Summary:

- Advancements in AI technology have led to billions of dollars in investments, particularly in data centers and companies’ data capabilities.

- Palantir is a major beneficiary, helping businesses integrate and manage their data while offering analytics and cybersecurity services.

- The company’s new AI offerings have boosted revenue and profits, positioning it for continued growth in both commercial and government markets.

- Despite the growth potential, the current stock price appears too expensive, leading to a “Hold” rating.

NicoElNino/iStock via Getty Images

The Investment Case

Advancements in artificial intelligence are arguably the biggest technological leap of humanity since the internet. This advancement comes with billions of dollars invested in the technology.

The main resource companies building AI models need is data. After all, all machine learning models, including ChatGPT, are trained on massive datasets.

The initial reaction of big technology companies after understanding this necessity was to invest in improving the data infrastructure. This included building data centers to increase data storage and processing capacity, as well as enhancing power generation to ensure data centers could operate efficiently. That was why Amazon is still a “Buy” and infrastructure investments remain intriguing.

Following this initial surge of infrastructure investments, companies trying to integrate AI realized another significant need. They required their data to be centralized and structured, so they could use it to build AI models and extract better insights to improve their businesses. This is no easy task.

That is where Palantir (NYSE:PLTR) comes in. It has already been helping businesses integrate their data, make it usable, and providing analytics and cybersecurity services. Now, with advancements in AI, companies need its services even more.

The investment case is simple: as companies increasingly rely on data, driven by AI and other business improvements, Palantir will realize higher demand. However, modeling future earnings and calculating the fair value of the business reveals that the stock is overvalued, leading to a “Hold” conclusion.

Understanding The Business

As mentioned, Palantir has been helping companies and government agencies integrate their data and has been offering data analytics and cybersecurity solutions.

It provides these services through 3 platforms: Gotham, Foundry, and Apollo.

Palantir describes Gotham as the “operating system for global decision-making”. It helps users integrate, clean, and manage data from various sources. It also visualizes the data and reports numerous analytics. Palantir highlights the platform’s security features that protect sensitive data. This is why Gotham is preferred by government agencies and it has military applications. It is used also in counterterrorism, law enforcement, cybersecurity, disaster response, and emergency management.

Foundry is a similar offering aimed at enterprise customers. It is a versatile data integration and analytics platform, helping transform complex data into actionable insights. This platform or “operating system” is used by data scientists and analysts in a broad range of sectors.

Apollo, on the other hand, is used to deploy software across diverse environments such as the cloud or on-premises. It allows users to monitor the status and performance of deployed software and alerts them if it identifies any issues. Additionally, it helps users maintain compliance with industry standards and provides security controls.

With these capabilities, Palantir was already an extensive data management platform. However, it made headlines in April 2023 when it introduced its Artificial Intelligence Platform (“AIP”). As the company states, the “software and company were built for this moment”.

Using the company’s existing products, AIP automates data integration, cleaning, and transformation, reducing the technical expertise needed to interact with data.

Moreover, through this segment, Palantir offers specialized machine learning models directly within the platform. As introduced last year in April, analysts working for the military can use ChatGPT-like language models to get insights from data. An example can be found below.

palantir.com

Providing this level of simplicity, Palantir allows users to interact with and learn from data without the need for extensive technical expertise. This is crucial for any organization from government agencies to various other sectors.

With this innovation, Palantir has transformed from a company helping with data integration and management to one that enables its customers to have access to artificial intelligence models trained on their data, which Palantir helps gather, clean, and structure. Thanks to its security and privacy features, government agencies continue to work with Palantir.

AI Remains The Largest Driver of the Business

This new AI offering has extended the lifespan of Palantir’s business for years, maybe even decades.

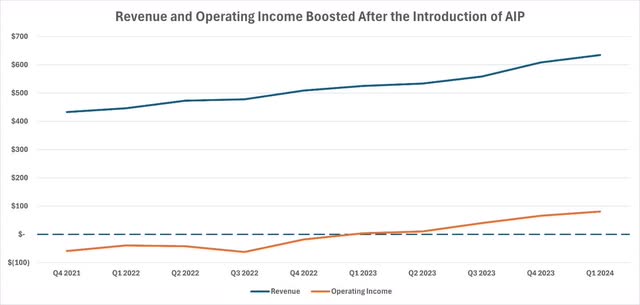

Revenue was already increasing before AIP was introduced, but the new platform had a significant positive impact on both revenue and bottom-line profits. Operating income, which was slightly above zero in Q1 2023, reached $81 million in Q1 2024.

S&P Capital IQ

Palantir is poised to continue to grow in both commercial and government markets.

Companies are increasingly investing in AI capabilities to improve business functions. AI not only allows employees to “talk to a computer” but also helps extract more actionable information from the data the company itself generates and collects. As these investments increase, Palantir will benefit as the go-to company for data gathering, management, and company-specific AI language models.

Additionally, there are substantial switching costs for government agencies. Palantir’s products are already used in critical government functions such as intelligence, counterterrorism, and military operations. The company believes it can capture an even greater share of the federal government spending, which seems possible. AI technology has the potential to revolutionize these government functions.

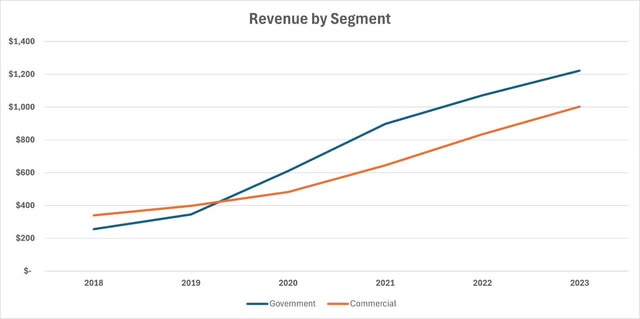

Currently, Palantir generates more than half of its revenue through products and services provided to government agencies.

S&P Capital IQ

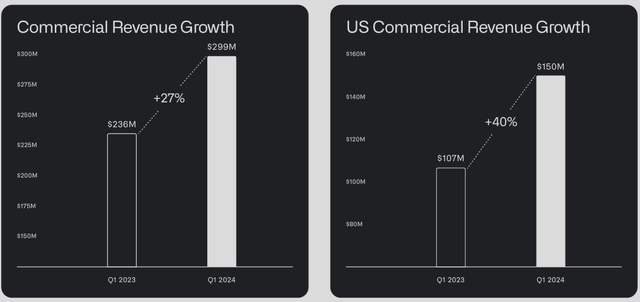

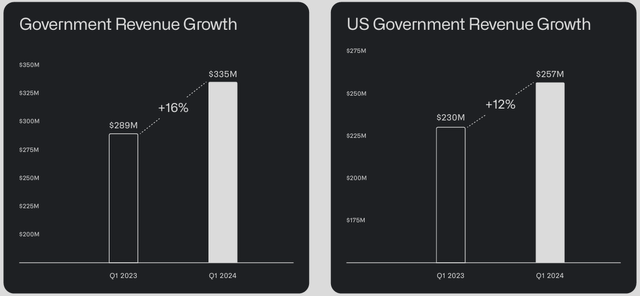

However, the commercial segment seems to be growing at a faster pace compared to the government segment. Year-over-year commercial revenue growth was 27% in Q1 2024, compared to the 16% growth of government revenue.

Palantir Q1 2024 Business Update

Palantir Q1 2024 Business Update

Additional Growth Strategies

The company highlights certain growth strategies in the most recent annual report.

Some of these have already been mentioned, such as the aim to become a more crucial supplier to the government.

In addition, Palantir aims to improve its direct sales force and increase cloud partnerships to reach new customers and upsell existing customers with new products and services.

Furthermore, the company is developing “central operating systems” for entire industries, helping government agencies and companies manage operations from a single platform.

While making these advancements, Palantir faces limited competition, as the company believes no competitors currently offer what it does. The most significant competition comes from the internal software development efforts of existing and potential customers.

Bearish Scenario Would Require A Slowdown In AI Spending

There is no arguing that the company has been successful so far in convincing customers of the importance of its products. Earnings growth has been impressive, in particular since the beginning of 2023. Companies seem to be continuing to invest in their data and artificial intelligence capabilities.

However, like most sectors, there is a chance that we’ll find artificial intelligence spending to be cyclical. Although it is incredibly intriguing now, there may come a time when we will be speaking of overinvestment in AI infrastructure, and more specifically data centers. The industry cannot sustain its current growth rate forever.

The potential slowdown also applies to government and corporate spending on AI technology and data. A reduction in spending on these capabilities could directly impact Palantir’s sales.

However, I do not believe this is going to happen soon.

Firstly, as mentioned, Palantir is a great partner for the government, and this relationship entails high switching costs. It is not easy for law enforcement, intelligence, and military agencies to stop using Palantir and switch to another provider, even if they can find another.

Additionally, artificial intelligence represents a new growth opportunity for many companies. Big tech companies, sitting on substantial cash reserves, now have a high-growth field to invest in. Many smaller companies see AI as a way of becoming more efficient and improving their operations. Gaining more insights from data becomes increasingly important, and companies that do not invest in their analytics capabilities fall behind the competition. In this environment, Palantir’s products are needed.

Even if the demand for Palantir’s products and the overall AI spending were to decline, I do not expect this to happen within the next 12 months.

Valuation

We will use a Discounted Cash Flow (“DCF”) model for the fair value calculation.

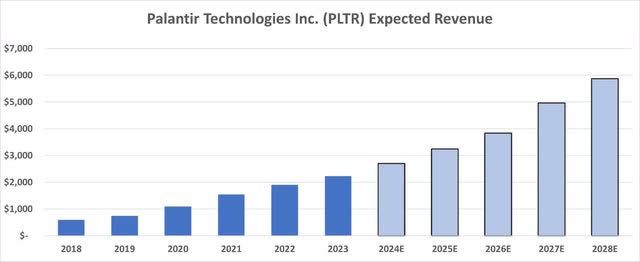

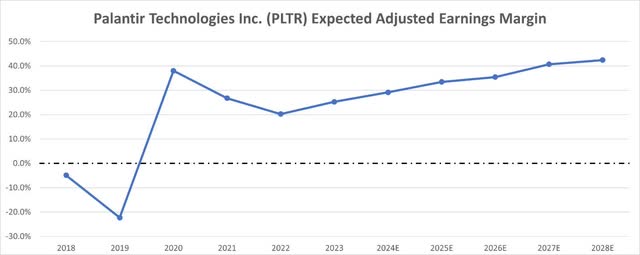

I am painting a very bullish picture for these calculations. As shown below, I am projecting strong sales growth and earnings margin expansion for Palantir. This means that the company will continue to upsell its existing customers and find new customers going forward, and the AI spending will not fade away.

S&P Capital IQ & Author

S&P Capital IQ & Author

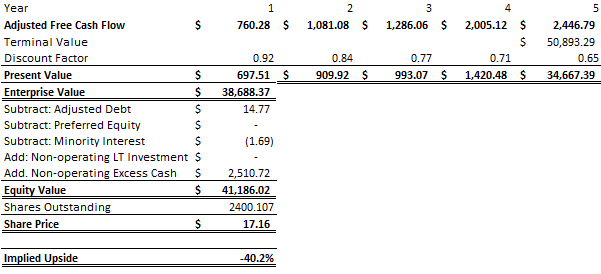

Continuing the bullish stance, I am using a terminal growth rate of 4%, above long-term inflation targets due to strong growth expectations, a long-term risk-free rate of 2%, a market risk premium of 5.7%, and the stock’s 5-year equity beta. The company has no debt on its balance sheet, therefore its cost of capital is equal to the cost of equity.

Please refer to one of my older articles if you want more details about my excess cash calculations.

Using these earnings assumptions, we find an equity value of $41.2 billion, translating to a target share price of $17.16. Even with very bullish estimates, the DCF shows a downside potential of -40% at the time of this article’s writing.

Author

Conclusion

I believe Palantir is an amazing business. It has already been helping companies and government agencies with data gathering, management, and analytics. With recent advancements in artificial intelligence and Palantir’s AIP, the company has become even more integral to business improvement through data.

There are high switching costs once you are a customer, so recurring revenue is high. Additionally, Palantir has a significant opportunity to expand its customer base as the dominant player in the industry.

The bear case requires companies and government agencies to stop using their data capabilities and discontinue using Palantir’s products, which is unlikely in the short term. Therefore, projections used in the DCF model may be aggressively positive. However, even with these estimates, the stock appears too expensive.

Despite my bullish stance on Palantir’s fundamentals and growth potential, I feel uncomfortable owning the stock at these price levels. Therefore, Palantir receives a “Hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.