Summary:

- Palantir’s inclusion in the S&P 500 is a significant milestone, boosting institutional interest and adding credibility, but the stock may face short-term volatility.

- Despite impressive growth and profitability metrics, Palantir’s current valuation is significantly stretched, with a forward P/E ratio of 200.71, making it risky. Better opportunities might come in the future.

- The stock’s high valuation leaves little room for error; any slowdown in growth could lead to a sharp decline, suggesting caution for investors.

- Given the high expectations and potential risks, it might be wise to trim positions and lock in gains, despite Palantir’s promising long-term outlook.

- Palantir remains an excellent company with solid execution, but the risk/reward isn’t really attractive at the time being.

hapabapa

Introduction

Palantir Technologies (NYSE:PLTR) is one of those companies that tends to divide opinions. Known for its work with government agencies and big enterprises, it’s built a strong reputation by turning massive amounts of data into useful insights.

The company sits at the intersection of data, artificial intelligence, and defense technology, making it unique in the tech world. While there’s a lot of optimism about its long-term growth, especially with its recent focus on AI and a string of profitable quarters, the short-term outlook is a different story.

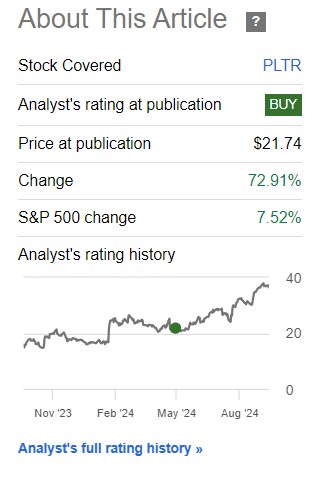

Since our latest article on Palantir, which was published in May, the stock is up over 70% compared to the S&P 500 (SPY)’s 7.5%.

Seeking Alpha

Palantir has risen more than 110% on a YTD basis, but given the meteoric rise and how stretched the stock is now, it might make sense to be cautious in the short term-especially if you already hold a position in the stock.

This article will go over some recent developments, mainly the inclusion in the S&P 500, and dive into Palantir’s valuation and growth metrics. We’ll also discuss why reducing your position might be worth considering in the near term, even if you’re bullish about the company’s future potential.

S&P 500 inclusion is a testament to the business model

The biggest news for Palantir recently has been its addition to the S&P 500 index, effective as of September 23, 2024. This isn’t just a symbolic achievement; it’s a major milestone that can have a lasting impact on the company’s future. So why is it such a big deal? Let’s break it down.

Joining the S&P 500 is more than just an acknowledgment of a company’s growth. It is an important feat for Palantir because large institutional investors-such as mutual funds, ETFs, and pension funds-often use the S&P 500 as a benchmark for their portfolios. When a company gets added to the index, these funds have to buy its shares to ensure their investments match the index.

In Palantir’s case, the announcement of its inclusion drove its stock price up by 13% in after-hours trading. But the impact goes beyond just a short-term price jump. Being part of the S&P 500 can create more consistent demand for the stock over time, as these large funds regularly buy and rebalance their positions. This additional buying pressure can help reduce the stock’s volatility and contribute to a more stable base for its price. However, it’s worth noting that this can also work the other way, of course.

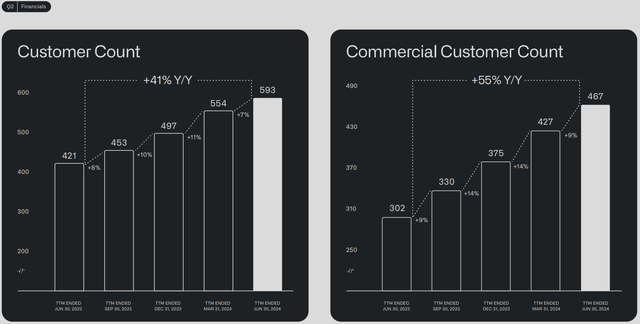

The timing of this achievement is also noteworthy. Since going public in 2020, Palantir has gone through a significant transformation. It was initially seen as a risky, unprofitable company with big dreams but no consistent earnings to show for it. Fast-forward a few years, and Palantir has now posted four consecutive quarters of positive net income, meeting a key requirement for S&P 500 inclusion. Just looking at their customer count in the figure below, it is clear that Palantir’s

Palantir Q2 Investor Presentation

Another benefit of being in the S&P 500 is the added credibility it brings. Palantir is likely to gain more attention from large institutional investors and Wall Street analysts who may have previously viewed it as too risky or speculative. With more eyes on Palantir, we could see an increase in buy ratings and more detailed analysis, although this is merely our own speculative opinion.

It’s important to keep expectations realistic. Stocks often see a short-term boost after being added to a major index like the S&P 500, but that initial excitement typically fades over time. Palantir’s stock might face the same pattern, especially considering its valuation is still quite high compared to other companies in its sector. We’ll take a closer look at its valuation in the next section, but it’s worth noting that these high valuations are not uncommon for high-growth tech companies.

What’s more important is that Palantir is demonstrating its business model is working, and it’s capable of delivering consistent results. This could justify a higher valuation compared to its competitors-though perhaps not as high as where it’s trading right now. The takeaway here is to stay mindful of short-term fluctuations and focus on Palantir’s longer-term trajectory and its ability to keep executing its strategy.

Valuation, Growth, and Profitability

Now, let’s dive into Palantir’s valuation, growth, and profitability metrics as outlined on Seeking Alpha. It’s no secret that we see Palantir as a solid long-term growth opportunity in the tech industry. That being said, while we’re excited about the company’s impressive growth and profitability numbers, it’s important to acknowledge that the current valuation seems significantly stretched. This article will highlight the strengths in Palantir’s financials but also emphasize the need for caution when considering the stock at its current price levels.

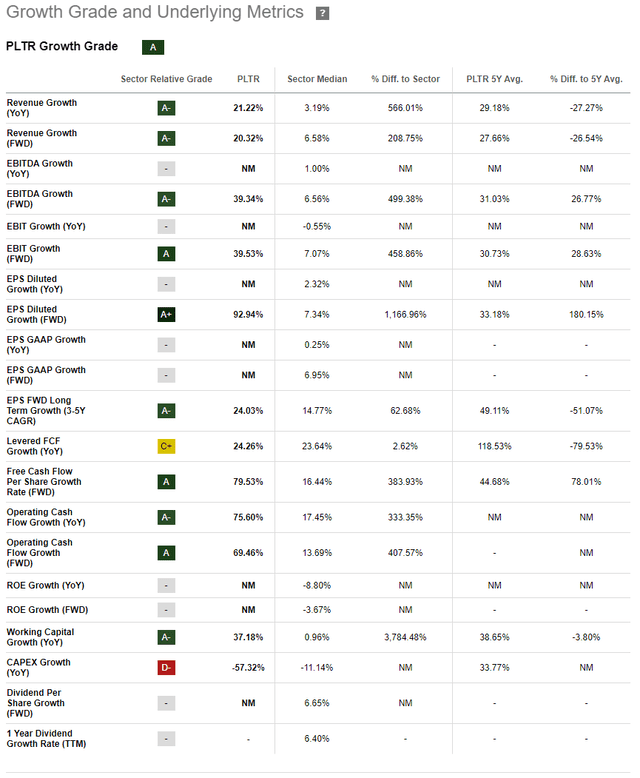

Growth

Let’s start by looking at Palantir’s growth metrics, which clearly set the company apart from most of its competitors. One key figure is its year-over-year revenue growth of 21.22%, which is significantly higher than the sector median of 3.12%. This indicates that Palantir is expanding much faster than its peers, tapping into new market opportunities thanks to strong demand for its AI and data analytics offerings.

What’s also noteworthy is Palantir’s forward operating cash flow growth of 69.46%, compared to a sector median of 13.86%. Palantir isn’t just increasing its revenue, but it’s also turning that revenue into cash incredibly efficiently. That’s a crucial factor, especially in a high-interest rate environment because it gives Palantir more flexibility to reinvest in its business and fund future projects without depending heavily on external financing. In addition, once interest rates start declining, Palantir will have even more flexibility.

Palantir’s working capital growth is another strong indicator of the company’s financial health. It’s currently at 37.18%, which is well above the sector median of 1.10%. It shows Palantir is not only growing quickly but is also managing its short-term resources effectively, ensuring it has enough liquidity to support ongoing projects and future growth initiatives.

Other metrics, such as free cash flow per share growth, which is up 79.53%, and forward diluted EPS growth, which has increased by 92.94%, also show that Palantir is maximizing profitability and efficiency.

So while people say Palantir’s valuation looks high on the surface, it’s still backed by strong growth and solid financial performance. While we also believe the valuation has exceeded a prudent level at this point, the long-term growth prospect is still alive.

Profitability

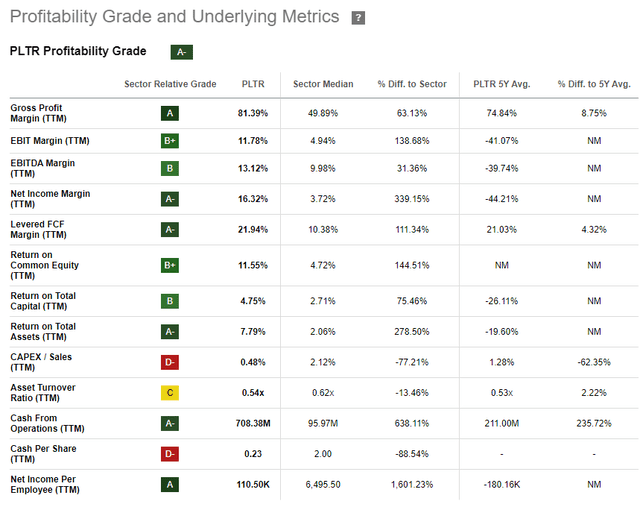

When it comes to profitability, Palantir is also doing quite well compared to its peers. One key figure that stands out is its gross profit margin of 81.39%. That’s significantly higher than the sector average of 49.71%, showing that Palantir has strong control over its costs and can efficiently turn sales into profits.

Another notable metric is its net income margin, which is 16.32%, compared to the sector’s 3.62%. This tells us Palantir is really good at turning top-line results into bottom-line earnings. For a tech company that’s still growing, these profitability numbers suggest that Palantir is managing its costs well and ensuring that its revenue translates into meaningful profit.

Another positive indicator for Palantir is its cash from operations, which stands at $708.38M-more than six times higher than the sector median. Thus, Palantir has plenty of money coming in from its regular business activities, which gives it the flexibility to invest in growth, pay down debt, or handle any unexpected expenses that might come up.

Overall, Palantir’s profitability numbers show a company that’s doing a good job managing costs and converting revenue into profit while also maintaining a healthy cash flow. For investors looking for a tech company that’s focused on both growth and financial stability, these metrics are a positive sign.

Valuation

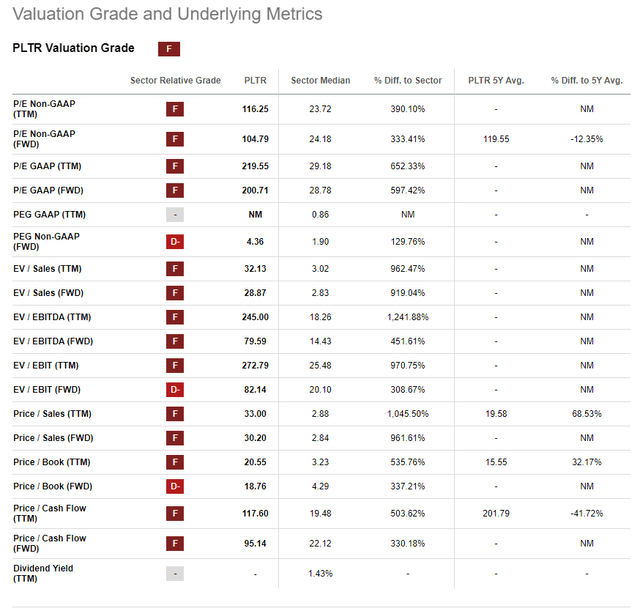

Now, we are at the source of Palantir’s problem. Palantir’s valuation metrics show that the stock is currently trading at a pretty steep premium compared to the rest of the sector. The most eye-catching figure is its forward P/E ratio of 200.71, while the sector median is only 28.78. Thus, Palantir’s stock price is more than four times higher than what investors typically pay for similar companies based on future earnings expectations.

Such a high P/E ratio usually indicates that the market is placing very high expectations on Palantir’s growth and profitability. This leaves little room for error-any sign of slower growth or disappointing results could lead to a sharp correction.

Another concerning metric is the forward price-to-cash flow ratio of 95.14, which is 330% higher than the sector median of 22.12. This once again shows the huge premium Palantir is currently trading at. Generally, when a company’s price-to-cash flow ratio is this elevated, it indicates that a company is generating limited cash flow relative to its stock price. In Palantir’s case, this makes it harder to justify its current valuation unless it can significantly grow its cash flow in the near future.

When we look at other metrics like the enterprise value-to-EBITDA ratio and price-to-book ratio, Palantir’s numbers are once again significantly above the sector averages. In essence, Palantir’s valuation metrics show it is expected to meet even the most optimistic analyst projections. While Palantir has recently started turning solid profits, the high valuation leaves very little room for error, making it difficult for us to feel comfortable investing at this point.

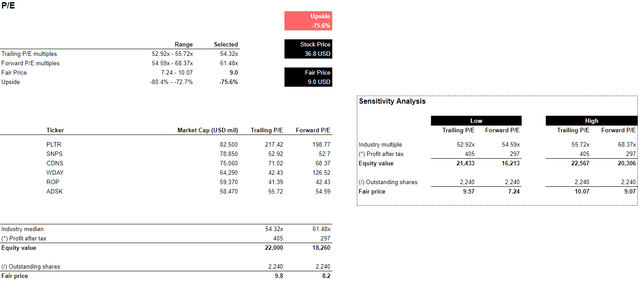

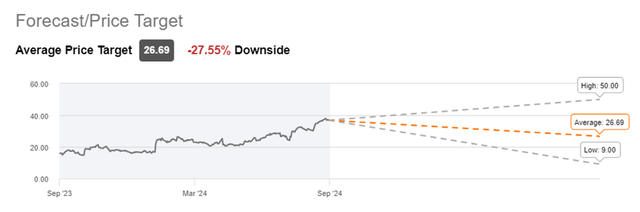

To get a better sense of where Palantir’s stock should be trading, we’ve used a P/E multiple analysis of some of its industry peers, as suggested by Seeking Alpha’s tool. While Palantir’s product line is somewhat unique and direct competitors are hard to identify, this analysis puts its fair value at around $9.60 per share when comparing it to industry peers (take this with a grain of salt, though).

This is quite a bit lower than its current price, but it aligns with the lowest target price reported on Seeking Alpha, which is $9. While this model makes many assumptions, it suggests that Palantir might be overvalued relative to its peers, especially if it were to be valued with no premium, as it is here.

It’s important to keep in mind that stocks don’t always trade exactly at their fair value. Prices often move above or below fair value depending on market sentiment, news, and other factors. So, in the next section, we’ll look at the current option chain to see where the market expects Palantir to go in the shorter term. To be clear, Palantir is worth more than $9 in our opinion, we rated the stock as a buyback in May when it was already trading above $21 per share. Since May, Palantir has had some good news, which further supports the bull case.

Options analysis

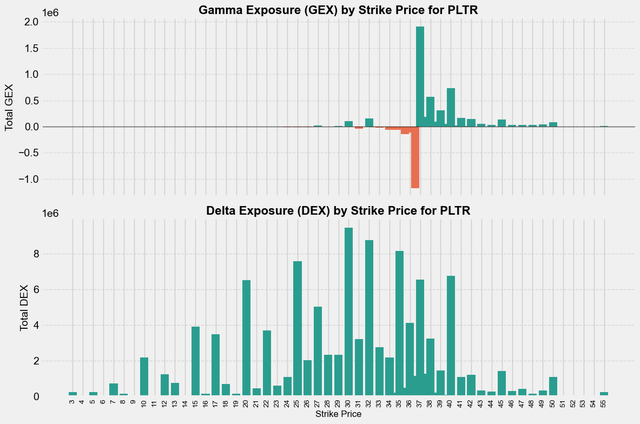

Next, let’s examine Palantir’s options market using gamma and delta exposure (GEX and DEX). Why is this important? These metrics help us understand how market makers may need to adjust their positions, which can influence the stock’s price movements.

In the chart below, we see that there’s a large amount of positive gamma exposure at the $38 strike price, and a big chunk of negative gamma exposure at the $37 strike price. Since Palantir’s latest closing price is $36.84, this puts it just below that heavy negative GEX area at $37. Why does that matter? Well, when a stock is below a level with significant negative GEX, it often means that market makers might start selling shares to hedge their positions, creating resistance around that level.

In simpler terms, $37 could act as a resistance, making it harder for Palantir’s stock to move above it unless we see a strong push from external factors – or if positioning changes significantly. If Palantir stays below $37, we might see some call options lose interest, which would further limit upward movement. On the flip side, if Palantir can break above $37, the next key level to watch would be $38, followed by $40, where positive GEX might start providing support instead of resistance.

What does this mean for investors? Keep a close eye on how the stock behaves around $37, as it seems to be a critical point that could determine Palantir’s short-term direction. Breaking through this level could lead to a rally up to $38 or even $40, but if it doesn’t, $37 might continue to act as a ceiling, capping any upward momentum for now.

Risks

One of the biggest concerns around Palantir’s stock is its very high valuation. With a price-to-earnings ratio above 200, investors are paying a steep price for future growth expectations, putting a lot of pressure on the company to deliver exceptional results each quarter. If Palantir’s growth slows even slightly, the stock could see a sharp decline, as much of the optimism may already be priced in.

Another risk is Palantir’s heavy dependence on government contracts, especially in the defense and intelligence sectors. While these contracts provide a stable revenue source, they are vulnerable to changes in government budgets or political priorities, which could impact Palantir’s financial health. Losing just one or two major contracts could significantly affect its revenue.

Palantir’s entry into the artificial intelligence space has generated excitement, but it’s a very competitive field. If the company struggles to differentiate itself or if investor enthusiasm around AI fades, Palantir could find it challenging to meet high growth expectations, putting pressure on its stock price.

Conclusion

While Palantir’s inclusion in the S&P 500 is a big achievement and confirms its place as a significant player in the industry, the current stock price raises some concerns. Its forward price-to-earnings and price-to-cash flow ratios are much higher than the sector averages, indicating that investors are paying a hefty premium for expected growth. This means the market is already expecting Palantir to execute flawlessly, leaving little room for any hiccups.

At these valuation levels, Palantir seems to be overvalued. An estimated fair value for the stock is closer to $9.60 per share, which is significantly lower than where it’s trading now. While the company’s growth and profitability are strong, the high expectations set by the market could lead to a sharp decline if Palantir doesn’t meet them.

Investors should consider that while Palantir’s long-term outlook is promising, the current stock price might not accurately reflect its true value. It might be a good time to consider trimming your position to lock in some gains, especially if you’re worried about potential volatility or unforeseen challenges. In short, Palantir is a solid company with a bright future, but its current valuation might be a bit too high to feel comfortable holding on to right now. Therefore, we give Palantir a sell rating at this point in time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.