Summary:

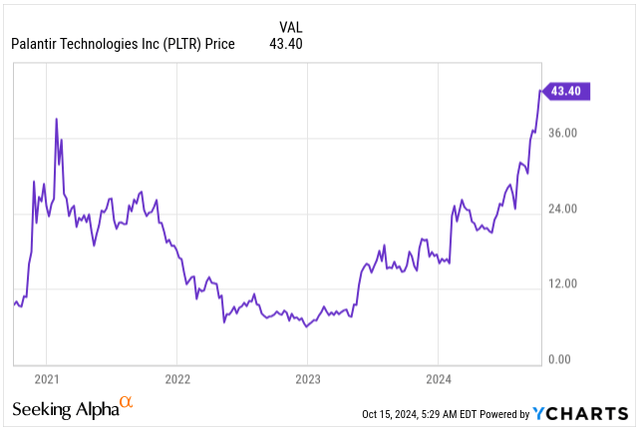

- Palantir Technologies Inc.’s stock has surged 153% YTD, driven by strong performance and AI integration, making it one of the top performers in the S&P 500.

- The company benefits from government contracts and is expanding its commercial segment, which is critical for future growth.

- Despite strong growth and improved profitability, Palantir’s valuation poses risks, requiring significant future earnings growth to justify current stock prices.

- Investors should be cautious of Palantir’s valuation, as sky-high expectations could lead to capital loss if growth doesn’t meet projections.

- I recommend investors to cash out their significant gains with the objective to buy back around $20-25/share.

hapabapa

Palantir Technologies Inc. (NYSE:PLTR) officially joined the S&P 500 (SP500) in September this year. This finally opened the door for institutional investors, mutual funds, and analysts to purchase the stock and increase the coverage, with the stock set to benefit from higher popularity and demand.

The data analytics software company has been red-hot this year, with its value increasing 2.86x from $15/share a year ago to $43/share today.

On a year-to-date basis, Palantir’s stock is up 153% alone and ranks third among the best-performing stocks in the S&P 500:

- Vistra Corp. (VST): 225.3% YTD Return

- NVIDIA Corp. (NVDA): 172.2% YTD Return

- Palantir Technologies: 153.4% YTD Return.

Although this is my first coverage of the stock on Seeking Alpha, I’ve followed Palantir since its IPO in 2020. Even though I currently do not have any exposure to the stock, I am keeping a close eye on the company, hoping to add its shares to a portfolio on a weakness, around $20-25/share.

With Palantir’s stock on fire this year and its Q3 earnings just around the corner on November 4, let’s take a closer look at whether it’s still a good buy heading into the earnings. Bulls generally argue Palantir’s improving profitability could drive more gains in the stock price. In contrast, bears point out potential revenue deceleration, particularly as Palantir’s stock trades at 29x its estimated 2025 revenue, making it one of the most expensive stocks in the S&P 500.

Palantir’s Business Keeps Benefiting From AI Integration

As a first step, let’s take a look at Palantir’s business, given the business is relatively complex and much of its software’s details are undisclosed due to the secrecy of dealing with government.

In fact, 60% of Palantir’s revenue comes from government agencies, whereas the remaining 40% comes from the commercial sector, an area where the company aims to expand its operations further to drive growth.

Palantir’s core business is based on three main segments:

- Gotham: Designed for government and defense agencies, providing intelligence and data analysis tools for national security.

- Foundry: A data integration and analytics platform that helps manage, analyze, and visualize data. Commercial clients generally use Foundry across a wide range of industries.

- Apollo: A scalable platform for developers to build customer applications on top of Palantir’s software.

Palantir generates revenue through two main avenues. Like most other software businesses, it generates revenue via licensing, charging subscription, or usage-based fees for its Gotham and Foundry platforms. In addition to licenses, the company offers consulting services, helping clients implement and optimize the software to address their custom requirements.

The business model is based on a three-phase approach: Acquire, Expand and Scale its business. In the acquisition phase, Palantir targets new customers by offering initial implementations at a very low cost or no cost at all. During the second phase, Palantir aims to hook the customer by addressing the customer’s specific pain points. In the last phase, Palantir fully implements and configures solutions, allowing customers to create a symbiotic environment by adding their own software atop Palantir’s platform.

Like most other software businesses, Palantir has been introducing AI into its product mix via the Artificial Intelligence Platform (“AIP”) in the last quarters, harnessing the power of large language models (“LLM”) for decision-making.

The first few used cases for Palantir are the integration of AI for its government customers, particularly aimed at intelligence gathering, counterterrorism, and military operations. However, the company is now aiming to leverage generative AI to drive growth in the commercial part of its business.

In my view, Palantir might be one of the key potential beneficiaries of generative AI. Its core strength lies in its ability to integrate and analyze large volumes of data to train models and decision-making, aligning perfectly with AI’s need for high-quality, well-structured data for efficient model training.

To showcase a few successes, Palantir announced the extension of the government contract Maven Smart System for an additional five years. Palantir was an early contractor for the project launched in 2017, which aimed to bring AI to the battlefield. The estimated contract value is for it to be worth around $90M annually, or roughly 3.6% of Palantir’s trailing-twelve-month revenue.

Likewise, Palantir was awarded a Department of Defense contract through the Chief Digital and Artificial Intelligence Office valued at up to $480M over the next five years and a $178M contract for project TITAN, a battlefield AI system.

From what we can see so far, Palantir’s AI strategy is paying off, as it has won over major defense contracts. However, the key to unlocking future growth will be a successful execution in the more significant commercial segment.

We can see a few of such successes with customers such as Aramark, Mount Sinai, and the National Geospatial-Intelligence Agency. These showcase how Palantir’s AI has helped to improve supply chain management, operational efficiency, and patient care in healthcare, as presented during the AIPCon 5 back in September.

Yet, more will need to come to justify its ballooning valuation.

Commercial Segment Gaining Momentum

As we are just three weeks away from Palantir reporting its Q3 2024 earnings, let’s just briefly look under the hood of Q2.

In the second-quarter earnings report, Palantir exceeded Wall Street expectations on both the top and bottom lines and issued better-than-expected Q3 guidance, with the strong performance responsible for the red-hot year-to-date price performance.

For Q2, Palantir reported GAAP earnings of $0.09/share, roughly an 80% YoY increase. Revenue rose 27% to $678M, beating analysts’ estimates of $0.08 per share and $653M in revenue.

Both the government and commercial businesses performed very well during the quarter. The government business generated $371M in revenue, up 23% from the analyst’s estimates of $349M. Its commercial business has delivered even better performance, with 33% revenue growth and revenue at $307M, ahead of the forecast by $1M.

Commercial revenue was significantly helped by a substantial 55% growth in US Commercial revenue, which reached $159M.

Palantir’s future depends on its success in growing its commercial segment, which is gaining momentum as the company strengthens its expansion into financial, healthcare, and energy, moving away from a government-dependent revenue structure.

Even though government-based contracts are more guaranteed and less cyclical, most of the money is to be made in the commercial segment.

In fact, CEO Alex Karp, in a letter to shareholders, highlighted that Palantir’s US commercial customer base increased 83% year over year, from 161 customers in Q2 2023 to 295 as of Q2 2024, now making up half of the company’s total customer base.

Top & Bottom-Line Growth Do Not Disappoint

Looking forward, Palantir appears to be on a solid footing to continue delivering, with the firm’s billing and remaining performance obligations (“RPO”) increasing 19% and 42% YoY, respectively.

These two metrics serve for us as evidence of the strong demand for the underlying Palantir’s software solutions. This is particularly as Palantir is facing higher demand than it can immediately serve, with customers very likely to stick around given Palantir’s software’s high switching costs.

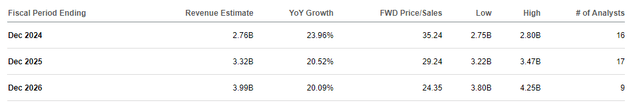

Thanks to the strong demand, Palantir’s management has raised its outlook for FY24 with estimated 2024 sales of $2.75B and $970M in operating income, an increase from the previous expectations of $2.68B of revenue and $874M of operating income.

Compared to full-FY23 revenue of $2.23B, this would represent a revenue growth of 23.3% with operating income expected to expand as much as 8x.

Nonetheless, given the strong tailwinds the business is experiencing, particularly in the US commercial segment, I expect the company to beat even its revised guidance by the end of this year. I further expect another 20-23% annual revenue growth on tap in the subsequent years.

Revenue Growth Expectations (Seeking Alpha)

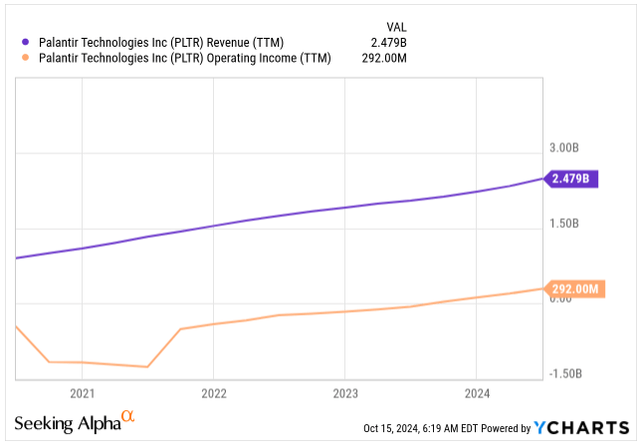

Even as many growth companies prioritize revenue growth, leaving profitability in the back seat or straight out failing to convert revenue into earnings, that’s undoubtedly not Palantir’s case.

From what we can see below, Palantir’s business became profitable on the operating level only in 2023, but operating income has continuously expanded, driven by higher revenue and margins.

Revenue & Operating Income (Seeking Alpha)

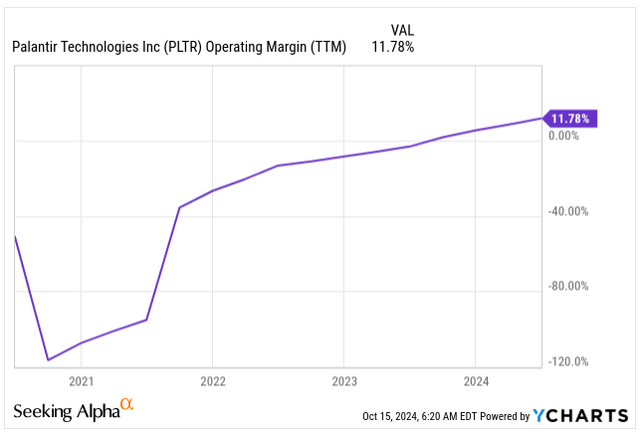

Palantir’s operating margins have been continuously improving. Thanks to the attractive unit economics the business can generate from the existing user base by upselling new products, I see margin expansion as the likely path for the company as it grows.

Operating Margin (Seeking Alpha)

Valuation Might Act As An Anchor On Future Returns

The issue with Palantir’s business is not the business itself, but the valuation—an issue we face as investors with most other high-quality companies.

Let’s first take a look at Palantir’s Price-to-Sales valuation:

- Palantir’s management expects the FY24 sales to land at $2.75B, which would imply a P/S ratio of 35x, given the $97B market cap.

- Analysts are expecting forward FY25 sales to land at $3.32B, a YoY growth of 22%, implying a 14-month forward P/S valuation of 29x.

Now, the rich valuation, even for large-cap stock such as Palantir, would be justifiable if the company exhibited massive EPS expansion over the coming years.

As per FactSet, analysts are forecasting Palantir’s EPS to grow at the following rate:

- FY24 EPS: $0.35E, YoY growth: 42%

- FY25 EPS: $0.42E, YoY growth: 19%

- FY26 EPS: $0.51E, YoY growth: 21%.

The growth we see above indeed categorizes Palantir’s stock as a genuine growth company. Still, the 20% EPS growth expectations beyond FY24 are, from my perspective, not enough to justify the exuberant valuation the stock carries.

Let’s look at the following scenarios. How much does Palantir’s bottom-line need to expand for the remainder of the decade to justify buying the shares at today’s prices?

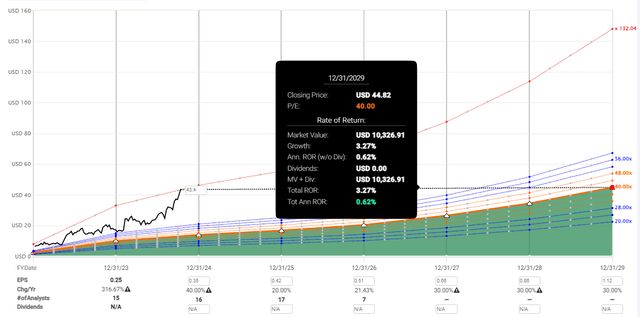

In Scenario 1, if we assume the projected FY24, FY25, and FY26 growth materializes as expected by the analysts and the company grows its EPS at 30% annually for the remainder of the decade, Palantir would need to trade at least at 40x its P/E by the end of 2029 to just break-even on your money or negative real return, if adjusted per inflation.

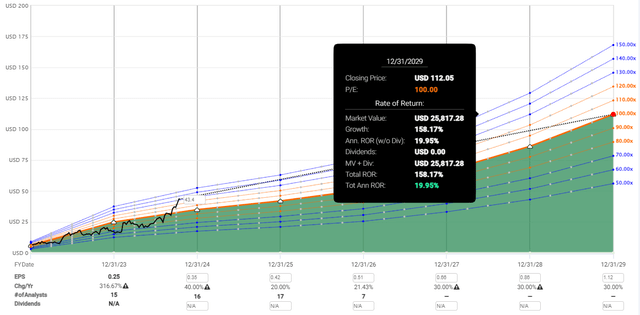

Given the non-existent margin of safety and uncertain future growth, I would aim for at least 20% ROR to justify buying Palantir’s shares at today’s valuation. If we stick to the same growth assumptions as above, Palantir’s shares would need to trade at 100x its earnings by the end of 2029 if I required the stock to deliver at 20% annualized ROR.

I am not saying Scenario 2 is impossible to materialize, but hoping for a 100x P/E valuation in 5.5 years is inherently uncertain and risky, and I do not like to bet allocate my heard-earned cash into uncertain promises.

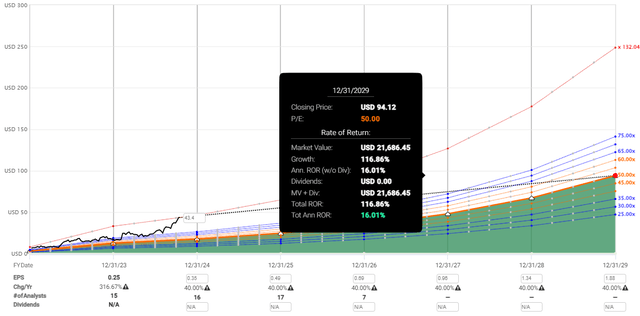

Naturally, it’s possible that Palantir will beat expectations and grow its bottom line much quicker than expected. In Scenario 3, I am assuming 40% EPS growth between today and the end of 2029, a truly hyper-scaler if this growth materializes. However, even in that case, we would need to see the stock trading at around 50x its earnings if we aimed to achieve at least 16% annualized ROR.

This indicates that it is critical to consider the perspective from which we examine Palantir’s growth and valuation before making an investment decision.

Forecasting Palantir’s future growth is inherently uncertain, given its relatively short life as a public company.

That’s perhaps one reason why analysts’ opinions on a short-term price target differ widely. However, the average price target is $27.7/share, implying a more than 30% downside from today’s share price.

Investor’s Takeaway

I believe Palantir is well-positioned for long-term success in the software industry, particularly in establishing itself as a leader in AI platforms. Its access to enterprise data is an excellent start for efficient AI data model learning, eventually building a competitive advantage.

The company is helping government and commercial companies worldwide convert data into decisions, and Palantir is set to materially benefit from organizations’ thirst for data-driven decision-making.

I also expect Palantir’s consumer footprint to materially increase over the coming years while the business benefits from unit economics, upselling its new product offerings to existing customers and improving profitability.

Nevertheless, investors should be cautious about Palantir’s valuation. The sky-high expectations are exposing investors to significant risks of permanent capital loss if the growth does not pan out as expected.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.