Summary:

- Strong execution in the US commercial segment with 70% growth year-over-year.

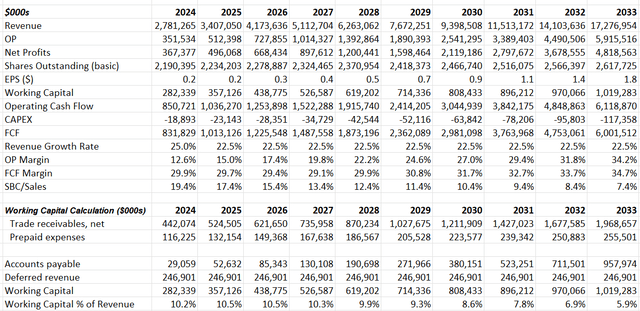

- Growth projections include 25% revenue growth for FY24 and a 22.5% growth rate starting in FY25.

- The fair value of Palantir’s stock price is calculated to be $32 per share, with downside risks, including a high stock-based compensation percentage.

Michael Vi

I gave Palantir’s (NYSE:PLTR) a ‘Buy’ rating in my previous coverage published in May 2024, highlighting their AIP growth potential in commercial markets. The company released its Q2 result on August 5th after the bell along with a guidance raise. I believe Palantir will benefit from the adoption of AI and large language models among enterprise customers. I reiterate a ‘Buy’ rating with a fair value of $32 per share.

Strong Execution in US Commercial

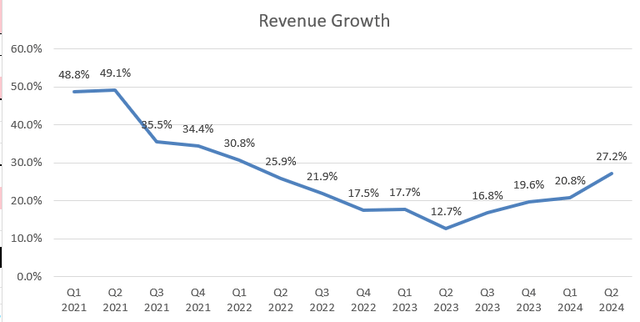

My biggest takeaway from the quarter is the strong growth in Palantir’s U.S. commercial segment, which increased by 70% year-over-year excluding strategic commercial contracts. Driven by the robust commercial growth, Palantir delivered a 27.2% increase in revenue for the quarter, as detailed in the chart below. It is evident that Palantir has accelerated its revenue growth over the past few quarters.

The strong U.S. commercial growth is driven by the following factors:

- As discussed in my previous article, Palantir has been leveraging their bootcamp events to attract new customers and secure new contracts. These bootcamp events enable Palantir to apply their AIP (Artificial Intelligence Platforms) to enterprises’ real operations such as supply chain, sales & marketing and human resources. I foresee Palantir will continue using their bootcamp to penetrate the commercial market in the near future.

- As indicated over the earnings call, Palantir’s AIP has been gaining traction with large commercial customers, with several significant deals signed in recent quarters. These large commercial deals could potentially grow the total annual contract value (ACV), contributing to further revenue growth for Palantir.

- Lastly, Palantir has demonstrated strong execution in moving AIP prototype to production with their enterprise customers. During the earnings call, the management expressed confidence that their sales and execution team will continue to successfully convert prototypes into real production deployments.

Growth Projection and Valuation

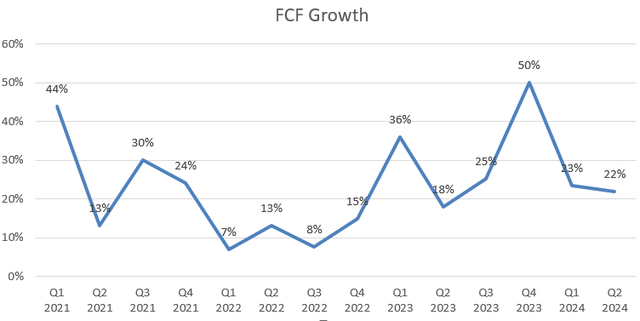

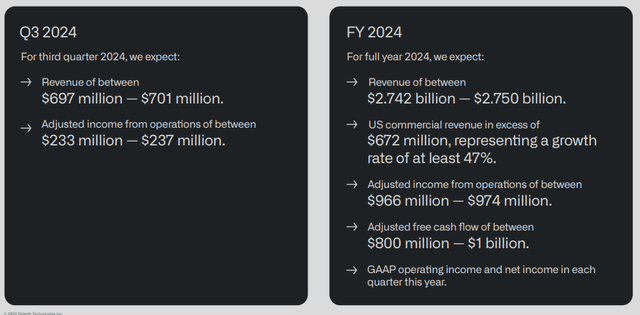

Palantir guides adjusted free cash flow to be between $800 million and $1 billion for FY24. As illustrated in the chart below, Palantir achieved a 22% year-over-year growth in free cash flow in Q2, demonstrating a strong performance.

As detailed in the table below, the company has raised the full-year revenue guidance midpoint to $2.476 billion, reflecting a 23% year-over-year growth.

Palantir Investor Presentation

I am considering the following factors for near-term growth:

- Commercial Business: I anticipate Palantir’s AIP will continue to gain traction among enterprises customers, driven by Palantir’s bootcamps and investments in AI initiatives. I forecast the growth momentum will persist in the second half of the year; therefore, I calculate that Palantir will grow its commercial revenue by 30% for FY24.

- Government Business: In Q2, the U.S. government revenue grew by 24% year-over-year, fueled by contract wins in the Department of Defense. In addition, the international government revenue grew by 21% in the quarter, with notable growth in Eastern Europe. I believe the government business will grow by 20% for the full year.

As such, I calculate that Palantir will deliver a 25% growth in overall revenue for FY24.

For growth from FY25 onwards, I assume their commercial business and government revenue will grow by 25% and 20%, respectively. The key growth drivers include: Palantir’s AI and large language models; e ongoing enterprise investments in AI, and increasing geopolitical tensions and regional wars. Consequently, I forecast Palantir will achieve a 22.5% revenue growth rate starting from FY25.

I forecast Palantir will deliver 240bps annual margin expansion, assuming:

- 120bps margin improvement from sales and marketing. Palantir spent 33.5% of total revenue on sales and marketing, which is relatively high compared to other software companies. I think the current high spending can be justified as Palantir’s product and AIP are standard products; they require extensive business communication, training, and education for customers.

- 30bps expansion from gross profits due to higher margin AI solutions

- 60bps operating leverage from G&A

- 30bps operating leverage from R&D expenses.

The DCF summary is as follows:

The WACC is calculated to be 14% assuming: risk free rate 3.9% (US 10Y Treasury Yield); beta 2.04 (SA); equity risk premium 5%; cost of debt 7%; equity balance $3.4 billion; tax rate 20%.

Discounting all the FCF, the fair value of Palantir’s stock price is calculated to be $32 per share.

Downside Risks

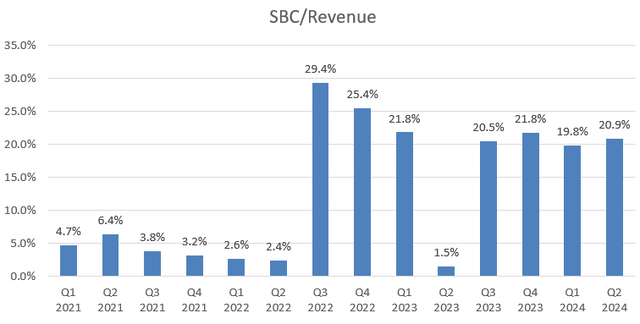

As illustrated in the chart below, Palantir allocated 20.9% of total revenue towards stock-based compensation, which remains high compared to other mature software companies. While Palantir’s has committed to reducing their stock-based compensation in the future, it is important to monitor the progress. The current high percentage of SBC relative to total revenue negatively impacts operating margins and earnings growth.

Conclusion

I am encouraged by Palantir’s robust growth in their commercial business, propelled by AI and large language models. The increasing adoption of AI among enterprise customers provides a structural tailwind for Palantir’s future growth. I reiterate my ‘Buy’ rating, with a fair value of $32 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.