Summary:

- Palantir, dubbed the “Messi of AI growth,” has shown exceptional performance. Its growth is accelerating, and it keeps surprising investors with its strong results and raised guidance.

- Despite Palantir’s impressive business model and high customer retention, I maintain a Hold rating due to the high valuation. However, I’m not ruling out the potential for more short-term momentum.

- The company’s AI platform, AIP, is driving significant operational improvements for clients, leading to increased demand and a strong and improving net dollar retention rate of 118%.

Michael Vi

Without getting into any Messi vs. Cristiano Ronaldo debates, Palantir (NYSE:PLTR) was recently dubbed the “Messi of AI growth.” Specifically, Wedbush’s Daniel Ives referred to the most recent quarter as an “eye-popping quarter for the Messi of AI growth story as AIP receives unprecedented demand as more enterprises realize the value of PLTR’s entire product suite with more AI use cases being brought to the table.”

Being called the Messi of AI growth is not a small feat, and Palantir probably deserves that nickname because its results have been so great and keep surprising investors (and management itself) to the upside, which I’ll talk about.

In my last Palantir article from September, I praised the business model because it truly is exceptional (although there are some things I don’t like as much, like high amounts of stock-based compensation). I gave the stock a Hold rating, though, because of the high valuation.

The stock has surged 61% since then. Does that make me wrong? Meh, maybe, but I don’t think I’m completely wrong. I didn’t rule out the possibility of short-term upside based on momentum, and I’m not ruling that out now. My point was that the valuation prices in a lot of growth, which is risky for investors that have a multi-year timeframe, as it’s very hard to achieve such high-growth rates.

Now that the stock is so much higher in such a short period, the risk has only increased. Therefore, I maintain a Hold rating for serious investors with a multi-year timeframe.

A Brief Overview Of Palantir

Palantir is a data analytics and software firm that helps customers interpret/use massive amounts of data. As a quick refresher for why it’s a good company, here’s some of what I wrote in my last article:

Its services are highly customizable, meaning that they can meet very specific customer needs, which creates loyal customers and product stickiness, and, in turn, a high gross profit margin and solid growth. After all, if a company creates a highly customized, advanced solution for you and you end up incorporating it into your company, it would be a pain to then abandon the solution for a new one, and this would come with high switching costs.

I also talked about how its customer acquisition is working very well. I would suggest reading my past article for more of an overview of the company’s strengths.

Palantir’s Q3 Results: The Messi Of AI Growth Keeps Dribbling Past Expectations

Palantir’s recent results showed a company that keeps firing on all cylinders and surprising to the upside. What’s interesting is that CEO Alex Karp said in the Q3 earnings call that even management was shocked that its U.S. business grew by 44% year-over-year off of a $2 billion base.

Here are some headline numbers. The company’s non-GAAP EPS came in at $0.10, beating by $0.01, and revenue came in at $725.52 million, a 30% year-over-year jump and $21.83 million higher than expectations. The 30% increase is much higher than the 16.8% seen in Q3 2023.

But that’s not all. Its Fiscal 2024 revenue guidance was raised to $2.805-2.809 billion compared to the consensus of $2.76 billion. The previous range was $2.742-2.750 billion. Palantir also raised its “adjusted income from operations guidance to between $1.054 – $1.058 billion,” while the previous range was $966-974 million. Similarly, it now expects adjusted FCF of over $1 billion for the year, compared to the prior expectations of $800 million to $1 billion.

Side note: this adjusted FCF adds back “Cash Paid for Employer Payroll Taxes Related to Stock-Based Compensation,” just to let you know. Personally, that makes no sense to me because it’s a cash expense, but it is what it is. For context, this expense comes out to $56.267 million for the trailing 12 months.

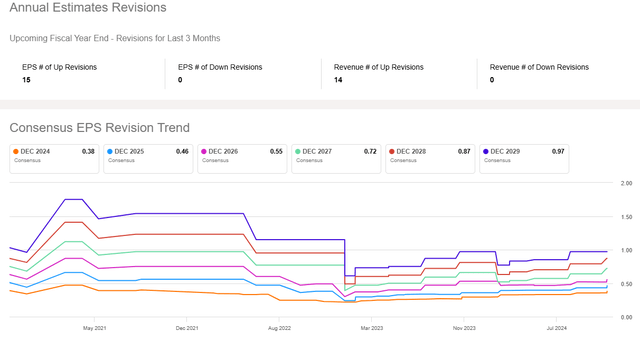

Anyway, you can see in the image below that analysts keep revising their EPS estimates higher as PLTR surprises to the upside.

PLTR EPS Revisions (Seeking Alpha)

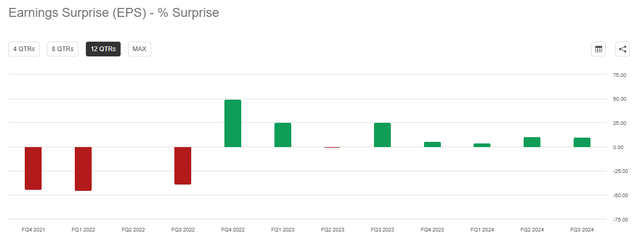

PLTR has also beaten estimates several quarters in a row now, which I like to see.

PLTR Historical EPS Beats (Seeking Alpha)

The Business Remains Critical, Causing Customers To Stick Around

Palantir’s management claims that there is a divide between those who use AIP (Palantir’s Artificial Intelligence Platform). AIP is clearly important for businesses. Here’s an example of what Ryan Taylor, the company’s CRO and CLO, said in the Q3 earnings call:

In this winner take all AI economy, the divide is widening between those who are leveraging AIP and those who are not. At a leading global insurance organization, AIP has helped automate key underwriting workflows, reducing the typical underwriting response time from over two weeks to 3 hours. We implemented over 10 business use cases in just nine months at Associated Materials, increasing its on time in full delivery rates from 40% to 90%.

The positive effect AIP can have is huge. For instance, reducing underwriting time from two weeks to 3 hours is huge. As Shyam Sankar, Palantir’s CTO, said regarding the underwriting example:

More than the labor savings, this presents the customer with an asymmetrical advantage in the marketplace to bind contracts before the competition has even gotten through 15% of their process.

With results like this, along with the high switching costs I mentioned earlier, customers will choose to stick around. This was again proven by Palantir’s net dollar retention rate of 118% for the quarter, which grew by four percentage points sequentially and by 11 percentage points compared to Q3 2023.

Notably, the net dollar retention rate doesn’t factor in revenue from new customers acquired in the past year. Thus, it doesn’t “yet fully capture the acceleration and velocity” in Palantir’s U.S. business in the last year, according to management. That, combined with an acceleration in revenue growth, makes me expect the net dollar retention rate to tick higher in the next few quarters.

All is looking good from a fundamental perspective, but how about the valuation?

Palantir’s Valuation Is The Main Risk

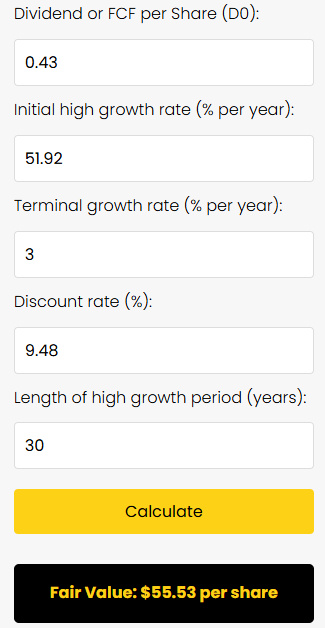

To show the high expectations baked into PLTR stock, I’ll use an H-model calculator that I’ve created but reverse engineer the inputs to see how high of an FCF growth rate Palantir would have to experience in order to justify its current share price of $55.53. That’s what I did in my last PLTR article.

PLTR H-Model Valuation (Author)

Here’s how it works. The H-model starts with TTM FCF/share, which is $0.43 (using regular FCF of $980.3 million, not adjusted FCF, and a basic share count of 2.278 billion). Then, I need a high-growth rate for FCF/share. This is the growth rate that will be seen in the first year. I put 51.92% because that’s what I needed to reach the stock’s current price when combined with the other inputs. I then input how long I think the high-growth period will last. I put 30 years because Palantir has many years of growth ahead.

The model assumes a linear decline in the FCF/share growth rate, which will gradually drop from 51.92% to a terminal growth rate of 3% by year 31. I chose 3% because it’s reasonable to assume that PLTR can slightly outpace long-term inflation expectations of 2% due to its importance and pricing power.

I used 9.48% as the discount rate, which I calculated using the CAPM model and a levered beta of 1.01, per simplywall.st.

For the PLTR example below, FCF/share growth would fall by 1.63% every year until reaching 3% in year 31. In other words, the growth rate in year five will be 43.77%, 35.62% in year 10, and 19.32% in year 20. That’s a lot of growth needed just for it to be fair value. By year 10, this suggests a FCF/share figure of $8.08, which is almost a 19x increase.

Let’s also not forget that the valuation uses FCF per share, and per-share metrics will be negatively affected by the high stock-based compensation ($542 million in the past 12 months). This is just too much expected growth for me to want to invest.

The Takeaway

Palantir may be the Messi of AI Growth, with accelerating growth and a high-quality business model that keeps surprising investors to the upside, but that doesn’t mean that the current price is justifiable for a medium-term investment. The expected growth is very high, as shown in my H-model calculator above. Palantir can grow that much, but I’d rather invest in it when it’s not as crowded of a trade to get a larger margin of safety.

In short, I love Palantir’s business, but I’m remaining on the sidelines for now (not including any short-term trades I may take) until the valuation comes down.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.