Summary:

- Palantir’s stock has surged 65.88% since October 2024, driven by strong earnings and revenue growth, surpassing market expectations.

- Despite a high forward P/E ratio of 156.35x, Palantir’s price-book ratio of 29.98x is comparable to industry peers, indicating reasonable valuation.

- Key support levels are at $40.90, with potential upward targets near $72, supported by strong bullish momentum and standard deviation price channels.

- I upgrade Palantir to a “buy” rating, contingent on maintaining momentum and avoiding significant retracements below $56.40 and $51.18.

hapabapa

When I last covered Palantir Technologies Inc. (NYSE:PLTR) on October 4th, 2024, with my article “Palantir: Considering Taking Profits“, I discussed the common arguments that the stock has reached a point of overvaluation and raised questions about whether or not it made the most sense to simply take profits on my prior gains before share prices encountered a potential reversal to the downside. Ultimately, the conclusion was that prior share price rallies were not yet over-extended and that the common arguments calling for overvaluation with Palantir seem to be missing parts of the broader picture. Since the article was written, the stock has seen another massive rally, and share prices have gained another 65.88% (far outpacing the paltry gain of 2.32% that has been seen in the S&P 500). In part, these incredible price moves have been propelled by major updates that have been seen on the earnings front.

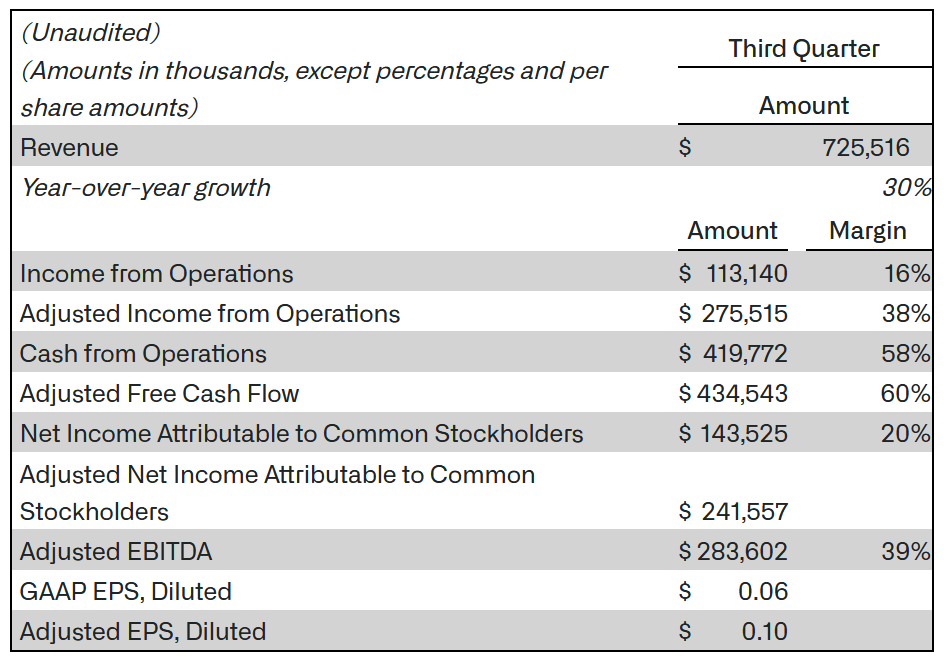

Palantir: Quarterly Earnings Figures (Palantir: Quarterly Earnings Presentation)

For the third-quarter period, Palantir generated adjusted per-share earnings of $0.10 and this surpassed consensus expectations by more than 11%. Top-line figures for the quarter came in at $726 million, and this performance beat expectations by nearly 3.6%. On an annualized basis, these revenue figures indicated growth rates of 30% and the company saw growth rates of nearly 100.7% in net income figures (at $143.5 million). In describing the company’s quarterly performances, Alex Karp (Palantir CEO) explained:

We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners.

Given the strength of the growth rates generated during the third quarter, it is not entirely surprising that guidance for the full-year period has been raised to a range of $2.805-2.809 billion, which is up from the $2.742-2.75 billion range that was released during the prior quarter. If these upwardly revised figures turn out to be accurate, this would indicate annualized revenue growth rates of roughly 26%. As a result, share prices have managed to break above the $60 in bullish trend moves that have likely surprised a large number of stock analysts.

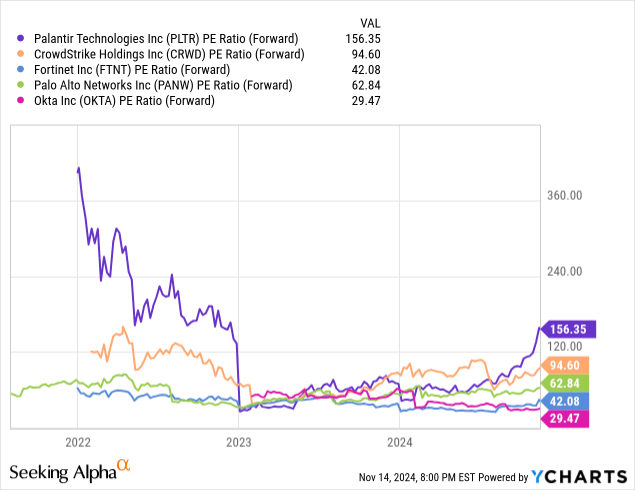

Palantir: Comparative Forward Price to Earnings Valuations (YCharts)

Data by YCharts

One of the most common arguments that is levied against Palantir is the elevated valuation that can be found in the stock’s forward price-earnings ratio (which currently stands at a lofty 156.35x). If we compare this valuation to competing stocks that can be found in the information technology and cybersecurity industries, we can see that there is certainly some validity to these arguments. Specifically, CrowdStrike Holdings, Inc. (CRWD) is one of the closer names (in terms of forward price-earnings valuations) and is currently trading with a ratio of 94.6x. However, from there, these valuations start to drop off quite dramatically. For example, Palo Alto Networks, Inc. (PANW) is currently trading at 62.84x forward earnings, while Fortinet, Inc. (FTNT) is trading at 42.08x and Okta, Inc. (OKTA) is trading at 29.47x. As we can see in the chart above, Palantir’s forward price-earnings ratio fell quite sharply for the entire 2023 period and has held those lower historical valuations for most of 2024. However, recent upticks have started to become visible, and now this metric has moved above 120x for the first time in nearly two years.

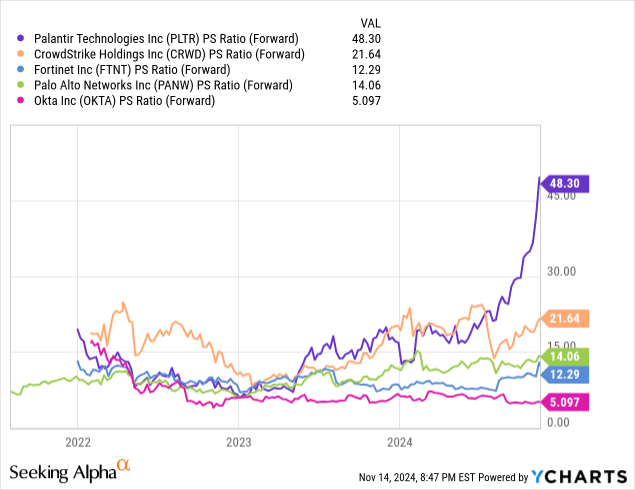

Palantir: Comparative Forward Price to Sales Valuations (YCharts)

Data by YCharts

However, the picture starts to look a bit different when we assess this grouping of stocks based on their forward price-sales ratios (at least, in terms of their recent divergences). Palantir is currently trading at 48.3x forward price-sales, and this figure has really started to spike quite substantially during the second half of 2024. In comparison, CrowdStrike is now trading at 21.64x forward price-sales, and Palo Alto is seen with a ratio of 14.06x. At just 5.097x, Okta is trading at significantly lower valuations, and these readings show that Palantir’s rise might be viewed as excessive as we head toward the end of this year.

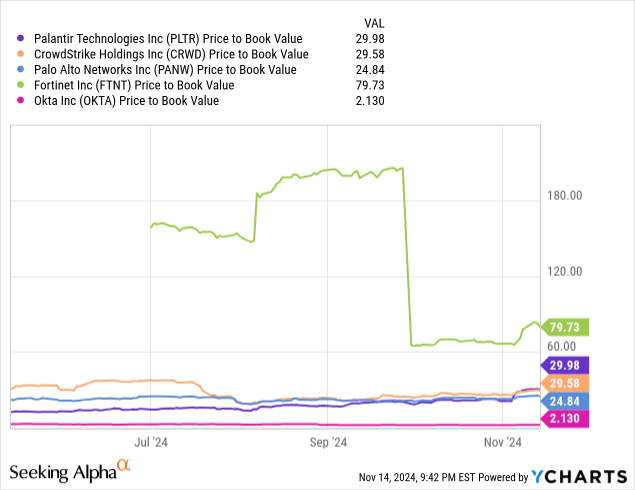

Palantir: Comparative Forward Price to Book Valuations (YCharts)

Data by YCharts

Finally, we will view these stocks based on their respective price-book valuations because this is where the picture starts to look a bit different. Specifically, Palantir is currently trading with a price-book ratio of 29.98x and this is almost the exact same valuation that we are now seeing with CrowdStrike (at 29.58x). Palo Alto Networks is trading slightly lower (at 24.84x) and Okta is currently trading at much lower valuations (at 2.13x). However, Fortinet is now trading with a price-book ratio that is significantly more expensive (at 79.73x), which means that Palantir is no longer the most expensive stock within this industry peer grouping. Using this valuation metric, we can still see that Palantir has risen into the end of 2024, but these changes have been much more subdued when we compare trends in the stock’s price-book ratio to the forward price-earnings and forward price-sales metrics.

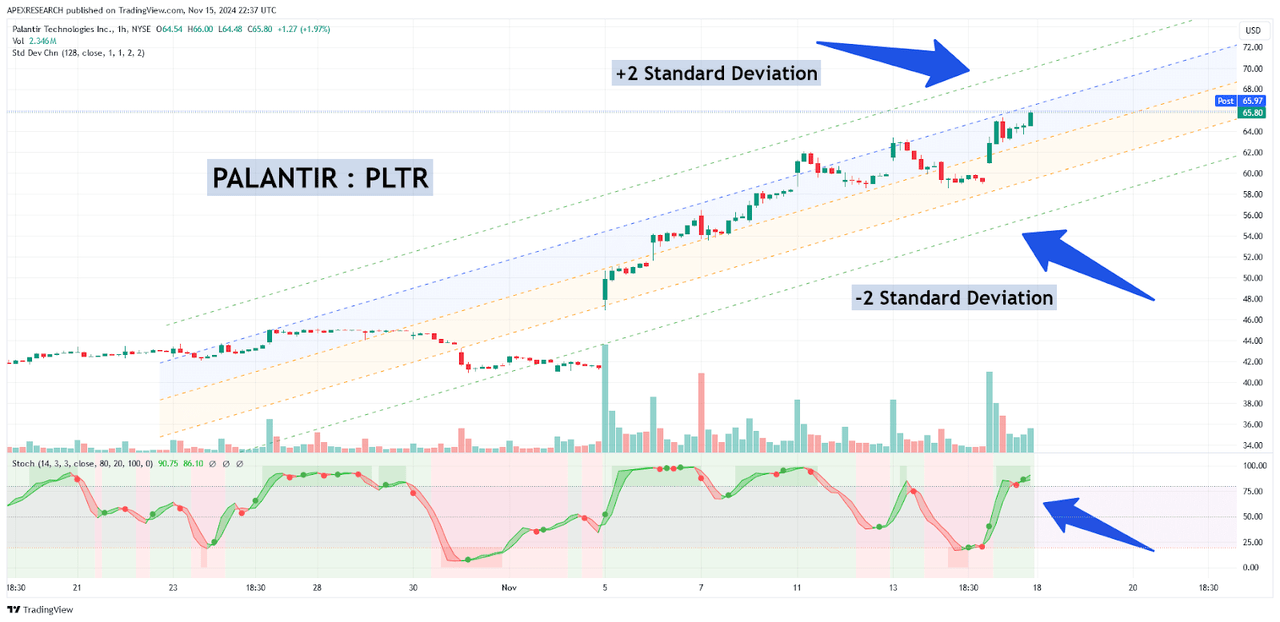

PLTR: Standard Deviation Price Channels (Income Generator via TradingView)

When looking at the share performances in PLTR that have been seen this year, we can see that the stock really began its forceful move higher on November 4th. These strong rallies help to solidify key support zones, which can now be found at $40.90 (marking the price low from October 31st, 2024). Unfortunately, when a stock is trading near record highs, it can be quite difficult to determine upward price projections because this is an asset that is literally moving into “uncharted territory.” Ultimately, this means that there will be no regions of historical support or resistance that rest above the current all-time high (which is the November 13th, 2024 high of $63.39). However, we do still have tools at our disposal in order to make these types of upward price projections, and my favorite option in this type of scenario is to use standard deviation price channels. As we can see, the stock is currently putting pressure on the +1 standard deviation channel, while the stochastic indicator is trading in oversold territory. This suggests that further rallies could be limited without a period of consolidation near-term. Of course, there is currently strong bullish momentum that continues to support share prices, and this could be enough to propel the stock toward the +2 standard deviation price channel (currently resting near $72 per share).

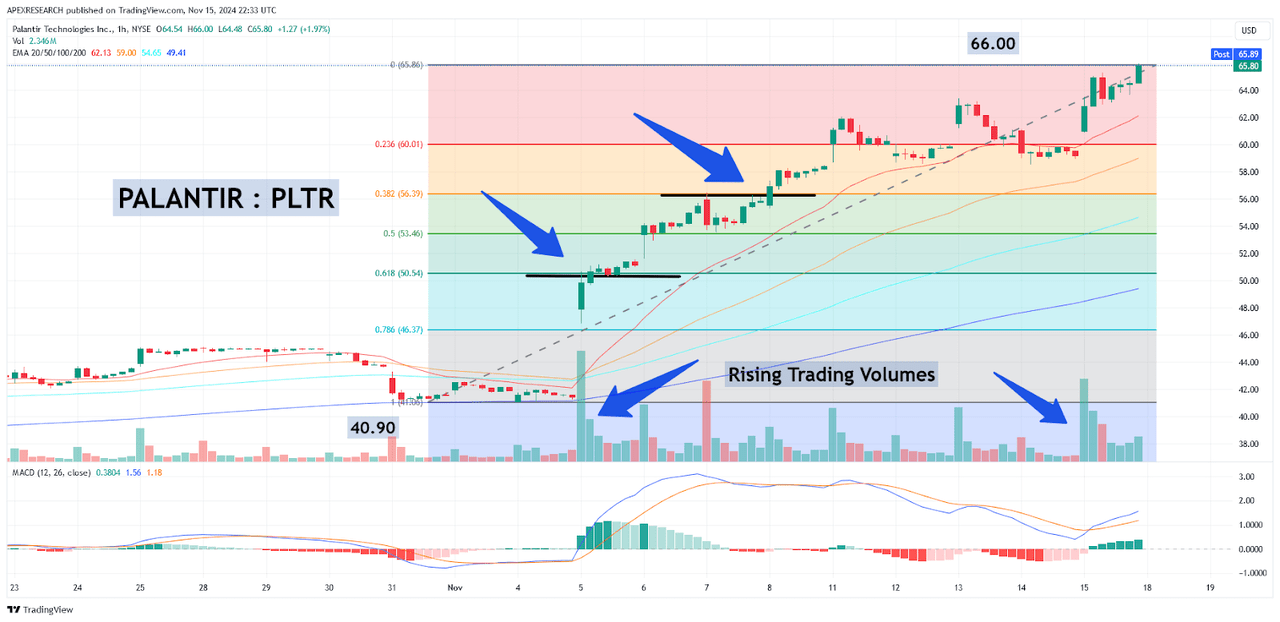

PLTR: Key Downside Reversal Pivots (Income Generator via TradingView)

For these reasons, I believe that Palantir can still extend further to the topside. Common arguments of overvaluation based on forward price-earnings metrics alone seem to be missing some of the broader picture because the stock’s price-book value is holding at fairly reasonable levels (despite the move higher that we have encountered toward the end of 2024). As a result, I will only be upgrading my outlook to a “buy” rating (rather than a “strong buy”). In order to revise my outlook (and begin to focus more on the neutral direction), I would need to see share prices break through the 38.2% Fibonacci retracement of the rally from $40.90 to $66.00 (which is located near $56.40). In order to reverse my outlook (and begin to focus more heavily on the bearish direction), I would need to see share prices break through the 61.8% Fibonacci retracement of the aforementioned yearly rally (which rests near the November 5th highs of $51.18). Until (or unless) these downside price moves occur, I will maintain my current long position and raise my rating outlook, based largely on the strong position momentum Palantir has continued to display into the final months of this year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.