Summary:

- Palantir’s stock is in the bubble territory.

- The potential normalization of the company’s growth rate and the recent selling of shares by insiders could suggest that the stock has reached its peak for now.

- We continue to believe that Palantir is a Strong Sell at this point.

peshkov

Our idea of shorting Palantir (NYSE:PLTR) failed to materialize and we exited our position at a loss when the stock crossed its pre-2024 all-time high levels recently. We explained the reasoning behind our short idea in our latest article on Palantir and explained that we would exit the position if the technical resistance level was crossed.

While we are out of the position and the stock has risen by over 100% since our latest article was published, we still believe that Palantir deserves its rating of a Strong Sell as its stock is currently in the bubble territory. We haven’t reentered a short position yet, as we’re waiting for the stock momentum to fade, but we also think that the growth of share price won’t last for much longer.

Palantir Is In A Bubble Territory

The major thing that happened since our latest article on Palantir was published was the release of the Q3 earnings report in early November. Thanks to the fact that the company beat the revenue and earnings consensus and improved its guidance, Palantir’s stock has rallied to new highs and currently trades around $60 per share.

The price action itself wasn’t that surprising. Ever since the generative AI revolution started, companies that have been able to beat expectations and raise their outlook saw a major bump in their share price. That happened with Nvidia (NVDA) and Microsoft (MSFT) in the last year and a half, and it also has been happening with Palantir for over a year already.

However, at this point, no growth opportunity can justify Palantir’s current valuation. The company’s forward P/E is 166x against the sector’s median of 24x, while its forward P/S is 51x, above the sector’s median of 3x. At a ~140 billion market capitalization, Palantir is worth approximately twice as much as the 2024 generative AI market even though it plans to make less than $3 billion in sales this fiscal year.

Although the launch of Palantir’s artificial intelligence platform has been largely responsible for the company’s growth in the last year, there are signs that the growth rate itself is now slowing down and normalizing. While Palantir’s revenues were up 30% Y/Y in Q3, they were up only 7% Q/Q. Even though the customer count increased by 39% Y/Y, it was up only 6% Y/Y. Next year when the initial bump caused by AIP onboarding will be gone, there’s a possibility that we could see a Y/Y growth rate for sales, customer count, deals, and other metrics either in single digits or teen numbers.

If that’s the case, then it would be hard to justify the excessive valuation with a more normalized growth rate. In addition, if there’s an escalation of the global trade war under the incoming Trump administration, then we don’t see how the company will be able to scale its business at an aggressive rate. Considering the recent major selling of shares by insiders and by Palantir’s CEO Alex Karp himself, there’s a possibility that the stock has reached or is about to reach its peak.

The Real Value Of Palantir

No matter how many growth opportunities Palantir has, it’s almost impossible to justify its current market price. In August, our valuation model showed Palantir’s intrinsic value to be $16.88 per share. Below we share an updated model that takes into account the company’s performance in Q3 and the latest developments.

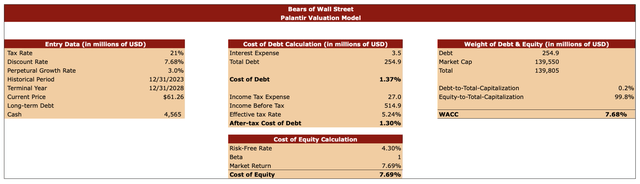

The tax rate in this model remains at 21%, and the perpetual growth rate remains at 3%. We create this model when Palantir is trading at $61.26 per share, and the cash data has been taken from its recent earnings report.

Our valuation model covers the period of the next five years and the discount rate that we use is 7.68%. To calculate it, we first figured out Palantir’s cost of debt and cost of equity. For the cost of debt, we used mostly Palantir’s TTM data. For the cost of equity, we used the risk-free rate of 4.30%, the market return rate of 7.69%, and the beta of 1, which was used in the previous model as well. Since Palantir doesn’t have a long-term debt, while its total debt is insignificant, the company’s perpetual growth rate is not that far off from its cost of equity rate.

Palantir’s Valuation Model (Bears of Wall Street)

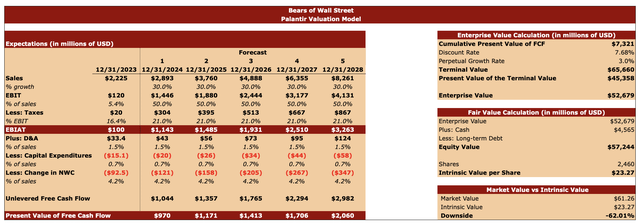

When it comes to forecasting Palantir’s growth, we wanted to figure out how much the company’s stock could be worth under fairly optimistic assumptions. By doing so, we wanted to figure out whether there’s any upside to Palantir’s stock, which already trades at excessive multiples.

The bottom part of the forecast table below didn’t change much in this calculation in comparison to the previous model since it has a fairly low impact on the outcome of the valuation. The two biggest changes happened to the sales estimates and EBIT estimates.

Currently, Palantir’s latest high-end outlook suggests that the company is expected to generate $2.809 billion in sales in FY24. This translates to a Y/Y growth rate of around 26%. For all the other years, the analysts currently expect a Y/Y growth rate of above 20% but below 25%. Given this information, we decided to assume a 30% Y/Y growth rate in FY24 and beyond. By doing so, our model can more than account for the earnings surprises this year and beyond. The EBIT as a percentage of revenue has also been slightly increased in comparison to the previous model to account for any additional upside.

This model shows that Palantir’s enterprise value is $52.68 billion, while its equity value is $57.24 billion. What is more important is that even under such wild assumptions that are likely to be higher than the actual performance, the model shows that Palantir’s intrinsic value is only $23.27 per share, which is around 62% below the current market price. Therefore, no matter how many growth opportunities Palantir remains extremely overvalued and its stock is in a bubble territory right now.

Palantir’s Valuation Model (Bears of Wall Street)

Risk to Our Bearish Thesis

We see several major things that can undermine our bearish thesis. Considering that companies like Nvidia and TSMC (TSM) talk about how the demand for their advanced products remains significant, there’s a possibility that the generative AI revolution is far from over. If that’s the case, then Palantir might have a shot of continuing to exceed expectations and raise the outlook, which could result in a major appreciation of its shares like it was happening in recent quarters.

Also, the potential improvement of the macro environment due to the potentially limited impact of Trump’s policies on global trade can help Palantir grow its sales and exceed expectations. This could also result in the further appreciation of its shares even though they are overvalued.

Final Thoughts

Our initial short idea failed, and we exited our position at a loss at the levels described in our latest article on the company. We learned our lesson and decided not to quickly reenter a short position and wait for the momentum to slowly fade before shorting again. Although the company has some growth opportunities, after the impressive run of its shares it’s hard to see how Palantir will be able to continue to trade at the current excessive multiples in the foreseeable future. That’s why reiterate our Strong Sell rating as the upside seems to be limited going forward.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.