Summary:

- Amid unrelenting AI demand, Palantir delivered strong numbers for Q3 2024 and lifted full-year guidance.

- In response, PLTR stock has popped by another 12% to ~46 per share in the after-hours session.

- At ~40x P/S, Palantir stock looks worse than dead money despite assuming above consensus future revenue growth and margins.

- Like it or not, PLTR stock is bubblicious. And its latest ER pop is another opportunity for shareholders to book some gains. Read on to learn more.

Michael Vi

Brief Review Of Palantir’s Q3 2024 Report

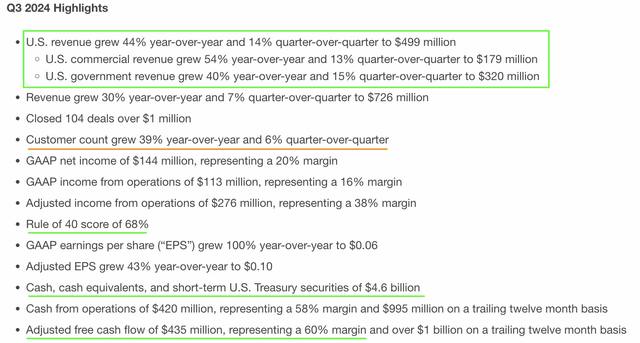

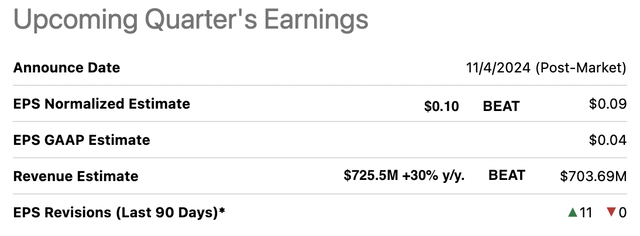

In the immediate aftermath of its Q3 2024 report, Palantir Technologies, Inc. (NYSE:PLTR) is popping up by ~12% to ~$46.4 per share in after-hours trading, with the emerging enterprise software giant soaring past top and bottom-line estimates:

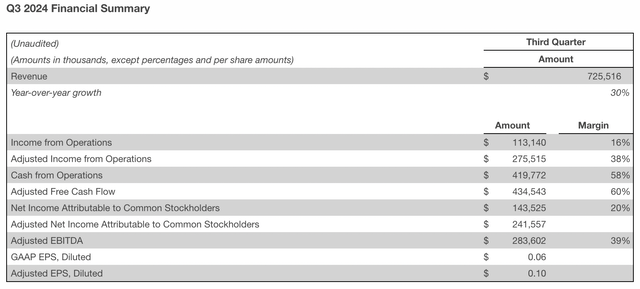

Seeking Alpha Palantir Investor Relations

With Q3 2024 revenues and normalized EPS coming in at $725.5M [+30% y/y, +7% q/q] and $0.10 per share, Palantir continued exhibiting strong business momentum, driven largely by robust growth in its domestic market, i.e., the United States. Furthermore, powered by accelerating top-line growth and operational efficiencies, Palantir generated $435M in adj. free cash flow (“FCF”) at a margin of 60% – boosting its cash & short-term investments from $4B in Q2 2024 to $4.6B in Q3 2024.

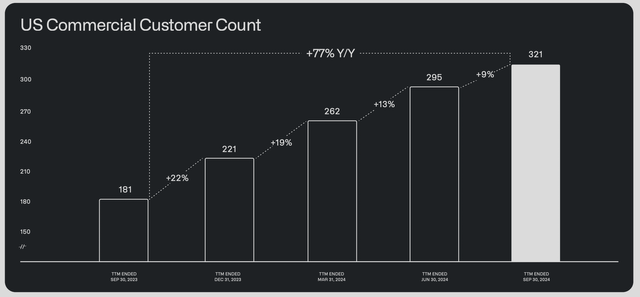

Now, in Q3, Palantir’s US Government revenue rose +40% y/y to $320M and US Commercial grew +54% y/y to $179M. And Palantir’s leadership attributed the strength in US to an ongoing AI [artificial intelligence] revolution:

We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners

– Alexander C. Karp, Co-Founder and CEO of Palantir

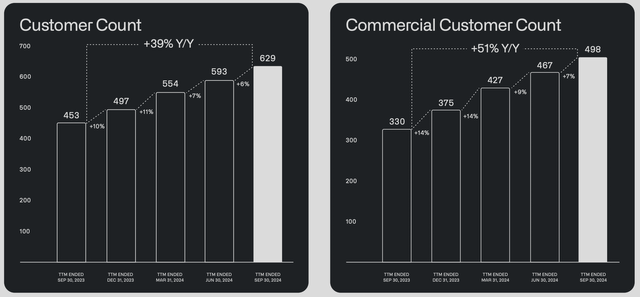

During Q3, Palantir closed 104 deals of >$1M, with AIP gaining greater adoption among enterprise customers. Now, despite seeing a sequential deceleration, Palantir’s customer base continues growing at a healthy clip:

Palantir Investor Relations Palantir Investor Relations

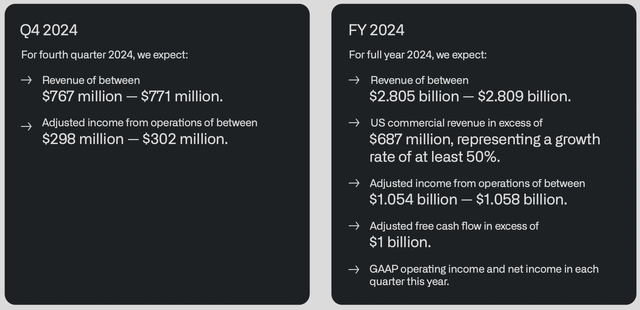

Emboldened by their stronger-than-expected financial performance and robust customer count growth (deal momentum), Palantir’s management once again lifted their guidance for 2024 – with total revenues now expected to come in at $2.805-2.809B (+26% y/y growth at the midpoint of the guidance range) above pre-earnings consensus street estimates of $2.76B.

While Q3 revenue outperformance is playing its part here, Palantir’s Q4 sales guidance of $767-771M is also well ahead of pre-earnings consensus estimate of $744M for Q4. Furthermore, Palantir is projected to deliver adj. FCF of >$1B in 2024.

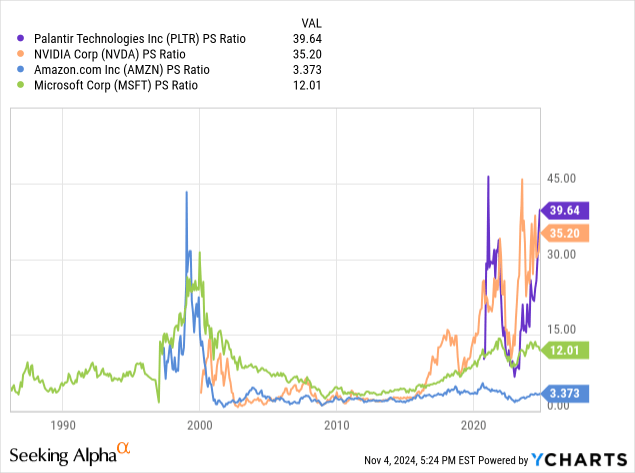

From a number’s standpoint, Palantir’s business momentum is incredible. However, at ~40x sales, PLTR stock is essentially priced like Amazon (AMZN) and Microsoft (MSFT) were priced at the peak of the dot com bubble:

Is Palantir the next Microsoft? A lot of PLTR bulls would say “YES”. However, in order to underwrite PLTR at $46 per share, one would need to be able to see a very high growth rate for a very, very long period of time.

Palantir’s Fair Value And Expected Returns

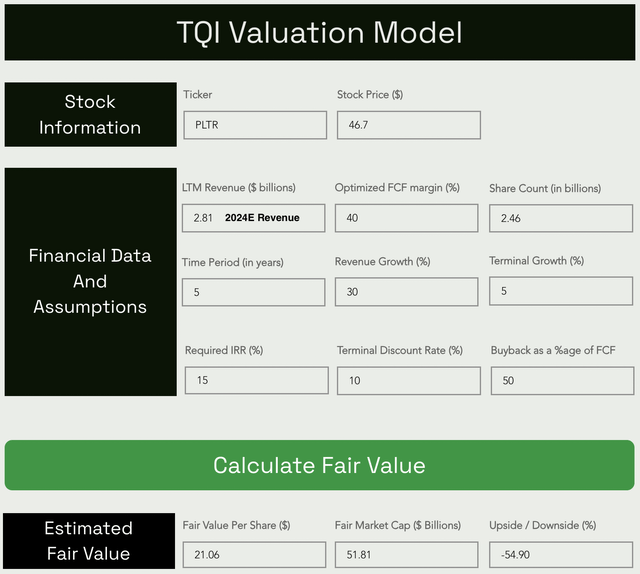

For today’s valuation exercise, I am modeling PLTR with a 2024E revenue base of $2.81B. Furthermore, I am lifting my 5-year sales CAGR growth and optimized free cash flow margin assumptions to 30% [well above consensus street estimates] and 40% [significantly higher than current margins], respectively. This upgrade rewards Palantir’s deal momentum and strong operating leverage.

All other assumptions are straightforward and self-explanatory, but if you have any questions, please share them in the comments section below.

TQI Valuation Model (Free to use at TQIG.org)

From an absolute valuation standpoint, Palantir is significantly overvalued, with PLTR stock having a potential downside of -55% to our updated fair value estimate of $21 per share [or $52B in market cap].

Now, I wouldn’t dismiss the idea of investing in Palantir solely due to its premium valuation, as history shows that winning stocks can be overvalued for long periods [e.g., Amazon.com, Inc., Tesla, Inc. (TSLA), NVIDIA Corporation (NVDA), etc.]. Let’s take a look at Palantir’s long-term risk/reward to make an informed decision:

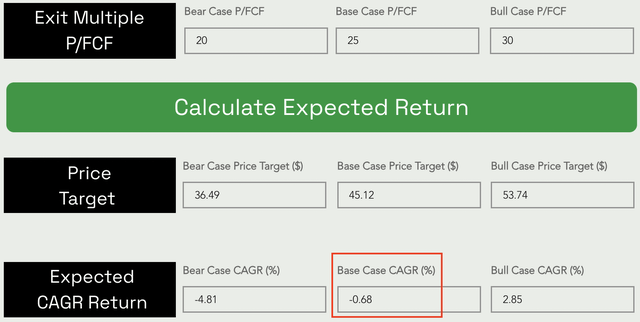

Assuming an aggressive exit multiple of 25x P/FCF, I see Palantir stock declining from $46.7 in 2024 to $45.1 per share in 2029 at a -0.7% CAGR.

TQI Valuation Model (Free to use at TQIG.org)

Despite modeling Palantir with aggressive assumptions for future revenue growth and margins, PLTR expected 5-year CAGR return falls short of risk-free treasury yields of 4-4.5%, average long-term S&P 500 (SP500) return of 8-10% per year, and TQI’s investment hurdle rate of 15%. In fact, Palantir’s 5-year expected CAGR return is negative, i.e., PLTR stock is worse than dead money right now!

Concluding Thoughts

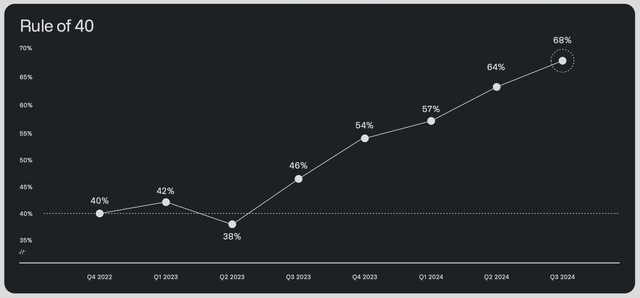

As of Q3, Palantir is showing robust business momentum, with the AI/data enterprise software company delivering a solid mix of revenue growth and profitability, with a rule of 40 score of “68”.

As a PLTR shareholder, I am happy with the business progress being made by Karp & Co. However, with PLTR’s valuation looking completely detached from its business realities, I continue to view Palantir stock as a tactical “Sell”.

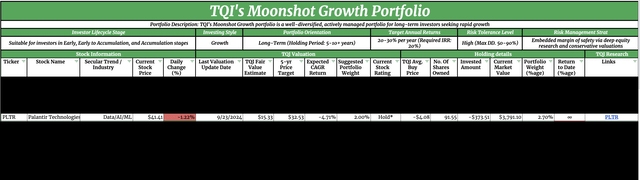

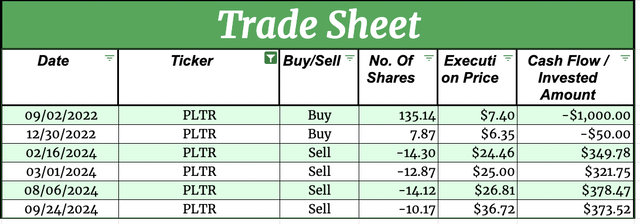

At my investing group, we own a 2.7% position in PLTR stock within TQI’s Moonshot Growth strategy – despite trimming at multiple occasions this year:

The Quantamental Investor The Quantamental Investor

After trimming ~10% of our PLTR position post Q2 ER and another ~10% in September 2024, I view today’s double-digit earnings pop as another trimming opportunity for Palantir shareholders.

Key Takeaway: Due to unfavorable long-term risk/reward, I continue to rate Palantir Technologies Inc. stock a tactical “Sell” at $46.7 per share.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – "The Quantamental Investor" – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.