Summary:

- Palantir has been firing on all cylinders.

- With demand for vertically integrated data management software exploding, Palantir stands to continue to benefit.

- That said, Palantir’s major risk continues to be its valuation.

- Today, we will explore what I mean by a vertically integrated data management platform, and we will examine my assumptions underlying my belief that valuation is its central risk.

hapabapa

Introduction

Today, we will cover:

- A primer on Palantir: A very basic, yet definitive, explanation of Palantir’s product

- Its Q2’24 performance

- Its number one risk, i.e., its valuation

Let’s begin!

A Little Alpha (Understanding Palantir)

In these introductory portions of my Palantir (NYSE:PLTR) reviews, I customarily begin with a description of the nature of the business.

These have often gotten a bit esoteric, e.g., likening Palantir’s strategy of making enterprises computable via digital replicas to the computable nature of a rain forest whose code is the laws of physics that govern our reality.

But, today, I will make this review far less esoteric. We will focus on the very basic business model of Palantir, and, trust me, it is rather basic (though I wouldn’t encourage you to go and try to build a rival, as, through that lens, I am quite sure you’d find that it’s a little less basic than I’m letting on in this review).

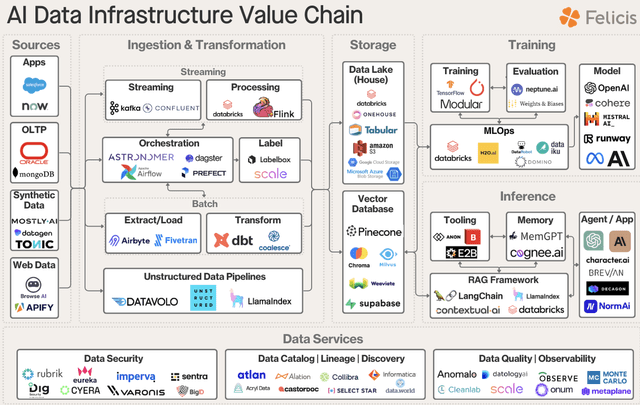

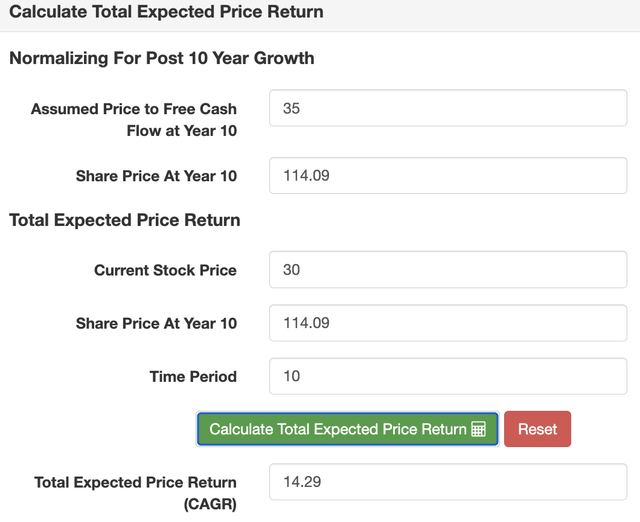

Below, we can see the “AI Data Infrastructure Value Chain,” which is comprised of a number of point solutions that facilitate ingestion of data from various sources, storage of that data, security of that data, cleaning of that data, and interpretation of that data that ultimately results in an actionable insight or end product.

Focus On Databricks Below And Its Pervasiveness (DB = Competitor To Palantir)

Substitute each instance of Databricks with Palantir, and we have a better understanding of the purpose that Palantir serves in, ultimately, vertically integrating the various components of the data analytics and AI tech stack, which is built atop the raw compute and storage of the public clouds, i.e., AWS, Azure, and GCP.

On Palantir’s Q2’24 earnings call, it described this vertically integrated nature, in which it has compiled a wide swath of point solutions in the data tech stack onto its platform, ultimately creating a more valuable platform that better facilitates its enterprise customers’ implementation of AI solutions.

Ana Soro: Our next question is from Jacob, who asks, we understand why Foundry has become the operating system for the modern enterprise. How does this change with LLMs?

Shyam Sankar: Well, the market doesn’t need point solutions even if it’s slightly addicted to them, and our customers can’t solve their business problems with hyperscaler infrastructure alone.

[Vertical integration of point solutions and built atop the public clouds, as we discussed above]

They need a system that organizes and orchestrates the interaction of their physical business with their technology with AI and LLMs. In the same way that your operating system orchestrates and organizes your hardware with your applications.

And in the same way that your operating system gives you application development frameworks like AppKit for Mac or WinUI for Windows, Palantir’s OSDK and ontology is that application development framework for the entirety of your business, that allows you to treat your business like code, leveraging the primitives that we’ve built that extend LLMs throughout your enterprise.

Q2’24 Palantir Earnings Call

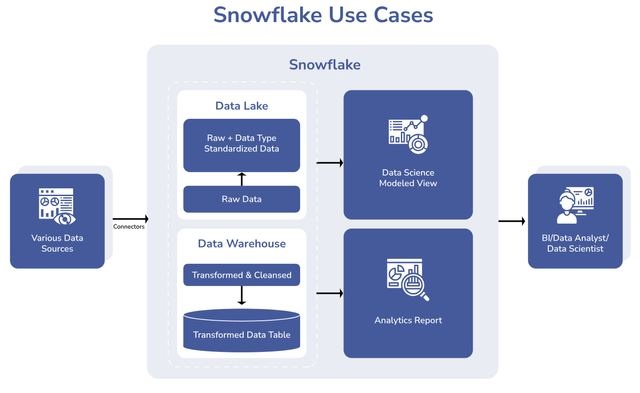

While Palantir does not offer an image of itself as this vertical integrator, though it does describe itself as this using differentiated jargon for what’s ultimately a fairly basic job of vertical integration of the data tech stack atop AWS, Azure, and GCP, there are images that illustrate this nature for Databricks and Snowflake, against whom Palantir competes.

Snowflake’s Vertical Integration Of The Above Point-Solution Filled Chart

Another View Of Snowflake’s Vertical Integration Which Mirrors Palantir’s Vertically Integrated Platform And Business Model

BizStory

As my readers know, this is a foundational investment framework that I target: The vertical integration of the point solutions associated with an underwhelming consumer experience (the management of data atop AWS, Azure, and GCP in the case of Palantir, Snowflake, and Databricks).

And this is the nature of Palantir and why it’s winning so many deals:

There’s just huge demand for this type of software in our modern data age; especially in our AI age!

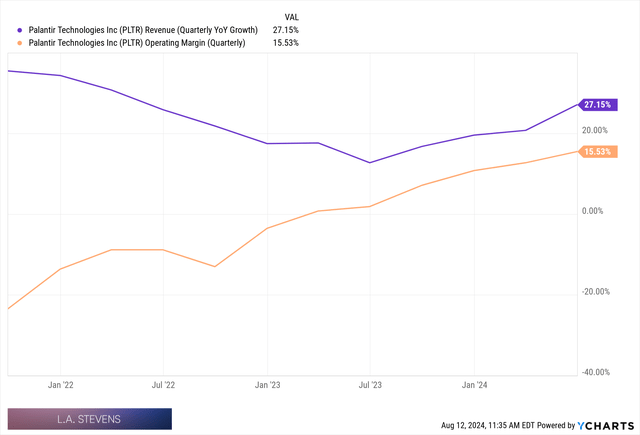

Non-Linearity

The next more philosophical element of Palantir that I’d like to briefly mention is the idea of business non-linearity.

If you review my Palantir work from late 2022 and early 2023, much of it focused on the idea that business non-linearity is normal and natural, and a decline in overall sales growth rate for a period of time does not portend the death of an enterprise.

Armed with our understanding of Palantir and the obviously giant TAM that lay in front of it as its growth rate hit ~10% in 2022, it was clear that there was ample room for revenue growth acceleration, and this is precisely what we’ve witnessed following that period.

Palantir’s Revenue Growth Accelerates

The best time to buy a great business is when it faces surmountable obstacles, and one such obstacle is simply the temporary slowing of sales growth, as Palantir has demonstrated for us.

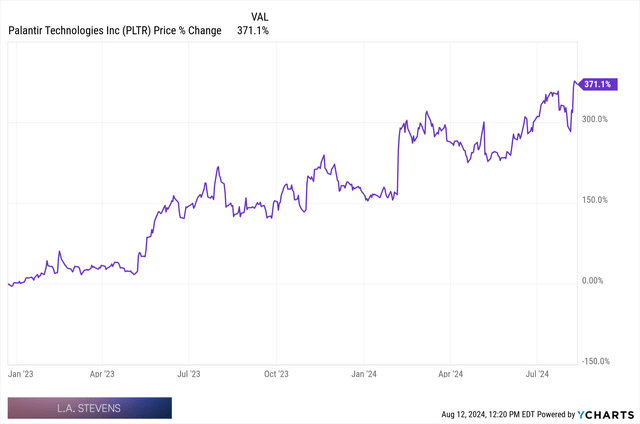

Palantir Has Generated 371% In Returns Since Its Growth Bottomed In Q4’22

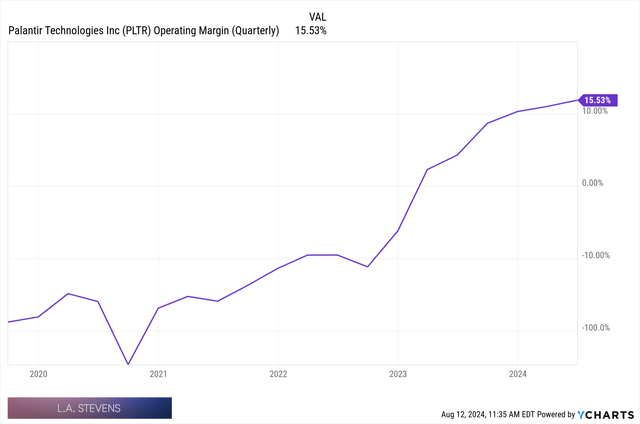

And the last idea I’d like to briefly touch on is the idea that margin expansion stories often produce the best investment outcomes.

The Best Theses Are Margin Expansion Stories

From Palantir to Chipotle, some of my best investments of all time have been byproducts of margin expansion.

Palantir’s Margins Expand

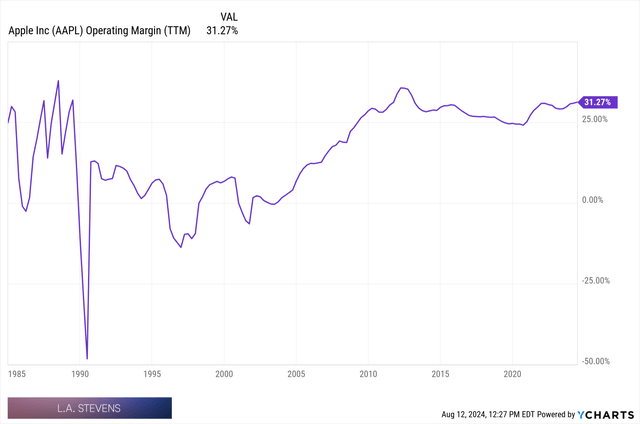

In fact, I would go so far as to say that the truly legendary investments all time have been a byproduct of margin expansion, with few exceptions.

Nvidia, Netflix, Chipotle, and Apple have all been really great (as opposed to just great) due to their margins expanding.

Apple’s Margins Have Expanded For The Last Thirty Years

And Palantir has been a very recent example of a margin expansion story producing an incredible investment outcome.

With these ideas in mind, let’s now turn to a review of Palantir’s Q2’24 earnings report.

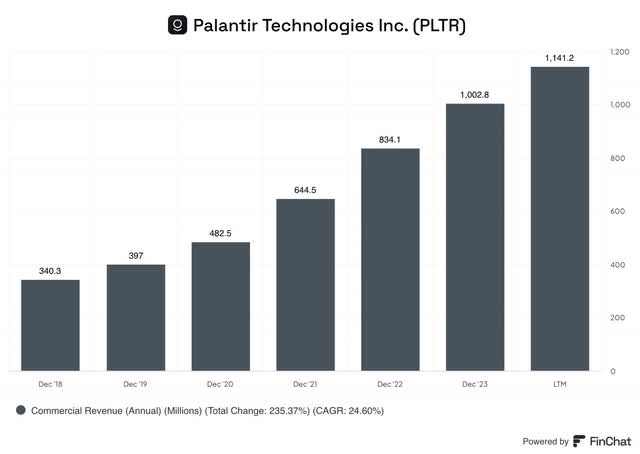

Palantir In Charts

In this section, we will review Palantir via a series of charts.

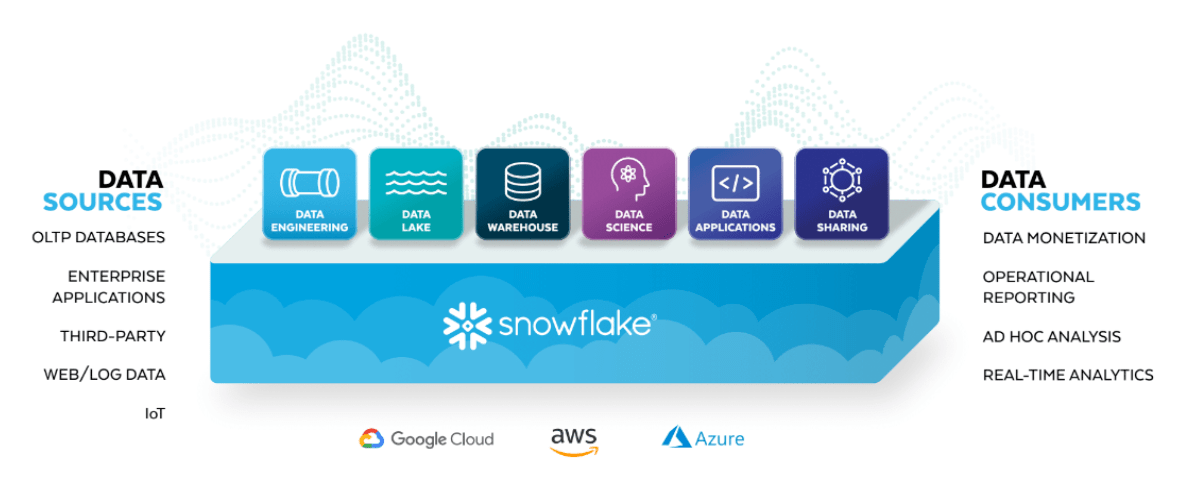

Below, I shared an overview chart of its Q2’24 that highlights most notably:

- Its government revenue growth, which re-accelerated,

- Its U.S. commercial revenue growth, which sustained phenomenal levels of growth,

- Its U.S. commercial customer count, which grew at 83%. Superb, and

- Its expanding margins.

Palantir Q2’24 Earnings Presentation

The chart below highlights the absolutely booming U.S. commercial business, and I will provide further interpretation of this statement and chart below.

Growing U.S. Commercial Customers, Growing Contract Values

Palantir Q2’24 Earnings Presentation

Palantir’s Chief Revenue Officer offered us insights into this chart in sharing,

We continue to see the greatest transformation in our US commercial business, evident in the many AIP-driven deals closed last quarter. Our US commercial revenue, excluding strategic commercial contracts, climbed 70% year-over-year. Our US commercial ACV closed was up 44% year-over-year and up 19% sequentially, while our deal count in US commercial was nearly twice what it was just a year ago.

[Phenomenal growth and momentum here]

We maintain conviction in our ability to land new customers and subsequently expand those engagements as we sharpen our focus to taking our customers across the chasm from prototype to production.”

-Ryan Taylor, Q2’24 Earnings Call

And, below, we can see Palantir’s commercial revenue growth along with its commercial customer growth:

Palantir’s Commercial Revenue Growth

Palantir’s Incredible U.S. Commercial Customer Growth

Palantir Q2’24 Earnings Presentation

And, atop this incredible growth and performance, as we’ve seen already, though it bears repeating, Palantir has expanded its margins.

Palantir’s Expanding Net Income Margins

Palantir Q2’24 Earnings Presentation

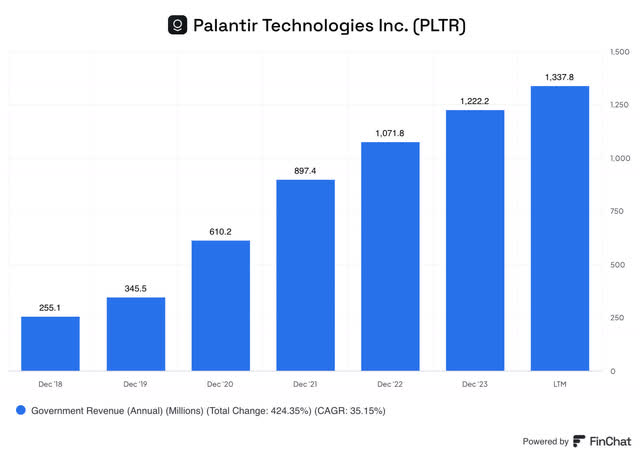

Let’s now turn to a review of Palantir’s government business via a series of charts.

Government Revenue

The phenomenal strength of our US government business shows the power and scale of our enterprise software delivery. Our US government business continued accelerating, growing more than 8% sequentially for two consecutive quarters.

[8% sequential growth is about 40% annualized growth, which, should Palantir sustain this, would be phenomenal and would look more like its 35% revenue CAGR from 2020-2021.]

We proudly received several notable awards last quarter, including a production contract from the Department of Defense, Chief Digital and Artificial Intelligence Office, CDAO, to deploy and scale an AI-enabled operating system across the DoD, starting with an initial order of $153 million to support certain combatant commands and the joint staff, while additional awards can be made up to $480 million over a five-year period.

This award reflects the criticality of our software and our nation’s defense capabilities.

Shortly after, CDAO announced a new initiative, Open DAGIR to enable defense tech companies, traditional contractors, and government developers to develop applications and integrations on top of Maven powered by Palantir in a contract worth $33 million. We maintain pride in the mission-critical impact of our products and celebrate the long-term strength of our US government business evident in last quarter’s results.

Ryan Taylor, Chief Revenue Officer, Palantir Q2’24 Earnings Call

One of the key elements of my Palantir thesis during those dark late 2022 and early 2023 days was that its revenue growth would re-accelerate again.

With such a giant need for AI-software and a geopolitical environment in which physical dominance still lay at the heart of international relations, it was clear that demand for Palantir’s government offerings would continue to expand for many years to come, and, as such, its growth slowdown during that period was temporary.

And this we have seen.

Palantir’s Government Revenue Growth Accelerates

Palantir Q2’24 Earnings Presentation

US government revenue grew 24% Y/Y and 8% Q/Q, driven by momentum in the Department of Defense and favorable deal timing.

Palantir Q2’24 Earnings Presentation

Palantir’s Total U.S. Government Revenue

Valuation: Palantir’s Number One Risk

With all of this being said, Palantir is not exactly cheap anymore.

In investing, there are two types of risk:

- Going concern risk (risks associated with the core product and execution of the business)

- Valuation risk (risks associated with overpaying for the business)

Palantir’s central risk today is its valuation.

To illustrate this idea, let’s walk through a brief valuation exercise before wrapping up today.

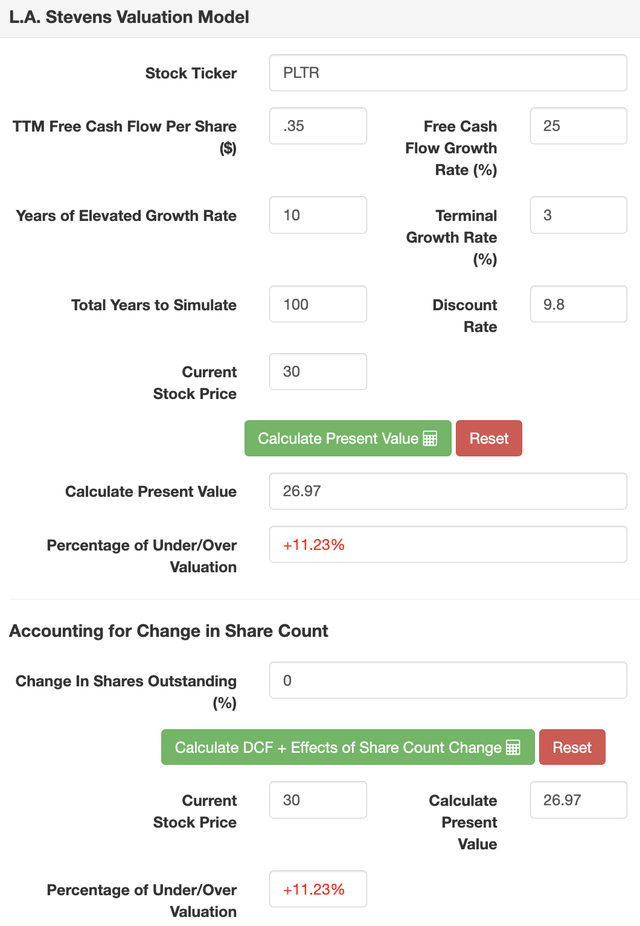

Assumptions:

|

TTM Revenue [A] |

$2.6B |

|

Potential Free Cash Flow Margin [B] (conservative) |

35% |

|

Total diluted shares outstanding [C] |

2.6B |

|

Free cash flow per share [ D = (A * B) / C ] |

$.35 |

|

Free cash flow per share growth rate |

25% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

And here are the results:

Notably, I used 0% dilution, which represents a “non-conservative” assumption.”

More on this line of reasoning in a moment.

Turning to projected returns…

As we can see, Palantir offers relatively underwhelming returns at $30/share.

Very notably, I used extremely aggressive assumptions, i.e., 25% annualized growth on $2.6B in sales.

Only the very, very, very (very) best companies can grow at 20%+ annualized for 10 consecutive years beyond $1B in sales, much less beyond $2.5B in sales.

That said, Palantir could certainly achieve this, though it will undoubtedly not be easy in any respect.

This level of growth implies $24B in total sales by 2034, and, while I do believe that’s possible, it will also be brutally difficult to achieve with perfect growth linearity, as 2022 and 2023 demonstrated!(!).

All this said, if you’re an owner at lower levels, I certainly wouldn’t be a seller. I do believe this is a lifetime stock to own.

Concluding Thoughts

Palantir is firing on all cylinders.

We simply could not ask for more from the company. It’s brilliant.

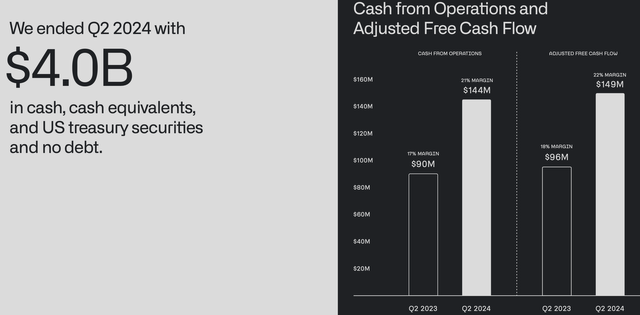

With $4B in cash, $0 in debt, and a huge runway for growth via a giant TAM and a very compelling product, I believe continuing to stick with Palantir makes sense.

Palantir Q2’24 Earnings Presentation

That said, I continue to think there’s better opportunity in the market presently.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.