Summary:

- Palantir Technologies Inc. is expanding beyond its traditional government contracts into unconventional business sectors, positioning itself as a leader in enterprise AI solutions.

- Although the U.S. and U.K. currently account for 75% of Palantir’s revenue, the company is targeting high-growth international markets in Asia, Europe, and Latin America.

- Early adoption in sectors like precision agriculture and renewable energy is giving Palantir a first-mover advantage, potentially leading to accelerated revenue growth.

- Despite its high valuation, Palantir’s diversified growth strategy and expanding international presence suggest strong earnings potential.

Michael Vi

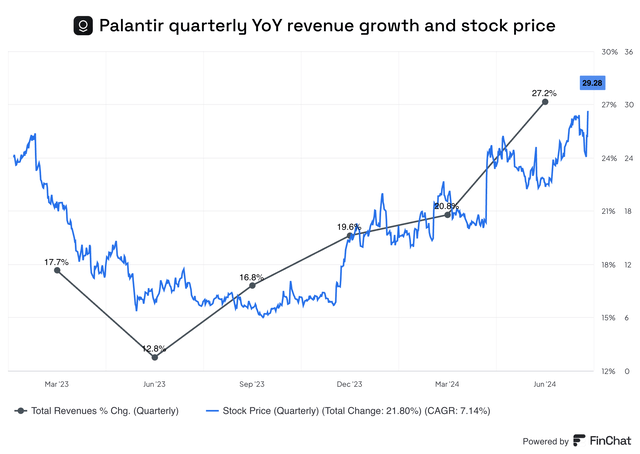

In February 2022, I turned bullish on Palantir Technologies Inc. (NYSE:PLTR) when the stock was trading around $13 as I believed the company’s valuation failed to reflect its true economic potential. In June 2023, during the early days of the AI stock market rally, I reiterated my buy rating for Palantir stock as I thought the company was well-positioned to emerge as a big winner of AI technology. The strong government sector performance and the industry recognition of Palantir’s technology were the main reasons behind my bullish stance back then. Palantir, since then, has delivered the promised goods, and Mr. Market has not been oblivious to this success, either.

Exhibit 1: Palantir quarterly revenue growth and stock price

As Palantir transitions into an AI enterprise company with a focus on the commercial sector, I remain bullish for two main reasons.

- The company’s expansion into unconventional business sectors.

- The untapped global growth potential.

The objective of this analysis is to dive deep into these two growth avenues to evaluate how Palantir is positioning itself to enjoy a multi-year growth rally.

The Expansion Into New Business Verticals

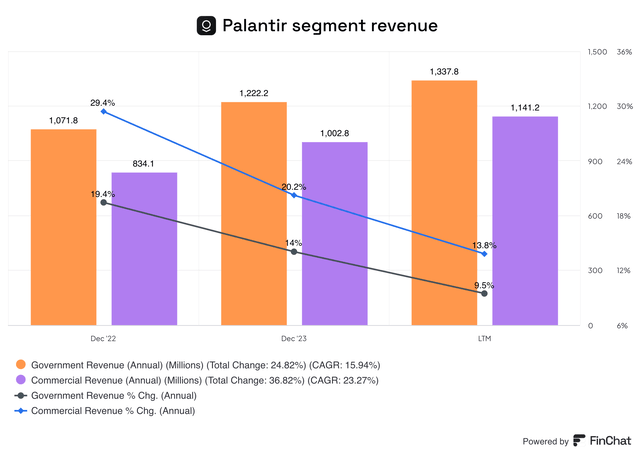

Palantir, until recently, was known for its long-standing contracts with government agencies including the Department of Defense, Central Intelligence Agency, and the Department of Homeland Security. In the last few years, Palantir management has made a concerted effort to diversify the business through an expansion into the commercial sector. Commercial revenue has grown at a faster pace compared to government revenue in the last couple of years.

Exhibit 2: Palantir segment revenue

Today, the company is expanding into several unconventional business sectors, where it is emerging as the leading enterprise AI solutions provider. These sectors include;

- Agriculture

- Climate change

- Public health

- Energy.

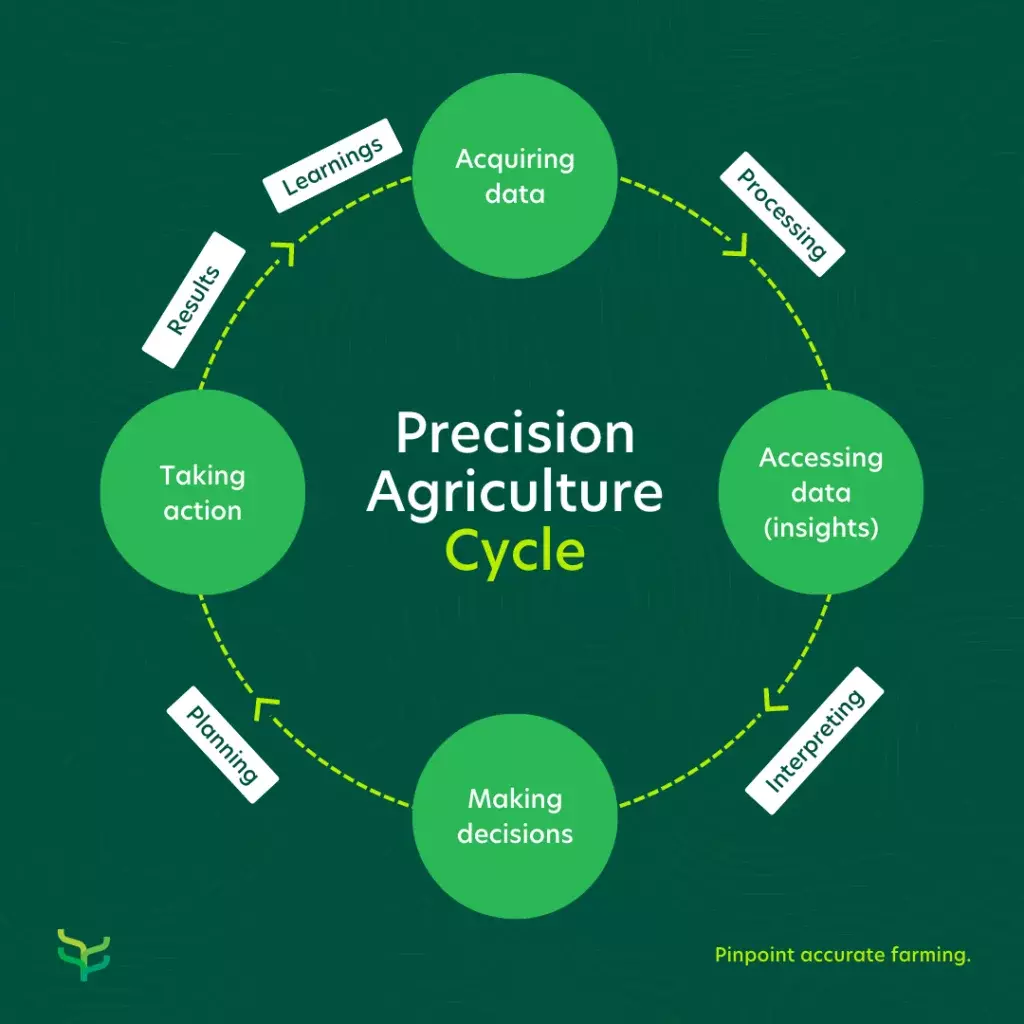

Palantir, at its core, is a data analysis company that enables its customers to analyze large data sets to make informed decisions. Today, the company is partnering with relevant stakeholders to improve the global food supply chain while building resilience to future food shortages. Palantir’s technology can be used to adopt precision agriculture, which focuses on optimizing available resources to maximize the yield while ensuring the safety of the soil. Predicting crop yields is a key part of the precision agriculture framework.

Exhibit 3: Precision agriculture cycle

Farm21

In 2022, Palantir partnered with the FDA through the 21 FORWARD Initiative in a $22-million deal to collaborate with regulators in their efforts to address food shortages through improved process and resource allocation efficiency.

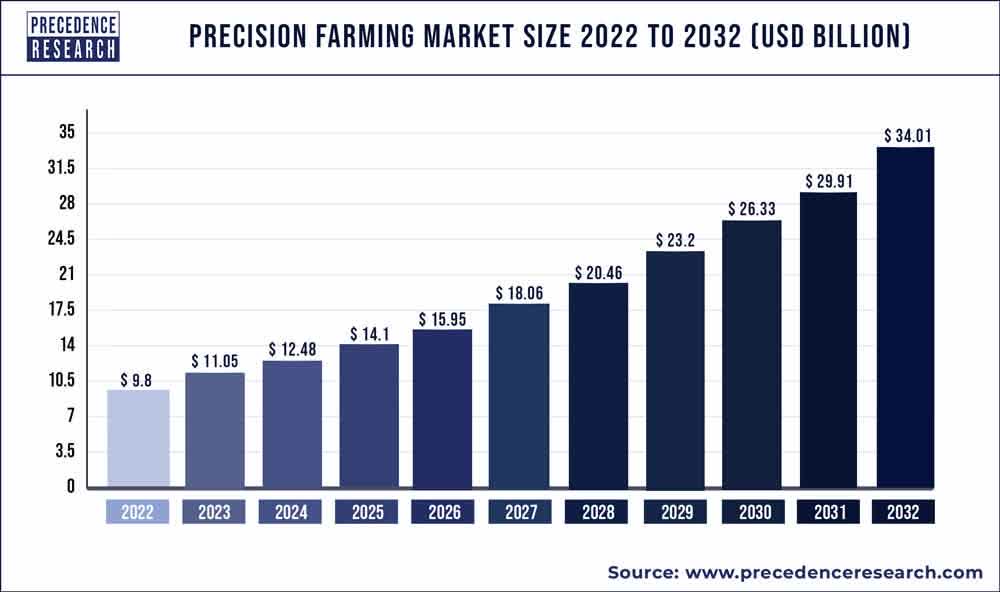

According to Precedence Research, the global precision agriculture market will grow at a CAGR of 13% through 2032 to reach a value of $34 billion. The growing adoption of advanced data analytics by farmers is expected to be the primary driver of this market. This follows a broad trend where physical labor is now being replaced with new technologies that offer greater efficiency.

Exhibit 4: Precision agriculture market growth

Precedence Research

Palantir’s early inroads into the precision agriculture market will help the company enjoy first-mover advantages in the future as this technology goes mainstream globally. Palantir is also focused on improving the supply chain process by helping agricultural businesses achieve greater efficiencies through data analysis, which should lead to reduced food waste eventually.

Palantir’s growing interest in climate change initiatives will also be a long-term growth driver, with government agencies doubling down on climate change investments amid peer and policy pressures. The company is a member of the CO-WY-led team that received the U.S. National Science Foundation grant, which aims to create 22,000 new jobs. This grant will inject more than $1 billion into the economy by developing AI tools and other data analytics tools to fight climate change. Palantir’s data analytics tools can be used to model the impact of climate change and also to predict natural disasters. The company’s technology can also be used to monitor pollution levels and to allocate resources efficiently to prevent a global shortage of critical elements such as clean drinking water.

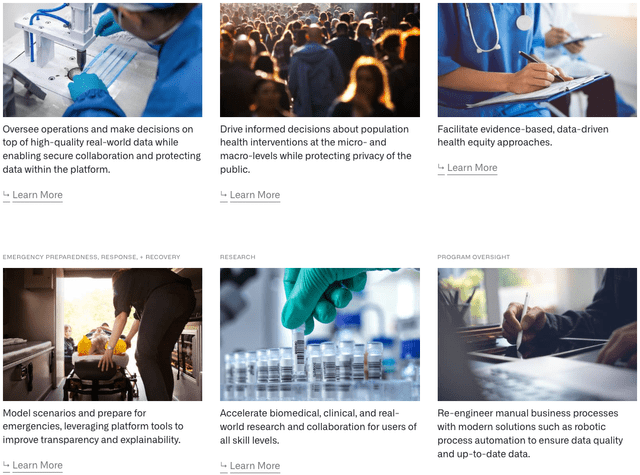

Palantir is expanding into public health care as well, which is another lucrative end market with a long runway for growth. The company is leveraging its existing relationships with government agencies to expand into new verticals, including public health.

Palantir played a key role during the Covid-19 pandemic by developing software tools to monitor the spread of the disease. Palantir’s Gotham and Foundry software was used by the CDC, NIH, and HHS in the U.S. while the UK NHS also used the software to gather and analyze data. Based on the successful collaboration during the pandemic, the CDC awarded Palantir a $443 million contract in December 2022 focusing on disease surveillance and outbreak response. This is just the start of a multi-year trend where Palantir will aggressively gain market share in the enterprise software market for public health. Below are some public health solutions offered by Palantir.

Exhibit 5: Palantir’s public health solutions

Finally, Palantir is making inroads into the energy sector at a time when leading energy companies are aggressively investing in data analytics platforms to improve their efficiency while embracing renewable energy. The company has won several important contracts in the recent past. For example, in August 2023, Azule Energy, a joint venture created by BP plc (BP) and Eni SPA (E), selected Palantir Foundry to digitize the operations of its assets. Palantir’s expansion into this sector is coming at an opportune time, with Gartner estimating 40% of energy companies to face a 50% increase in capital expenditure by 2025 due to resource scarcity. Palantir’s solutions can be used in various stages of energy operations to optimize exploration, manage complex supply chains, and improve the efficiency of distribution networks.

Overall, Palantir’s expansion into non-traditional business sectors should open new doors for the company to grow in the next five years, leading to an acceleration in revenue growth.

The Untapped Global Growth Potential

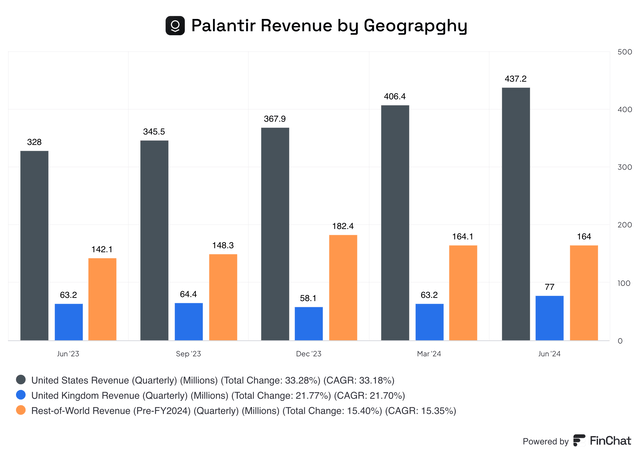

Palantir generates the bulk of its revenue in the domestic market. In Q2, the United States accounted for 64% of total revenue, while the United Kingdom accounted for 11% of revenue. Other geographies accounted for just 25% of revenue, which suggests the company’s business is highly concentrated on one major market.

Exhibit 6: Palantir revenue by geography

Palantir faced criticism in Germany back in 2023, but with the current political unrest in Europe, German officials are pressing for a return of the policy analysis platform Bundes-VeRA developed by Palantir, which was banned by a German court in early 2023. Commenting on the important role played by VeRA in identifying potential national security risks, the Chairman of the Association of German Criminal Police Officers Dirk Peglow said last March:

When defending against terrorist threats, the German security authorities are urgently dependent on bringing together the information available in the different data sets on relevant people across Germany as quickly as possible in order to identify networks, recognize attack plans and prevent their implementation. With Vera, existing knowledge deficits could be reduced to threatening situations.

Palantir, in a bid to tap into faster-growing markets in Asia, is expanding into innovative hubs such as South Korea and Japan, where digital transformation spending is expected to accelerate in the coming years. The company’s strategic partnership with Hyundai Heavy Industries Group forms the backbone of its expansion efforts in South Korea. The company is also expanding its presence in Latin America, especially in big economies such as Brazil, Mexico, and Colombia.

These fast-growing markets, aided by robust infrastructure spending by government agencies, will create many new growth avenues for Palantir in the next decade. Early expansion into these markets to establish long-lasting relationships with government and commercial clients, in my opinion, is a prudent move that would unlock substantial value for long-term shareholders.

Takeaway

I invested in Palantir because of the strength of its government contracts and its diversification efforts into the commercial sector. A good understanding of Palantir’s expansion into unconventional business sectors and its growth potential in international markets has alleviated my concerns about Palantir’s expensive valuation (the company trades at a forward P/E of 82). Although the company is not cheaply valued, I am confident in its ability to create shareholder value through strong earnings growth in the foreseeable future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.