Summary:

- Palantir’s stock has experienced a significant rise due to growing investor confidence and government contracts.

- The company’s financial performance has been strong, with profitable years and increased revenue.

- Concerns about overvaluation and scalability have been addressed, leading to a more optimistic investment thesis for Palantir.

Michael Vi

The remarkable ascent of Palantir Technologies’ stock (NYSE:PLTR) in the past year, spurred by growing investor confidence and significant government contracts, marks a significant shift from the skepticism highlighted in my initial analysis. To delve deeper into this transformation:

-

Investor Confidence and Market Dynamics: Palantir has captivated retail investors, particularly enthused by its cutting-edge AI capabilities. This investor segment, predominantly small investors rather than professionals, has been instrumental in driving the stock’s high momentum. The surge in stock value can be attributed to a blend of investor optimism and Palantir’s strategic progress, with the stock experiencing a 187.6% rise over the past year and a 38.7% increase since the year’s beginning.

-

Government Contracts as a Growth Lever: Palantir’s business strategy has been significantly bolstered by securing substantial government contracts. A notable instance is the $178.4 million deal with the U.S. Army for the Tactical Intelligence Targeting Access Node (TITAN) systems, a testament to Palantir’s prowess in providing AI solutions to government agencies. This contract, along with the $99.6 million agreement with the U.S. State Department for health monitoring software, demonstrates Palantir’s expanding footprint in government sectors beyond its traditional defense and intelligence clientele.

-

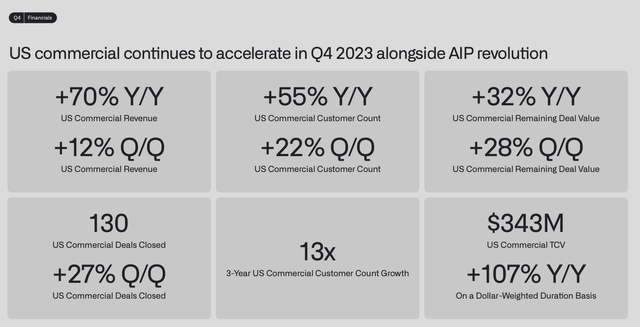

Financial Performance and Forecast: Palantir’s financials have shown robust growth, underpinning the optimism surrounding its stock. The company reported a profitable year in 2024, buoyed by strong demand for its AI products. It signed 103 deals each over $1 million in Q4 2023 alone, and its U.S. commercial revenue increased by 70%, reflecting a significant business expansion. These figures have not only validated the company’s growth trajectory but also painted a promising picture for future earnings potential.

-

Revisiting Valuation Concerns: Initially, there were concerns regarding the overvaluation of Palantir’s stock. However, the company’s recent financial performance and the securing of lucrative contracts have led to a reevaluation of its market value. While the stock might still seem high by traditional valuation metrics, the growth potential harnessed through its AI and data analytics capabilities, coupled with strong government and commercial engagements, provide a more favorable outlook.

Palantir Financial Snapshot (Palantir Q4 Earnings Presentation)

In conclusion, the positive shift in Palantir’s fortunes is underpinned by a combination of strong financial performance, strategic government contracts, and increasing investor confidence in its AI-driven business model. This marks a notable departure from the earlier concerns about scalability, overvaluation, and an unproven value proposition, suggesting a more optimistic investment thesis for Palantir Technologies moving forward. In reassessing Palantir Technologies from an investment perspective, we must consider the evolution of key factors initially pointing towards a “Sell” recommendation.

Overvaluation Concerns

The previous analysis indicated a notable discrepancy between Palantir’s stock price and its fundamental value, hinting at potential overvaluation. However, recent trends compel us to rethink this stance. The upward trajectory of Palantir’s stock, fueled by market enthusiasm, reflects a growing recognition of the company’s intrinsic value. This change is not merely speculative; it’s rooted in tangible advancements. Palantir’s recent financial results, characterized by solid growth and profitability, especially in the fourth quarter of 2023, underscore a strong financial base. Additionally, the company’s substantial stock performance, outpacing market indices with a surge of 187.6% over the past year, aligns more closely with its enhanced AI technology capabilities and overall financial health. This performance suggests that the market is pricing Palantir’s potential more optimistically, considering its AI technology not just as a promising venture, but as a driver of tangible growth.

Addressing Scalability

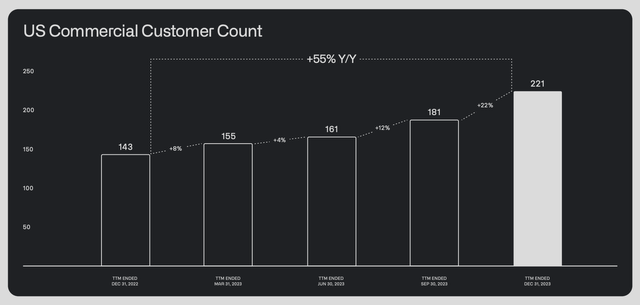

The original analysis raised concerns about Palantir’s scalability, primarily due to its modest rate of customer acquisition and contract expansion. However, recent developments indicate significant improvement in this area. The company’s substantial increase in U.S. commercial revenue, which surged 70% as reported, demonstrates enhanced capability in not only acquiring but also effectively monetizing its customer base. Moreover, the signing of 103 deals each over $1 million in the fourth quarter of 2023 signals a scaling up of business operations, dispelling earlier apprehensions about its growth trajectory. These improvements in scalability are not just confined to commercial ventures; Palantir’s ability to secure substantial and high-value government contracts, such as the $178.4 million Army deal and the $99.6 million State Department contract, shows its growing appeal and effectiveness in navigating the complex government sector.

Commercial Customer Development (Palantir Q4 Earnings Presentation)

Articulating Value Proposition

Initially, Palantir’s ability to demonstrate the tangible value of its offerings to clients, particularly in the competitive data analytics and AI space, was unclear. The past year has witnessed a shift in this dynamic. The successful closure of sizeable deals and a discernible impact on financial performance are now evidencing the value that Palantir offers to its clients. Notably, the company’s government contracts are emblematic of its value proposition, especially considering the stringent requirements and high stakes involved in such agreements. The government’s trust in Palantir for critical projects like TITAN and health monitoring for the State Department speaks volumes about the perceived and realized value of its technology. This tangible demonstration of value, especially in high-visibility and high-impact projects, lends credence to Palantir’s claims of its technology’s effectiveness and market relevance.

In light of these developments, the previous “Sell” recommendation for Palantir warrants reconsideration. The company has shown notable progress in addressing key concerns, reflected in its improved financial performance, successful expansion in both the commercial and government sectors, and a clearer demonstration of its value proposition. These factors suggest a more optimistic outlook for Palantir Technologies, making it a potentially more attractive investment than previously assessed. However, investors should continue to monitor these factors closely, as the technology and government contracting landscapes are subject to rapid and unpredictable changes.

Driving Forces Behind Palantir’s Stock Ascendancy

For Palantir Technologies in 2024, several potential catalysts could further propel its stock price. Firstly, the continuation and expansion of government contracts, such as the recently secured TITAN and State Department deals, could significantly boost revenue and investor confidence. The government sector, with its large-scale and long-term contracts, presents a steady growth avenue.

Another key catalyst could be breakthroughs in commercial sector engagements. Given the 70% surge in U.S. commercial revenue, further expansion in this domain, especially with large-scale enterprises, could bolster Palantir’s market position and drive its stock price upwards.

Technological advancements, particularly in AI and data analytics, where Palantir already exhibits strength, offer another avenue for growth. As the company continues to innovate and potentially unveil new AI-driven products or features, these could open up additional markets or enhance penetration in existing ones, providing a significant push to the stock value.

Finally, the broader market’s increasing emphasis on AI and data-driven decision-making could act as a macroeconomic catalyst. As businesses and governments alike recognize the value of advanced data analysis, Palantir, being at the forefront of this technology, could see heightened demand for its offerings, thereby positively impacting its stock price.

A Glimpse on Palantir’s valuation

Palantir exhibits a notably high Price-to-Earnings ratio, recorded at 259.96 as of March 18, 2024 and a forward P/E ratio of 72.46. This elevated ratio, well above that of peers like IBM (P/E 23.75) and Microsoft (P/E 38.10), suggests that investors are pricing Palantir’s shares with considerable expectations for future growth. Palantir so far has been able to meet these expectation and the forward P/E suggest this gap narrowing over the coming year. The premium in the P/E ratio often indicates strong market confidence in the company’s forward-looking earnings potential, especially in innovative fields like AI and data analytics where Palantir is operating in.

Navigating the Hazards: Risk Factors for Palantir

While the outlook for Palantir Technologies appears increasingly optimistic, several risk factors loom that could impact its trajectory in 2024. The intense competition in the AI and data analytics sectors from established players like Microsoft (MSFT), IBM (IBM), Google (GOOG), Splunk (SPLK) and emerging startups presents a constant challenge. Another risk is the dependence on government contracts, which, while lucrative, can be subject to political shifts and budgetary constraints. Technological innovation, a key driver of Palantir’s success, also poses a risk; any slowdown or failure in delivering cutting-edge solutions could hamper growth. Additionally, macroeconomic factors such as market voMSFlatility or a downturn in the tech sector could also adversely affect investor sentiment and stock performance.

Conclusion

In summation, Palantir Technologies stands at a pivotal juncture. The company has demonstrated notable resilience and adaptability, addressing previous concerns and capitalizing on new opportunities, particularly in the burgeoning field of AI and big data analytics. With significant contracts and a growing presence in both government and commercial sectors, Palantir’s prospects for 2024 are bright. However, investors should remain cognizant of the inherent risks, including fierce competition, reliance on government contracts, and broader market dynamics. A balanced approach, considering both the potential catalysts and risks, would be prudent for those looking to invest in Palantir’s evolving narrative.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.