Summary:

- Palantir’s stock has surged to all-time highs, prompting me to sell half my stake due to valuation risks while holding the rest for long-term potential.

- I recommend new investors wait for a pullback before buying, as current prices are too risky given the company’s valuation.

- Palantir remains a strong company with growth opportunities, but I’ll reconsider a BUY rating if shares drop closer to $30 per share.

Tasos Katopodis/Getty Images Entertainment

Palantir Technologies Inc.’s (NYSE:PLTR) stock had impressive momentum in recent months and currently trades at its all-time high levels. I’ve used the latest stock rally as an opportunity to sell half of my stake in the company as valuation risks have become too big to ignore. At the same time, I’m still holding the other half of my stake at a decent average purchasing price as Palantir’s long-term potential still looks promising.

However, I believe that buying new shares for new investors at the current price is too risky, and it’s much better to wait for the potential pullback to get a greater margin of safety before adding the position to the portfolio. That’s why I’m changing my rating for Palantir from BUY to HOLD for now.

Reasons For Selling Palantir’s Shares

My latest article on the company titled Palantir: This Is Not A Bubble came out nearly three months ago. In that article, I’ve highlighted why Palantir is a great company to own and noted that its growth story is far from over. Back then, its valuation was relatively reasonable and thanks to numerous growth opportunities, its stock had more room for growth.

Since that time, Palantir’s shares had an impressive run and in less than three months appreciated by ~60% and greatly outperformed the broader market.

After such a great performance, I decided to sell half of my stake in the company recently. One of the reasons for selling half of the position was the fact that the stock price had greatly exceeded even my optimistic price target, which made me pull the plug. After more than a decade of experience investing in the stock market, I learned the hard way that it’s important to never have an emotional attachment to any investment and execute trades when your goals are reached.

Another reason for trimming half of the position was the fact that Palantir’s biggest insiders have also started to gradually unwind their stakes after a massive price increase. Just like the insiders, I decided to take some profits, but still keep a stake in the company in case the company continues to generate additional shareholder value.

Going forward, the further direction of Palantir’s stock price will likely be decided after the company reports its Q3 earnings report on November 4. Currently, the street expects Palantir to grow its revenues by 26% Y/Y and EPS by 30% Y/Y in Q3.

The problem is that even if Palantir exceeds those expectations, and there’s a high chance that it will considering its performance in recent quarters, it still makes it questionable to justify the company’s current valuation. In my latest article on Palantir, I posted valuation models that include the base and optimistic scenarios. My base case model showed that the company’s fair value is $21.59 per share, while the optimistic model showed that the company’s fair value is $30.57 per share. Palantir currently trades above both of those price targets.

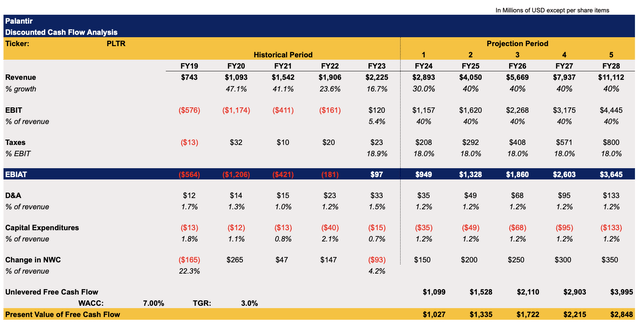

The biggest difference between those models was the revenue and earnings growth rate. Considering the rapid rise of Palantir’s shares in recent months, I decided to create a new model to figure out whether the upside after the latest rally is still there. In the model below, most of the assumptions for major metrics remained the same as in the optimistic model, but the revenue growth rate has been increased. In FY24, the growth rate increased from 23.6% to 30%, while in FY25 and beyond the growth rate increased from 35% to 40%.

Palantir’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

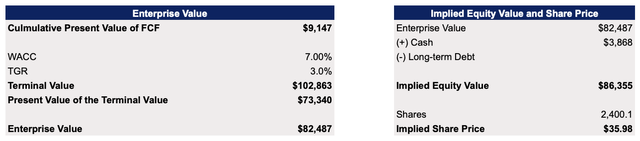

With such an increase in the revenue growth rate, this model now shows that Palantir’s fair value is $35.98 per share. Such a price target is higher in comparison to the previous optimistic model, but also below the current market price.

Palantir’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The issue with this new model is that a 40% revenue growth rate in the next five years is unlikely at this point. The rapid growth of Palantir’s shares in recent quarters was fueled primarily by the company’s entrance into the generative AI sector with the launch of AIP in the spring of 2023. The product has been there long enough already, and we have some basic understanding of how much sales it can generate.

The consensus on the street after all the latest upward revisions is that the overall revenue growth rate in the next couple of years will be in the range of 20% to 29%. Palantir itself reported a 27% Y/Y revenue growth rate in Q2 and expects a ~25% Y/Y growth rate in Q3. As such, expecting a 40% or higher growth rate for a few years in a row as shown in the model above is unrealistic at this point. Even if we see a 30% revenue growth rate in Q3 and Q4, it would still be hard to justify the current valuation.

The reality is that Palantir’s fair value is likely to be somewhere in between the base and optimistic scenarios that were shown in my latest article on the company. That’s why at this stage, it makes sense to sell some shares for a good profit as the current stock rally can’t last forever. With a forward P/E of 120x and a forward P/S of 35x, it’s safe to assume that the upside for its shares is simply limited.

Going forward, Palantir will remain a great company that grows at a solid double-digit rate and aggressively expands its customer base. But I’ll wait for a potential pullback closer to ~$30 per share before considering giving the stock a BUY rating again.

Reasons For Holding Palantir’s Shares

Another major lesson that I learned over the years of investing in stocks is that fundamentals often don’t dictate the price action. Back in 2021, Tesla, Inc. (TSLA) was trading at multiples similar to the ones at which Palantir is trading today, and it didn’t stop its stock from appreciating even further. Only the change in the macro environment in 2022 finally brought Tesla to more reasonable multiples. That’s why despite being overvalued, there’s always a possibility that Palantir’s shares would nevertheless continue to appreciate further. That’s why I haven’t sold my whole position and still hold the other part at a decent average purchasing price.

Considering that the economy is resilient and Palantir has been recently added to the S&P 500 Index, it’s unlikely that some major macro development will undermine its growth story. In 2022, Tesla’s growth story was primarily undermined by the Federal Reserve, which started to raise rates to battle the rising inflation. Today in 2024, Palantir doesn’t face the same macro challenges as we’re currently in the disinflationary environment.

At the same time, Palantir’s commercial business continues to thrive to this day as the company is adding more customers who are embracing the generative AI revolution. The government business also appears to be on the rise, as more contracts are being awarded to Palantir. Considering this, it seems that Palantir has more than enough growth opportunities that could help it continue to grow at a decent double-digit rate.

Finally, as I write this article, the momentum is still on Palantir’s side. The company’s shares have been trading around the all-time high levels for over a week already and formed a technical support level of around $40 per share. If the stock holds above the $40 per share level until the earnings report comes out, then there’s a possibility that the rally could be extended, especially if the earnings expectations are exceeded and guidance for the year is improved once again. That’s the main reason why I haven’t sold my whole position and still hold half of it even at the current multiples.

The Bottom Line

There’s no denying that Palantir is a great company. It has greatly capitalized on the generative AI revolution and has all the chances to continue to grow its customer base and scale its business.

The only issue at this stage is that its shares trade at significant multiples that can’t be justified if the company doesn’t increase its growth rate to even more aggressive levels. That’s unlikely to happen right now. This is the main reason why I have sold half of my position in the company at a nice profit.

However, I’m still holding the other half of my stake in the company due to Palantir’s long-term potential. The decent average purchasing price makes it possible for me to account for the valuation risks without worrying too much about losing the invested capital. If you don’t have a position right now, then it’s much better to wait for a potential pullback to have a greater margin of safety.

That’s why I’m downgrading Palantir from BUY to HOLD right now. I’ll consider changing the rating back to BUY again if the shares pull back closer to $30 per share, which is close to the price target from my previous optimistic model.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.