Summary:

- I initially rated Palantir Technologies stock as “Buy,” but downgraded to “Sell” due to its overvaluation despite impressive growth and market position.

- Palantir’s valuation remains excessively high, driven by optimistic growth forecasts, making it vulnerable to correction if growth slows even slightly.

- Despite strong financial performance and government contracts, PLTR faces significant competition in both government and commercial AI markets, questioning its premium valuation.

- While Palantir is way more expensive than Nvidia with a more modest EPS growth rate for 2025, its stock price relative strength has begun to fade recently.

- I maintain a “Sell” rating on PLTR stock, anticipating a medium-term correction as institutional buying pressure fades and growth rates potentially decelerate.

hapabapa

My Updated Thesis On Palantir Technologies

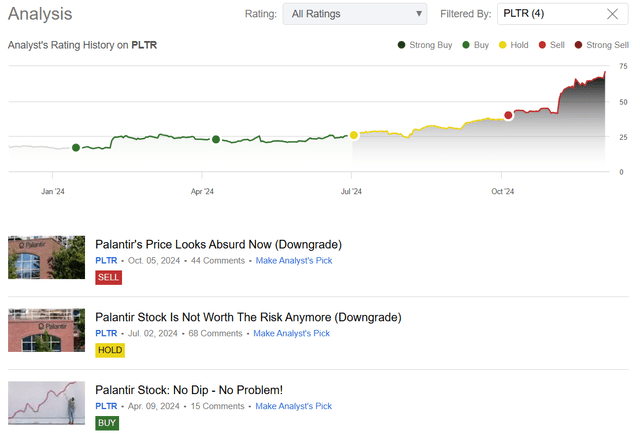

I initiated coverage of Palantir Technologies Inc. (NASDAQ:PLTR) stock back in January 2024 with a “Buy” rating, reiterating it 6 months ago on April 9, 2024. Since the publication of my April article, the PLTR stock has managed to grow significantly by July, when I had to downgrade the stock to “Hold” given its widening valuation metrics that couldn’t be explained by the firm’s insufficient growth rates (and even by out-of-consensus bullish expectations). As the stock continued its strong rally, on October 5th, I decided to downgrade it again (from “Hold” to “Sell”). That decision was based on my assessment that Palantir became significantly overvalued – many times more expensive than even Nvidia (NVDA) when factoring in EPS growth forecasts for the next 2 years. Should I say that my call aged extremely poorly since that downgrade?

Oakoff’s coverage of PLTR stock on SA

After the stock surged more than 70% following my downgrade and is now touching ATH levels, I still find it difficult to understand Palantir’s valuation. The market continues to place an exceptionally high premium on this company. I recognize that the rapid growth of its financials in recent years has been impressive, as has its dominant position in the “government AI space”. However, contrary to popular belief, Palantir is far from the only player in that space and its analytics platform for the commercial segment, while growing at a phenomenal rate, doesn’t make it a monopolist there either.

This is Palantir, not Nvidia, where the latter dominates with an 80-90% market share and may be justified to be valued as if it’s the only major player in its Gen AI niche. I believe that the current overvaluation of PLTR will inevitably lead to a correction from today’s price levels. The market seems to be pricing in tens if not hundreds of times earnings (i.e. FWD P/Es), based on very optimistic forecasts for the coming years – this kind of valuation seems fragile and unsustainable, especially if Palantir shows even the slightest signs of a slowdown in growth shortly.

In my view, the current premium is too high to remain stable. I might reconsider my thesis if Palantir’s stock price falls by 20-30% from its current level.

My Reasoning

From the Q3 2024 data Palantir released, we see that the firm is clearly taking advantage of the AI revolution everyone is talking about. Their revenue increased 30% YoY to $726 million, exceeding estimates – this increase came from the U.S. market where revenue grew 44% YoY, led by a 54% YoY increase in U.S. commercial and a 40% YoY increase in U.S. government revenue. Palantir’s success in turning its AI platform (AIP) into real results for industries and government customers has been an underlying differentiation factor with a growing customer base and deal pipeline. As of note, Palantir’s total customer count increased by 39% YoY while they signed 104 deals valued above $1 million, which is a lot. So again, the boot camp methodology of onboarding and adoption for customers has been very successful with a number of customers having made seven-figure ACV contracts in the first two months of joining, as the management noted during the latest earnings call.

Palantir’s Maven Smart System which automates critical military processes was a strong driver of the firm’s government sales during the quarter (+40% YoY). They’re pretty good at working with the government and solving the AI needs there. Their Maven system, for example, decreased targeting operations from 2,000 people to 20, and that’s quite a significant efficiency boost in my understanding. Palantir’s delivery of the next-generation Targeting Node through Titan and its new 5-year deal to provide Maven Smart System AI/ML to all branches of the U.S. military also highlight its importance to national security. I expect PLTR’s acquisitions of Combined Joint All-Domain Command and Control (CJADC2) and other leading military technologies to reinforce its leadership as a key supplier to the US government.

But I should note here, that Palantir is not a monopolist in its government offerings. I mean, yes, their products and services clearly work pretty well – otherwise, we wouldn’t see the abundance of contracts with government-related structures as of late. On the other hand, the IT government niche is full of other players trying their best to grab some part of “Palantir’s pie” so to speak. For example, Leidos Holdings (LDOS), which is actively partnering with government entities to provide customized solutions that leverage AI technologies, also offers a range of services that incorporate AI for defense applications. Its EBIT has risen over 30% YoY on a TTM basis, while the diluted EPS made 8x and almost 2x to the FY2023 and FY2022 figures, respectively. So it seems that the growth is accelerating through the IT defense niche overall, not just at Palantir.

In the commercial space, Palantir has even more severe competition, having just ~1.7% in market share, according to 6sense.com. Among notable competitors, I see IBM (IBM), Splunk, Tableau (part of Salesforce (CRM)), Alteryx, and SAS (OTC:SASDQ). Of course, given the recent strong growth of Palantir’s commercial segment, I don’t believe the selling products and services of its listed peers currently pose a significant threat, but looking at PLTR’s success, I assume these peers could begin moving in that direction. As for their technical and innovative potential, it appears, in my view, to be sufficient to present a serious challenge to Palantir’s future development and its position within its commercial niche.

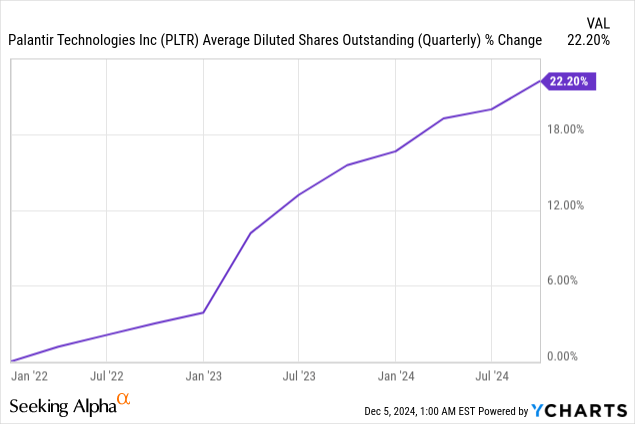

The latest financial data shows that Palantir has managed to grow profitably – something that put most investors off in 2022-2023. In Q3, Palantir’s adjusted operating margin rose to 38% compared to 36% during the previous quarter, and adjusted free cash flow ($435 million) reached a 60% margin. For the first time in trailing 12 months, the company posted more than $1 billion in adjusted FCF, which helped it end the quarter with $4.6 billion in cash and short-term investments, leaving enough capital to fund growth, share repurchases, and potential acquisitions. Unfortunately for investors, the share count keeps growing by bounds and leaps despite the FCF dynamics as of late:

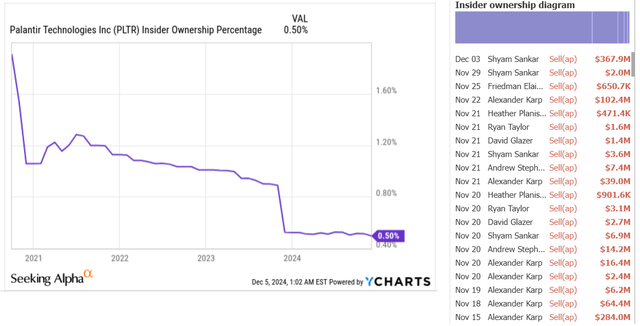

Meanwhile, I believe, it seems that insiders and top management of the company take every opportunity to sell their shares:

YCharts, TrendSpider Software, Oakoff’s compilation

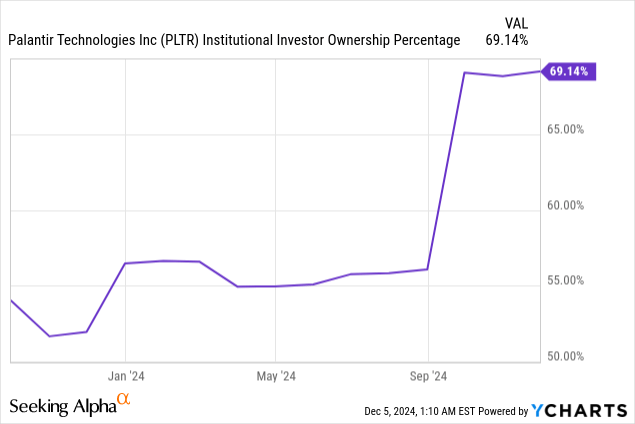

Despite that, Palantir continues to rise and hit its ATH recently – why is that? There are several reasons. First and foremost, the most obvious reason is the company’s rapid growth, with everyone focusing solely on its growth metrics -revenue, operating profit, and EPS. However, there’s an important nuance to consider here. Palantir was recently a highly unprofitable company, and while it now earns about 38 cents per share in adjusted EPS (on an FWD basis, FY2024 projection), its absolute bottom line figure remains relatively small, with a very low base for comparison. This means that as time goes on, the growth rates are likely to slow down significantly – at least, that’s my assumption. For now, though, these growth rates remain high, which continues to drive optimism and sustain the positive sentiment around the stock. Secondly, I believe the company’s quarter-end inclusion in the S&P 500 helped it raise more popularity among investors for the stock. This index is by far the most popular on the market to date, so that inclusion most likely brought in plenty of new buyers.

According to Alaric Securities, the average institutional ownership percentage among S&P 500 stocks is currently around 70% (something between 40% and 90%), so the buying pressure on PLTR from institutions is coming to an end shortly, in my opinion.

I anticipate that soon the new investors will start paying closer attention to the price they are paying for Palantir relative to its projected growth rates. As the company matures and its bottom line becomes a more significant metric for comparison, the growth rates will likely naturally decelerate. In FY2025, today’s consensus forecasts project a growth rate of about 25% YoY (slightly lower than that). Even if Palantir manages to outperform this forecast by 10-15%- let’s say that PLTR’s EPS will rise by 40% YoY in FY2025 – this scenario would result in a diluted EPS of ~$0.66. At the current stock price, this would imply a valuation of 106 times earnings for FY2025. Let’s avoid direct comparisons with Palantir’s peers and say it’s unique in what it’s doing. Then another example arises – Nvidia. NVDA is almost a monopolist in its niche, which is currently valued at less than 30 times its projected earnings for the next financial year (at a consensus EPS growth of 50%). This stark contrast underscores the premium investors are paying for Palantir, despite it being far from a “moaty monopolist” in both of its end markets.

Another factor that provides some insight into what to expect from Palantir in the future is the stock’s relative strength. While I understand that this is a technical indicator that many may view as unreliable, it still offers valuable context. This indicator suggests that the momentum behind Palantir’s stock growth is beginning to weaken. Historically, similar patterns of declining relative strength have often been followed by a correction, a period of stagnation, or at least slower growth. This is precisely what I anticipate for Palantir very soon, given the poor seasonality of the price action:

TrendSpider Software, Oakoff’s notes added

Based on those expectations, I reiterate my “Sell” rating, which may be reconsidered based on the upcoming price action.

Risks To My Thesis

I may be wrong again in my reasoning today, as was the case in October this year.

First, I might be underestimating the market appetite for Palantir’s apparent AI dominance. I say the price is too high, but the market might reward the company for its upward momentum, government AI market lead, and growing business. Also, I might have been drawing an analogy with Nvidia that made sense on valuation metrics but could not quite reflect how their respective industries are different – the government and commercial AI niches at Palantir might have different growth stories to draw analogies upon, for example.

In addition to that, I might be grossly exaggerating the chance of an extreme slowdown in growth. I believe it will slow down as the company matures, but Palantir’s capacity to consistently outperform, seal big deals, and add new customers may be able to maintain higher growth rates than I forecast. The strong free cash flow and cash on hand also give the company more leeway to make investments in growth activities, acquisitions, or buybacks of shares that may boost its value. The fact that I am assuming the buying pressure of the institutions will fade quickly might also be wrong.

Your Takeaway

I acknowledge that there are several drivers behind Palantir’s growth, such as faster industry adoption of AI, the growing importance of national security in a tumultuous geopolitical landscape, and the fact that the company can provide tangible results to its customers. The US market is a major growth driver, and businesses and government organizations have taken Palantir’s solutions. On the other hand, the slower growth of the international commercial side reflects the impossibility of scaling out its solutions outside the U.S. where AI is relatively late to the game. Then there’s the fact that the company has its dependence on large government contracts that can be subject to budget and political constraints.

All in all, my medium-term expectations are that Palantir is already close to correction. That’s in part because after it made it into the S&P 500 recently, a lot of “smart-money investors” have been flocking to it and I think someday these investors will question why they bought the stock at that price. When we look at the stock chart of recent days, though the price is still at peak levels, its relative strength has begun to fade recently. In the past, that often signaled the beginning of a medium-term correction or stagnation of the price action. That is the assumption I have. On this basis, I’m keeping my “Sell” rating for now – hopefully in the future valuation will get better, and I will upgrade my rating.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.