Summary:

- After predicting a correction, Palantir Technologies offers an attractive investment opportunity, with its stock stabilizing below its peak of $27.50.

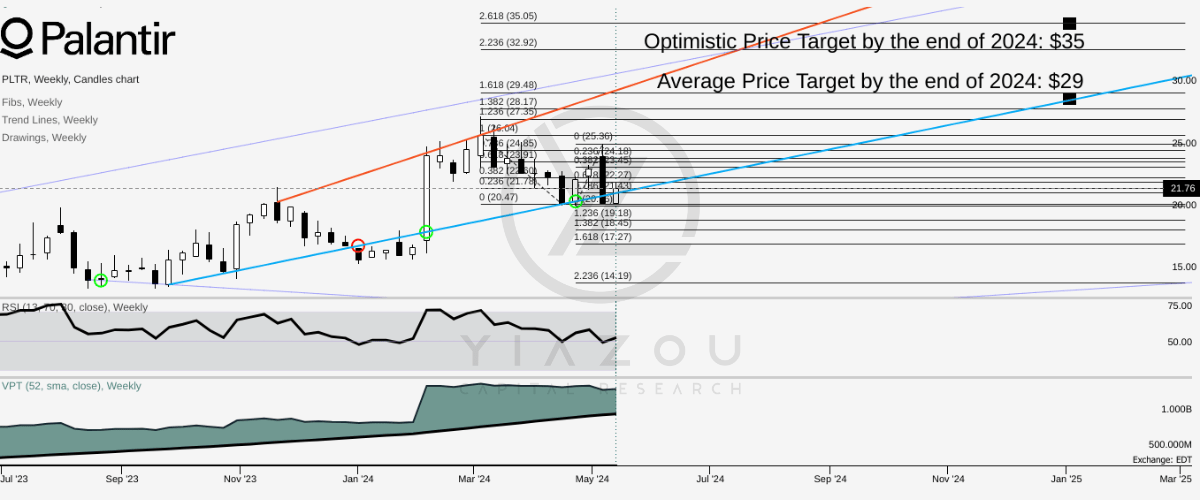

- Our technical analysis targets prices of $29 and $35 by 2024, driven by sustained upward trends and Fibonacci projections.

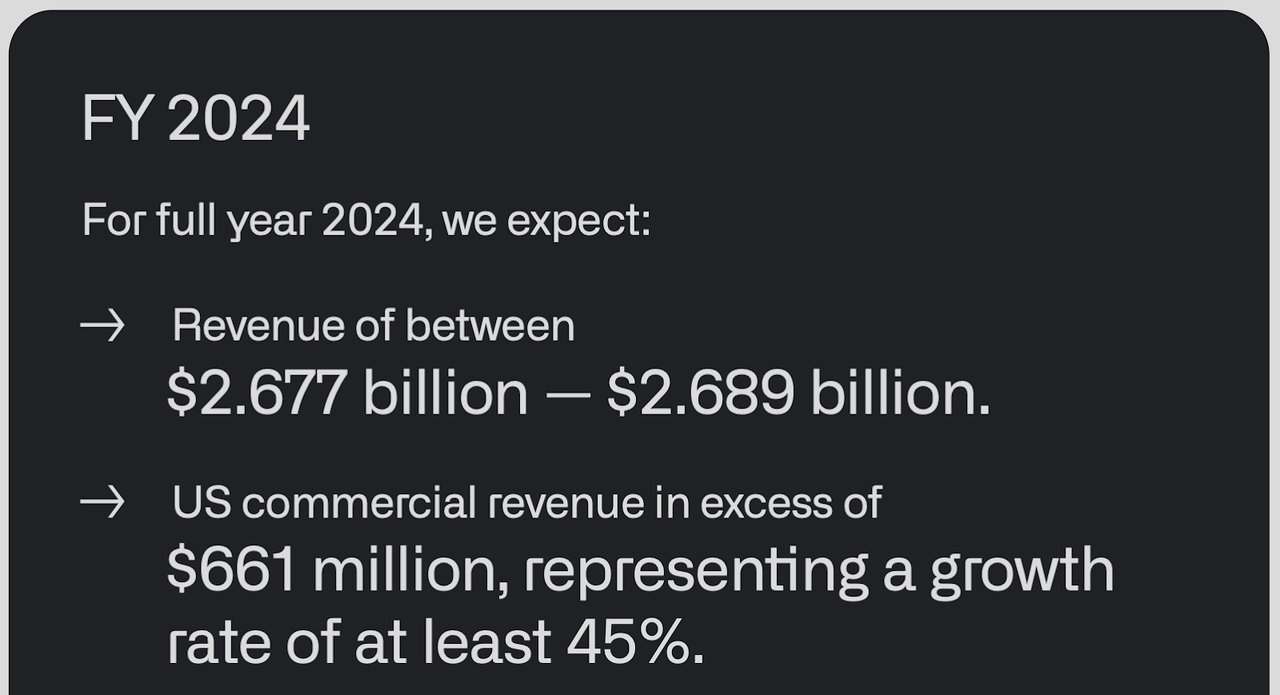

- Palantir projects its full-year revenue to reach between $2.677 and $2.689 billion, reflecting a substantial 21% growth compared to the previous year.

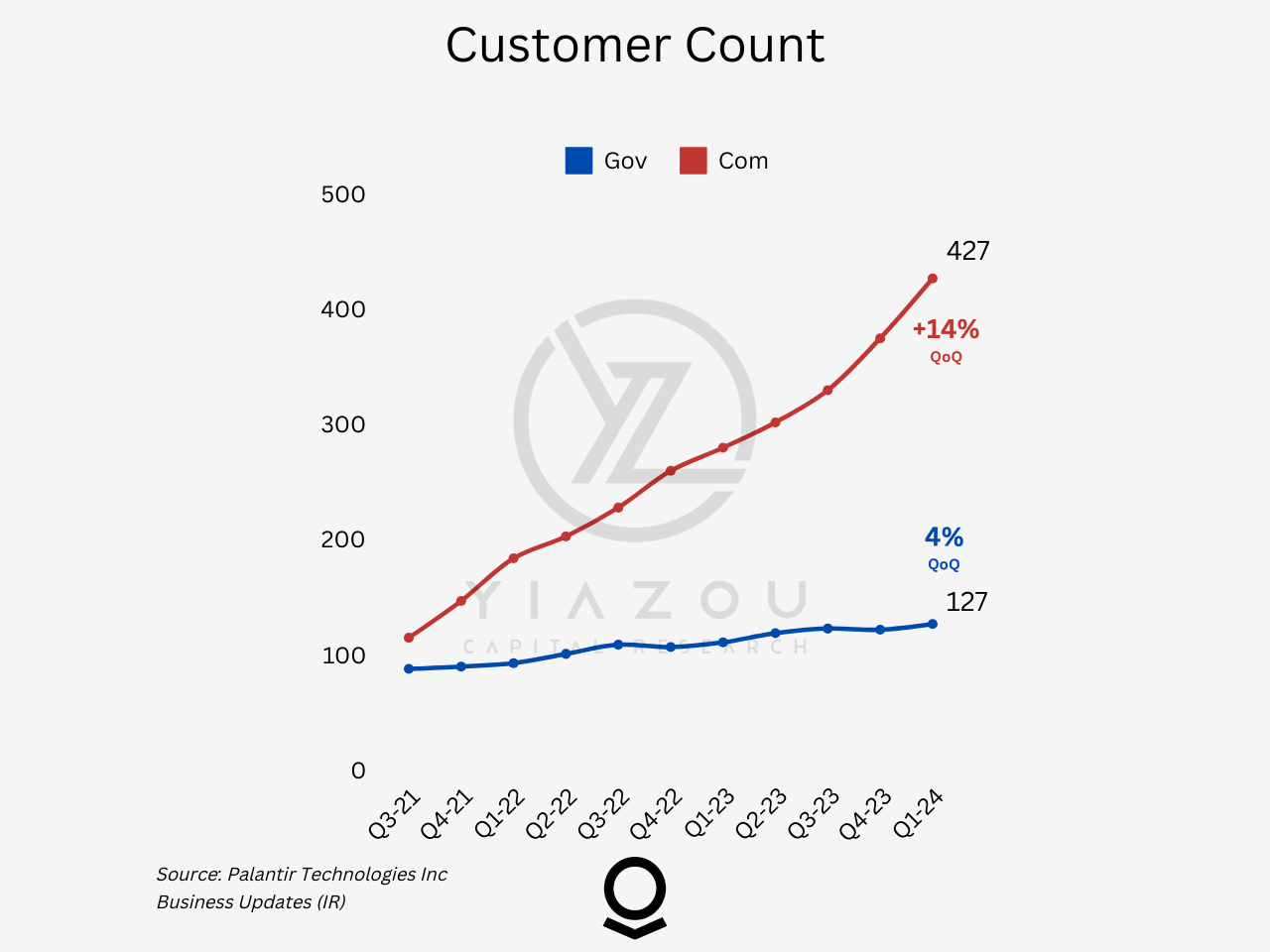

- Palantir’s customer base from Q3 2021 to Q1 2024 shows robust commercial growth with a CAGR of 68.1%, increasing from 115 to 427 customers, contrasting with a more stable 13.8% CAGR in the government sector.

koto_feja

Investment Thesis

In our previous analysis from March 13, we anticipated the unavoidable correction in Palantir Technologies Inc. (NYSE:PLTR) stock following its significant gains, which we identified as an opportune moment for investors to enter or expand their positions.

PLTR’s stock price stabilized after a period of volatility and moved sideways, providing an attractive entry point for long-term investors. The stock is priced below its March high of $27.50, indicating a cooling-off from earlier peaks but setting a stage for potential future gains.

Looking ahead, we have set a conservative price target of $29 and a more optimistic target of $35 by the end of 2024. These targets are not arbitrary, but underpinned by the sustained momentum of creating higher lows over the midterm and an expected increase in bullish momentum, corroborated by Fibonacci extension levels.

Finally, long-term investors need to look beyond the market’s short-term fluctuations and concentrate on the fundamental value that Palantir is creating. Thus, following the pullback and recent developments, we assign PLTR a strong buy rating, supported by the company’s strong fundamentals, strategic initiatives for growth, and the expanding use of its AI technologies across various sectors.

Sideways to Skyward with Targets of $29 and $35 by 2024

The stock price of Palantir has been trending sideways recently. Over the medium term, it is down after hitting $27.50, an all-time high, in March 2023.

Looking forward, the price may hit $29 on average and $35 on an optimistic basis by the end of 2024. The average price target is based on the current momentum of higher lows over the midterm. Meanwhile, an optimistic price target is based on higher price momentum, projected over Fibonacci extension levels.

The relative strength index (RSI), at 52, signifies neutral strength in the price trend. However, the indicator has taken support at 50, which makes upside price moves more likely in the coming weeks. On the other hand, assessing the volume price trend (VPT) reflects stable bullish momentum building up in the price over the short term. Here, the VPT line is hovering well above the 1-year weekly average.

On the downside, the price may hit $17.25 at minimum based on the 0.618 Fibonacci level (weekly swing). Therefore, the positional average below $17 is quite safe from the short-term volatility in the stock price.

Author (trendspider.com)

Strong Q1 Results and Bullish Outlook for 2024

In the first quarter, Palantir’s revenues increased 21% to $634 million, above management estimates of $616 million and consensus estimates of $615 million, signaling that the company continues to fire on all cylinders amid the AI frenzy. Amid the robust revenue growth, Palantir also posted a 60% year-over-year (YoY) increase in earnings to $0.08 a share, affirming the company’s ability to profit.

Additionally, revenue growth came as the data analytics firm had solid demand for its services, allowing businesses to deploy various AI applications. In addition, it’s benefiting from its AI platform (AIP), which is increasingly used to test and debug codes, allowing users to evaluate AI scenarios among other users. As a result, Palantir has already raised its growth outlook for the U.S. commercial sector to 45% from an initial estimate of 40%.

Lastly, the company also hinted at continued growth in the second quarter, forecasting $651 million in revenue (midpoint), representing a 22% YoY increase. Similarly, Palantir raised its full-year revenue guidance to between $2.677 – $2.689 billion, implying a 21% annual growth.

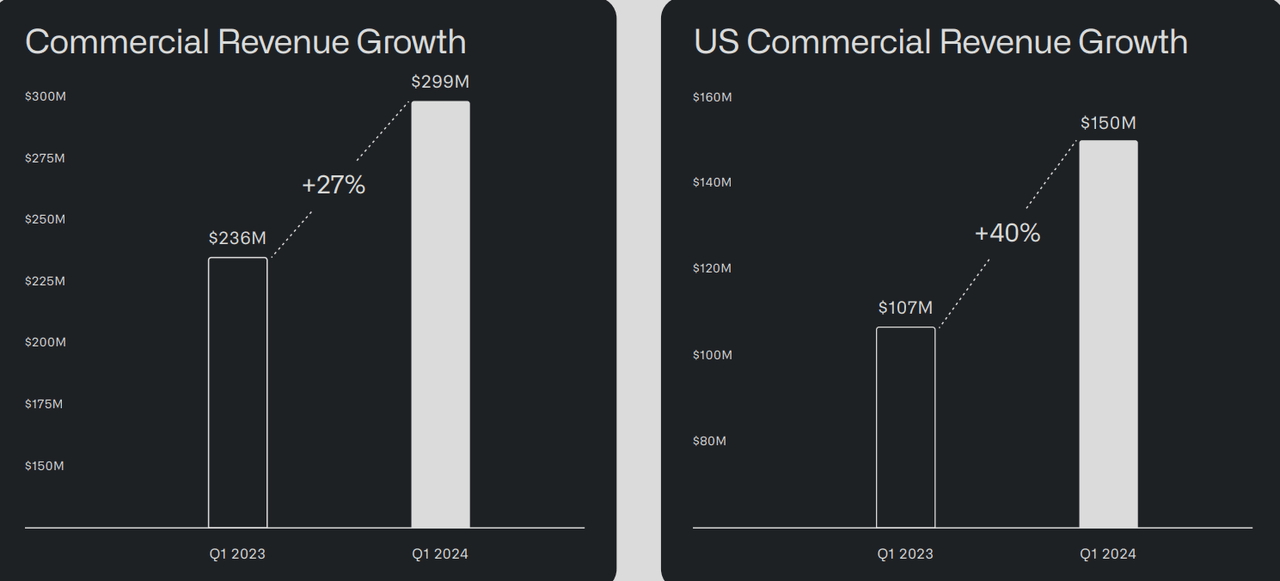

Palantir’s Commercial Surge: Robust Growth Amid Rising AI Demand

According to the Chief revenue officer, the company’s AIP continues to drive new customer growth while impacting the overall business. As a result, the customer count grew by 42% YoY in the last quarter and 11% quarter-over-quarter (QoQ). Additionally, the overall commercial revenue grew by 27% YoY, while the U.S. commercial revenue grew by 40% to $150 million in the fourth quarter, nearly half the 70% growth recorded in the previous quarter. A slowdown in growth in the U.S. is a significant concern that raises serious doubt about opportunities in the company’s key market.

While U.S. commercial growth slowed, Palantir still reported remarkable growth in the U.S. commercial sector, with the customer count increasing by 69% YoY and 19% QoQ to reach 262 customers. This expansion is part of a broader trend that shows a three-year cumulative growth rate of 12x in the U.S. commercial customer base. These numbers highlight Palantir’s successful penetration and the increasing demand for AI solutions in the commercial market.

The strategic growth in customer acquisition suggests increasing market adoption of Palantir’s innovative AIP aimed at complex data analytics and decision-making processes. Speaking to Palantir’s overall technology capability, these expansions underline strategic shifts towards more revenue diversification and less dependence on high-value customers. As Palantir continues to advance its AI solutions with expanded market reach, it remains well-positioned toward sustainable growth and building leadership in operating within the AI-driven analytics sector.

Additionally, Palantir has demonstrated robust growth in its customer base, especially in the commercial sector, from Q3 2021 to Q1 2024. The trend shows that the government sector grew at an almost stable yet slower CAGR of around 13.8%, from 88 to 127 customers. On the contrary, the commercials sector has been more dynamic, with a CAGR of around 68.1%, reaching 427 customers from 115. Such a discrepancy underlines a strategic pivot to tap the growing demand for AI and data analytics commercial solutions.

Author

The commercial sector is growing rapidly, underlying that Palantir has been quite successful in its penetration and well-received in the market with its advanced analytics and AI-driven solutions. Broader industry trends suggest digital transformation is picking up significant momentum. However, the challenge for a company like Palantir shall be to sustain growth at such a fast pace while expanding into technological horizons and maintaining quality service.

Finally, the fact that Palantir customers are signing much bigger deals is a testament that revenue growth is not expected to slow down soon. For instance, the company existed in the first quarter with 87 deals worth more than $1 million. The signing of multimillion-dollar deals comes as the company completes over 600 AI boot camps, through which clients gain access to the platform for up to five days, driving customer additions.

Palantir Bolsters Government Ties with $178M Army Contract and Advanced AI Solutions

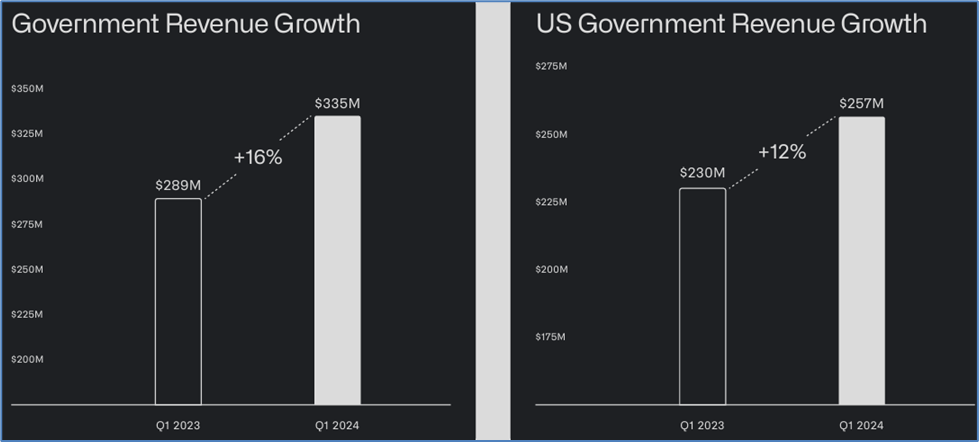

Palantir is also generating more revenues from its government contract, further diversifying its revenue streams. Government revenues in the first quarter grew by 16% YoY, while U.S. government revenue grew by 12% yearly to $335 million. Palantir is currently working with governments, providing software for visualizing army positions, among other things.

The data analytics firm has already bagged a $178 million US Army TITAN deep sensing contract, affirming its growing business with the U.S. government. The contract paves the way for the data analytics firm to build 10 TITAN ground stations and support the U.S. Army modernization bid using artificial intelligence and machine learning. Palantir became the first software company to deliver a novel AI-defined vehicle with deep sensing capability to the U.S. Army.

Palantir Business Update

Therefore, ahead of Palantir’s Q1 results on May 6, the company secured several significant contracts that highlight its diverse operational scope and strategic partnerships across governmental and commercial sectors:

-

Government Contracts:

- US Government: Palantir’s substantial $650 million deal runs through 2029, although it’s not specified if they are the sole recipient.

- TITAN Prototype: A $178 million contract for developing the first ten prototypes over two years.

- Lithuanian Government: A $37 million agreement for undisclosed services.

- DISA: A $9.8 million one-year contract for an Electronic Battle Management prototype.

- Ukrainian Government: Engagements include humanitarian demining efforts scheduled until 2033 and a partnership with the Ukrainian Ministry of Education.

-

Commercial and Academic Partnerships:

- Carahsoft: Expanding their partnership to expand services to the Canadian public sector.

- University of Colorado Anschutz Medical Campus: A collaboration extending up to four years.

- Option Care Health: A multi-year partnership focusing on healthcare solutions.

- Coles: A three-year partnership aimed at enhancing retail operations.

- Bapco Energy, Voyager Space, and Sky-Watch: These partnerships underline Palantir’s penetration into energy, space, and defense sectors, respectively.

- Anduril, Red 6, and Holo.com.ai: Collaborations leveraging Palantir’s Foundry platform for various advanced applications, including mixed reality integrations.

Bottom Line

In summary, with this recent pullback, Palantir should see new highs. The firm has been strong in growing clientele, especially commercially. Palantir’s big contracts and an established market in the high-growth field of AI and data analytics point toward a bright future with strategic diversification and innovation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.