Summary:

- Palantir’s significant revenue growth is overshadowed by high equity dilution, resulting in negative per-share revenue growth and diminished shareholder value over the past 3 years.

- Stock-based compensation, representing 66% of CFO, inflates cash flows but dilutes shareholder equity, questioning the quality of earnings.

- Given the excessive equity dilution and unrealistic market assumptions, I recommend a sell rating and advise investors to stay on the sidelines.

Michael Vi/iStock Editorial via Getty Images

Recent developments

Palantir (NYSE:PLTR) over the last quarters has seen significant growth in the top and bottom line. As the founder mentioned:

The U.S. government has begun awakening as well to the scope of the opportunity ahead. This past quarter, for the first time in our company’s history, the trailing twelve-month revenue in our U.S. government business-including defense and intelligence agencies-surpassed $1 billion.

Indeed, a milestone for a newly founded company.

During FY2023, net income and operating income turned positive for the first time since the company’s inception. Net income increased by 156% YoY, and operating income by 158%, driven by a 16.74% revenue expansion.

Between Q2 and Q1 of 2024, US Commercial revenues increased by 55% climbing to $159M, and International Commercial revenues increased by 33%, reaching $309M. Government US and non-US revenues grew at 25% reaching a combined total of $649M.

Additionally, net income increased by 27% QoQ and operating income increased by 31% QoQ for the same period respectively, positioning the Q2 2024 GAAP operating margin at 16%. During Q2 FY2024 they reached a record rule of 40 of 64% (growth rate + % EBITDA margin) indicating that PLTR is one of the healthiest SaaS startups by wide margins. View Q2-2024 results here.

However, current market appraisal raises concerns for old and new investors as the market has valued the aforementioned net income growth at 200 times earnings, raising even higher the expected growth. As we will soon observe, past growth hasn’t been adequate for such a valuation if we consider the tremendous equity dilution that shareholder’s experienced over the past 2–3 years. Let’s take a look.

Quality of earnings

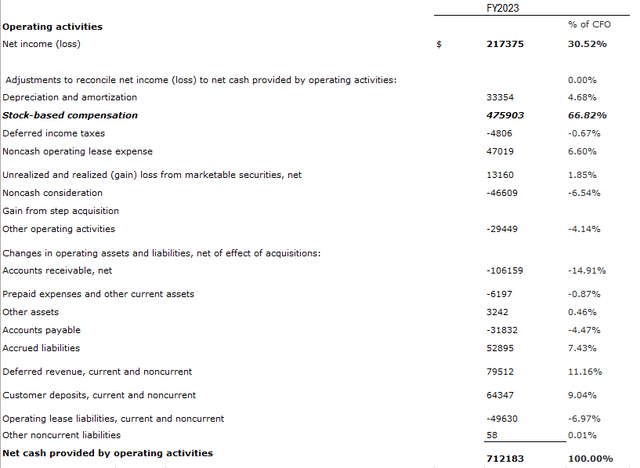

Palantir’s net income is lower than cash-flows from operations, which is an indication of high quality of earnings. But we need to further analyze CFO to find out what items were included and if any adjustments need to be made. After a brief vertical analysis on cash flows from operations, these are our findings:

CFO extract (Palantir 2023 Annual Report)

Stock-based compensation represented 66% of CFO. When such expense goes through the income statement but is added back to compute CFO, the result is lower earnings and higher cash-flows, which in turn indicate high quality of earnings. However, If the expense is eliminated from the income statement, the inverse takes effect. Higher net income and lower CFO, which is a characteristic of poor earnings quality.

Consequently, if stock-based compensation gets eliminated, the cash flows will look poorer and earnings will be higher (and possibly inflated). It is a trade-off that needs to be carefully considered, but since it increases the cash-flow figure, it is likely that such large dilutive compensation will persist.

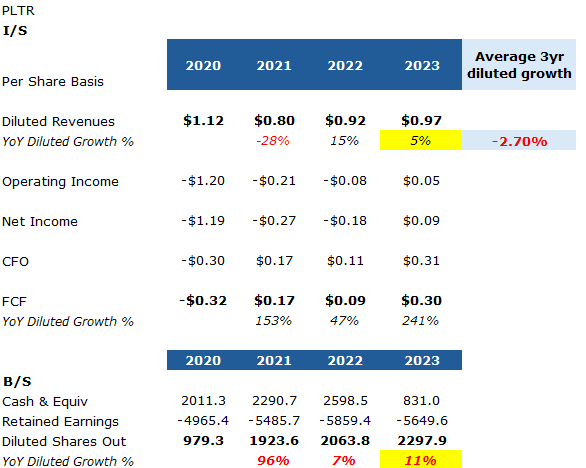

As we can see in the below extract, from FY2022 to FY2023 another 200M shares were added to the total, driving the value of current shareholders even lower. What happens if we carefully investigate the per-share figures?

In that case, shareholders haven’t realized any intrinsic growth over the past 3 years. Of course, one might make the case that per-share figures don’t matter since an increase/decrease in shares does not impact the top or bottom line. I have to remind you, however, that issuing shares and diluting equity is a real expense to the current shareholders as are asked to purchase more shares to offset the dilution effect.

Impact of dilution on past growth

Top-line expansion is not as good as it looks if we view the per-share figures:

Diluted Shares – Impact on I/S (Author’s Estimates)

It is clear that Palantir averaged a negative -2.7% 3-year revenue per-share growth if we take into account the tremendous equity dilution. On a diluted per-share basis, shareholder’s stakes shrank by 11%. On the bright side, YoY(2022-2023) retained earnings increased slightly by 3%.

Investors to date have put $5.6B in the enterprise to realize about $300M from operations annually. If we assume that investment was made yesterday to harvest $300M of earnings from operations today, then the return matches the annual yield of a 3 month T-Bill.

Market assumptions

EPS

New investors are asked to pay 200 times earnings, given the recent acceleration in the top line.

What does a cost of $36 per share mean for Normalized GAAP Diluted EPS $0.11 (TTM) annual earnings? If we assume that 200x is a “fair value”, GAAP Diluted EPS should grow 200% consistently for the next 5 years.

Additionally, if we use 5% for the risk-free rate, which sets the fair P/E at 20, Normalized GAAP Diluted EPS should be $1.8 today to support a fair no-growth valuation.

P/B

Old Graham readers will recall his comments on paying a price above book value. It is generally not recommended unless the book value premium can be actually realized by the enterprise in the future. A 20x multiple indicates that there is a $76B premium that the company should earn in the future to justify a P/B of 20 bringing it down to a P/B of 1. Of course, no technology company is trading at P/B of 1 because they are perceived to have a wide competitive advantage over other companies. As a result, a P/B of 2 or 3 might be justified. But a P/B of 20 is unreasonable for a startup.

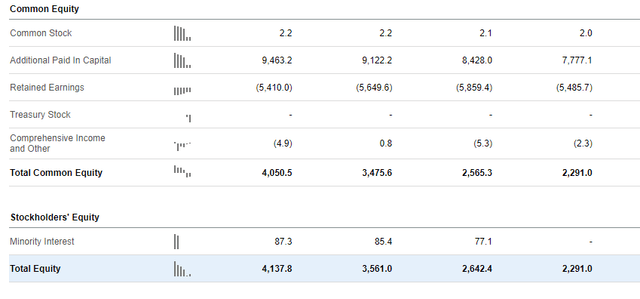

Effects of Additional Paid-in Capital (APIC) on Book Value

Last Report, 2023, 2022, 2021 (Seeking Alpha)

When an option is exercised, the company raises more cash, stockholders equity goes up by the same amount. This is the reason why we need to consider both figures retained earnings and APIC.

We can see that during the latest report and the past 3 years, book value grew at a substantial pace. The investor should not mistake growth in book value, with capital contributed. A large part of the growth in book value was driven by more cash that the company was able to raise by exercising stock options. We can see that APIC between 2023 and Q2 2024 was increased by $341M and retained earnings by $240M for a combined $580M increase. Thus, the stock exercise in the first two quarters, grew book value by nearly 59%.

Investment Considerations

All things considered, the enterprise at the current growth state is not of investment quality. Given the large equity dilution, I would recommend a sell for the security. Investors can remain on the sidelines until the long-term view changes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.