Summary:

- Palantir stock has surged over 120% in the past year, outperforming the market.

- PLTR’s recent inclusion in the S&P 500 has driven another surge as investors rushed in.

- I explain why its frothy valuations are increasingly challenging to justify, notwithstanding the buoyant market sentiments.

- Palantir’s go-to-market strategy and ability to scale its AI platform have been validated. But has too much optimism been priced in?

- I explain why it’s time for investors sitting on significant gains to consider selling and cashing in before the dominoes potentially collapse.

hapabapa

Palantir Investors Have Gone On A Rampage

Palantir Technologies Inc. (NYSE:PLTR) investors have helped the stock go on a blistering run as it briefly broke above the pivotal $40 level last week. As a result, PLTR has continued its stellar market outperformance since its bottom in December 2022. Accordingly, the stock delivered a total one-year return exceeding 120%, lifting its valuations further into “nosebleed” levels. The AI platform has likely turned the corner in its government business, even as it ramps up its commercial offerings through its AIP boot camps. Hence, investor sentiments on PLTR have surged through the roof, bolstered by its recent S&P 500 inclusion.

Notwithstanding the relative caution demonstrated by Wall Street analysts on PLTR, investors have confidently brushed aside signs of froth. Despite that, PLTR’s buying sentiments are likely nearing “irrational exuberance” levels. Palantir’s inclusion in the S&P 500 has validated the sustainability of Palantir’s earnings profile. However, it’s also hard to argue that the market hasn’t priced in the optimism, given its incredible surge. PLTR’s nearly 50% public ownership has also been a significant source of support for the stock. However, the recent insider sales have also reached “feverish” highs, as CEO Alex Karp and Peter Thiel unloaded significant holdings, capitalizing on the market’s optimism.

In my previous Hold rating on PLTR, I argued that the company’s solid Q2 report underscored its remarkable turnaround and highlighted the AI platform’s value proposition. Its novel boot camp concept has also proven its go-to-market strategy, as more than 100 organizations signed up for its AIPCon in September 2024. However, investors must question whether getting on board PLTR’s train at the current levels still makes sense. In addition, should investors sitting on significant gains consider leveraging the recent surge to take some profits and reallocate?

PLTR Stock: Valuations Have Reached Frothy Levels

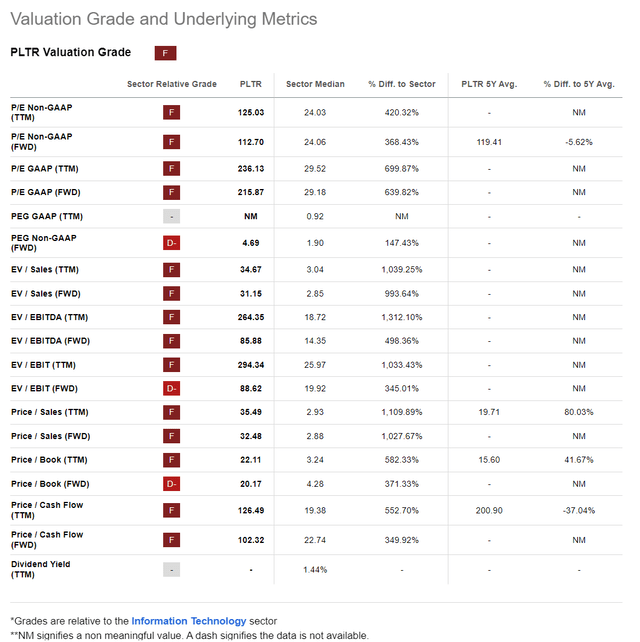

PLTR Valuation Metrics (Seeking Alpha)

As seen above, PLTR’s forward adjusted EBITDA multiple has surged close to 90x, significantly above its tech sector (XLK) median of 14.4x. It’s also markedly above its software peer median of 20x (according to S&P Cap IQ data). As a result, I find it increasingly challenging to justify the market’s optimism on PLTR, notwithstanding its continued outperformance.

I assess that Palantir’s AI platform has won critical acclaim from well-established technology reviewers. Coupled with the improved traction from its boot camp as it demonstrated its platform’s efficacy and use cases, it could lift its operating metrics further. In addition, Palantir has upped the ante as it seeks new growth optionalities in edge AI use cases, broadening potential industry adoption. Hence, it could accelerate its growth momentum as the company aims to leverage its platform advantages over its peers.

In addition, Palantir has also demonstrated the inherent flexibility and scalability of its multi-agent systems in its Customer Service Engine. The company aims to help manage complex customer queries more effectively while scaling the systems without reconfiguring them extensively. Coupled with Palantir’s ontology-driven capabilities, it helps to provide the appropriate context for effective enterprise deployment, improving the reliability and accuracy of its CSE. Coupled with the platform’s ability to leverage multiple LLMs, customers are not limited to a single foundation model, allowing them to exploit the strengths of various models within the same platform.

Palantir’s “Irrational Exuberance” Is Hard To Justify

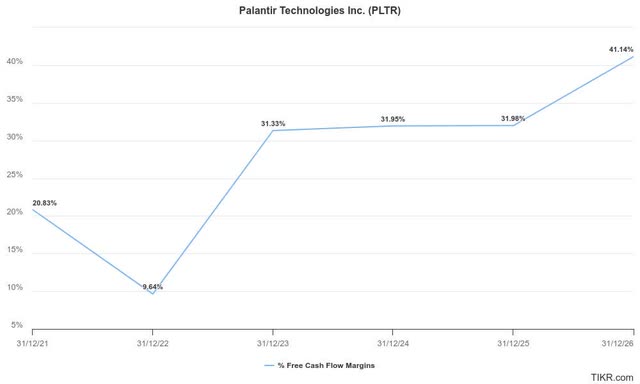

Palantir free cash flow margins estimates % (TIKR)

In addition, Palantir has also delivered more contractual wins recently, corroborating the improved buying sentiments on the stock. However, investors are urged not to throw caution to the wind, as its valuation has reached frothy levels that could be highly challenging to justify.

The company’s free cash flow margins are expected to continue scaling up, supporting its recent optimism. Despite that, can investors expect Palantir to deliver significant revenue growth rates over the next ten years to justify its current valuation? Let’s use a simple reverse DCF model to assess the “irrational exuberance.”

| Assumptions | Metrics |

| Annual hurdle rate | 15% |

| Current valuation | $89.6B |

| Required FCF yield after 10 years | 4.5% |

| Assumed FCF margin after 10 years | 42% |

| Target valuation after 10 years | $362.5B |

| Required annualized revenue growth rate | 30.3% |

PLTR stock reverse DCF model. Data source: Author, S&P Cap IQ data

As seen above, a hurdle rate of 15% for a high-growth stock like PLTR shouldn’t be construed as too aggressive. Given its valuation, a lower hurdle rate might not attract growth-oriented investors, as they could consider allocating to the Nasdaq (QQQ) (NDX) or the S&P 500 at significantly lower valuation levels.

Therefore, investors investing in PLTR at the current levels are likely anticipating an annualized revenue growth rate above 30% over the next ten years. While that’s not impossible, I believe it requires near-perfect execution to deliver such growth rates consistently without disappointing investors. In other words, the margin of safety at the current levels is seemingly non-existent.

Consequently, I assess investors who joined the bandwagon recently as possibly ending up with massive disappointment, as PLTR’s valuations have baked in significant growth prospects over the next ten years. If you are sitting on substantial gains, it’s timely to consider taking profits.

Rating: Downgrade to Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!