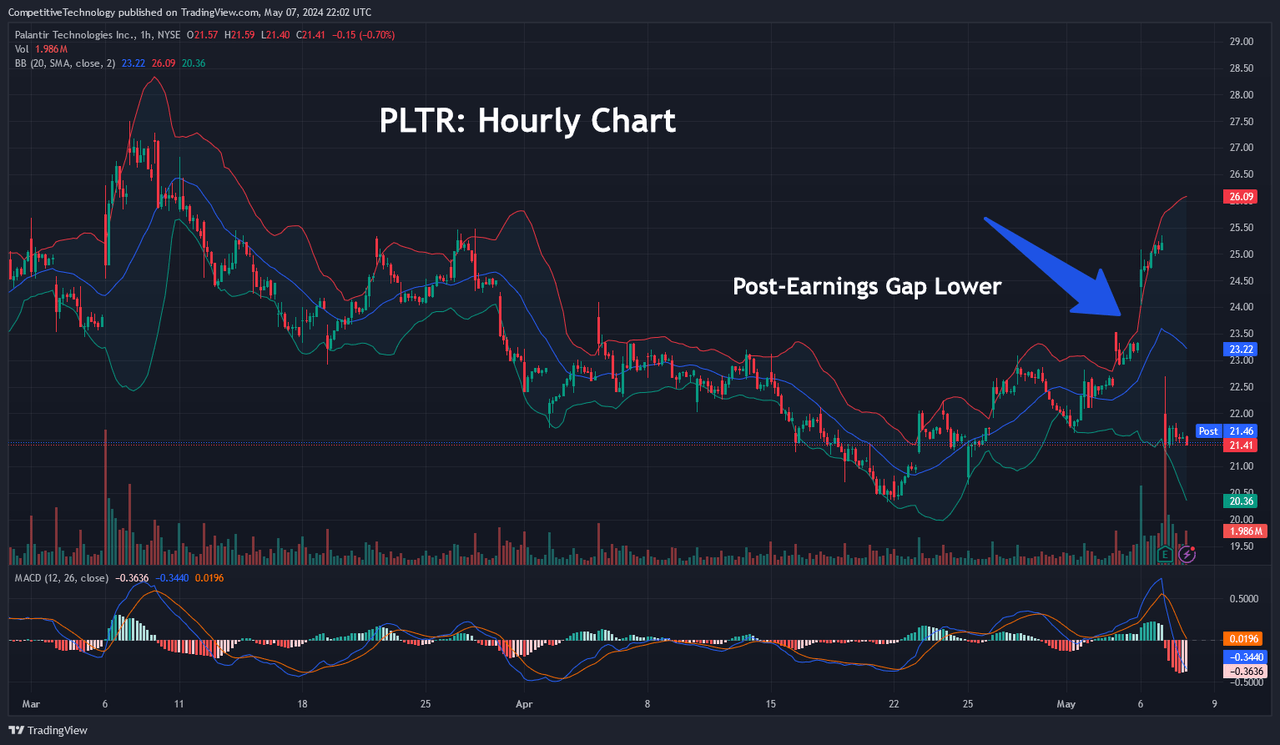

Post-Earnings Price Gap (Income Generator via TradingView)

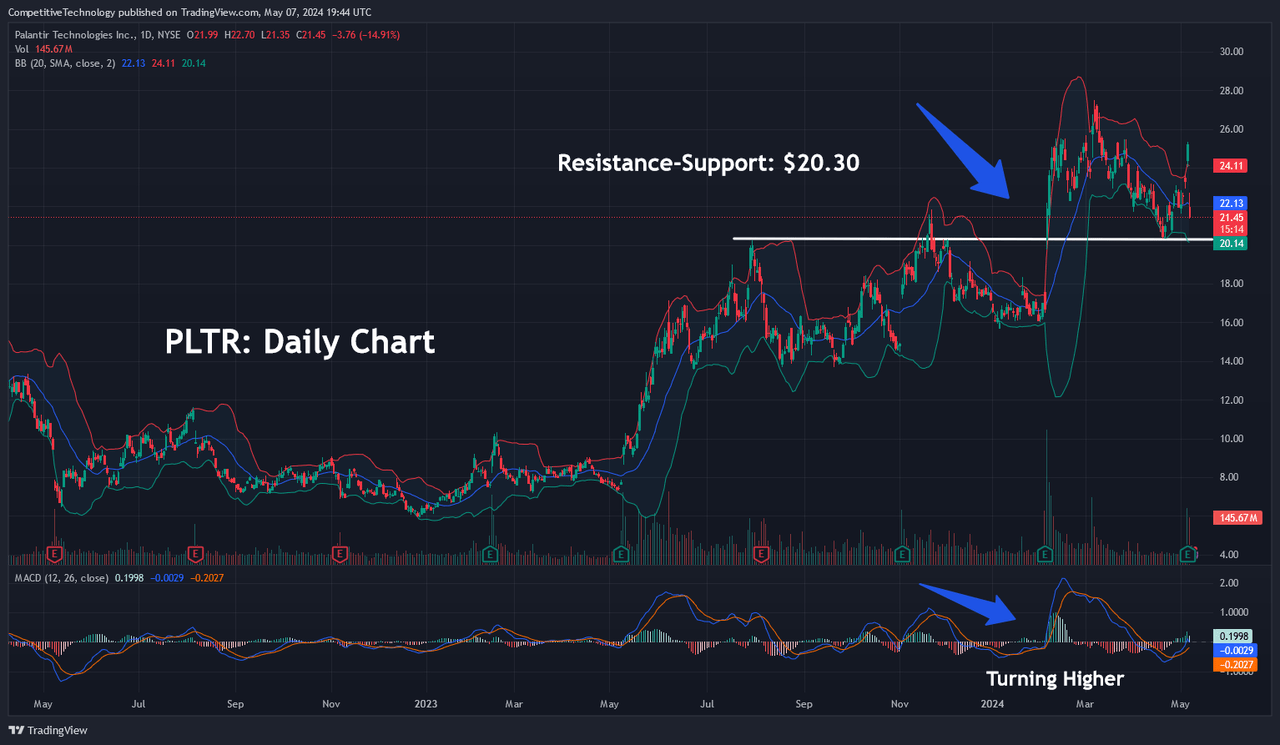

All of that said, it is very difficult to argue with the concept that “price is king” – and the market’s reaction to these quarterly earnings results can only be described as extreme in nature. In the chart above, we can see PLTR’s dramatic gap lower following the release of Palantir’s earnings report, and share prices are now falling sharply toward the April 19th low of $20.33. Unfortunately, a downside break here could cause selling pressure to build in this stock because this region marks a significant level of prior resistance that would now be expected to work as support. Specifically, the stock’s prior highs from August 2023 (at $20.24) align quite closely with this level and this resistance area was re-tested again in November 2023 (when a false upside breakout occurred prior to share prices falling back to $15.66 in January 2024).

PLTR: Key Price Levels (Income Generator via TradingView)

Remember, prior areas of resistance are expected to function as support zones after they are breached and then re-tested from the upside. In the daily chart above, we can see an example of how this type of price formation tends to appear in active markets. In this case, the $20.30 level initially works as resistance until prices are able to make a slight upside break (in November 2023) before reversing sharply lower. When this region was first re-tested from the topside (in April 2024), this support level contained selling pressure and prevented share prices from heading lower. Following the bearish price gaps that developed after Palantir released its most recent earnings report, traders will need to monitor this area closely in order to better characterize broader trend direction and ultimately identify price levels that can be used to establish new buying opportunities going forward.

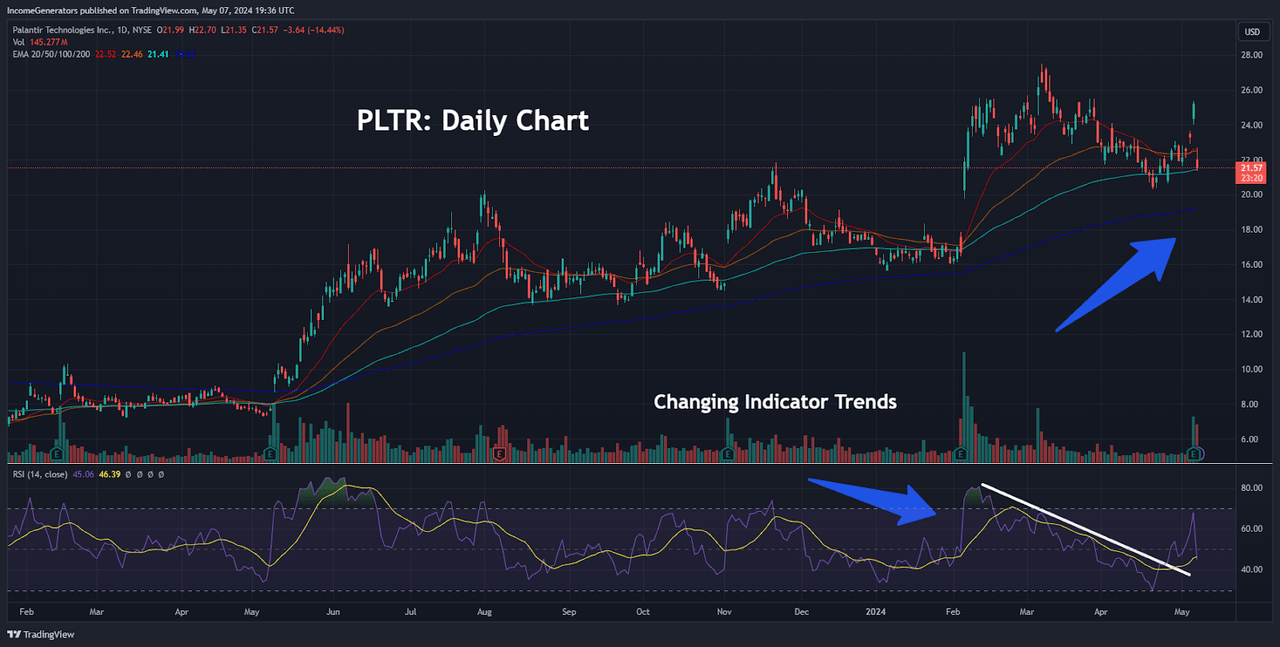

PLTR: Daily Chart (Income Generator via TradingView)

In the next price chart, we can see PLTR plotted against its 20-day, 50-day, 100-day, and 200-day exponential moving average cluster. In this instance, we can see another example of a confluence of bullish signals which suggests that PLTR shares have strong potential to find support near-term. Specifically, we have not seen a convincing downside break of the 20-day, 50-day, and 100-day exponential moving averages and the quickly rising 200-day measure is on track to break above the $20 level in coming sessions (likely to provide additional support). Moreover, daily indicator readings in the Relative Strength Index (RSI) have already broken the prior bearish downtrend – and, since we are currently holding near the mid-point of the histogram, there is plenty of room for share prices to move higher without first reaching overbought levels.

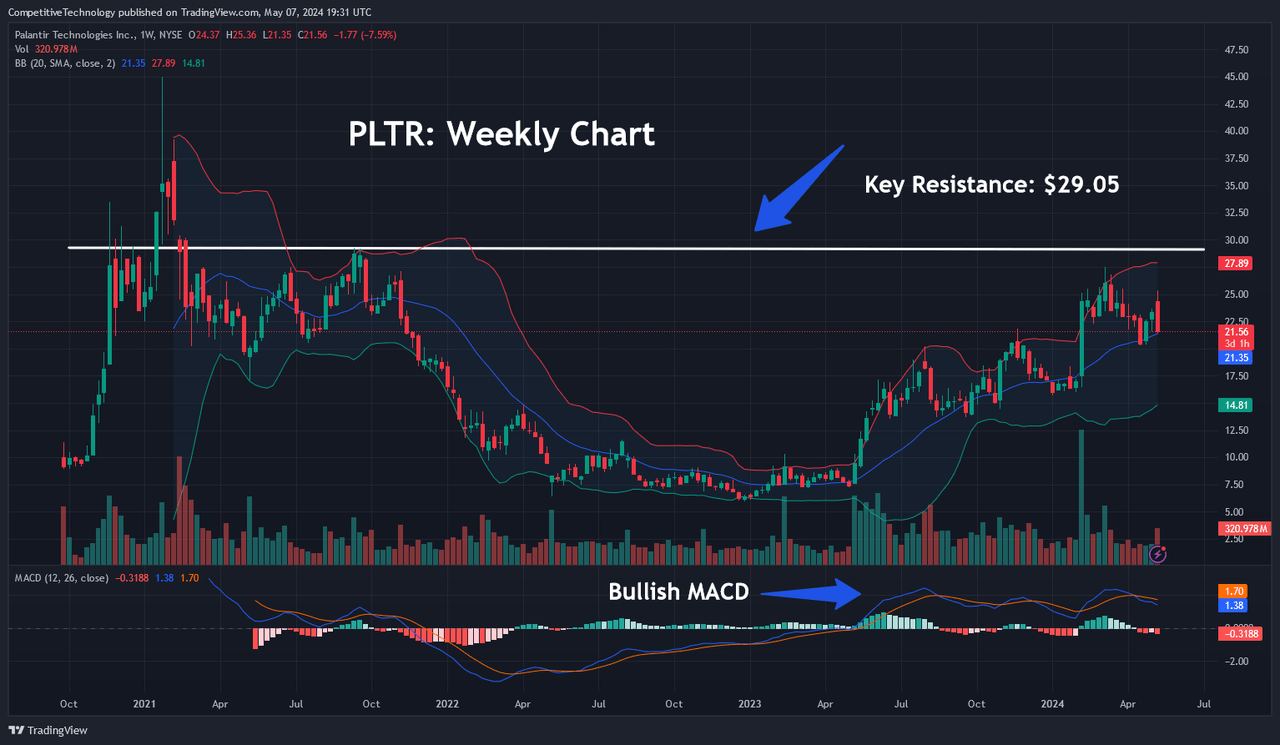

PLTR: Weekly Chart (Income Generator via TradingView)

Longer-term, we must also identify potential price targets that can be used to structure positions in the event that recent declines begin to slow (and potentially reverse). Looking at the weekly charts, we can see that bullish momentum in the Moving Average Convergence Divergence (MACD) remains supportive and that prices themselves have formed an uptrend channel structure since May 2023.

Overall, this indicates that the long-term bullish momentum does not align with the shorter-term bearish momentum that we have seen this month. Supportive long-term trend momentum allows us to target the stock’s next level of historical resistance, which is currently located near the September 2021 highs (just above $29 per share). With bullish momentum signals on the weekly MACD indicator, we can also see that prices are still trading well below the upper Bollinger Band and this suggests that further price gains toward $29 remain entirely plausible. In contrast to our current bullish bias, we would consider reversing our stance if prices fail to hold our initial support zones near $20.30. If share prices in PLTR drop further (and breach the $20 handle), we think there is potential for declines to accelerate, and the stock could be at risk of establishing a new downtrend.

In our view, recent market reactions seem to be missing the broader, long-term performance improvements that we have seen at Palantir over the last several quarters. Somewhat disappointing guidance figures should be viewed alongside the company’s respectable beat on quarterly revenues and continued successes in attracting new customers (both within the private sector and in global government entities). As one example, Palantir signed agreements in early 2024 with the United States Army to aid in the development of next-gen sensor stations (which will be field deployable) in a contract valued at $178 million. Of course, this is in addition to the 660 product Bootcamps that were completed during the first-quarter (where Palantir offers prospective clients an opportunity to test the company’s technology products and gain familiarity with various functionalities and use cases prior to purchase). All of this activity places the company on an excellent footing to meet its current performance expectations into next quarter, and we believe that the recent declines in share prices are currently giving the market an interesting opportunity to pick-up shares while the stock is still trading at relatively lower levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.