Summary:

- While I have made good money off of Palantir stock, it has still been one of my worst stock calls ever.

- I revisit my sell call after Palantir’s Q2 results.

- I materially upgrade my fair value estimate, but is it enough to make it a Buy?

Ake Ngiamsanguan/iStock via Getty Images

Revisiting Palantir Technologies After Q2 Results And S&P 500 Inclusion

Palantir Technologies (NYSE:PLTR) has been one of my worst investment calls on Seeking Alpha so far. On February 16, 2023, or about a year and a half ago, I downgraded my very successful strong buy call, which had generated a 42% total return, significantly outperforming the S&P 500 (SPY), to a sell rating due to overvaluation concerns. In hindsight, my sell call was premature as I had a fair value estimate of just $8 for the stock, based on very slow growth expectations for the company. However, since then, management has successfully accelerated its growth in a meaningful way, and the stock has soared over 250% since that sell call, making it one of the worst investment ratings of my investing career.

Thankfully, I have still profited significantly from my exposure to Palantir shares because I was long the stock when I rated it a strong buy, and then – once I changed to a Sell rating – I sold the stock and then sold puts against it in case it dipped again, but I did not short it. As a result, I made strong quick gains on the stock’s run up in value as well as off of expired put premiums. However, the truth is that I still clearly misread this stock and have been made to look like a fool on it as a result.

With that said, I will revisit the stock in light of Q2 results and the recent S&P 500 (SP500) inclusion in mind and share my updated assessment of the thesis.

Palantir Q2 Earnings

Palantir posted very impressive Q2 results, with commercial revenue in the United States soaring by 55% year over year. US government revenue delivered a strong 24% year-over-year growth rate. The international business generated decent performance overall, but significantly lagged behind the US business, with 15% year-over-year international commercial growth and 21% year-over-year international government revenue growth. However, on a sequential basis, international commercial revenue actually declined by 1% due to continued headwinds in Europe, and there was an 18% sequential growth in the international government business. It is important to keep in mind that the growth in the international government business was largely fueled by the war in Ukraine so that growth number is not necessarily indicative of the long-term growth potential of the business.

Still, their overall headline revenue growth was strong at 27% year over year and similarly strong at 7% sequentially. Palantir was also quite profitable, with a GAAP net income of $134 million, resulting in a solid 20% profit margin. GAAP earnings per share came in at six cents, and adjusted earnings per share were $0.09.

The value proposition of Palantir’s products was also verified by the fact that they continue to attract business from some of the top companies in the world, including recent deals with BP (BP) in which Palantir signed a five-year deal to collaborate strategically on introducing new artificial intelligence capabilities through Palantir’s AIP platform and supporting BP’s oil and gas production operations. Moreover, Microsoft (MSFT) and Palantir have also partnered to serve US defense intelligence agencies with AI services. Perhaps the strongest validation of the thesis is that Palantir recently joined the S&P 500, which adds a large amount of additional demand from passive investors and establishes Palantir as one of the major AI companies with a proven, profitable, and durable business model. Given these recent headlines alongside Palantir’s strong balance sheet and cash-generative business model, it appears that Palantir’s risk in terms of its sustainability is quite low.

PLTR Stock Valuation Model

That said, Palantir is still struggling to generate durable and impressive growth outside of the United States. Even though the top-line revenue growth of 27% year over year and 7% quarter over quarter is impressive, it pales in comparison to the valuation that the market is assigning to the stock. Currently, it trades at 59.3 times EV/EBITDA and has an 87.42 times price-to-earnings ratio.

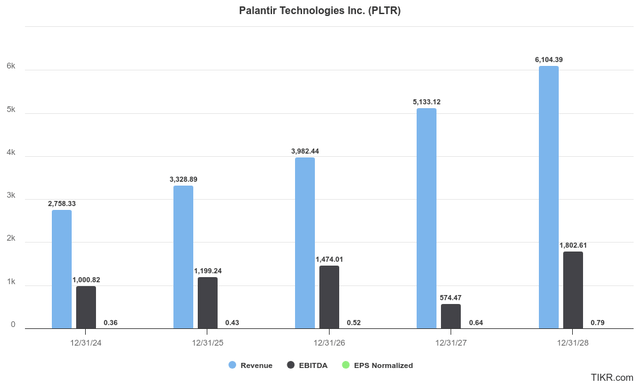

Moreover, analysts are not expecting the company’s revenue to accelerate much beyond what was generated this past quarter. The company is forecast to deliver a 22% revenue CAGR and a 15.8% EBITDA CAGR through 2028, while normalized earnings per share are expected to grow at a 22.1% CAGR over that span, putting 2028 earnings per share at $0.79.

Analyst Consensus PLTR Growth Projections (TIKR)

Even if the market were to assign it a very generous 40 times earnings multiple, assuming interest rates fall meaningfully over that period due to Federal Reserve rate cuts and continued sustained strong growth outlook for the company, the stock price would be just $31.60, which is down about 10% from today’s $34.60 stock price. This is at least three years and a quarter into the future. This means it is very difficult to find a valuation that makes sense right now or a scenario in which the current stock price makes sense unless the company can massively accelerate its earnings per share growth. Given that the company has struggled to expand its margins materially over time, it is hard to see how this happens unless the company also can massively accelerate revenue growth. To do that, it would have to post international revenue growth rates akin to what it is achieving in the US commercial space. Again, it is hard to see that happening, especially given that Europe actually shrank sequentially this past quarter.

Investor Takeaway

While Palantir is proving to be a much stronger company with generally better growth than I feared a year and a half ago, and therefore deserves a much higher stock price than my original fair value estimate, the market is far too enthusiastic about its prospects right now. I believe PLTR stock deserves a sharp pullback, and I think $20.00 at most is a fair price in the current environment given the consensus analyst forecasts for growth. As a result, I am giving the stock a strong sell rating.

However, since it would require a significant shift for the stock to reach those levels, I have no plans to short the stock, as Palantir is a case in point of why I never short stocks because the market can stay irrational far longer than I can stay solvent, and I prefer to allocate my hard-earned capital to positive growth stories rather than trying to predict swings in market sentiment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Now to Receive our Top Picks for H2/2024

Your timing couldn’t be more perfect! We have just unveiled our top picks for the second half of the year, and by joining us now, you can take advantage of these exciting investment opportunities.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Our high-yield strategies have garnered 150+ five-star reviews from delighted members who are already reaping the rewards.

Click here to get started!