Summary:

- Palantir Technologies reported better-than-expected sales and achieved its sixth consecutive quarter of GAAP profits.

- The company is making progress in growing its free cash flow, driven by finding new paying customers for its analytics products, particularly in the US commercial sector.

- Despite the positive financial performance, the excessive valuation multiple for Palantir Technologies cannot be justified based on reasonable valuation metrics, in my view.

Michael Vi

Sales for Palantir Technologies Inc. (NYSE:PLTR) came in better than expected last week, and the software and AI company produced its sixth consecutive quarter of GAAP profits.

Palantir Technologies is also making solid progress in terms of scaling up its free cash flow, a trend that is connected to the company finding new paying customers for its analytics products, particularly in US commercial.

I think that the excessive valuation multiple for Palantir Technologies still cannot be justified based on reasonable valuation metrics, but I do acknowledge that the company is making respectable progress in terms of growing its free cash flow.

My Rating History

I warned of the dangers of investing in Palantir Technologies in my February piece titled Palantir Technologies: Valuation Unsustainable, Pullback Likely, in which I warned about the risk of paying an excessive sales multiple for the company’s software and AI platform.

I think that Palantir Technologies makes a slightly better value proposition after 1Q24, particularly because the company has had some success in growing its free cash flow, a metric that I think not a lot of investors focus on with regard to PLTR.

With that being said, the risk/reward relationship looks too unfavorable to me, and I stick with my Sell classification despite success on the sales and free cash flow fronts.

Palantir Technologies Is Growing Fast And Scaling Up Cash Flow

Palantir Technologies’ software product suite produced $634 million in sales in 1Q24, up 21% YoY, particularly because of growing demand for the company’s AIP (Palantir Technologies’ custom AI platform).

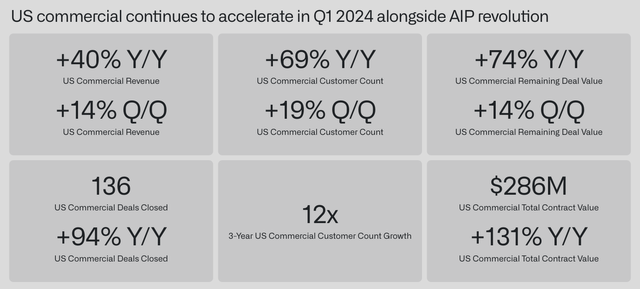

Sales growth, once again, was driven by US commercial which is where most of the action with regard to Palantir Technologies’ business happens: US commercial enjoyed a 40% sales jump, YoY, to $150 million.

This growth, fundamentally, was supported by growth in new customer accounts: compared to the year-ago period, Palantir Technologies’ US commercial customers skyrocketed 69%, proving the strong interest in AIP as well as the competitiveness of Palantir Technologies’ services.

Palantir Technologies’ sales growth is primarily supported by the company’s AI product, AIP, which stands for Artificial Intelligence Palantir. This is a platform that allows Palantir Technologies to deploy its AI tools at scale and bring its data insights to the enterprise market. Palantir Technologies is conducting software boot camps to showcase AIP’s capabilities to companies, particularly in US commercial, which has been a sales success.

US Commercial Sales Growth (Palantir Technologies)

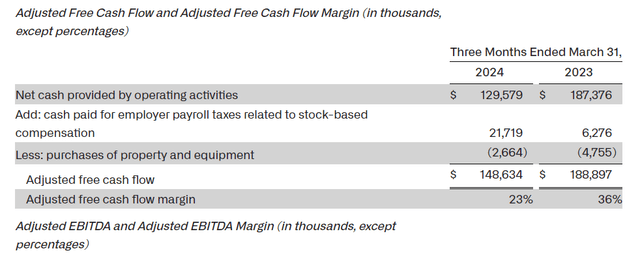

Most notable was Palantir Technologies’ strong scaling of its free cash flow. Palantir Technologies has been able to grow its customers very quickly and has been able to convert this growth into substantial free cash flow gains.

In 1Q24, Palantir Technologies earned $148.6 million in adjusted free cash flow at a margin of 23%. Last year, Palantir Technologies earned $188.9 million at a margin of 36%. The software and AI company is now quite profitable in this regard, a fact that I think is supported by the company’s guidance.

Adjusted Free Cash Flow (Palantir Technologies)

Palantir Technologies’ free cash flow is anticipated (by the company) to go as high as $1.0 billion in 2024, based on sales of $2.68-2.69 billion which marked a raise from $2.65 billion to $2.67 billion in sales previously estimated. This implies that investors could see a free cash flow margin of between 30-37%.

Palantir Technologies Is Still Expensive

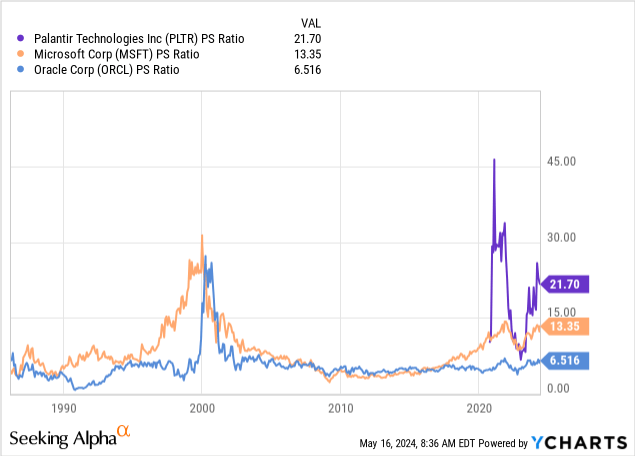

The two largest problems that I have with Palantir Technologies relate to the company’s high SBC expenses (which I covered last time) and it’s still very high valuation based on sales and free cash flow. Palantir Technologies forecast $2.685 billion in sales this year which implies, at a present market valuation of $46.7 billion, a sales multiple of 17x.

Paying 17x sales for a business that is growing its sales at around 20% per annum is very rich, and I think that investors are possibly overpaying for Palantir Technologies’ sales potential at this level.

Even large software companies like Microsoft Corporation (MSFT) or Oracle Corporation (ORCL) are selling at much lower sales multiple, despite also growing their sales quickly: Microsoft is on track to grow its sales by 14% next year, whereas Oracle is anticipated to see 9% growth. Palantir Technologies may grow faster than those two companies, but PLTR only recently turned profitable, and both Microsoft and Oracle produce billions in annual profits.

Both Microsoft and Oracle also have very strong market positions in their respective fields and have long growth histories. Palantir Technologies, on the other hand, competes essentially with every software/AI company that offers business intelligence services and managed to turn profitable only after two decades of consistent losses.

Though Palantir Technologies is growing a tad faster here, it remains to be seen whether the company can sustain those growth rates in the future. Taking into account that highly successful (and profitable) companies like Microsoft sell for a lower sales multiple, I think that Palantir Technologies’ valuation is too high given the underlying business reality.

This multiple is still pretty excessive, even considering that the company is scaling up its cash flow. The company, in its top estimate, sees $1.0 billion in free cash flow this year, which implies an FCF multiple of 47x. This multiple is also excessive, even under the consideration that the software and AI company did reach a milestone finally, after more than 20 years of operations, to grow its business to free cash flow profitability.

I think a 20x FCF multiple might be considered appropriate for a fast-growing software company that sees considerable customer interest in its products, but 47x is very, very rich.

A 20x FCF multiple is of course a subjective valuation number, but I think that given Palantir Technologies’ loss-making history, a 47x FCF multiple is a bit excessive. A 20x FCF multiple also accounts for the fact that the software/AI company only achieved profitability in 2023 and that its high SBC expense structure poses a risk to investors. A 20x multiple translates into a 57% correction potential and an implied fair price of $9.

Why The Investment Thesis Might Be Faulty

AI obviously is the hottest theme in the market right now, and Palantir Technologies does have a connection to the theme by offering artificial intelligence services as part of its software packages.

AI-driven analytics are a complementary field to Palantir Technologies’ core software/foundry services, and the new service could help the company’s customers increase efficiency and profitability. The value proposition for Palantir Technologies’ AI products is therefore strong, and a product that helps companies operate more effectively at a lower cost at scale sells itself.

From this angle, Palantir Technologies could be set to expand its services and products to more companies in US commercial that seek business intelligence and analytics services. As such, Palantir Technologies could see more robust growth in the quarters and years ahead, particularly in US commercial.

If the AI theme persists and US commercial continues to shine, Palantir Technologies could ultimately grow into a higher valuation.

My Conclusion

Palantir Technologies had a pretty good first quarter, though the market appeared to dislike the company’s results, sending the stock sharply lower after earnings.

My opinion on Palantir Technologies has not changed fundamentally, though I acknowledge that the software and AI company is looking better from a free cash flow angle. Palantir Technologies is also forecasting up to $1.0 billion in free cash flow in 2024 which would indicate a free cash flow margin of up to 37%.

With that being said, though, I still don’t like Palantir Technologies’ sales and free cash flow multiples, which in my view signify an unattractive risk/reward relationship for investors.

The valuation is still way too high considering the underlying financials to make sense or justify buying the stock, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.