Summary:

- Palantir’s stock has surged without any selling pauses, raising concerns about a potential sharp pullback.

- Historical examples like Nvidia and Super Micro Computer show the importance of periodic selling months to maintain healthy stock growth.

- Palantir’s rapid rise is driven by increased government spending, but its heavy reliance on this sector poses risks if budgets are cut.

- The stock’s future hinges on whether it finds a selling pause; either it retreats or sets up for a significant rally towards $130.

Flashpop

I have just published an article on Super Micro Computer, Inc. (SMCI) which covers the same technical issue that Palantir (NASDAQ:PLTR) is facing, that is, the price pumping relentlessly high after an initial breakout without finding any selling.

Of course, it is fantastic for investors who are watching a stock propell upwards, finding one northern new pasture after the other. The issue… every stock needs to pause and find a selling month or months as it makes its way north, and it is better to see that printed on a chart rather than not.

Allow me to explain, let’s first use Nvidia (NVDA) as an example. The company that has led this AI revolution and dragged the sector and arguably the whole market with it.

In January 2023, we said that if Nvidia broke $187 it would go to $267. It subsequently did that and nearly squeezed in a selling month at $280 only to finish the month in green and take off to the $500 area. Here, Nvidia did find more selling where we said if that resistance is broken above, Nvidia can go looking for $850 next and so on as the chart created conventional patterns that give probable exact targets in the future. We can see in the chart below how a normal structure containing consistent buying and selling should appear like.

Nvidia Monthly Structure (C trader)

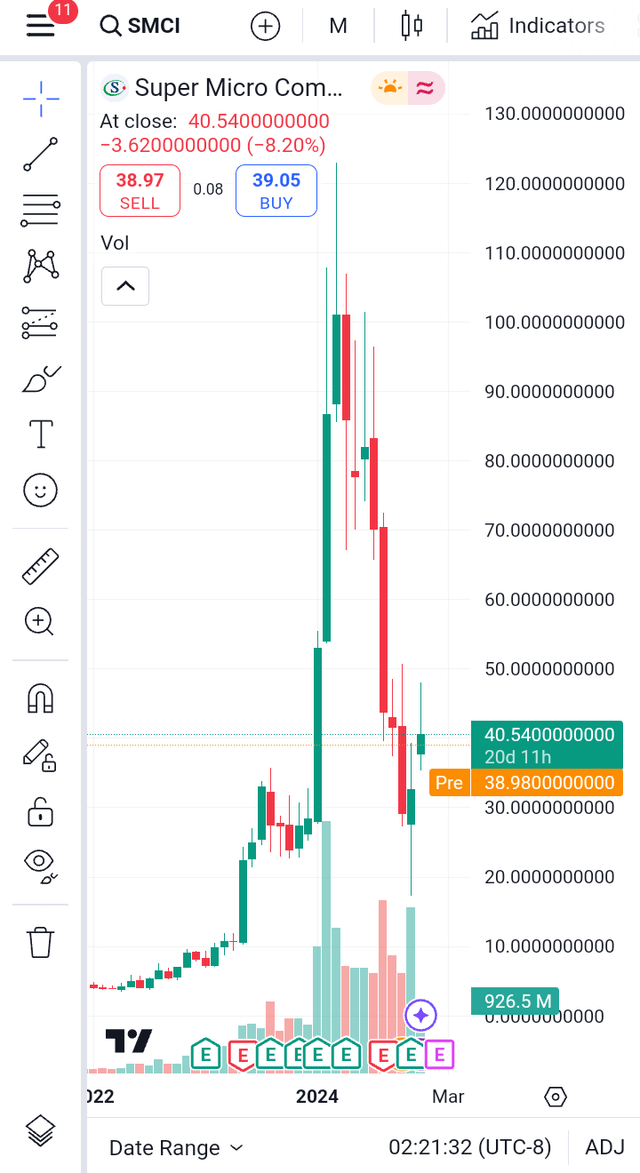

Let’s quickly take SMCI as a counter example. The stock broke $35 with a target from us of $60, I watched in amazement as it continued to climb unbelievably to $120 straight from $35 without finding any selling months along the way. Each company has their different story obviously but since we can gain probable future pricing by reading supply and demand from a financial chart, something we have been greatly successful at in both bear and bull markets, a stock rising too fast too rapidly with pausing and finding at least a selling month in its structure can lead to two things – one, it could return to where it broke out from as quickly as it rose or quicker. Two, investors are in for a bumper surprise as when the stock does pause and then is broken above, there will be another enormous wave to come.

SMCI monthly chart 11 December 2024 (TradingView)

Why is Palantir rising so quickly:

The company, founded in 2003 with its headquarters in Denver, specializes in big data analytics that assists governments and corporations gather and analyze huge amounts of data that identify complex patterns as well as constructing detailed intelligence. Palantir has a market value of $162 billion, a remarkable rise from $35 billion at the beginning of 2024 including an increase of $23 billion since president-elect Donald Trump won the election.

The bottom line is that the US government is Palantir’s largest customer, the NSA, CIA, armed forces and police use their systems and a proposed increase in government defense spending under Donald Trump has seen the stock propell higher.

Earnings

The company has seen an EPS increase of 30% in the last four quarters, while just over a 10% revenue increase for the same period. Questions over whether revenue can continue to grow if an economic downturn emerged leading to government budget cuts linger as Palantir relies heavily on government spending.

The Charts

We can see in the chart below from the $27 breakout there has been no pause on the monthly chart to create additional selling in order to go higher, the stock has just driven higher relentlessly. This, in reality, is a worry for investors. Returning to the paragraph earlier in the article, either this area is a top that can lead Palantir to return to the area it came from – financial markets have a habit of returning to the area they broke out from either within a short space of time from the breakout or eventually after a sustained period of climbing.

Palantir monthly chart (TradingView)

Or, Palantir is setting up for an almighty wave of buying towards the $130 area. The rate of revenue growth in the past twelve months, you could say does not justify the latter.

To finalize

I have read a lot of commentary on Palantir lately, while the reality remains, nobody actually knows what is next. The charts will tell a story over the coming months though, whether the monthly wants to find that long-awaited selling candle and break above that towards $130 or fall of this or an additional high and retreat further, the weekly timeframe will play a big part in this story. My summation is Palantir has climbed too fast too quickly, as the patterns emerge I will return with follow-up articles.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.