Summary:

- Shares are reflecting the optimism surrounding Palantir’s commercial segment and bottom line expansion, with shares up more than 47% YTD and nearly 280% since the start of 2023.

- For the full year, US commercial revenue rose at more than double Palantir’s growth rate, increasing 36% YoY to $457 million.

- Palantir’s shares are no longer cheap. It’s the third most expensive enterprise software stock on a forward P/S basis, behind Cloudflare and Snowflake.

Bloomberg/Bloomberg via Getty Images

Palantir Technologies’ (NYSE:PLTR) Q4 earnings confirmed an acceleration in its US commercial business as it closed out its first GAAP profitable year. Shares are reflecting the optimism surrounding Palantir’s commercial segment and bottom line expansion, with shares up more than 47% YTD and nearly 280% since the start of 2023.

We noted in our stock newsletter in December that Palantir was “exhibiting multiple signs of acceleration heading into 2024 with an improved fundamental backdrop driven by increasing AI demand. Palantir’s Artificial Intelligence Platform (AIP) is driving a significant acceleration in its US commercial business, while underlying metrics and the bottom line are rapidly improving.”

Revenue acceleration stemming from the commercial business is the major story for Palantir through 2024 and into 2025, with revenue growth poised to accelerate from 17% last year to 20% this year and nearly 21% in 2025.

Strong Acceleration in US Commercial Is Driving Growth

In a deep dive at the time of Palantir’s direct listing, our firm said in 2020 that the “commercial sector is the growth story.” Palantir’s public offering was seen as a way to facilitate attracting and acquiring commercial clients before AI brought a wave of competition. The fruits of Palantir’s labor are beginning to pay off, with a newfound rapid acceleration in its US commercial business after AIP’s launch in Q2 was met with “unprecedented” demand. At its core, Palantir’s AIP is a comprehensive AI solution that lets customers lever Palantir’s AI and machine learning tools and harness the power of the latest large language models (LLMs) within Foundry and Gotham. Customers can deploy LLMs on their own private networks using their own private data, maximizing data security and improving efficiency by helping reduce data transfer and storage costs.

Although its US commercial segment accounts for less than 25% of quarterly revenue — it just surpassed a $500 million annual run rate in Q4 — it is now becoming the dominant factor behind the strong business momentum Palantir has seen over the past few quarters.

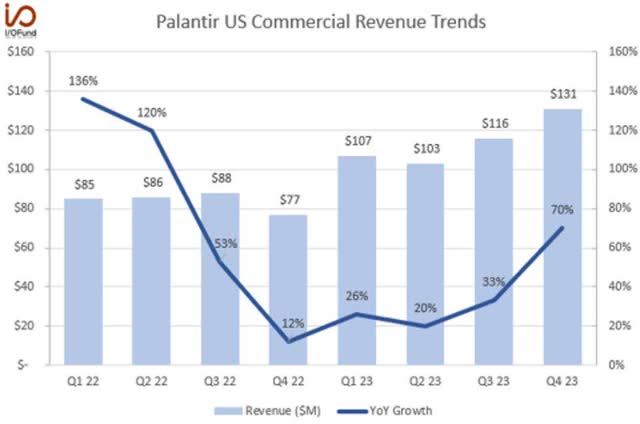

US commercial revenue rose 70% YoY to $131 million, a 37 percentage point acceleration from Q3 and a 58 percentage point acceleration from the year ago quarter. For the full year, US commercial revenue rose at more than double Palantir’s growth rate, increasing 36% YoY to $457 million.

The graph below illustrates just how strong the recent quarter was:

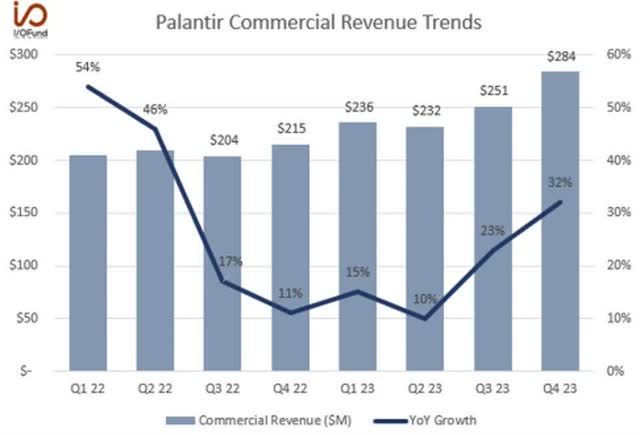

This acceleration in the US over the past two quarters is driving global commercial revenue higher. Palantir’s global commercial revenue accelerated by 22 percentage points, from 10% growth in Q2 to 32% in Q4. The segment topped a $1.1 billion annual run rate last quarter, up from a $920 million run rate two quarters ago.

While the revenue acceleration was the main headline for the US commercial business, a closer look reveals that the segment also drove more than 90% of Palantir’s customer additions with very strong underlying metrics.

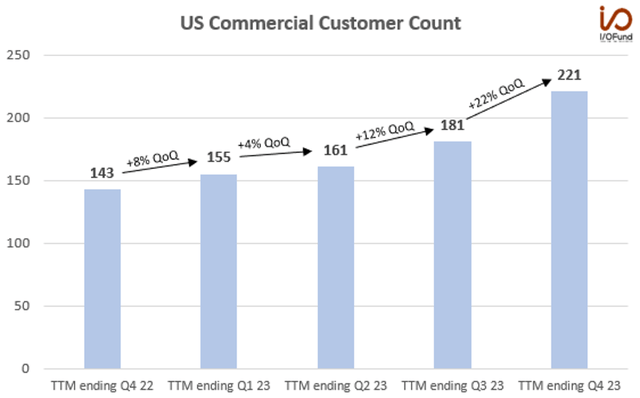

Palantir reported 55% YoY and 22% QoQ growth in US commercial customer count to 221 in the quarter, as customer growth continues to accelerate. Over the past two quarters, Palantir has added 60 net new US commercial customers with 40 customers added in Q4 alone. This is more than 3X higher than the previous period of just 18 net new US commercial customers from Q4 2022 to Q2 2023.

Global commercial customers increased 44% YoY and 14% QoQ to 375 customers – representing 45 net new customer additions in the quarter. This means the US commercial segment drove more than 90% of Palantir’s net new customer additions in Q4. That compares to below 63% of net new customer additions in Q3 and just 20% in Q2.

This growth was “meaningfully driven by AIP” with Palantir saying that “demand is off the charts” for its new product. AIP is “propelling growth both through new customer acquisitions and expansions with existing customers,” with evidence of AIP bootcamps “helping to significantly compress sales cycles and accelerate the rate of new customer acquisition.”

Palantir had set a goal in October to hit 500 AIP bootcamps to drive top of funnel growth, and it has already surpassed that target, completing 560 bootcamps in just four months.

CRO Ryan Taylor commented on how this translates through to growth in the US commercial segment, with

“70% year-over-year growth in revenue in Q4, 55% growth in customer count year-over-year, and a 107% growth in TCV closed on an adjusted basis […] Either it’s — first, its bootcamps that are quickly converting to paying customers or its expansion of existing customers or its customers where maybe we’ve been engaged for a while and introduction of AIP, that whole process has been accelerated. We’re seeing that across the board, and yet at the same time, we barely touched that addressable market.”

Engaging customers via bootcamps to then translating that engagement into new customer deals or expanded deals sets the foundation for sustained revenue growth at a higher rate, more so if it can drive its net retention rate higher.

A Note on Net Retention Rate

Palantir reported a company-wide NRR of 108% in Q4, but noted that it “does not yet fully capture the acceleration in our US commercial business” since customers acquired over the last twelve months are not reflected in the calculation. A majority of the net new customer additions have come in the last two quarters, suggesting US commercial NRR will be higher than 108% come the end of FY24 when this customer cohort is reflected. For context, Palantir reported an NRR of 150% at the end of FY21 in US commercial, but that likely fell significantly when growth slowed to a crawl at the end of FY22.

If AIP can continue to drive a high level of customer acquisition and expansion through FY24, this can help drive and maintain the revenue acceleration we’re seeing in the segment through FY25 and into FY26.

Valuation Remains a Risk Despite Strong Improvement in Fundamentals

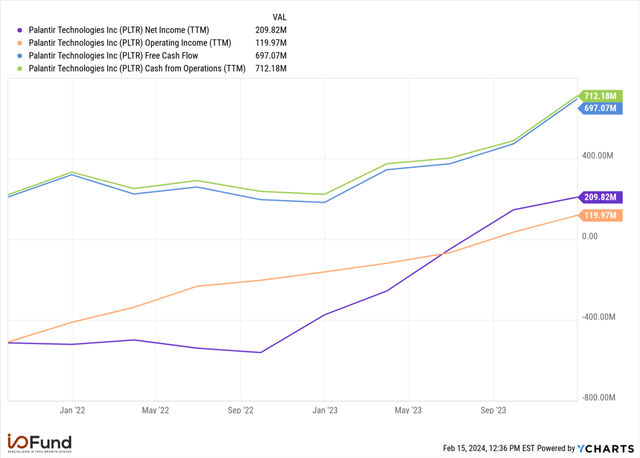

Fundamentally, Palantir has seen major improvements throughout FY23, as it became the company’s first GAAP profitable year.

Gross margin has expanded consistently throughout the year, rising 300 bp YoY from 79% to 82% in Q4. GAAP operating margin shifted positive and expanded in each quarter in 2023, rising from (4%) in Q4 2022 to 11% last quarter.

Net income growth has been particularly strong, with Palantir generating nearly $210 million in net income during the year, compared to nearly ($374 million) in 2022. Cash flow generation has improved substantially, with operating and free cash flow both more than doubling QoQ in Q4 to over $300 million. Palantir ended the year with a 32% OCF margin and a 33% adjusted FCF margin.

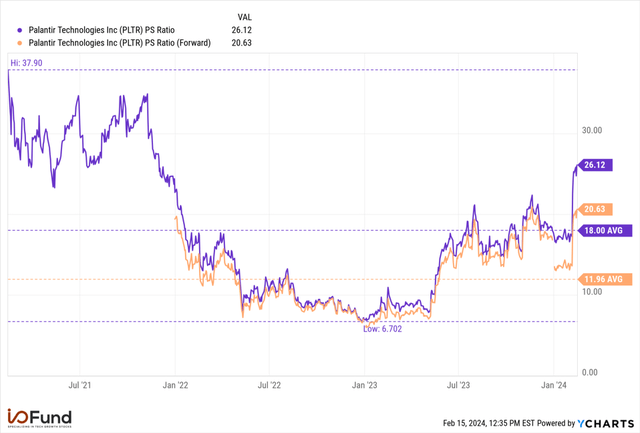

While the fundamentals are certainly supporting an increase in Palantir’s share price, the AI hype may be overshooting the near-term potential for returns at this level. What’s striking is that investors are paying prices last seen when the market set a major top in November 2021, meanwhile the 2021 growth story is decoupled from management’s long-term 30% revenue growth target.

In early 2021, Palantir’s management expected to reach $4 billion in revenue by 2025 as they expected more than 30% annual revenue growth each year for the next five years, or through 2026. Palantir exceeded this target with 34% growth in 2021, but a macro-inflicted deceleration in late 2022 and early 2023 has practically nullified its ability to reach that $4 billion target after posting 24% growth in 2022 and just 17% in 2023. Current analyst estimates point to nearly 21% growth to $3.22 billion in revenue in 2025, meaning Palantir is one year off track – it’s projected to reach the $4 billion milestone in 2026, one year later than expected.

To reach $4 billion by the end of 2025, Palantir would need to record 35% growth this year and next, about 15 percentage points above estimates for both years. While AIP is aiding strong acceleration in the US commercial segment, it’s unlikely to drive revenues to that target. As a result, shares may be pricing in perfection for AIP and AI-related stock performance.

Prior to Q4’s earnings, Palantir was trading near its average P/S ratio of 18x, but the strong rally has now taken shares to over 26x P/S and 20x forward P/S – this is the highest level since late 2021 yet growth has slowed. On a cash flow basis, shares are trading at around 60x 2024’s projected $800 million to $1 billion in adjusted FCF.

Palantir’s shares are no longer cheap. It’s the third most expensive enterprise software stock on a forward P/S basis, behind Cloudflare and Snowflake, despite having the slowest forward revenue growth rate by more than 700 basis points, at 20% compared to 27% to 30% for the other two. This valuation may open up the door for downside throughout the year as it leaves no room for error, considering its lower revenue growth rate compared to peers; in addition, any dampening to growth stock sentiment from higher-for-longer rates with cut expectations being pushed back further in the year also presents a potential headwind for shares.

Conclusion

Enterprises are showing elevated interest in Palantir’s Artificial Intelligence Platform, which is translating to new customer additions. AIP’s early success in the US commercial segment drove Palantir’s new customer additions in Q4. US commercial revenue is accelerating significantly, reaching 70% YoY growth in Q4 from 33% in the prior quarter.

Management’s commentary about how Palantir is engaging and converting customers via bootcamps sets a foundation for a sustained acceleration thanks to a rapid customer acquisition cycle. However, the size of the US commercial business at less than 25% of quarterly revenues means that the AI-related acceleration may not be enough to sustain the stock’s current valuation.

Tech Insider Network Equity Analyst Damien Robbins contributed to this analysis.

Recommended Reading:

- AI Driving Acceleration For Big 3 Cloud Stocks

- Social Media Stocks: The Strongest And Weakest Heading Into 2024

- Coinbase, Robinhood: Examining The Impact Of Spot Bitcoin ETFs

- Tesla Q4 Earnings Preview: Margins Likely To Slip Again

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PLTR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.