Summary:

- Growth versus value has long been a key debate in the investing community. And the latest developments at Palantir and SMCI have made them a fitting pair for such comparison.

- Although both stocks were once viewed jointly as key AI beneficiaries, they’ve since diverged in their paths.

- On one hand, Palantir’s soaring to all-time highs with an eyewatering valuation of almost 50x NTM sales, backed by AI-driven acceleration to its growth trajectory.

- Meanwhile, on the other hand, whether SMCI’s fall from grace can be reverted remains a substantial uncertainty, given ongoing accounting woes and their implications.

- The following analysis will discuss the context of both stock’s performance this year, and provide a deep dive into their growth and value implications ahead.

hapabapa

There’s long been a debate between growth and value investment. And in light of recent events, there’s no better comparable pair than Palantir (NASDAQ:PLTR) and Super Micro Computer (NASDAQ:SMCI).

Palantir has become one of the most favoured AI stocks this year. Its value has surged about 300% this year, or almost 10x the all-time low hit just a little more than a year ago. Palantir currently trades at 46x NTM sales, and represents the most expensive amongst its software peers. And much of the stock’s valuation upsurge has been underpinned by rising confidence in Palantir’s fundamental outlook. In addition to restored growth prospects at the 20%+ multi-year CAGR cadence, investors are also applauding the favourable go-to-market strategy for AIP that enables sustained margin expansion at scale.

Meanwhile, SMCI’s been on a rollercoaster ride since the advent of generative AI interest. The stock returned almost 4x earlier this year before investors’ optimism in SMCI’s AI server opportunity became overshadowed by the company’s financial reporting woes. Yet some investors are still considering SMCI as a potential value play at current levels, as it trades at a discount relative to server peers with a similar growth profile.

The following analysis will dive into what’s behind both stocks’ recent performance, and discuss their implications ahead for growth and value investors alike.

Palantir – How Long Can This Growth Spurt Last?

Palantir’s robust Q3 earnings update this year has further fuelled the stock’s blistering rally this year. With both commercial and government revenues delivering consistent acceleration this year, Palantir’s newest AI Platform (“AIP”) product just might be the key it’s long been looking for to sustain a multi-year growth cadence at the 30% range.

Recall that it was earlier in CEO Alex Karp’s ambitions for Palantir to grow at a multi-year CAGR of 30% during the stock’s IPO days. But it was subsequently met with a rough drawdown during the post-pandemic normalization of government contract revenues – especially those related to managing the rollout of COVID vaccines. At the same time, initiatives aimed at building a sustained trajectory of growth for the commercial business, such as Foundry for Builders and Day-0 SPAC investments, failed to complement Palantir’s fundamental “land and expand” business model.

But the company’s swift capitalization on its years of AI expertise gained through Foundry and Gotham was evident in its timely deployment of AIP. Just a little more than a year ago, Karp still had difficulties putting a price on AIP and confirmed the monetization strategy for the product remains uncertain. Yet in the last 12 months, AIP has not only demonstrated itself as a rapid share gainer in the enterprise AI software segment, but it’s also showcased its monetization power.

Clearly, AIP was Palantir’s key all along in keeping its “land and expand” engine running.

The company’s consistently delivered growth in the 20% range over the last 12 months. This was primarily driven by AIP’s strengths in capturing both new customer acquisitions and existing deal expansions, which was evident in the 453 net new customers gained over the last 12 months (+39% y/y; US commercial +77% y/y). AIP’s favourable contributions to Palantir’s land and expand business model was also evident in its net dollar retention rate’s 400-bps expansion to 118% during Q3. And this just might mark the beginning of Palantir’s accelerating growth cadence, given the low revenue base and substantial AIP uptake observed since launch.

More importantly, yet lesser spoken of, Palantir is operating a prudent go-to-market strategy for AIP. Specifically, AIP Bootcamps have delivered an optimal combination of rapid conversion and low customer acquisition cost. By showcasing AIP’s capabilities through group-wide demos that can yield real-time company-specific value generation, the bootcamps have been able to immediately turn Palantir’s promises for rapid time-to-deployment and time-to-value into reality:

I think, I gave examples of boot camps where we’re seeing multiple different customers across different industries that are going from, from the initial boot camp to a seven figure ACV deal within a matter of less than two months.

And this has been a key strategy to enabling sustained margin expansion ahead for Palantir, especially as AIP deployments continue to scale. Specifically, sales and marketing spend (ex-SBC) as a percentage of revenue has decreased by at least 500 bps since AIP Bootcamps began, marking one of Palantir’s biggest earnings contributors over the past year.

Admittedly, Palantir’s current valuation premium on a relative basis to its software peers might be hard to justify. The stock’s currently trading at eyewatering multiples of close to 50x NTM sales and 145x NTM earnings. This even beats peer Snowflake’s (SNOW) previous valuation premium when it held the software valuation crown during its all-time highs.

But an analysis on the intrinsic basis could provide a better understanding of Palantir’s current valuation premium. We believe it remains well-supported by the combination of anticipated growth acceleration and sustained margin expansion in the underlying business.

Adjusting our previous forecast for Palantir’s actual Q3 performance and forward outlook, it’s reasonable to expect that the company’s multi-year growth prospects in the 20%+ range remains intact – especially as AIP fosters continued success for Palantir’s land and expand strategy. The expectation for a robust multi-year growth cadence is further corroborated by increasing market confidence in a marked transition of AI opportunities from semiconductors to the software segment in the years ahead. Palantir also stands to flourish further under President-elect Donald Trump’s impending administration, which prioritizes a “pro-defense” and DoD modernization stance.

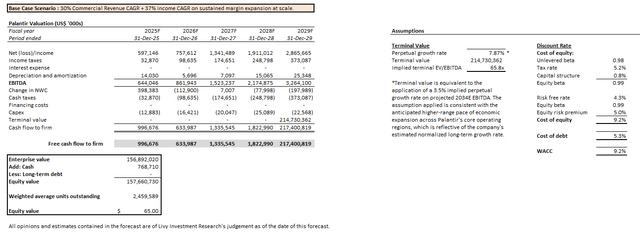

A five-year discounted cash flow analysis that considers commercial revenue expansion at a multi-year CAGR of 30%, alongside sustained margin expansion with scaled AIP deployments would yield a valuation of $65 apiece for Palantir. This largely approximates the stock’s currently traded levels.

A WACC of 9.2%, in line with Palantir’s capital structure and risk profile, is applied. The analysis also considers an estimated perpetual growth rate of 7.9% on 2029E EBITDA to determine Palantir’s terminal value. The terminal value considered in the analysis is equivalent to the application of a 3.5% implied perpetual growth rate on projected 2034E EBITDA, which is consistent with the higher-range pace of anticipated economic expansion across Palantir’s core operating regions, and is reflective of the company’s normalized long-term growth rate.

Author

SMCI – A Wildcard or Deep Value Play?

Meanwhile, SMCI remains deep in uncertainties pertaining to its ongoing financial reporting issues. And the stock’s recent volatility is reflected in the intensifying debate between bulls and bears.

On one hand, SMCI’s short float remains at an all-time high of more than 17%. Bears continue to anticipate looming delisting risks for the stock, as Nasdaq is still in the process of reviewing SMCI’s recently submitted “compliance plan” (or “remediation plan”) for bringing its financial reporting up to date. The plan will need to be approved by Nasdaq in order for it to extend the 180-day filing extension to SMCI.

Meanwhile, on the other hand, longs remain confident that SMCI’s technological competency and dependent operations are intact. They’re also positioned for a further short squeeze if Nasdaq does grant SMCI the 180-day filing extension.

At the end of the day, the delisting risk and ensuing liquidity implications facing SMCI will remain a constant overhang on the stock. Until SMCI brings its financial statements up to date with an unqualified opinion from its newly appointed independent auditor, BDO USA (“BDO”), the stock will face substantial volatility ahead (if it stays listed in the process).

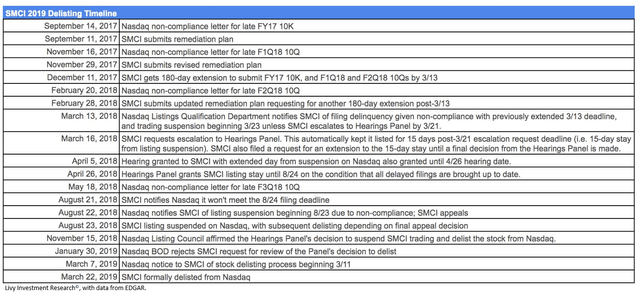

What makes the situation worse is that this isn’t SMCI’s first brush with accounting issues and related delisting risks. The last time it happened in 2018, SMCI wasn’t formally delisted until almost 1.5 years after it received the first Nasdaq non-compliance letter for its late FY17 10K filing:

Author, with data from EDGAR

Yet this time, the situation facing SMCI’s also different for several reasons.

1. Nasdaq’s likely less lenient

SMCI’s filing delay this time around stems from the same issue it faced in 2018 – accounting issues. And knowing that SMCI was, time and again, delinquent on its promises for remediation within a timely manner back in 2018, it is possible that Nasdaq will respond to the company’s plea for extension this time with reduced leniency.

In the latest development, SMCI’s already submitted its initial remediation plan to Nasdaq. Now the ball’s in the exchange’s hands on whether to accept the plan and grant SMCI the 180-day filing extension. This would give the outstanding FY24 10K and other subsequent filings a new deadline in February 2025.

In its assessment of SMCI’s remediation plan, Nasdaq will likely be looking for why the filings have been delayed, and whether the pending work to be done will fit into the 180-day extension, if granted. If Nasdaq rejects the remediation plan, then SMCI can stay listed for another 15 days by escalating to the Hearings Panel for a subsequent review of the decision. And if all else fails or if SMCI’s granted the 180-day filing extension yet remains delinquent, the company can still escalate the case to the Listing Council for another 180-day extension.

Given it’s SMCI’s repeated offense, a formal delisting could be much closer than expected. Nasdaq knows that it’s a time crunch for SMCI to get its outstanding FY24 10K and subsequent filings done by the end of February. And while it’s a positive development that SMCI’s finally retained a new independent auditor, BDO, getting the audit done in three months remains a huge challenge.

It’s one thing for an auditor to complete a recurring year-end audit of a S&P 500 company in three months’ time, but another for a brand-new auditor with no prior knowledge of the company to do so. BDO would have to build its understanding of SMCI’s operations, organizational structure, entity-level and financial reporting controls from square one in order to determine the appropriate risk assessment and audit procedures for the engagement. And in order to ensure the FY24 financial statements are fairly presented without material misstatements, BDO would also need reliance on FY23 numbers. This means BDO will likely have to carry out additional reviews to ensure SMCI’s opening balance (i.e. FY23 numbers) can be relied on.

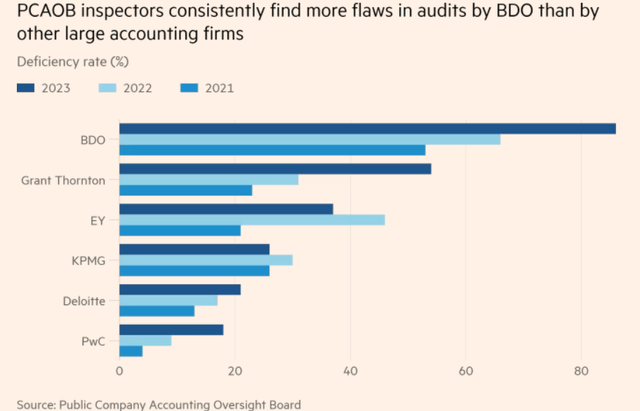

The added audit workload for BDO on top of existing FY24 financial reporting issues makes it highly unlikely that SMCI will be able to bring its filings up to date by Nasdaq’s extended timeline, if granted. And if by some miracle BDO does complete the SMCI audit with an unqualified opinion by Nasdaq’s extended filing deadline, if granted, it’d likely face an elevated risk of inspection by the PCAOB. The PCAOB’s job is to inspect the work of auditors to ensure compliance with SOX, PCAOB, SEC and GAAP rules. When material deficiencies/misstatements are found in the inspection, the auditor would need to communicate with their client and have the financial misstatements restated.

Now, BDO has the worst reputation with PCAOB inspections. 86% of its year-end 2023 audits selected for PCAOB inspection had material findings and deficiencies. The audit firm also has a consistent lead in inspection findings over its peers, with the latest results marking its worst in the past three years.

Financial Times

This essentially heightens SMCI’s exposure to risks of another re-offense related to accounting issues and non-compliance with Nasdaq listing rules, even if it gets away with delisting this time with a timely filing by February.

And Nasdaq knows all of these existing challenges facing SMCI’s efforts in bringing its filings up to date. It also knows of SMCI’s poor track record in sticking to the plan from 2018. This is expected to lower Nasdaq’s leniency for SMCI, and adversely impact its consideration on the outlook of SMCI’s listing.

2. SMCI’s delisting could trigger an early cash redemption on its $1.7 billion outstanding convertible notes

The heightening risks of a fast-tracked road to delisting also escalates concerns on SMCI’s liquidity. As discussed in our previous coverage, holders of SMCI’s $1.7 billion outstanding convertibles can request early cash redemption under certain events – including the stock’s delisting from Nasdaq and early maturity on outstanding debt that exceeds $50 million.

This explains why the SMCI stock’s been relatively more sensitive to delisting headlines this time around. Specifically, the stock’s lost close to 60% of its value since disclosing its “Notification of Late Filing” for the FY24 10K, before recently recouping some losses as it awaits Nasdaq’s approval of its remediation plan for a 180-day filing extension. This compares to the stock’s mere 20% selloff amidst SMCI’s accounting debacle in 2018; at its worst point, the selloff bottomed at about -40% from the date of SMCI’s initial receipt of its Nasdaq listing non-compliance letter for the late FY17 10K filing.

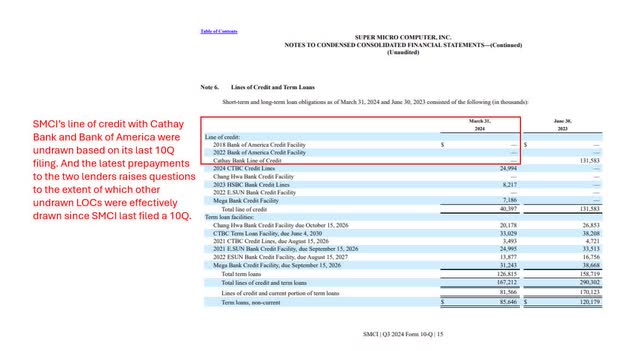

In the latest development, SMCI’s been prepaying outstanding term loans and other bank debt. Following its prepayment of about $500 million in outstanding term loans in early November, SMCI’s recently disclosed that it’s also prepaid an undisclosed amount of outstanding borrowings on its lines of credit with Cathay Bank, Bank of America, and other lenders.

SMCI’s likely got no choice but to move ahead with the early debt repayments, since it’s unlikely to file the FY24 10K by previously renegotiated filing deadlines with lenders. It’d have to prepay these outstanding borrowings to prevent breach and early maturity, which could trigger an early cash redemption clause on the $1.7 billion convertible notes.

But a deeper dive into SMCI’s latest prepayment on outstanding line of credit borrowings may unveil that its liquidity might be at risk of faster than expected deterioration – even without the Nasdaq delisting.

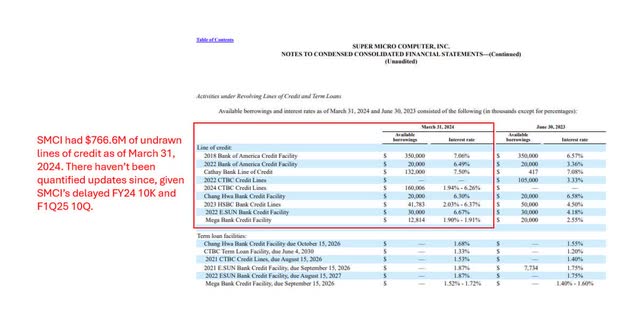

Specifically, SMCI’s Cathay Bank line of credit was completely undrawn as of SMCI’s last filed F3Q24 10Q. At the time, the Cathay Bank line of credit had $132 million in available borrowings.

SMCI F3Q24 10Q

This amount was subsequently reduced to $458,000 based on the “Fourth Amendment to Loan Agreement” filed on November 15. Yet SMCI’s had to prepay outstanding borrowings on the line of credit, which effectively raises questions to the extent of which the $766+ million in undrawn lines of credit as of March 31, 2024 were effectively drawn since it last filed a 10Q.

SMCI F3Q24 10Q

The recent string of early debt prepayments is also escalating doubts to SMCI’s ability to continue as a going concern, in our opinion. Based on the company’s latest “business update” for F1Q25, it reported an ending cash balance of $2.1 billion, alongside $0.6 billion in outstanding bank loans and $1.7 billion in outstanding convertible notes. Since then, it’s repaid $500+ million of the outstanding term loans and an undisclosed amount pertaining to the outstanding lines of credit. And further prepayments could be on the way, given the size of previously available lines of credit that could have been drawn on since SMCI’s last 10Q filing.

This could push SMCI’s cash balance to as low as $850 million, which is far from sufficient for covering its quarterly operational cash burn run-rate, especially considering costly GPU inventory builds.

3. SMCI’s ongoing accounting woes are already spilling over into operations

The risk of a liquidity spiral is further exacerbated by the recent slew of “client exodus” facing SMCI, highlighting how its ongoing accounting woes are spilling over into operations.

Earlier this month, SMCI’s suspended its expansion plans for Malaysia. This is consistent with our expectations of anticipated disruptions to its cash spend trajectory, given the consecutive string of material debt payments in recent weeks. The change of events has reportedly cost SMCI a major AI server order from its Malaysian customer, YTL Group. This was closely followed by reports that Elon Musk’s xAI has also shifted $6 billion of its previous AI server orders with SMCI to Dell (DELL) instead.

It’s evident that SMCI’s suppliers and customers are already taking mitigative actions against adverse operational implications of the server maker’s outstanding accounting issues, delayed filings, and looming delisting and liquidity risks. And it comes at a costly time for SMCI, as it was previously positioned to be a key beneficiary of the ongoing AI transformation – particularly the transition to liquid-cooled servers critical for next-generation accelerators starting with Nvidia’s (NVDA) upcoming Blackwell systems.

Recall that SMCI’s proprietary direct liquid-cooled (“DLC”) solutions had previously represented a catalyst for the stock. It was the only server maker that had the capacity to deliver critical DLC servers at scale to facilitate next-generation Blackwell system deployments. Based on one of our earlier coverages on the stock, the anticipated growth uplift from DLC servers was capable of driving additive FCF expansion critical for underpinning an upward valuation re-rate for SMCI.

Yet the previous optimism over SMCI’s DLC catalyst is rapidly losing its lustre, overshadowed by none but immediate accounting and operational woes. This was corroborated by SMCI’s lacklustre business update for F1Q25. While the company sought to punt the culprit of its disappointing revenue outlook to potential Blackwell shipment delays from Nvidia, this was rapidly shutdown by subsequent deployments of the next-generation systems at Google (GOOG/GOOGL), Microsoft (MSFT), and Dell.

Although SMCI’s currently traded levels remain a far cry from its previously expected intrinsic value as if its prospects of a DLC-driven growth uplift were intact, it’s hardly a deep value opportunity, in our opinion. The combination of extended filing delays, accounting uncertainties, and ensuing operational implications have effectively muddled its cash flow prospects. The lack of reliability on SMCI’s financial statements also makes it difficult to gauge the stock’s prospects based on its underlying fundamentals. SMCI’s suppressed valuation at current price levels continues to underscore its resemblance to a wild bet instead.

Conclusion

Taken together, both Palantir and SMCI may not be favourable opportunities today, but for different reasons. And if we had to choose, then Palantir would probably be our pick, given it still benefits from significant growth headroom in the nascent enterprise AI software segment.

As for SMCI, until it brings its filings up to date without material issues, the stock remains a wildcard with substantial volatility ahead of Nasdaq’s decision on its listing. The combination of unreliable financial information, delayed financial reporting, ensuing liquidity deterioration, and spilt over operational impacts continues to highlight risks skewed to the downside for SMCI. While the stock’s discounted at current levels, it’s likely that the existing problems won’t be going away for a while.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.