Summary:

- Palantir is again trading at irrational levels and the upside to its shares, in our opinion, is non-existent.

- Even the boost in sales from Palantir’s generative AI platform can’t justify the price of the company’s stock.

- Today, we reiterate our strong sell recommendation for Palantir’s shares, since we believe that the downside is significant.

sefa ozel

Back in 2021, we published several bearish articles on Palantir (NYSE:PLTR) where we explained that the company is severely overvalued and despite having some growth catalysts, its stock was a strong sell. In 2022, our bearish thesis played out well as Palantir’s share price has halved in more than half since its 2021 highs as a result of the exuberant valuation in a time when macro conditions significantly worsened.

While Palantir’s entrance into the generative AI market in 2023 helped the company’s shares to recover from the disastrous performance in 2022 and push them close to their all-time highs in 2024, we believe that not a single growth catalyst that Palantir currently has going for it can justify the excessive multiples at which its business once again is trading. While generative AI is certainly not a fad like NFTs or the metaverse, even its successful growth can’t fully justify Palantir’s $60 billion market cap when the company barely makes $3 billion in annual revenues and is not expected to exceed $10 billion in annual revenues by the end of the current decade.

That is why today we once again reiterate our strong sell recommendation, since we don’t see any upside at the current price and believe that the downside is significant.

The Story So Far

It’s been a while since we published our take on Palantir, so it makes sense to start this article by reiterating several major events to get the bigger picture of the company and where its business and its shares might head. Our latest article on Palantir was made public in August of 2021. In that article, we highlighted Palantir’s constant widening of net losses and the continuous use of excessive share-based compensations that ate the bottom line and in our opinion were unsustainable for much longer.

The company was trading at around $25 per share back then, and we believed that the excessive multiples at which its shares were trading made the business a strong sell at that price.

That bearish thesis played out perfectly a couple of quarters later, primarily thanks to the changing macro environment. First, the Federal Reserve warned about the upcoming rate hikes to battle the rising inflation, which meant that borrowing costs were about to rise and economic activity was about to take a hit. For a company that was trading at aggressive multiples at that time, it meant that its shares could be hit the hardest in a worsening macro environment, as it would be significantly harder to justify the excessive price when the bottom-line performance was already weak, and the environment was worsening. Then the Russian invasion of Ukraine in 2022 made things even worse as it shocked energy markets and prompted the Federal Reserve to act more aggressively in tackling inflation and rapidly increasing interest rates throughout most of 2022.

That’s when cracks in Palantir’s growth story began to appear. If we go through Palantir’s earnings releases from Q1’21 to Q1’22, we’ll see that at the end of each release for those periods the company mentions that per its long-term guidance policy that was set up by its CEO Alex Karp, it expects annual revenue growth rate to be 30% of more through 2025. Starting from the earnings report for Q2’22, Palantir stopped mentioning its long-term guidance policy as the new macro environment started to negatively affect its performance. The company has been providing relatively disappointing guidance throughout a portion of 2022, its shares traded mostly under $10 per share throughout most of 2022, and its revenue growth rate in the second half of 2022 was under 20% Y/Y. Our bearish thesis played out well during that time as there were no fundamental reasons for the company to trade at high multiples in the first place, so when the macro environment changed, it was almost impossible to justify its 2021-level valuation.

However, after trading mostly under $10 per share for nearly a year, things began to change in the spring of 2023. As the generative AI revolution picked up pace, Palantir quickly joined it by launching its own generative AI platform called AIP. In the Q1’23 conference call, Palantir’s management noted that the demand for AIP has been unprecedented and they’re aggressively capitalizing on the interest to meet that demand. After that, Palantir’s shares got a second wind as the business performance began to improve thanks to the aggressive demand for AIP since companies started to implement various generative AI tools within their organizations.

Since the spring of 2023 and until today, Palantir’s shares have aggressively appreciated and are once again trading at exuberant multiples. We believe that Palantir’s current valuation makes no sense and that is why we’re once again providing a strong sell recommendation for its shares as the upside from the current price is non-existent in our opinion.

Is AIP Palantir’s True Savior?

While Palantir’s stock was able to regain its momentum thanks to the company’s entrance into the generative AI market, its current price makes no sense to us. We don’t deny that the demand for AIP is unprecedented, and it certainly appears to be a solid product considering that more and more organizations are joining Palantir’s bootcamps each quarter to test the platform.

Our issue is that despite boosting Palantir’s sales in recent quarters, it’s still not enough to justify the aggressive rise of the company’s stock. In 2023, when AIP was launched, Palantir’s revenues increased by only 16.75% Y/Y. For 2024 and 2025, the expectations are that Palantir’s revenue growth rate will be around 20% Y/Y. This is below Palantir’s initial estimates of growing by over 30% through 2025 which were given back in 2021.

Despite this, Palantir’s share price is already around the 2021 levels, and the company trades at over 80 times its forward earnings and over 20 times its forward sales. Even if we assume that AIP will continue to boost Palantir’s sales in the future, it seems that the upside for its shares is non-existent anymore.

When doing research for this article, we were looking at what is the true worth of the generative AI market. Estimates varied depending on the source. The conservative assumptions show that the generative AI market will be worth $66.62 billion this year and increase to $206.95 billion by 2030. The more optimistic assumptions show that the generative AI market will be worth $137 billion this year and $897 billion in 2030.

With a market capitalization of over $60 billion today, it seems that Palantir is already worth almost as much as the entire generative AI market under the conservative assumptions and around half the market under the more optimistic assumptions. We believe that it makes no sense for a company that has less than 600 clients to be worth so much, and this is why, in our opinion, Palantir’s stock is overhyped at this stage. While AIP certainly created new growth opportunities for Palantir’s business, the stock itself got too far ahead of itself and at the current price, the company is extremely overvalued.

What Is The Real Value Of Palantir?

We believe that Palantir is extremely overvalued and below we present our valuation model.

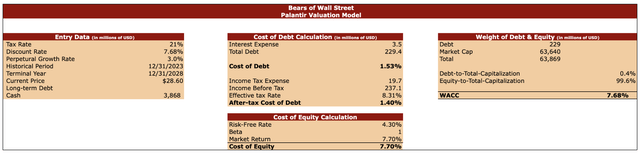

To properly value Palantir, we first need to highlight some of the entry data that will help us determine the company’s intrinsic value. The tax rate that we use in our valuation model is 21%, which has been a flat corporate tax rate in the United States in recent years. The discount rate is 7.68%. We arrive at that percentage by calculating the company’s cost of debt, cost of equity, and then determining the cost of capital.

We determined that Palantir’s after-tax cost of debt is 1.4%. To calculate that we used its financial data such as interest expenses, total debt, income tax expenses, and others from the fiscal year 2023.

The cost of equity in our model is 7.7%. For determining the cost of equity, we used a risk-free rate of 4.30%, which is close to the current yield of the 10-year treasury note. The beta is 1, which is the S&P 500 average. The market return is 7.7%, which is the average annual return rate of the S&P 500 in the last two decades.

In the end, we arrived at a discount rate of 7.68%. The main reason why it’s so close to the cost of equity is that Palantir has no long-term debt and very little total debt, which is why the cost of equity had a significantly greater weight when determining the discount rate.

The perpetual growth rate is 3%, which mirrors the historical inflation rate. The cash reserves are $3.8 billion, which is what the company had at the end of the latest quarter, while the share price at the time of valuing the company was at $28.60.

Bears of Wall Street valuation model (Bears of Wall Street)

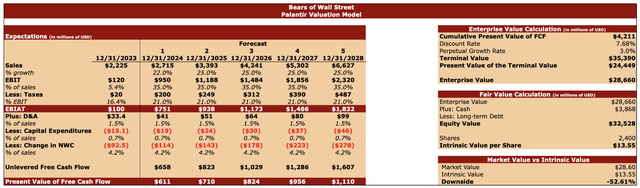

After filling in the entry data, we then turn to our forecast. For 2024, we expect Palantir’s sales to grow by 22%, which is slightly above the overall expectations. After 2024, we assume that the growth rate will be around 25%. This is above the current estimates, but if AIP continues to aggressively add new customers, then a boost in sales won’t be something out of the ordinary. We also expect significantly higher earnings, which mirrors the analysts’ expectations. The tax rate in the model is 21%, and the expectation for other financial data closely mirrors the company’s performance in 2023.

Once we finished with the forecasts, we calculated the cumulative present value of the FCF, the terminal value with the help of the discount rate and the perpetual growth rate, and the present value of the terminal value. All of this helped us to get Palantir’s enterprise value, which in our case is $28.66 billion.

After that, we added the company’s cash reserves to the enterprise value and did not subtract any long-term debt because it’s non-existent, to calculate Palantir’s equity value, which is $32.51 billion. We then divided the equity value by the number of Palantir’s shares to find out the company’s intrinsic value, which is $13.55 per share.

This means that according to our model, Palantir’s shares are extremely overvalued and that is why we believe that giving it a strong sell recommendation makes perfect sense.

Bears of Wall Street valuation model (Bears of Wall Street)

Could We Be Wrong?

There’s one thing that needs to be discussed before jumping to the conclusion. While we believe that Palantir is a strong sell and the upside at the current price in our opinion is almost non-existent, we also shouldn’t forget that throughout history, markets have been extremely irrational from time to time. There’s no need to look that far considering that Palantir itself was trading over $30 per share in early 2021 despite generating much less sales than today and losing money. While there were periods of significant appreciation and depreciation of its shares throughout 2021, it wasn’t until 2022 that the share price had truly collapsed.

That’s why it would be foolish to assume that the price will collapse on weak fundamentals today or tomorrow. If the management reports another revenue and earnings beat for Q2’24 next month and increases the guidance, then the shares will likely retain their momentum and could appreciate even higher to new highs.

However, such an appreciation of shares can’t last forever. After publishing our latest bearish article on the company in 2021, it took a couple of quarters before the share price truly collapsed and our thesis played out. We could have the same thing happen again. That’s why the depreciation of Palantir’s shares is not guaranteed in the short term despite the company trading at an exuberant valuation. But once the momentum fades over the long-term and fundamentals once again start to matter more than the growth rates, then the depreciation on weak fundamentals will likely begin, since the company that has less than 600 customers can’t be worth as much as the whole generative AI market.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.