Summary:

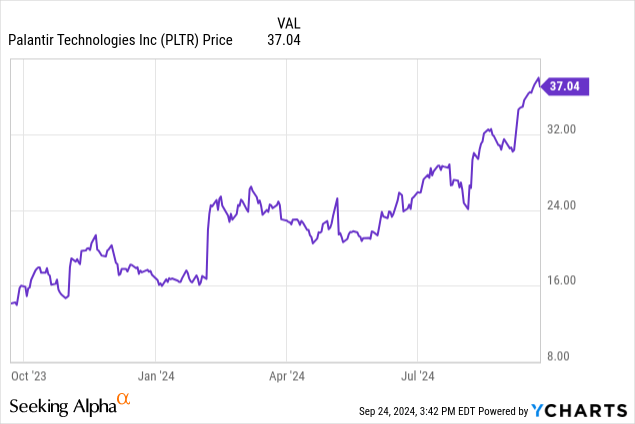

- Palantir’s stock surged 160% in 12 months due to commercial market success.

- Valuation concerns and macro risks make it tough to justify an investment at current levels.

- Economic slowdown fears could impact AI spending, making Palantir’s rich valuation vulnerable to market corrections.

hapabapa

Much has been made of Palantir’s (NYSE:PLTR) valuation recently as the stock has gained more than 160% over the last 12 months due to the company’s successful foray into commercial markets after previously servicing mostly government clients. While the company has been and will continue to benefit from macro tailwinds, I think investors should be cautious at current levels and should trim winning positions.

Coverage from Seeking Alpha authors has been quite bearish as a breakdown of September PLTR article recommendations shows:

- 1 Buy

- 5 Hold

- 7 Sell

However, part of being an investor is knowing when to be contrarian and ignore the crowd, so I’ve been questioning the overwhelming bearish narrative in an attempt to maybe see the hidden value that others might be missing. But the more I look, the more that narrative seems to make sense. Palantir is certainly riding the AI wave and is providing production AI solutions that have remained elusive to the broader market, but, in my opinion, the risks significantly outweigh potential rewards at current levels. Let’s start by covering some of the positives.

AI Boom or AI Bubble?

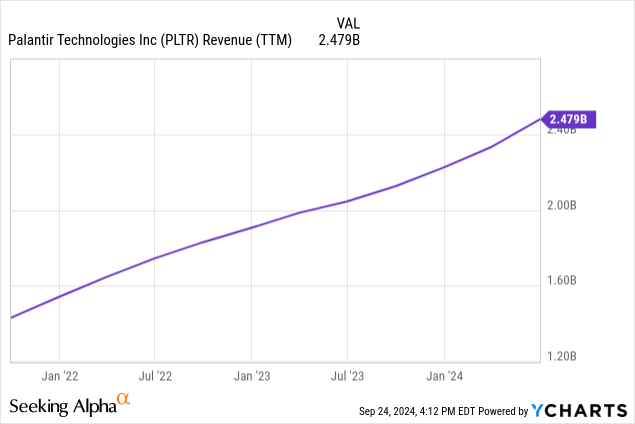

The first positive is, of course, Palantir’s scorching growth over the past few quarters. The company has turned in impressive operating results, specifically from an increase in the number and value of commercial contracts, which spurred revenue to nearly $2.5 billion for the trailing twelve month period:

While government business has also grown modestly, commercial growth has been the primary driver of financial results and stock price. CRO Ryan Taylor broke it down on the most recent earnings conference call:

Our US commercial revenue, excluding strategic commercial contracts, climbed 70% year-over-year. Our US commercial ACV closed was up 44% year-over-year and up 19% sequentially, while our deal count in US commercial was nearly twice what it was just a year ago.

It is numbers like that 70% commercial YoY growth figure that has excited investors and driven PLTR higher. Palantir attributes this increase to its unique success in getting AI products from prototype to production through its Artificial Intelligence Platform (“AIP”), which is one of the main reasons I think the company actually has a decent pitch. So many firms like Microsoft (MSFT), Tesla (TSLA), and others are snatching up accelerated compute resources by the fistful, but have yet to produce any real profitable applications. Perhaps this investment will pay off down the line somewhere in the future, but Palantir is one of the few companies actually making money off AI-related customer solutions today.

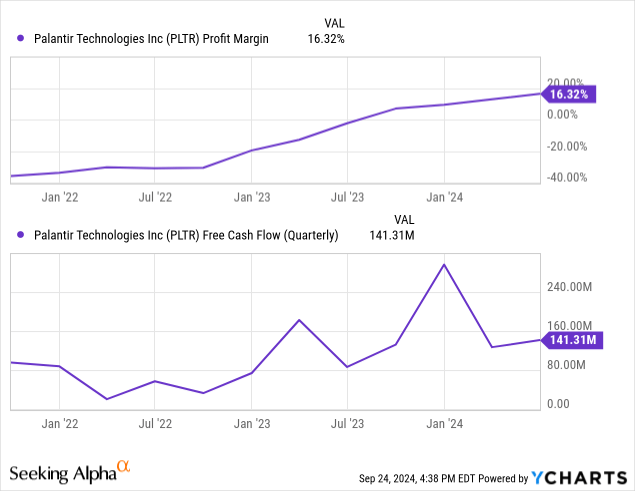

A further positive is that Palantir has already achieved profitability and is generating cash flow, which is rare for companies that are just starting to see accelerated earnings growth. Add in margin expansion and you can see why the market might be excited about future prospects:

For FY2024, Palantir expects to generate between $800 million and $1 billion in free cash flow, a remarkable number considering how poor the company and shares were performing just two years ago! But no stock can be evaluated in a vacuum and therein lies the rub.

Let’s start with a comparison. The consensus estimate for Palantir’s FY2024 EPS is $0.36 (data pulled from Seeking Alpha), giving the stock a P/E of a bit over 100 based on expected earnings for the year. Contrast this with, say, the ultimate AI stock, NVDA, which has a FY2024 P/E of 42. Nvidia has higher growth rates, substantially higher margins, a wider moat, and a better balance sheet, yet is being priced at less than half the valuation multiple of PLTR. To take it a step further, at the company’s FY2024 EPS estimate of $0.36, Palantir would need to grow earnings by 20% annually over the next 5 years to achieve the same multiple that Nvidia has right now. But considering Nvidia’s superiority in nearly every conceivable financial metric, this comparison is likely understating the relative overvaluation of PLTR.

Now bulls are probably thinking that this comparison is unfair — Nvidia has mostly saturated its target market while Palantir’s addressable market, which is every company on Earth, is much more substantial. Think of the growth potential! And while it’s true that the untapped market here is significant there are a multitude of uncertainties surrounding how large the market actually is and who will ultimately win this market share. On the earnings call, Taylor said this about the AI ecosystem:

As noted by Sequoia, the revenue expectations from the AI ecosystem’s infrastructure build-out have grown from $200 billion to $600 billion per year in just nine months.

A tripling in nine months is impressive indeed! If you go to the cited Sequoia research, the methodology is pretty interesting. Essentially, that $600 billion is calculated as the necessary revenue to match the purchase and operating costs of Nvidia’s accelerated compute in the data center. In other words, this isn’t really a total addressable market figure but rather how much revenue the companies snapping up Nvidia GPUs would need to generate in order to break even. Of course, the central assumption here is that these AI infrastructure build-outs will become major money makers and that they are not massively overpaying for computational capacity. However, as I’ve argued elsewhere, this is not a guaranteed outcome and there are still extreme mismatches between how much hyperscalers are spending and the current and expected revenue from these investments.

Palantir is betting that AI will be transformative and that its offerings will be the bridge between the AI infrastructure, on which Silicon Valley is spending hundreds of billions of dollars, and end users who don’t yet know how they can utilize these newfound capabilities. And investors are betting on Palantir succeeding. I have a few qualms with this.

First, while Palantir has a fairly robust AI offering and is picking up customer and contract value momentum, the barriers to entry for a market like this are not very high. A first-mover advantage can give some extra value, but ultimately, if there’s enough profits to be had, other companies will join the fray (and likely already have). I’m sure Palantir will talk up the technological edge it has and by all accounts its sales team is second to none, but this does not have the signs of a high-margin business long-term.

Second, macro headwinds are beginning to appear off in the distance and getting closer. While all the big tech companies have committed major cash to AI initiatives, in the event of an economic slowdown, many will scale back these purchases to keep their margins from imploding. End customers too will be reluctant to sign onto cutting-edge AI-based custom solutions when cost-cutting and layoffs begin. Of course, the Fed last week opted to cut interest rates in response to cooling inflation, but decided to commit to a jumbo 50 bps cut instead of the usual 25 bps, signaling that the economy might not be as strong as previously thought. Make no mistake, AI spending is a luxury good — one that will falter should the broader economy begin to struggle. In such a situation, the companies that have hitched their wagons to AI and stocks with extremely rich valuations will be the ones to suffer the most. PLTR is both.

Thirdly, this has been discussed heavily recently but an analysis would not be complete without it: insider selling. Two weeks ago Chairman and Co-Founder Peter Thiel filed to sell up to $1 billion in stock and CEO Alex Karp did sell around $300 million or 10% of his holdings that same week, leading to concerns that the stock overheating and management knows it. I usually don’t put too much emphasis on insider selling since we don’t know the liquidity needs of these individuals and sometimes a sale is necessary for larger purchases like a home or a yacht, but that said, these are pretty hefty transactions.

From Karp in particular this is curious, since his grand, patriotic statements on earnings calls make it sound like this could be the greatest company the world has ever seen. I particularly like this quote from the most recent call:

And the single most important part, however, of this is that we are going to play a determinant role in making America and its Western allies the dominant force again on this world — in this world. And because of that, the best times for this company are not in the past. I would say the single most interesting thing about this quarter, if you had to reduce it to one simple fact, after 20 years, after changing the way people do intel, after changing the way the battlefield works, after changing the way people procure software, after exporting our platforms to our allies, after punishing our adversaries, after building a commercial business . . .

It goes on like this for a bit longer, but I just wanted to highlight the extent to which he emphasizes that Palantir is in prime position to put America and the West back in front on the world stage again (I didn’t know they’d fallen behind, but I digress) in both the public and private sector. It’s all very rah-rah and is a sort of rallying cry for investors to back PLTR, not just because it’ll make them money, but because it’s the patriotic thing to do. It’s just an interesting contrast hearing these conference calls and public appearances and then seeing the news that he’d sold 10% of his total stake a month later.

While stock sales can happen for liquidity reasons, the most important thing to look for, in my opinion, is quantity and timing. A sale of 2-3% while the stock price meanders upwards or downwards is probably nothing to worry about. A sale of 10% while the stock is at all-time highs and has surged 160% in a year? That could be a cue that those who run the company think the valuation has gotten ahead of real operating results. In the case of Karp, I think it’s more important to watch what they do (sell $300 million in stock) rather than what they say (this company will bring glory back to America and her Western allies), and in this case, his actions imply it might be time for investors to take a beat.

Investor Takeaway

Palantir has made great strides recently in turning speculative AI opportunities into real, revenue-generating applications. The company is seeing impressive growth and has achieved profitability and positive free cash flow perhaps earlier than might have been expected. However, uncertainty remains regarding the AI revolution and exactly how much of a monetization opportunity exists.

Further, recession fears after a big rate cut from the Fed could prompt customers to be wary of spending on expensive custom AI solutions with the specter of an economic slowdown approaching. Lastly, insider selling indicates that those in the know could be seeing some froth when it comes to PLTR’s valuation, and investors might want to take that as a sign to trim positions.

Overall, I think Palantir is a great company, just not an $82 billion company. Yet. Due to the mentioned risks and extremely rich valuation, I’m rating Palantir a Sell.

Thanks for reading!

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.