Summary:

- Palantir Technologies Inc. has experienced strong financial performance and high revenue growth, with its stock increasing by 215.94%.

- The company offers four products, including Apollo, Gotham, Foundry, and AIP, which cater to different industries and provide data analytics solutions.

- Palantir’s expansion into the artificial intelligence industry through its AIP platform is expected to drive significant gains in net margins and revenues.

hapabapa

In a previous article published in November of 2023, I gave Palantir stock a sell consensus with an intrinsic value of $13.79, my reasons centering around slowing growth and legislative concerns. However, the company recently released its FY2023 financial statements indicating a reversal in many trends I was poignant on along with the widespread adoption of artificial intelligence, which has caused me to reevaluate the company.

Thesis

Palantir Technologies Inc. (NYSE:PLTR) is an American company that specializes in software platforms for data analytics. With a history of strong financial performance and a high double-digit revenue growth rate along with positive operating income, the company’s stock has increased by around 215.94% from lows of $7 a share. Its commercial segment, for example, grew 70% YoY in Q4 2023 while it continued to partner with government divisions, indicating the company’s firm position in the industry. Additionally, the company recently rolled out its Artificial Intelligence Platform, serving as a central catalyst for the company going forward.

Product Portfolio

Palantir provides four product platforms: Apollo, Gotham, Foundry, and AIP.

First, Apollo is designed to assist individuals in monitoring, managing, and protecting data across different environments, allowing the operation of SaaS (Software as a Service) in environments where connectivity is limited. Apollo also provides solutions and enhances software performance in a highly secure environment. This feature makes Apollo best used for sensitive government and military activities.

Secondly, Gotham is a product focused on managing and analyzing large amounts of data from multiple sources to detect suspicious patterns in any activity. The ability to analyze complex real-world data propagates Gotham’s practical use in various government and international defense agencies in fraud detection, counterterrorism, and cybersecurity. It assists users to make more informed and faster decisions or operational plans.

Thirdly, Foundry, targeted to commercial customers, allows organizations to analyze and consolidate data, find trends, and gain insights. Foundry breaks down data and optimizes its users’ data-driven analysis and decision-making processes.

Lastly, Palantir’s newest product line is the Artificial Intelligence Platform (AIP). The introduction of this new platform has signaled a remarkable change in Palantir’s targeted customers. AIP also marks the company’s entrance into the artificial intelligence and machine learning technologies industry. AIP incorporated existing Palantir platforms to offer advanced AI and machine learning services. It provides a customized experience accessible to a broader range of customers. IBM’s Watson and Google Cloud AI are the competitors in the market. However, AIP’s advantage is from its focus on data integration acquired from other Palantir platforms.

Comparative Advantage

Strategic Government and Commercial Partnership

Palantir has a competitive advantage in partnership with different government divisions. It partnered with the CIA, NSA, FBI, and military organizations in the United States and internationally. The platforms’ ability to work with sensitive information and analyze complex datasets has made it a partner for defense organizations. I am confident these partnerships show Palantir’s credibility and support its long-term growth.

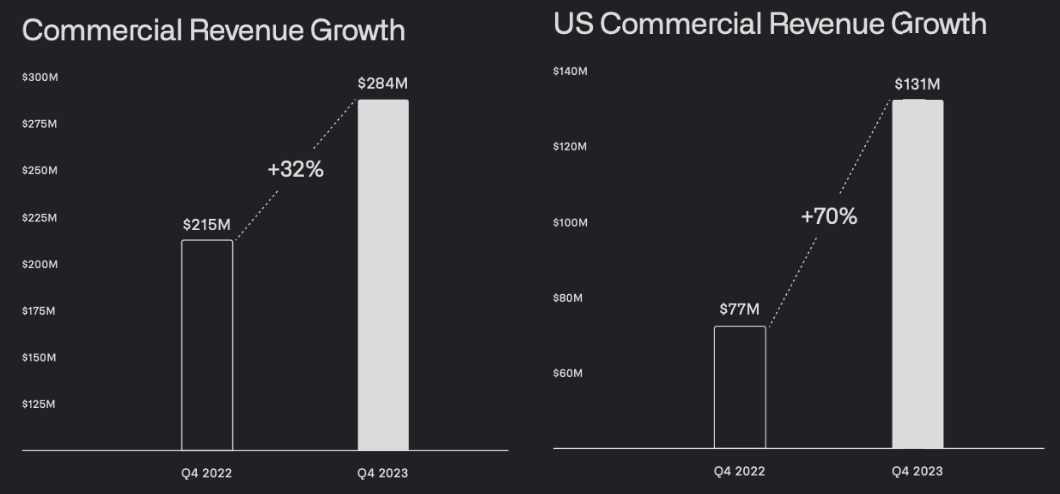

Palantir’s targeted commercial customers, specifically industries with large numbers of complicated data, are growing fast. Palantir’s experience in data analytics and supply chain optimization supported its expansion in the healthcare, energy, finance, and manufacturing industries. The sales in the commercial segments are growing much quicker. Palantir’s commercial revenue growth increased by 32% YoY, which hit $284 million in Q4 2023.

Q4 2023 Presentation

Specifically, within just the US, the commercial revenue growth reached 70%, from $77 million in Q4 2022 to $131 million in Q4 2023.

Catalyst

Expansion Into Artificial Intelligence

As the AI industry is expected to grow to $225 billion in 2027, I believe Palantir will realize significant gains in its net margins and revenues through its Artificial Intelligence Platform by improving efficiencies in its current product line but also by creating an additional product line targeted at the commercial market.

AIP analyzes data from sources, such as streaming and structured or unstructured data formats. It offers tools to modify and extract data into a consolidated format. Organizations can use AIP to support group projects, gain insights, and collaborate on decision-making processes. For example, in the energy industry, AIP can study people’s energy usage patterns and then analyze data across time to give insights into predicting the month with the highest demand or the energy usage pattern. With this information, consumers can reduce energy consumption and manage resources effectively.

AIP can also be integrated with other Palantir products, enhancing the product’s ability in AI and machine learning. For example, AIP can be used with Foundry to build models on diverse datasets, helping to apply analytics and deep learning to their data. Moreover, AIP enhances operational planning for Gotham users by integrating AI models that can analyze real-time data for defense or law enforcement for threat detection.

Finally, the company conducted over 560 boot camps in October 2023 with Palantir’s CEO, Alex Karp, mentioning that AIP can give solutions in hours compared to what businesses produce in months or years using different platforms. Similar to AI tools like Amazon Augmented AI (A2I) and Google Cloud AI, Palantir’s AIP can create customized products based on the company’s previous experience in specific industries. In my opinion, AIP will be the future of Palantir as it seeks a more general audience while enhancing its current product line.

Financials

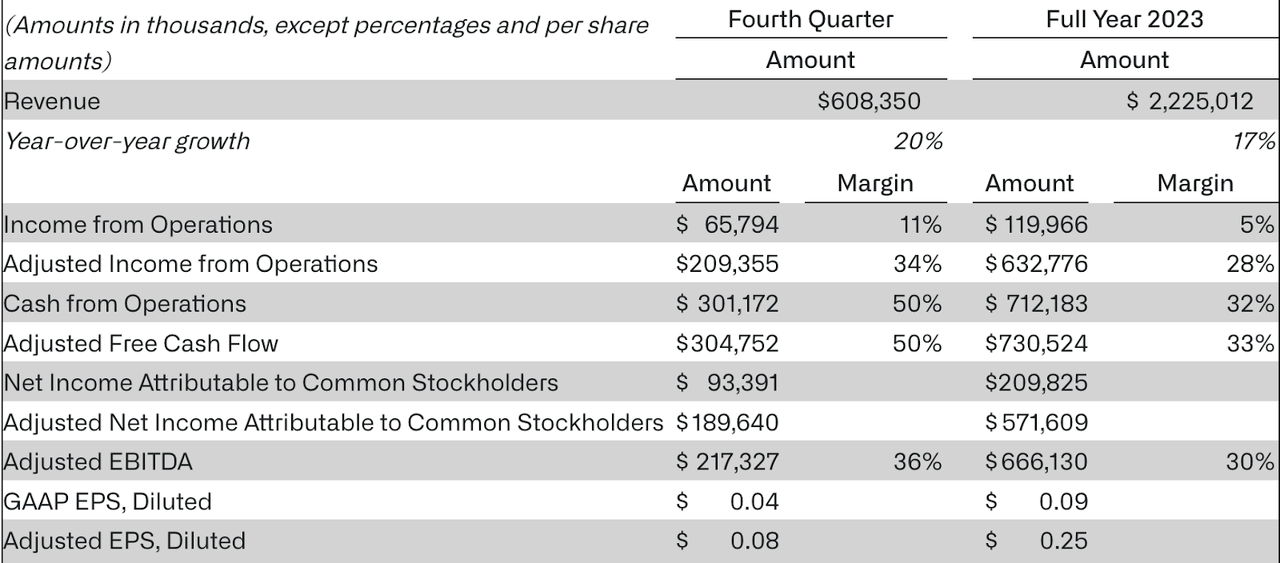

In Q4 2023, Palantir’s revenue reached $608 million, a 20% YoY growth. In particular, Palantir posted $324 million in government revenue for Q4—an increase of 11% from last year. Commercial revenue for Q4 2023 was posted at $284 million—an increase from 32% compared to last year. Moreover, the adjusted free cash flow margin is substantial at 50% for the fourth quarter and 33% for the full year, indicating good liquidity and financial health for the company.

Over the past five years, Palantir has consistently increased revenue, particularly from diverse sectors beyond government contracts, which is a positive sign. Palantir’s executives are optimistic about the company’s future performance with the accelerated demand for their AIP products. The company estimates its revenue will rise to $612 million to $616 in revenue for Q1 2024. I think it’s reasonable based on the growth of their AIP product’s introduction.

Operating and free cash flow increased by 50% QoQ in Q4 to over $300 million. Palantir ended the year with a 32% OCF margin and a 33% adjusted FCF margin. The company is also net income positive with $209.82 million in net income on a trailing twelve-month basis. In my opinion, the company has a strong financial performance with increased revenue and earnings, solid cash generated, and a strong balance sheet with good liquidity and low debt levels.

Valuation

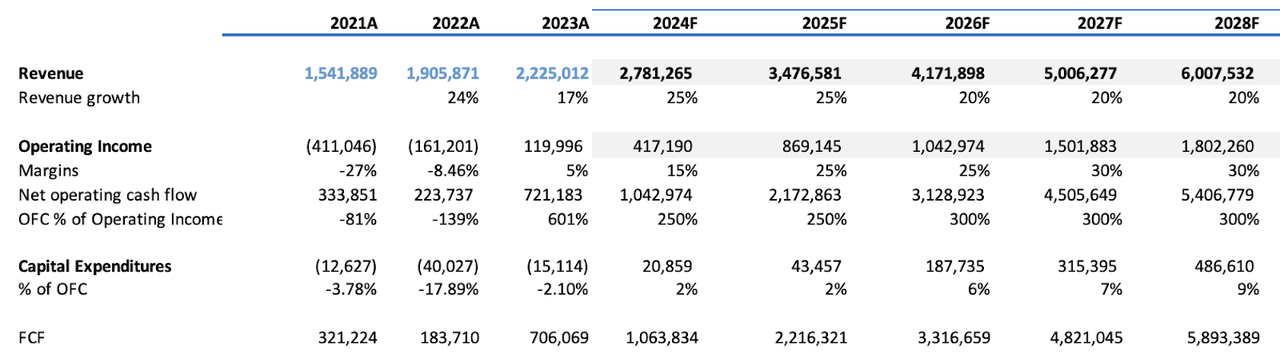

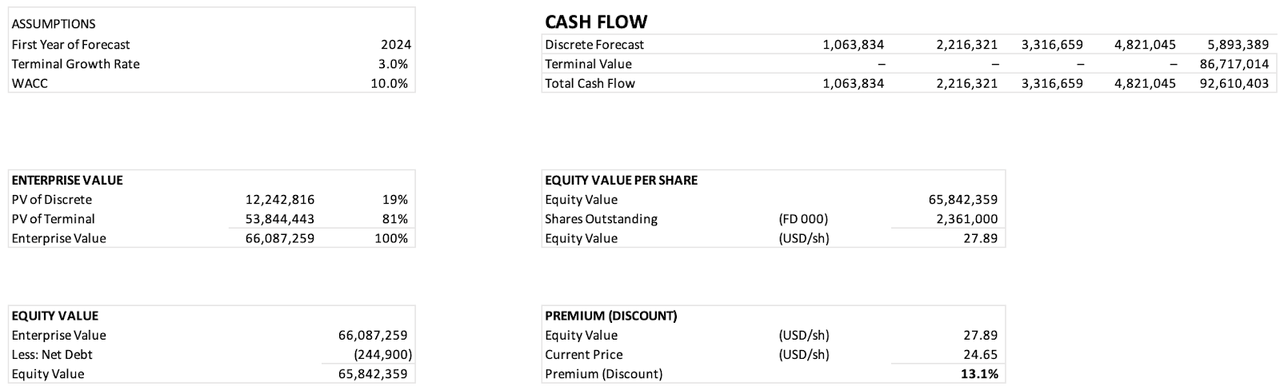

I use the DCF model to calculate Palantir’s intrinsic value. I estimated the revenue growth rate to be 25% in FY24, as an expansion in commercial markets and growth via government contracts. The average growth is 20% for ongoing years. The projected CapEx as a percentage of the operating cash flow will increase, implying that the company will continue to invest in projects. These investments could be in data centers, infrastructure, or research and development for advanced technology. The projected operating cash flow is $5.4 billion.

I assumed a terminal growth rate of 3%, which is the U.S. economy’s long-term growth rate. Then, I calculated the Weighted Average Cost of Capital (WACC) as 10% with the following method. Palantir’s market value of equity is $54 billion and the book value of debt is $244 million. The calculated debt weight is 0.5% compared to the equity weight of 99.5%. The company tax rate is calculated from tax expense divided by the pre-tax income, which is 8%. The cost of equity is using CAMP, with a risk-free rate of 4% (10-Y Treasury Constant Maturity Rate), and the company’s beta is 1.3. To calculate the cost of debt, I divided the interest expense by the quarterly average debt where I arrived at a WACC of 10.4% based on the debt weight, the after-tax cost of debt, equity weight, and cost of equity. Based on the model, the equity value per share is $27.89. Compared to the current price of $24.65, the stock is undervalued by 13.1%.

Risk

There are risks associated with its forecast. Competition in the data analytics and AI industry is growing, as many tech companies like Google are competing for positions in this segment. An inability to adapt to the growing market dynamics or technology setbacks could hinder the company’s expansion and returns. However, I believe Palantir will remain the dominant leader in the industry, especially shown by their rapid growth in the commercial segment, established by its large data pool from years of experience.

Another risk is its involvement with sensitive government and data privacy contracts. Challenges may develop regarding ethical concerns, affecting the company’s valuation. Although significant issues have yet to arise, this, in my opinion, is still a significant concern.

Takeaways

With the growth in demand for AI platforms, Palantir Technologies has much potential for future growth. However, the competition in the data analytics field is intense. The AI industry evolves with tech giants and startups innovating. To maintain its competitive position, Palantir must continue to invest in AI research, enhance strategic partnerships, and adapt to AI trends and regulations, which I believe it will accomplish. Also, Palantir’s converting customers rate for AIP through boot camps shows this sustained acceleration with high customer acquisition. Hence, I rate Palantir a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.