Summary:

- Palantir Technologies stock has surged 86.9% in the past year due to optimism about AI growth.

- The company’s financial performance has been strong, with revenue and profits rising significantly.

- Despite impressive growth, its valuation remains high, potentially warranting a downgrade to ‘sell’ in the future.

hapabapa

One of the most impressive stocks over the past year has been Palantir Technologies (NYSE:PLTR). From one year ago today through the present day, shares are up an amazing 86.9%. This move higher has been driven in large part by optimism regarding how the company will benefit from the AI boom. But with optimism comes a risk of overvaluation. You see, back in early May of this year, I wrote an article that took a neutral stance on the company. Over the span of four days around that time, the stock had dropped nearly 19% at its worst. This was in spite of the fact that overall financial performance reported by the business for the first quarter of its 2024 fiscal year indicated that management was achieving attractive growth.

I pointed out, in that article, that investors would likely be making a mistake by buying that plunge. And this was because of how expensive shares were. Much to my surprise, things have gone a lot better than anticipated. Shares are up 33.6% since then at a time when the S&P 500 is up only 3%. As disappointing as this is to me, I do think that we are reaching the point where the stock might very well warrant a downgrade to something more bearish like a ‘sell’. Because of improved growth, particularly higher guidance for this year, I’m not pulling that trigger just yet. But it won’t take much more to justify such a downgrade.

Management has really surprised

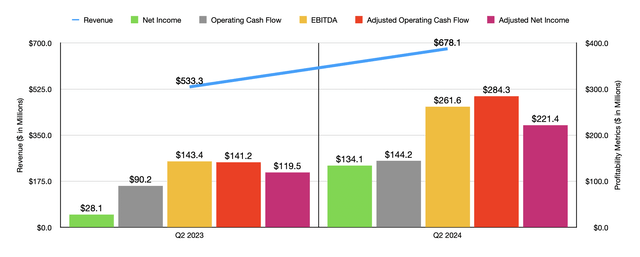

When I last wrote about Palantir Technologies earlier this year, we only had data covering through the first quarter of 2024. That data now extends through the second quarter of this year. By every measure that matters, management has done a fine job. Take revenue for starters. During the second quarter, revenue totaled $678.1 million. That’s 34.3% above the $533.3 million the company reported just one year earlier. For much of its early history, Palantir Technologies built its business around government agencies. But over the past couple of years now, management has been emphasizing the potential role that the commercial side of the economy could play in pushing revenue and cash flows higher.

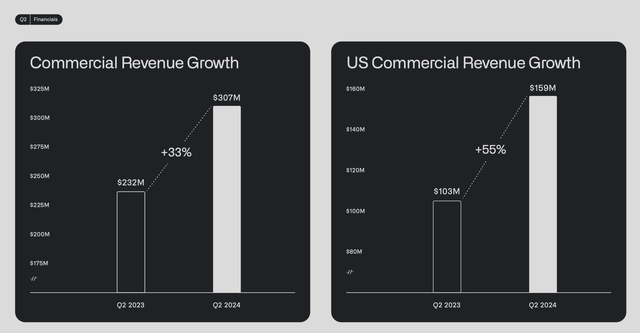

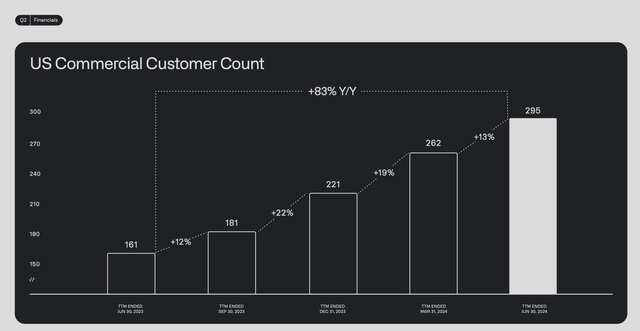

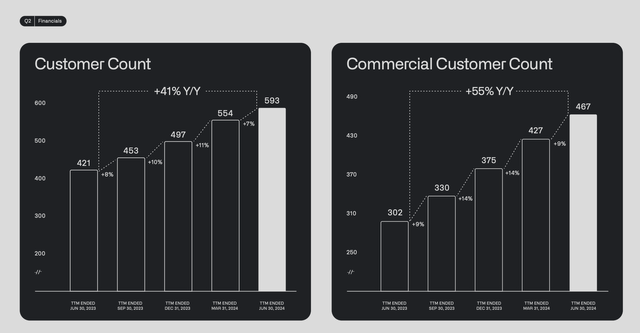

During the second quarter, the company generated $307 million in revenue from commercial activities. That’s 32.3% above the $232 million reported the same time last year. In the US specifically, commercial revenue growth was an astounding 54.4%, growing from $103 million to $159 million. On the commercial side of things, the company finally hit 295 customers in the US during its most recent quarter. That’s up from 262 in the first quarter of this year and it dwarfs the 161 that the company had in the second quarter of 2023. Its total global commercial customer count hit an all-time high of 467 during the quarter. That’s well above the 302 reported for the second quarter of 2023.

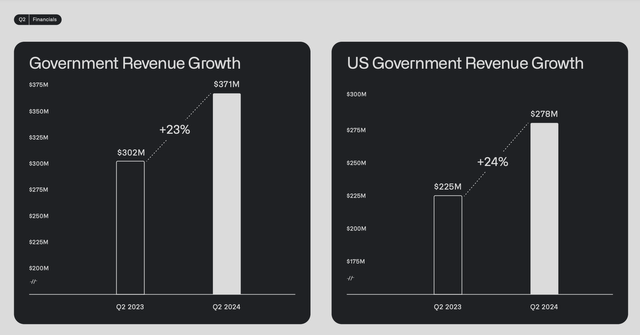

This is not to say that the company isn’t continuing to grow on the government side as well. Government revenue in the second quarter of this year was $371 million. That happens to be 22.8% above the $302 million reported one year earlier. In the US, government revenue jumped 23.6% year over year, climbing from $225 million to $278 million. When you add on to this the commercial customers that the company has, its total customer count hit 593 in the most recent quarter. This stacks up nicely against the 554 reported in the first quarter and the 421 reported in the second quarter of 2023.

During the second quarter alone, management closed 96 deals that were worth, individually, $1 million or more. 33 of these were worth at least $5 million. And 27 of them were worth $10 million or more. This is quite a haul. And, so long as nothing significantly negative comes out of the woodwork, it should translate to additional revenue growth for the foreseeable future. A lot of these contracts seem to be related to AI. In fact, during the second quarter, one of the contracts that it signed was a five year, $480 million deal, with the Chief Digital and Artificial Intelligence Office for the purpose of scaling AI and machine learning capabilities across the entire US Department of Defense.

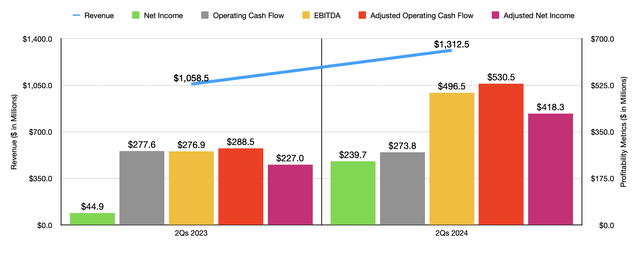

With revenue climbing, profits and cash flows have followed suit. Net income skyrocketed from $28.1 million in the second quarter of 2023 to $134.1 million in the second quarter of this year. After making certain adjustments, net income nearly doubled from $119.5 million to $221.4 million. Operating cash flow expanded from $90.2 million to $144.2 million. On an adjusted basis, where we strip out changes in working capital, we get an increase from $141.2 million to $284.3 million. And finally, EBITDA for the business expanded from $143.4 million to $261.6 million.

In the chart above, you can see financial results for the first half of 2024 compared to the first half of 2023. Clearly, things are going quite well for the company, with revenue, profits, and cash flows, all rising significantly on a year over year basis. In fact, things are going so well that management decided to increase guidance for the year. Previous guidance had called for revenue of between $2.677 billion and $2.689 billion. But now, that number has been pushed up to between $2.742 billion and $2.750 billion. At the midpoint, that’s an increase of about $63 million.

On the bottom line, management now anticipates adjusted income from operations of between $966 million and $974 million. The prior expected range was between $868 million and $880 million. At the midpoint, that’s an improvement of about $96 million, or 11%. If we assume that other profitability metrics will rise at the same rate, then we would get adjusted operating cash flow of $1.08 billion and EBITDA of $1.02 billion. These would be quite a bit higher than the $705.9 million and $666.1 million, respectively, generated in 2023.

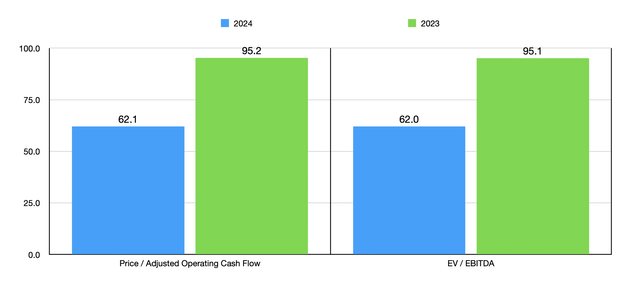

Using these figures, you can see how shares of the company are valued on a forward basis in the chart above. You can also see the valuation using results from 2023. I don’t know about you, but I consider these to be incredibly high multiples. Now to be fair, this is backed by rapid growth. But even if we assume that strong growth for the company will persist for the foreseeable future, this is a difficult valuation to get excited about.

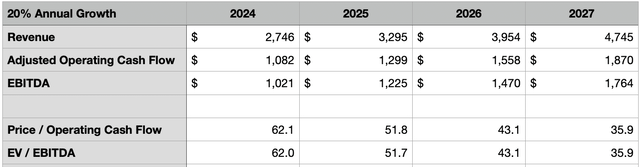

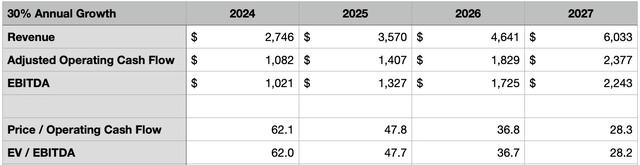

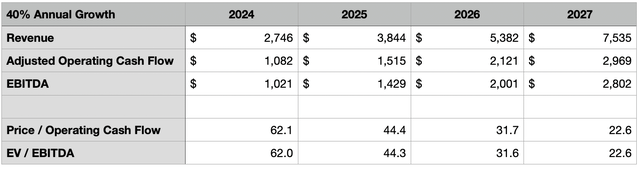

In the table above, you can see what should happen if revenue and cash flows for the company grow at a 20% annualized rate from 2025 through 2027. You can see the trading multiples of the company in those cases. Even in 2027, shares do look very pricey. However, profits this year are expected to be about 53.3% above what they were last year. So a 20% annualized growth rate might not be aggressive enough to assume. In the first table below, I repeated this analysis using a 30% annualized growth rate. And in the table below that, I did the same thing with the assumption that revenue and cash flows grow at 40% per annum. I would argue that, under the most aggressive scenario, the stock finally becomes reasonably attractive in 2027. But that’s banking a lot on future growth that might fail to impress.

Author – SEC EDGAR Data Author – SEC EDGAR Data

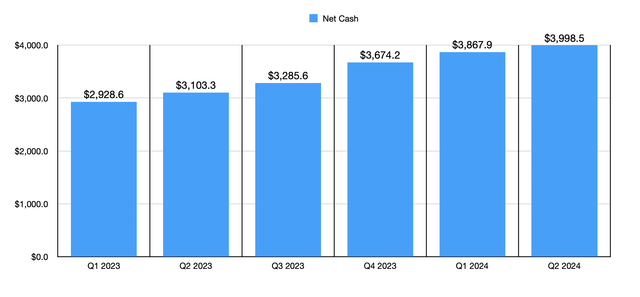

One good thing about the company is that it does have plenty of fuel in the tank. Back in the first quarter of 2023, the company had no debt on its books and it enjoyed $2.93 billion worth of cash and cash equivalents. This number expanded to $3.87 billion by the end of the first quarter of this year. And by the end of the second quarter, it had grown even more to just a hair under $4 billion. This does provide flexibility and safety for investors. It also provides the company capital with which to grow. While this situation can probably justify a slight premium, the multiples that we are looking at now still look absurd.

Takeaway

Truth be told, I’m not ready to take a bearish stance on Palantir Technologies just yet. The company is a growth machine and its balance sheet is robust. However, even the healthiest companies can reach the point of being overvalued. I do think that shares are very lofty at this point in time. And I would argue that, if we continue to see the stock outperform the broader market, without some corresponding improvement in financial condition, it may not be long before a downgrade from a ‘hold’ to a ‘sell’ is warranted.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!