Summary:

- Palantir shares have surged 115% YTD due to AI-driven platform gains, strong customer acquisition, and improved fundamentals, but now seem highly priced.

- Recent insider sales, including 9M shares by CEO Alexander Karp, have surged, signaling potential overvaluation and warranting investor caution.

- AIP momentum is still solid, however, as the company just announced a new contract from the DEVCOM Army Research Laboratory, worth up to $100M over five years.

- Palantir’s valuation now exceeds my fair value estimate of $31.40 per share by 18%, prompting a downgrade to hold.

- Risks include potential slowdowns in AI spending, which could impact customer acquisition and free cash flow growth, necessitating careful investor consideration.

Vladimir Zakharov

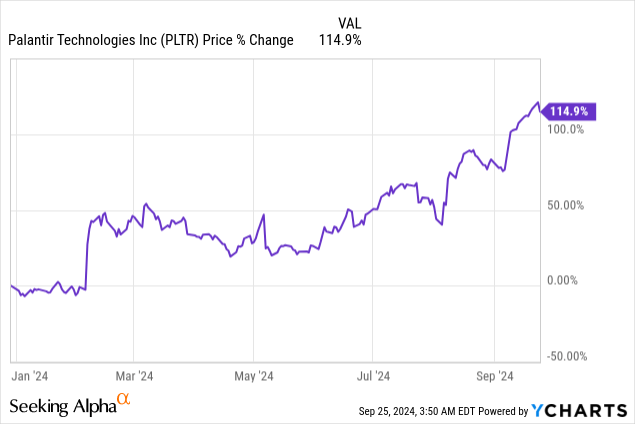

Shares of Palantir (NYSE:PLTR) have soared to new 1-year highs recently, on general optimism about AI-driven platform gains. Year-to-date, Palantir’s share price has increased 115% as the company’s fundamentals considerably improved due to strong customer acquisition momentum, growing operating income and free cash flow as well as strengthening margins. Shares, however, now seem highly priced and since the company has seen a huge increase in insider sales lately, including from the company’s CEO, I believe investors should be more careful here.

Previous rating

I rated shares of Palantir a strong buy after the software analytics company reported better than expected second-quarter results: AI Inflection Point Makes Palantir A Strong Buy. Palantir specifically benefited from growing customer up-take of its artificial intelligence platform AIP, which was integrated with Palantir’s core Foundry platform. Palantir also saw an acceleration of its top line and raised its revenue guidance for FY 2024, indicating momentum in its core software business. However, shares of Palantir have soared lately making shares more than fairly valued and recent disclosures of massive insider sales are cause for concern, in my opinion. While the business has growth momentum, at the current price I believe the potential is fairly priced, and I see limited upside potential.

New contracts driven by AIP’s value proposition

I have repeatedly argued that Palantir was set for a revenue and free cash flow upswing related to growing adoption of its artificial intelligence platform AIP which offers government and corporate customers valuable analytics insights. Just days ago, Palantir announced a new contract with the DEVCOM Army Research Laboratory, worth up to $100M over a five-year period, to expand access to the Maven Smart System, a governmental AI platform.

Further, AIP got another significant endorsement this week as oil and gas company APA Corp. (APA) deepened its relationship with Palantir. APA uses AIP to plan its operations, manage its supply chain and optimize production. These deals show that demand for Palantir’s software/AI tools is growing and that AI products that deliver business insights will be a key lever of growth for the company going forward.

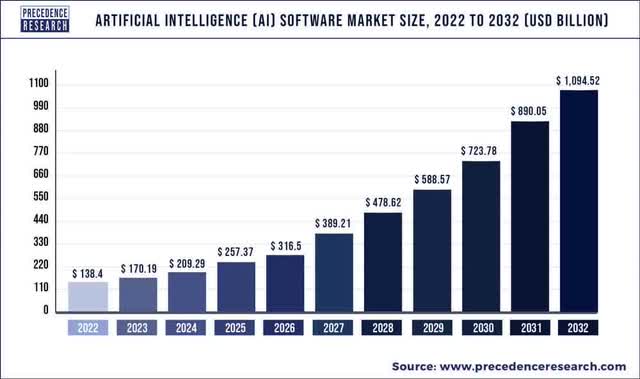

According to Precedence Research, the AI software market is set for rapid growth and Palantir could play a vital role here with its AIP software positioning. The AI software market is expected to grow to $1.1T by the end of FY 2032 which implies a 8X factor increase compared to the FY 2022 base year.

The outlook for AIP is very promising for a number of reasons:

- AIP helps companies deal with large amounts of data, both structured and unstructured, and organizes it in such a way that companies can make the most use of

- AIP helps reduce business complexity and therefore supports decision-making

- Palantir is growing its portfolio of companies that use AIP across industries. By expanding its circle of competence Palantir can highlight industry-specific use cases and turbo-charge its customer acquisition in the commercial segment

- Palantir’s AI expertise can be leveraged not only by commercial enterprises (which is where the focus currently is), but also by many different government institutions. AI-driven growth in governments is therefore a potential lever for acceleration of AIP up-take going forward

- Ultimately, AIP adoption should lead companies to develop more efficient cost structures, justifying investments in Palantir’s AI products.

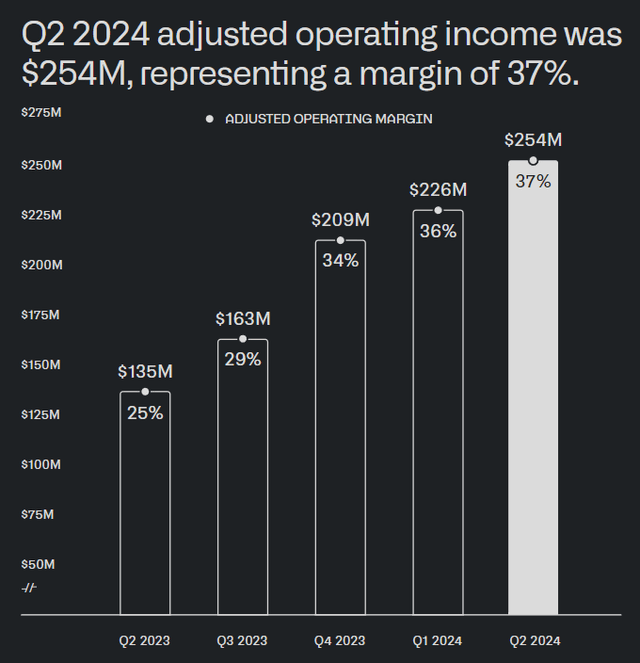

Palantir is scaling AIP aggressively and it is this strategy that has resulted in significant operating income margin growth in the last several quarters. The OI margin as of the end of the June quarter was 37%, showing a significant 12 PP margin expansion year-over-year. At its current trajectory (and since AIP is scalable), I would not be surprised to see an OI margin of 40% by the end of this year and ~45% by the end of next year.

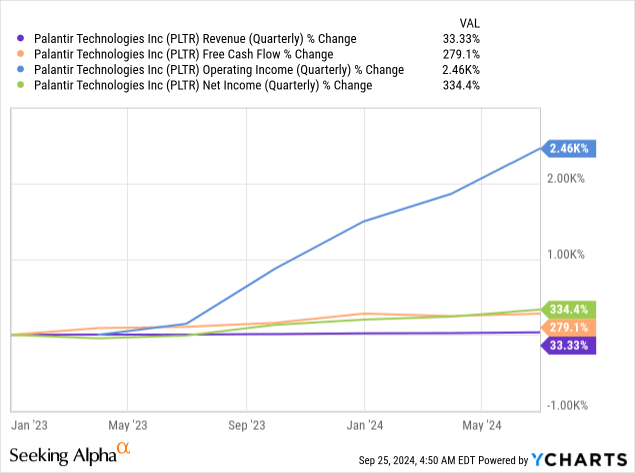

Palantir’s shares have more than doubled in valuation this year, mainly because of excitement about the company’s AI platform and strong operating income/margin gains. In the last three years, key metrics like operating income especially have soared and Palantir achieved a massive $149M in free cash flow in Q2’24, driven chiefly by momentum in the U.S. commercial segment.

Positive AIP momentum offset by surging insider sales

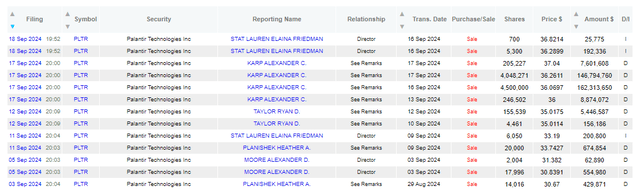

Maybe because of Palantir’s strong execution and soaring share price, it should not come as a surprise to shareholders that insiders are taking advantage of a much higher company valuation: insider sales have dramatically ramped up in September which I believe sends a strong warning signal to investors, especially with shares just reaching a new 1-year high.

Insiders often sell their shares in the companies they run, so to some extent insider sales are nothing unusual. However, in the case of Palantir, the recent surge of insider selling is telling and it could indicate that insiders view the stock as overvalued.

What stands out with Palantir’s recent insider sale sheets is that sales surged compared to previous trades and that insider transactions were wide-spread, meaning numerous shareholders were selling, including the company’s Chief Executive Officer. Other investors, including 10% owners, hired banks to assist in private stock sales. The biggest seller in September — based off of transactions that occurred up until September 18, 2024 — was Alexander Karp, the company’s Chief Executive Officer.

Palantir’s CEO sold 9M shares for approximately $326M while other insiders sold smaller amounts ranging as low as just 700 shares. Alexander Karp sold Palantir shares between $36 and $37 last week which is close to recent highs around $38. In August 2024, the last time Karp sold shares, he disposed of just 975,000 shares for total proceeds of $31.4M. In May 2024, he sold about 729,000 shares for $15.6M. In other words, compared to his August transactions, Karp’s sales surged by a factor of 10X. Compared to his May sales, exit trades increased by a factor of 21X.

The insider sales are therefore significant, in my opinion, because not only have AI stocks, including Palantir surged lately, but the amount of sales is truly unique in a historical context. Since such aggressive insider sales should not be overlooked and because shares of Palantir now have surged past my fair value estimate, I am treading a bit more carefully.

Palantir’s valuation

In my last work on the software analytics company, I said that I saw a fair value for Palantir’s shares in the neighborhood of $31.40 per-share… based off of a historical P/E ratio of 55X and a consensus FY 2027 EPS estimate of $0.57 per-share. Since shares have reached this price target (and now exceed it by 18%), I believe caution is warranted.

Shares are also very highly valued based off of revenue, another metric often used, considering that Palantir only last year achieved GAAP profitability. Shares of Palantir are currently valued at a price-to-revenue ratio of 24.9X, based off of FY 2025 consensus estimates while shares of C3.ai (AI), a rival software analytics play, trade for only 6.4X next fiscal year’s revenues. Adobe (ADBE) and Oracle (ORCL), two other AI software stocks, trade at forward price-to-revenue ratios of 9.8X and 7.1X, respectively, and both companies generate stronger profitability than Palantir. Palantir’s P/S ratio stands clearly out here, and I believe that the valuation has gotten a little bit too lofty. For those reasons, and because of the flurry of insider exit trades, I am downgrading shares of Palantir to hold.

While Palantir’s revenue and EPS can be expected to grow going forward, at the current state of Palantir’s business, I believe the firm’s robust fundamentals and a favorable outlook for AIP are fully reflected in the company’s valuation. What may change my fair value estimate going forward is if the company were to see an even more drastic upswing in free cash flow and operating income profitability. A drop towards $31 (or preferably below) could be a potential buying opportunity, in my opinion.

Risks with Palantir

The biggest commercial risk for Palantir is a potential slowdown in spending on AI hardware and software products which could have a negative impact on the rate of customer acquisition, monetization figures such as revenue per average customer, and free cash flow growth. The biggest opportunity for Palantir could also be its greatest vulnerability: more companies are using AI technology than ever before and if other companies, including start-ups, come up with better AI that generates cheaper, more valuable data insights, AIP may have no moat whatsoever and be therefore easily replaceable.

If AIP customer up-take were to slow, Palantir may experience considerable revenue headwinds as the company is only going to rely more on its AI tools in the future to drive incremental revenue gains. What would change my mind about Palantir is if the company were to see weakening monetization or failed to see operating income margin improvements going forward.

Final thoughts

As much as I like Palantir as an AI-focused investment in the software space that has demonstrated an ability to translate strong interest in AI-driven intelligence into real earnings and free cash flow growth, the recent flurry of insider sales is a red flag.

Insider sales, to a certain extent, are a normal occurrence and insiders sell for a variety of reasons from a desire to cashing out to improving diversification. But when insider sales surge broadly and deeply at a time when shares are reaching new highs, I believe investors should take notice and tread more carefully.

The CEO’s insider sales especially are quite significant and could indicate that he (and others) see shares of Palantir as fully valued… or maybe overvalued. Given the recent surge in enthusiasm for Palantir, an explosion of insider trades and the fact that Palantir is now trading at a premium to my (generous) fair value estimate, I believe that a down-grade to hold is appropriate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.