Summary:

- Palantir Technologies Inc. needed significant growth in Q2 ’24 to justify its stock valuation.

- The company should hit growth rates topping consensus analyst estimates, but any hiccup will lead to a disastrous outcome for shareholders.

- The stock now trades at an extreme valuation of 25x forward sales targets due to multiple expansion far beyond reported growth rates.

andy0man/iStock via Getty Images

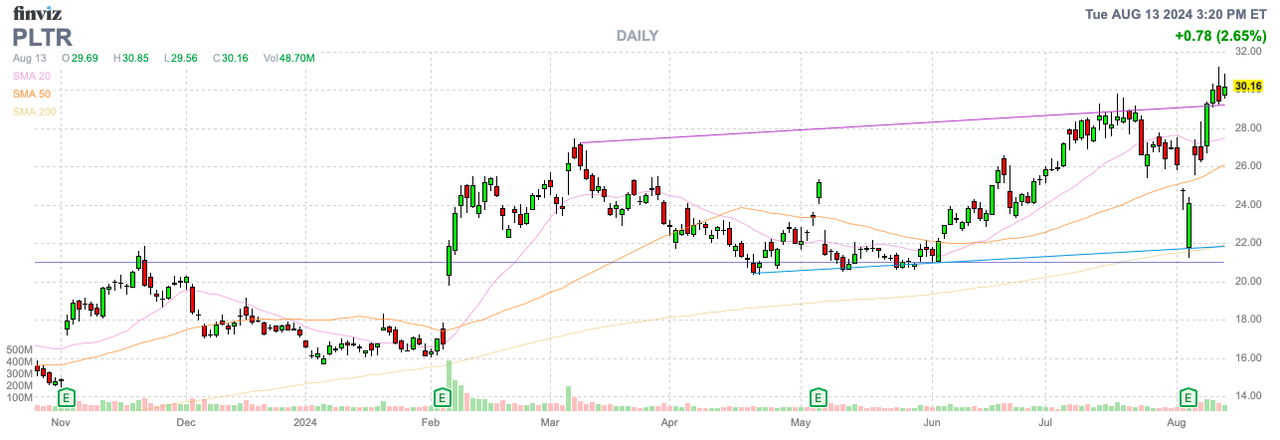

Coming into Q2 ’24 earnings, Palantir Technologies, Inc. (NYSE:PLTR) needed a massive bump in growth rates to warrant the stock valuation. The enterprise AI software sector had shown no signs of sales growth to warrant the excitement. My investment thesis is still Bearish on Palantir following the surprise bump in Q2 results, but the company still doesn’t warrant the massive multiple expansion of the last year.

AI Software Leader

Palantir has long been recognized as a likely leader in the enterprise AI software space. The question has always been whether hesitant corporate customers could provide enough growth to offset weaker growth in government spending, where the software company was the strongest.

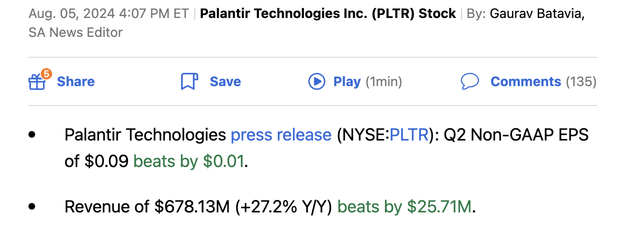

The company reported a strong boost in Q2 ’24 sales by smashing consensus estimates as follows:

Palantir has a history of beating quarterly results, though the AI software company missed estimates back in Q2 ’23. Still, Palantir doesn’t regularly smash numbers, with a Q2 beat of nearly $26 million on revenue of $678 million.

The Q3 revenue guidance at $699 million was equally strong, predicting growth hits 25%, though down from the just reported 27% growth rate. Naturally, Palantir was recovering from the easy comps of last Q2, when the AI software company actually missed revenue targets.

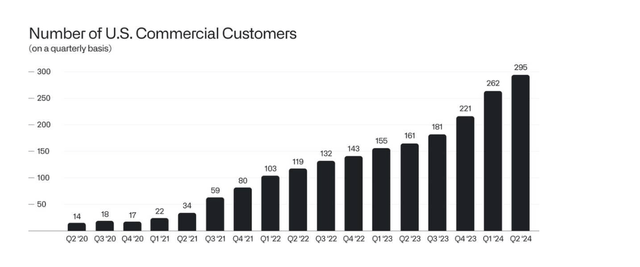

The big question is whether Palantir can grow revenues at an even faster clip with surging demand for AI software. The big key will be the scale of the U.S. commercial customer base.

Palantir has scaled from only 14 U.S. customers in Q2 ’20 to 161 last Q2 to 295 this last quarter. The AI software company grew this business by 83% YoY, leading to 55% revenue growth, though the quarterly revenue number is still relatively small at only $159 million.

Source: Palantir Tech. Q2’24 shareholder letter

What continues to hold back the overall business is government spending. Palantir built the company on the government side, and this business grew 23% YoY to $371 million in quarterly revenues.

The only sector with explosive growth is the U.S. commercial sector with ~25% of total quarterly revenues, whereas Palantir is more of a startup business with current growth rates unlikely sustainable as the business scales. This revenue could double next Q2 to $318 million and Palantir would produce around 40% if the rest of the company continues growing at existing rates as follows:

- U.S. Commercial – $159 million in Q2, 100% growth = $318 million in Q2’25

- Non-U.S. Commercial – $148 million in Q2, 15% growth = $170 million in Q2’25

- Government – $371 million in Q2, 23% growth = $456 million Q2’25

- Total – $678 million in Q2, 39% growth = $944 million in Q2’25

Palantir growth rates could definitely accelerate from the current rates. In the next year, the U.S. commercial business will become a much larger portion of the business.

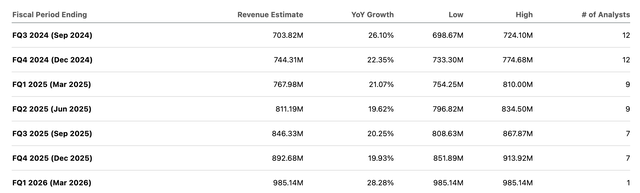

The U.S. commercial business probably won’t hit the 100% growth rates while the rest of the business grows at the Q2 rates. The consensus analyst estimates have Palantir only growing at a 20% growth rate in Q2’25 to reach just $811 million in quarterly revenues.

The math seems to support far higher revenue totals in 2024. The stock would actually plunge if Palantir takes until Q1’26 to top quarterly revenues of $900 million.

Company Versus Stock

The stock price has a considerable disconnect here, soaring to $30. Remember, Palantir only has forecasted growth rates in the mid-20% range and the stock has doubled in the last year.

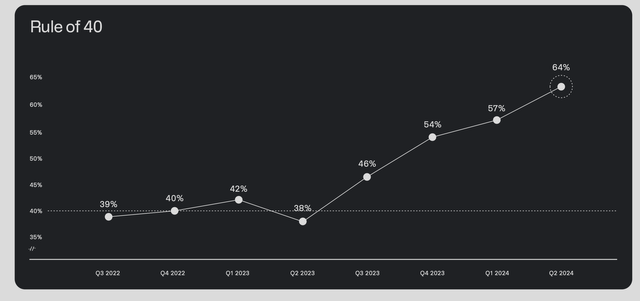

Palantir is a great company, already producing considerable profits. The software business has far surpassed the Rule of 40 goal, hitting 64% in the last quarter due to the strong combination of 27% growth and 37% operating margins.

Source: Palantir Tech. Q2’24 presentation

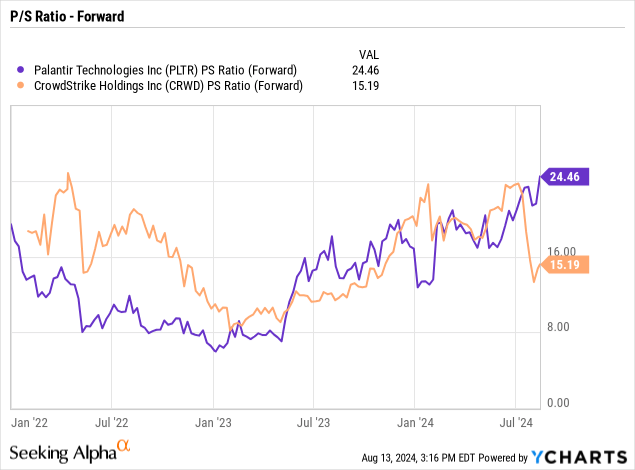

The issue is that the stock has long been disconnected from the business. Palantir now trades at nearly 25x forward sales targets, when investors could’ve bought the stock at 8x targeted sales in early 2023. The company has a huge growth opportunity in enterprise AI software, but the growth rates aren’t as impressive as the valuation multiple would suggest.

CrowdStrike Holdings, Inc. (CRWD) is a prime example of what can occur with an enterprise software stock trading at a highly premium valuation and the business runs into a hiccup. Palantir is working with defense organizations, and any software problem opening up a national security event could be devastating for the business.

CrowdStrike fell 50% dropping from $400 to $200 simply by disrupting business operations at customers due to a software implementation flaw leading to a high-profile dispute with a large customer. An actual security issue could be far more damaging for either company, leading to a struggle to ever recover, while the stock could be flat to down for years due to the premium valuation disappearing.

As an example of the valuation disconnect, consensus analyst estimates have Palantir producing $6.1 billion in revenues in 2028 for nearly 11x targets. A software company with mid-20% growth rates would be expected to trade nowhere higher than 10x forward sales targets, suggesting Palantir could end up in 2028 with the stock still trading at $30.

The stock made far more sense when trading at $10 to $15. The valuation was stretched, but Palantir trading at 10x forward sales targets was at least practical, providing a logical upside with faster growth rates.

The problem here is that stock returns from the current price above $30 require Palantir to trade at extreme valuations. Even the ultra-Bullish Dan Ives from Wedbush only has a $35 price target on the stock. To just hit this price target requires Palantir to trade at a massive valuation topping $75 billion for a company set to only hit $2.7 billion in sales this year.

Takeaway

The key investor takeaway is that Palantir is a great company in enterprise AI software, where demand will produce substantial growth rates over the next decade. The concern now is that the stock already factors in those growth rates, while any hiccup in the business operations could leave investors with a 50% dip, or even more.

Investors should use the recent rally to find an exit point. The stock has so much momentum now that Dan Ives’ $35 price target might provide the perfect exit point. However, investors need to clearly understand such a price reflects perfection, not a stopping point on the way to higher prices in the next year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.