Summary:

- Palantir Technologies’ stock has surged 88.5% since August, outperforming the S&P 500, but shares are now deemed excessively expensive.

- Despite impressive revenue and profit growth, including a 34.8% revenue increase in Q3 2024, the stock’s valuation is unsustainable.

- The company’s strong financials, including no debt and $4.56 billion in cash, are overshadowed by its high trading multiples.

- Given the lofty valuations, even with continued rapid growth, I downgrade Palantir Technologies to a ‘sell’ due to likely underperformance.

hapabapa

One of the best performing stocks in recent months has been none other than software giant Palantir Technologies (NYSE:PLTR). Since I last reaffirmed the company as a ‘hold’ candidate back in August of this year, shares are up an astounding 105%. That’s over 18 times the 5.7% increase experienced by the S&P 500 over the same window of time. A chunk of that upside came from the 11.1% jump shares saw on November 15th after it became clear that the firm will be joining the NASDAQ. In that previous article, I made the claim that while the company was exhibiting robust performance improvements, shares were ‘nearing the tipping point’. What I meant by this was that the stock had gotten so expensive that a downgrade to a ‘sell’ was probably not a long way away.

Admittedly, some of the fundamental improvements the business exhibited warranted a positive re-evaluation of the firm. But even with those improvements, the stock has gotten ridiculously pricey. Even if we assume continued rapid growth for the next few years, shares are trading at levels at, frankly, don’t make sense. In the near term, we could see the stock continue to appreciate. But absent something majorly positive coming out, such an increase would be undeserved. Because of this, I have no choice but to finally downgrade the stock to a ‘sell’ to reflect my view that, for the foreseeable future, shares are likely to underperform the broader market.

Time for a downgrade

Fundamentally speaking, things have been going really well for Palantir Technologies and its investors. Take results from the third quarter of the 2024 fiscal year as an example. This is the only quarter for which new data is available that was not available when I last wrote about the company a few months ago. During that time, revenue for the business came in strong at $725.5 million. That happens to be 34.8% above the $558.2 million the company reported for the third quarter of 2023.

Growth for the company has been broad based. For starters, growth in the US has been incredibly strong. Revenue jumped from $345 million last year to $499 million this year. That’s a gain of roughly 44% year over year. In fact, sequential growth for the quarter was roughly 14%. The heavy lifting here came on the commercial side of things. The fact of the matter is that big investments in AI have fueled demand for the company’s services. This led to a roughly 54% surge in US commercial revenue growth, taking sales from $116 million last year to $179 million this year. U.S. government revenue growth was a more modest, but still strong, 40%, taking revenue from $229 million to $320 million.

During the third quarter of the 2024 fiscal year, the company had 321 commercial customers in the US. This was up 9% compared to the 295 customers that the business had during the second quarter. It also happened to be around 77% above the 181 customers that the company had at the end of the third quarter of last year. This accounted for the bulk of the commercial customer increase that the company saw globally. Total commercial customer account happened to rise roughly 51% year over year, expanding from 330 last year to 498 this year. When you do the math, you find that US commercial customers accounted for 83.3% of the overall commercial customer additions for the year.

As I mentioned earlier in the article, the company saw some pretty impressive growth when it came to government revenue in the US. Global government revenue shot up from $308 million to $408 million on a year over year basis. When you compare this with the previous numbers that I mentioned, with U.S. government revenue growth expanding from $229 million $320 million, you find that the US government accounted for 91% of the company’s overall government revenue growth. And when you strip out the commercial customers, with the total number of customers for the company expanding from 453 last year to 629 this year, you find that the business added only 8 government customers on a year over year basis.

However, government customers almost always come with big checks. For instance, during the third quarter of the year, the company signed a new five-year contract to expand Maven Smart System AI/Machine Learning capabilities across U.S. military services that could be worth up to $100 million. But of course, this is only the tip of the iceberg. While it is true that government customers do have larger deals, there are a lot more deals on the commercial side. During the third quarter on its own, the company signed 130 deals with US commercial customers. Of all of its deals closed during the third quarter, 104 were worth at least $1 million each. 36 of those were worth at least $5 million, and 16 were worth at least $10 million.

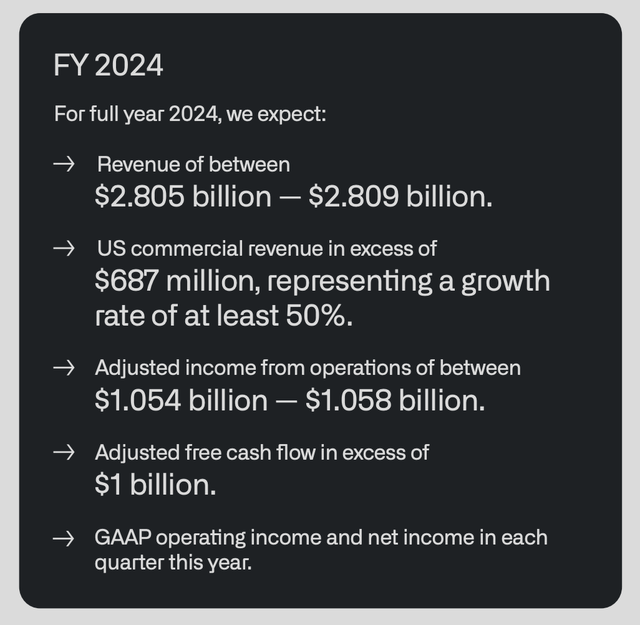

This robust performance necessitated an increase in guidance for the year. Previously, at the midpoint, management had been forecasting revenue for 2024 of $2.746 billion. Now, the range has been moved up to between $2.805 billion and $2.809 billion. At the midpoint, this would be 26.2% above what the company generated last year. They have also increased their guidance when it comes to profitability. The previous guidance had called for adjusted income from operations of between $966 million and $974 million. That has now been pushed to between $1.054 billion and $1.058 billion. Free cash flow, on an adjusted basis, used to be forecasted at between $800 million and $1 billion. Management is now forecasting this to be in excess of $1 billion.

This increase in guidance on the bottom line has been fueled by margin expansion in addition to the increase in revenue. Again, talking about third quarter earnings figures, we see that the company generated net profits of $143.5 million. That’s just over double the $71.5 million reported one year earlier. That’s an increase in the company’s net profit margin from 12.8% to 19.8%. Adjusted net income shot up from $155 million to $241.6 million. That’s an increase from 28.8% of sales to 33.3%.

But that’s not all. The company also saw improvements when it came to cash flow figures. Operating cash flow expanded from $133.4 million to $419.7 million. If we adjust for changes in working capital, we get an increase from $199.1 million to $337.3 million. That represents an increase from 35.7% of sales to 46.5%. And finally, EBITDA grew from $171.9 million, or 30.8% of revenue, to $283.6 million, or 39.1% of revenue. For context, in the chart below, you can also see financial results for the first nine months of 2023 compared to the first nine months of 2024. As was the case for the third quarter on its own, the first nine months of this year ended up being far better than they were for the first nine months of 2023.

This robust performance has also allowed the company to continue growing its net cash position. At present, Palantir Technologies has no debt on its books and it enjoys $4.56 billion worth of cash and cash equivalents. That’s well above the $4 billion reported for the second quarter of this year on a net basis, and it is above the $3.29 billion that the business had at the end of the third quarter of 2023. This gives the company a tremendous amount of flexibility and stability. It also gives it fuel with which to grow if management so desires. In terms of balance sheets, you can’t ask for much better than this.

Unfortunately, there is a downside to this rapid growth and these high-quality operations. And this is that shares are, quite frankly, massively expensive. Instead of focusing just on this year, I wanted to look at a couple of different scenarios. You see, while management did come out with guidance for the fourth quarter of this year for revenue of between $767 million and $771 million, that still translates to a year over year increase in sales of only 26.4%. And as I mentioned earlier in this article, revenue for the entirety of this year is likely to be only 26.2% above what it was last year.

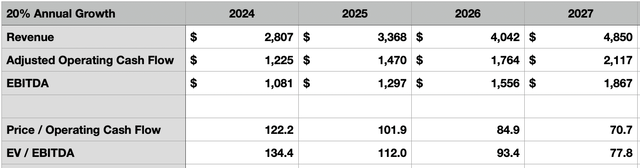

In the table above, I decided to look at what happens if the company continues to grow revenue, adjusted operating cash flow, and EBITDA at a rate of 20% per annum after this year. This year, the company seems to be trading at a price to adjusted operating cash flow multiple of 122.2 and at an EV to EBITDA multiple of 134.4. But even if the business continues to expand at the growth rate mentioned, by 2027, it will still be trading at multiples of 70.7 and 77.8, respectively. The EV to EBITDA multiple does assume that the company continues to spend very little on capital expenditures and continues to accumulate all of its excess cash onto its books.

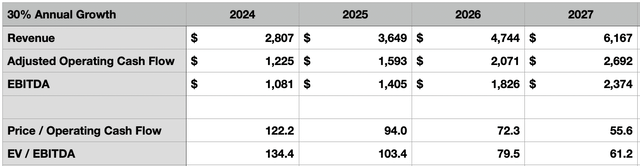

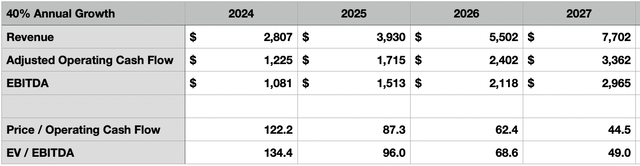

But what if the business expands at a rate that is faster than this? As part of my analysis, I created the next table above. This assumes a 30% annual growth rate to these metrics. By the end of 2027, shares are still trading at multiples of 55.6 and 61.2, respectively. In the table below, meanwhile, I did the same thing regarding a scenario where results continue to expand by 40% on an annualized basis. And even in this case, the company is trading at a price to adjusted operating cash flow multiple of 44.5 and at an EV to EBITDA multiple of 49.0 by the end of 2027. Even if the company continues to exhibit rapid growth beyond that point, those are multiples that I would consider to be at the high end of the fair value range. But as the business grows, it is likely that further meteoric growth will slow as well.

Takeaway

Truly, Palantir Technologies is one of the biggest growth stories of the last several years. The company has done an extraordinary job of expanding its revenue, profits, and cash flows. However, shares have just gotten far too expensive. It’s difficult to fathom just how pricey shares have gotten. And even if we assume that growth becomes even greater than what has been forecasted for this year, the stock still ends up trading at levels, multiple years from now, that are well above what most investors should feel comfortable with. I also don’t believe that the firm’s move to the NASDAQ will fundamentally change any of this. Because of this, I have no choice but to downgrade it to a ‘sell’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!