Summary:

- Palantir’s AI offerings strengthen Western defense capabilities, crucial in a new cold war period, highlighted by a $480M U.S. defense contract for AI system Maven.

- Balancing 55% government and 45% commercial revenue, Palantir’s agility in AI-led information warfare and cybersecurity positions it for sustained growth amid shifting global security demands.

- Despite positive free cash flow and GAAP profitability, Palantir’s high P/S ratio of 25 suggests overvaluation, risking long-term market underperformance amidst intensifying global AI defense competition.

Bussarin Rinchumrus/iStock via Getty Images

In my last thesis on Palantir (NYSE:PLTR), I described the company as a long-term Buy. While I think that this is true and that the company’s long-term growth trajectory remains largely intact, with significant growth coming from the vital utilization of Palantir’s AI offerings for Western defense, I think that the stock is now overvalued. I mentioned this in my previous thesis, but since the stock has gained 20% in roughly three months since my last analysis, I think a rating downgrade is warranted.

Operational Analysis

In my opinion, Palantir is arguably going to be the leader in AI-assisted warfare. I am not personally bullish about warfare companies often, partly because it is not my field of expertise and partly because I view diplomacy as always favorable when possible. However, I believe that the utilization of AI for defense is vital during a time when global international conflict is looming. Niall Ferguson, in an Intelligence Squared interview 4 weeks ago available online, said we are currently in a cold war period. I think this is true, and I think that Palantir’s Western government defense AI offerings are largely conducive to the balance of power being kept. In my opinion, it is advantageous for the U.S. to continue to strengthen itself in defense in core areas while curbing the federal budget in other areas. In my opinion, AI-assisted technologies like those offered by Palantir, which it has a considerable moat in, are likely to take a much greater focus in Western defense budgets moving forward. This has been made evident recently by the $480M U.S. defense contract for an AI system prototype called Maven. In many respects, I think that the nature of warfare is changing, and I wonder whether moving forward, it will be as physical as it has been historically. I think Palantir has recognized this early and has positioned itself for long-term growth under these catalysts.

Part of how the battlefield and international relations are evolving if it is to be less about physical conflict is that it is more about psychology. Palantir is very closed about the workings of its defense programs, because it is under strict NDA agreements. While Palantir’s tools support the shift toward a more information-centric form of future warfare, it is still speculative at this stage how this will evolve. Thus far, much of what has been developed by Palantir in the defense world and in its commercial contracts is software for efficiency in decision-making and information management. However, from my analysis and research, including watching interviews with why Peter Thiel and CEO Alex Karp founded the company, a big driving force is to transform international security to be more subtle and sophisticated. I think management is on to something very special here, and I think the company is actually at the nascent stages of these profound shifts in international defense. Palantir stock is likely to grow extremely well if it continues to consolidate its moat in these areas, and I think the company is also extremely sophisticated in its operational structure, with around 45% of its revenue from commercial contracts and 55% from government contracts. This allows the company to be agile to the shifting nature of international security, especially if the demands and necessity for high levels of government defense become less acute over the long term, which is a potential outcome that I see from the growing reliance on information and AI in international defense and more globalized world order in the long-term future.

This brings me nicely to Palantir’s role in commercial cybersecurity, which I think is likely to grow for the company over the long term. The company has developed an AI-enabled solution for discovering, understanding, and remediating cyber vulnerabilities. It calls this its Enterprise Vulnerability Management (‘EVM’) System. It also uses Palantir Gotham, which is primarily known for defense and intelligence applications, for commercial cybersecurity. Furthermore, Palantir Foundry offers cybersecurity capabilities for commercial clients, including AI-led threat detection. At the moment, the government market for Palantir is bigger than its commercial market, but I think this is going to change over the long term. In essence, its strength in both areas acts as an ongoing hedge against the change between peace and wartime economies. In my estimation, the current cold war period, which is intensifying, is likely to bolster the company’s government revenues over the next decade, but I am hopeful that as AI, robotics, and automation capabilities scale, driven by the West, the deflationary effects will support the dollar as the global reserve currency and re-establish the West as the uni-polar leader of the world order, re-establishing a peacetime economy. At this time, Palantir is well-positioned to navigate a future strategic redirection toward its commercial contracts to continue to deliver revenue growth, and I think Palantir is one of the foundational companies that is crucial in strengthening the West into a leadership position again and out of concerns of international multipolarity.

Financial & Valuation Analysis

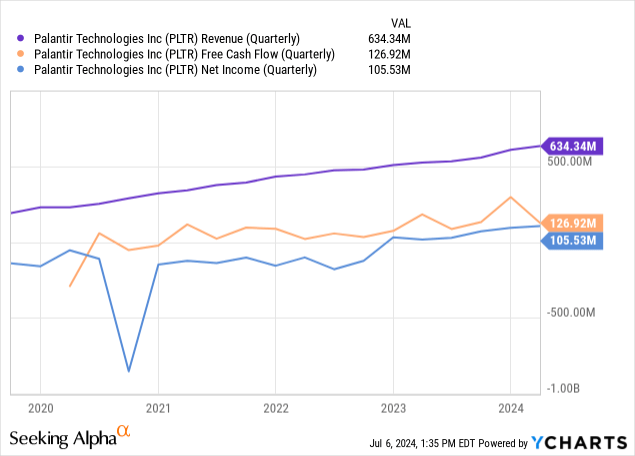

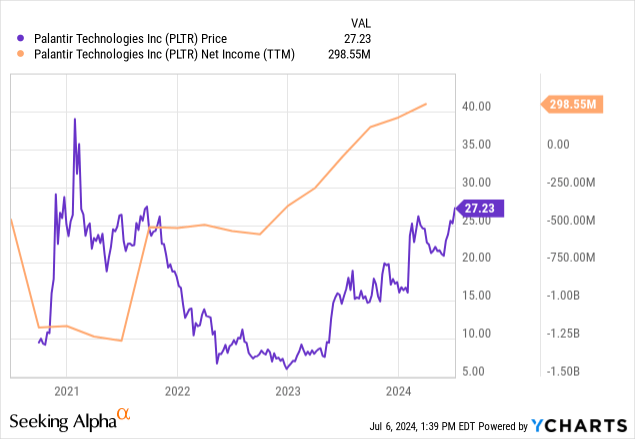

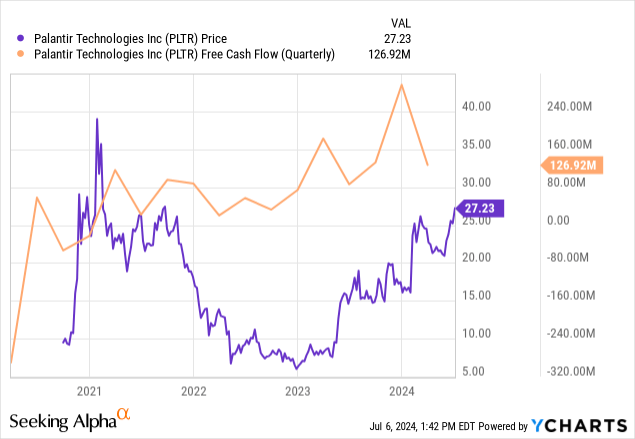

The company is operating slowly and steadily with all of the ingredients for long-term success on a pure financial front. Its positive free cash flow generation earlier than net income was largely due to high levels of SBC. The real good news is that the company is GAAP net income positive as of fiscal 2023. This resulted in massive enthusiasm from the market, as we can see in my second chart.

I see this time and time again, the market loves to buy shares when net income gets reported. However, in my opinion, the real secret to investing in many non-profitable growth companies is to look for free cash flow generation before net income generation. If free cash flow positivity has already been achieved, it is very possible to buy before the herd, as would been the case with Palantir if investors bought in 2022 when the valuation was favorable.

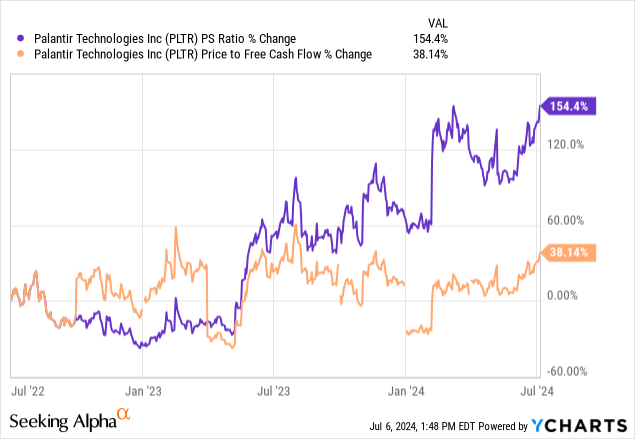

However, now, it is arguably too late to buy PLTR shares to achieve a competitive long-term price CAGR. Even in my last thesis, the likelihood of a long-term market-beating CAGR was relatively low. After gaining 20% in three months since that analysis, I see it highly unlikely the company will beat the market over 10 years now, primarily based on its valuation.

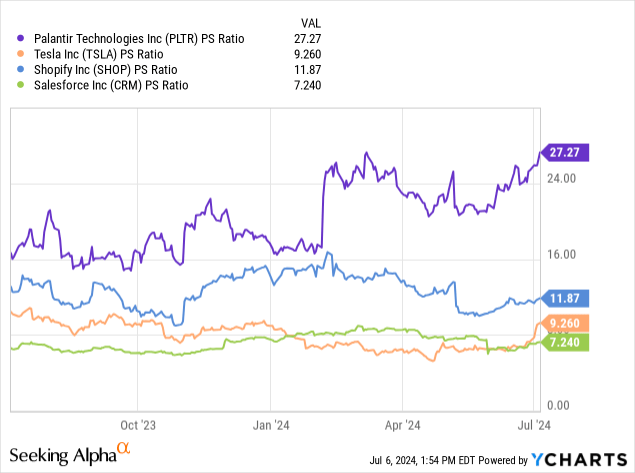

Based on analyst estimates, I don’t think it is unreasonable for the company to achieve a revenue CAGR of 15% over the next 10 years. However, I do not think that the current price-to-sales ratio of around 25 is sustainable. There are very few companies like Palantir, but one has to argue why it deserves a price-to-sales ratio that is so much higher than even other technology companies that are renowned for rich valuations, like Tesla (TSLA) and Shopify (SHOP) and even other software companies more similar to Palantir like Salesforce (CRM):

My question, which I am still trying to ascertain, is what is the market expecting from Palantir, which makes a price-to-sales ratio of 25 reasonable? From my research thus far, it isn’t reasonable, but I would be interested from readers in the comments if they have ideas of why it could sustain such a high P/S ratio, given its revenue growth is only likely to be circa 15% annually over the next 10 years. In my opinion, over the long term, a P/S ratio of around half that, 12.5, might be realistic for the company to have in 10 years’ time. But for the purposes of this analysis and relative conservatism related to its historical valuation multiples (19 as a 5Y average for P/S), if the company has a P/S ratio of 15 this time in 2034, with a 15% revenue CAGR, the stock price would be $65, implying a price CAGR of 9% from the current stock price of $27.23, based on TTM revenue per share of $1.07.

Risk Analysis

There are very few direct competitors to Palantir, but notably, there are growing threats in international government programs. China is rapidly developing AI capabilities for military applications through its Military-Civil Fusion strategy. This integrates civilian research and commercial sectors with military development, potentially rivaling Palantir and Western interests. Russia has also been heavily investing in AI for military purposes, as outlined in its National AI Strategy.

On the Western front, Palantir is not the only company with advanced capabilities developing. While it is the most advanced, Israel’s Unit 8200, an elite intelligence unit, has been at the forefront of developing advanced AI and cybersecurity technologies. Many startups founded by Unit 8200 are now competing in the global defense AI market. In addition, the European Defence Fund has multiple AI projects for defense applications. It is important for Palantir to focus on integration with Western counterparts during this time, in my opinion, as its capabilities scale and if it can offer the most advanced capabilities in AI-led international security.

Furthermore, India, the highest growth nation in the world at this time based on GDP, has launched the Defence AI Project to develop AI-powered defense applications. It is not improbable that India will develop highly advanced forms of international security and commercial security systems similar to Palantir, given the country’s heavy focus on AI and consulting services already. As such, Palantir needs to focus on dominance in the field to continue to help Western powers lead internationally, in my opinion.

I also think there are considerable risks with Palantir developing AI for defense in the future, which prove uncontrollable as the capabilities of the technologies scale. Defense is arguably the most sensitive use of AI, and a high level of risk mitigation and ethics is required in the development, maintenance, and strategy of future implemented systems. I think if there are bad instances where defense AI has a widespread mistaken negative effect on general civilian populations domestically and/or internationally, market sentiment for Palantir could be severely depleted, perhaps even over the long term. In my opinion, this is the largest risk for PLTR shareholders.

Conclusion

Palantir is actively involved in this current cold war period in international relations, where weaponized AI is becoming increasingly prevalent as a security measure and a threat of attack and defense. In my opinion, there is a long-term likelihood of AI rising as a leading threat in information and psychological warfare akin to nuclear weapons, but much more subtle. I think Palantir is in the nascent stages of developing this, and while it might be viewed as negative for those who do not like to invest in military companies due to ethical reasons, I think that the evidence mounts that the West is likely to continue to mount in strength to position itself in unipolarity in the world order. A large catalyst that I believe will support this is the region’s lead in AI, which some believe is about a 10-year lead against China. I think this lead should be capitalized on, and I think that Palantir can help to support this. By initiating further emphasis on AI defense in the West, I believe international peace can remain. This is why I am long-term bullish about PLTR, despite present valuation risks, which means I am not initiating a position at present.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.