Summary:

- PLTR has already pulled back by -9.8%, well underperforming the wider market at +3.2%, with it apparent that sentiments surrounding generative AI has finally entered normalization zones.

- Even so, the SaaS company continues to report robust generative AI demand, growing operating margins, and increasing multi-year backlog.

- Much of the tailwinds are attributed to the highly successful AIP boot camps and significant “deal cycle compression,” as many customers signed days after the boot camps.

- With PLTR already growing its customers base while reporting healthier balance sheet, we believe that it may continue growing at scale ahead.

- With the market sentiments increasingly pessimistic, interested readers may want to observe the stock’s movement before adding depending on their dollar cost averages.

Klaus Vedfelt

We previously covered Palantir Technologies Inc. (NYSE:NYSE:PLTR) in February 2024, discussing why we had chosen to downgrade the stock as a Hold, attributed to the massive baked-in premium observed in its stock valuations and pulled forward upside potential in the stock prices.

While we remained convinced about its long-term prospects, we believed that it might be wiser to wait for a moderate pullback then.

Since then, PLTR has already pulled back by -9.8%, well underperforming the wider market at +3.2%, with it apparent that sentiments surrounding generative AI has finally entered normalization zones.

Even so, the SaaS company continues to report robust generative AI demand, as observed in its growing operating margins, expanding customer base, and increasing multi-year backlog, thanks to the successful AIP boot camps.

As a result, we are cautiously re-rating PLTR as a Buy, though potentially after a moderate retracement to its previous support levels of $18s for an improved margin of safety.

The PLTR Investment Thesis Remains Robust – Thanks To The AIP Boot Camps

For now, PLTR has reported a top-line beat in the FQ1’24 earnings call, with revenues of $634.34M (+4.2% QoQ/ +20.7% YoY) and EPS of $0.08 (inline QoQ/ +60% YoY).

Much of its top line tailwinds are attributed to the growing adoption across the Government and Commercial sectors, with a higher Government customer count at 127 (+4% QoQ/ +14.4% YoY) and accelerating Commercial customer expansion at 427 (+13.8% QoQ/ +52.5% YoY).

This is on top of the excellent Net Dollar Retention rate of 111% in FQ1’24 (+3 points QoQ/ -4 from FY2022 levels of 115%), highlighting the increasing stickiness of its offerings significantly aided by PLTR’s AIP boot camps.

Most importantly, its US commercial growth has grown opportunistically to revenues of $150M (+14.5% QoQ/ +40.1% YoY), as the SaaS company better monetize existing customers and engage new customers, further aided by the significant “deal cycle compression,” as many customers signed days after the AIP boot camps.

At the same time, PLTR’s bottom-line has benefited from the growing positive operating margins of 12.7% (+1.9 points QoQ/ +12 YoY/ +90.3 from FY2019 levels) in FQ1’24, with it apparent that the SaaS company has hit the sweet spot of operating scale.

The same has also been observed in the positive adj Free Cash Flow generation of $148.63M (-51.2% QoQ/ -21.3% YoY), FCF margins of 23.4% (-26.6 points QoQ/ -12.5 YoY), and increasing cash on balance sheet at $3.86B (+5.1% QoQ/ +34.6% YoY) in FQ1’24, with effectively zero debts.

As a result of the insatiable generative AI demand, it is also unsurprising that PLTR has reported a growing multi-year backlog of $1.3B as of March 31, 2024 (+8.3% QoQ/ +38.8% YoY) and total remaining deal value of $3.9B as of December 31, 2023 (+5.4% YoY).

Combined with the management’s reiterated FY2024 revenue midpoint guidance of $2.66B (+19.8% YoY) and Free Cash Flow of $900M (+29.1% YoY), implying richer FCF margins of 33.8% (+2.5 points YoY), we believe that PLTR may continue generating growth at scale ahead.

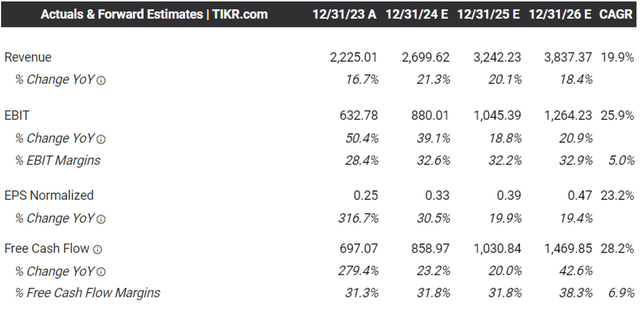

The Consensus Forward Estimates

The same has been estimated by the consensus, with PLTR expected to record a top/ bottom line CAGR of +19.9%/ +23.2% through FY2026, building upon the historical top-line growth of +30.1% between FY2018 and FY2023, respectively.

PLTR Valuations

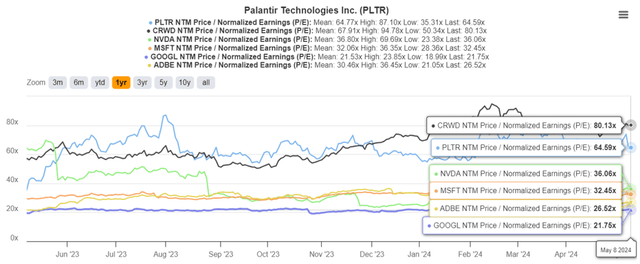

For now, based on the current stock prices of $21.56 and the LTM adj EPS of $0.28, it is painfully apparent that PLTR is trading at an eye-watering LTM P/E valuations of 77x, compared to its 2022/ 2023 P/E mean of 57x.

In addition, PLTR remains somewhat expensive at FWD P/E valuations of 64.59x, compared to its generative AI SaaS peers, such as Google (GOOG) at 21.75x, Adobe (ADBE) at 26.52x, Microsoft (MSFT) at 32.45x, Nvidia (NVDA) at 36.06x, and with the rare exception being CrowdStrike (CRWD) at 80.13x.

While market leaders may never come cheap, with PLTR’s double digit growths expected to taper over the next few years, we believe that the stock is likely to trade sideways as it grows into its premium valuations in the near-term, as observed since the start of 2024.

So, Is PLTR Stock A Buy, Sell, or Hold?

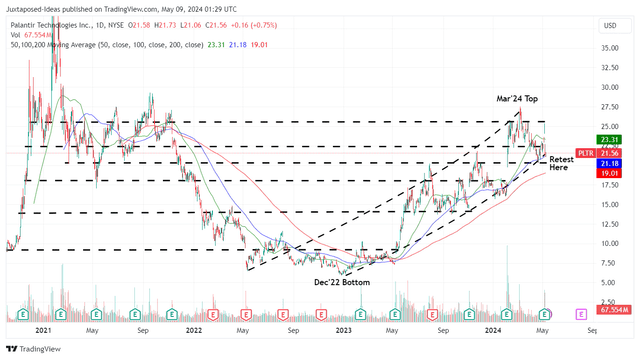

PLTR 3Y Stock Price

For now, PLTR has already lost much of its 2024 gains, despite the supposedly excellent FQ1’24 earnings call. With another data center stock, Super Micro Computer, Inc. (SMCI) also in correction zone, it is apparent that market sentiments surrounding Artificial Intelligence is normalizing.

Even so, we believe that PLTR’s investment thesis remains more than decent.

For example, we believe that there is an improved margin of safety upon a further pullback to our previous recommended entry point of $17s/ 18s, attributed to our long-term price target of $26.70, based on the consensus FY2026 adj EPS estimates of $0.47 and the 2022/ 2023 P/E mean of 57x.

At the same time, the shorts are no longer in control, based on the relatively reasonable short interest of 3.52% at the time of writing, compared to the previous heights of 6.5%.

Combined with the strategic share repurchases, as the management has done in FQ1’24 at $9M, we may see the SaaS company’s bloated share count of 2.4B (+0.05B QoQ/ +0.19B YoY/ +1.82B from FY2019 levels) moderate as its balance sheet grows.

Market Volatility Index

However, while we may re-rate the PLTR stock to a Buy, it is with the caveat that interested readers observe the stock’s movement for a little longer before adding, depending on their dollar cost averages and risk appetite.

Readers may want to note that while the VIX index has already moderated, the McClellan Volume Summation Index appears to be going higher to 1,304.11x at the moment, against the neutral point of 1,000x.

With market sentiments increasingly skewed to Fear, we may see more volatility in the near-term, with it remaining to be seen if PLTR’s current support levels may be breached.

At the same time, we believe that an entry point of $18s offers an improved margin of safety as discussed above. Patience may be prudent here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, MSFT, GOOG, NVDA, CRWD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.